24K-Production/iStock via Getty Images

Beam Global (NASDAQ:BEEM) is a relatively under-the-radar EV charging company that’s been riding the growing wave of EVs to newer operational heights. The company recently closed on the all-stock acquisition of AllCell Technologies, an energy storage solutions and technologies provider. The company also continues to make headway into its core markets with new deals signed with state and local governments for the rollout of the EV ARC 2020, an off-grid renewable EV charging solution. This product is more easily deployed than conventional charging stations, and generates and stores its own energy.

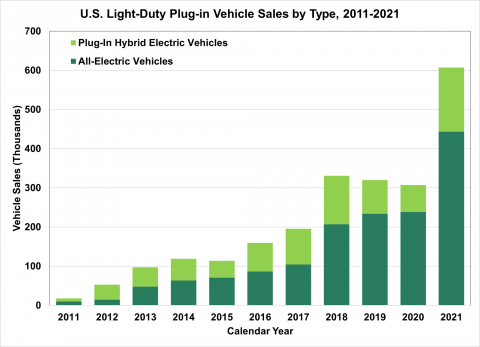

The bull case for Beam is built on the growing adoption of EVs across the United States. There is now a clear upward trend of rising EV sales from a mix of supportive government policy and rising consumer sentiment. Sales of all-electric vehicles and plug-in hybrid electric vehicles in the United States nearly doubled from 308,000 in 2020 to 608,000 in 2021. This year-over-year beat looks set to continue in 2022 even with the spectre of a recession.

Department of Energy

Ancillary charging companies like Beam are likely to ramp up the pace of their revenue growth in the years ahead on the back of the rising number of new EV owners. With sales of EVs as a per cent of total new cars sold yearly still quite low, the structural shift to electric transport is very much still in its early stages. 2021 saw only 4% of new cars sold in the United States being all-electric. Hence, the growth ahead is likely to be dramatic even against heavy competition from a large number of competing public companies like ChargePoint (CHPT), Blink Charging (BLNK), EVgo (EVGO) and Volta (VLTA).

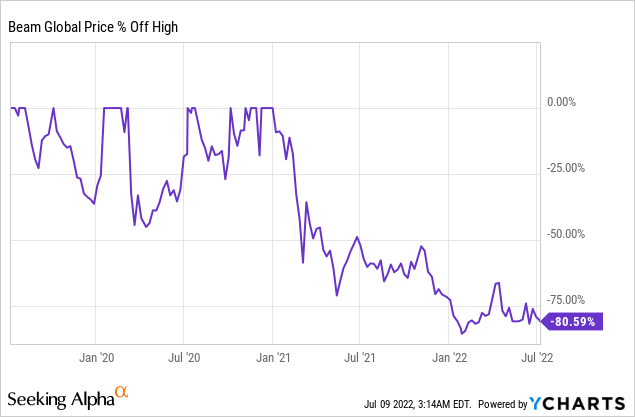

Beam has joined the cascade of collapsing stock prices over the last year, with its stock down nearly 81% from its all-time highs. The company now trades on a $144 million valuation, with $19 million in cash and equivalents held.

Revenue Ramps Up As Electrification Charges Up

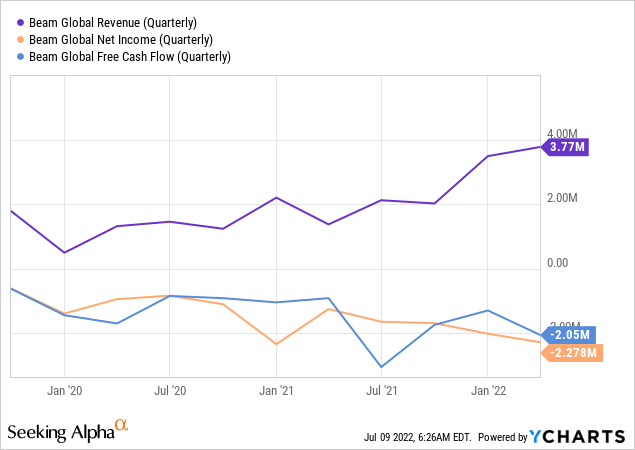

Beam last reported earnings for its fiscal 2022 first quarter. It was a broadly positive earnings report with revenue coming in at $3.77 million, a 175% increase from the comparable year-ago quarter and a $420,000 beat on consensus estimates. This came on the back of a 250% increase in system deliveries during the quarter and a sales pipeline that grew to hit a record of over $100 million.

The company is still unprofitable, with a net loss during the quarter of $2.3 million. This was a 77% increase from the year-ago figure. This also meant cash burn for the quarter, including capital expenditure of around $100,000, was at $2 million.

A majority of Beam’s customers are public bodies, hence, the company has been a big winner of a number of EV infrastructure funding pledges announced since the new Biden administration. During the quarter, the company received an order for 23 EV ARC systems from the California Department of General Services.

This positive headway continued post-period end, with Beam expanding to reach 31 states where its ARC charging systems are deployed. Management provided no guidance for fiscal 2022, but assuming a constant rate of revenue growth on the back of the first quarter, we should see revenue come in at around $16 million. This is likely to be an understatement, as the company’s first quarter has historically been its weakest. But using this as a benchmark, the company’s forward price to revenue multiple stands at 9x. This is significantly down from previous highs and is somewhat reasonable against a triple-digit revenue growth rate and a relatively long runway of more than 8 quarters.

An All-Electric Future

Whilst 2022 has been apocalyptic for growth stocks, with the macroeconomic backdrop still showing signs of further deterioration, Beam’s increasingly high pace of revenue growth will be welcomed by its shareholders. However, the company’s unprofitability and cash burn will make any new investment in it quite uncertain against the fast deteriorating capital market. This risk is somewhat derisked by Beam’s relatively large cash position.

The future of transport is EVs, an inevitable trend driven by a number of factors that have come into place over the last few years. The most important of these is the need to restrict the rise in mean global temperature to well below 3.6 °F (2 °C) above pre-industrial levels. EVs form an important part of the solution to mitigating our carbon emissions and the subsequent environmental impacts.

I expect Beam to continue to realize a revenue ramp, and likely continue to beat consensus estimates. This will not be done from a point of profit for a while to the disappointment of shareholders. The first-quarter results showed hypergrowth and I expect this momentum to continue as Beam rides the waves of US electrification.

Be the first to comment