martin-dm/E+ via Getty Images

Article Thesis

Equity markets are very troubled right now, as rate hike fears, inflation, and a potential recession lead to a risk-off sentiment among investors. Nevertheless, not all equities are equal when it comes to their vulnerabilities in the current environment. In this report, we’ll showcase five Dividend Aristocrats that will provide reliable income no matter what and that are positioned to weather the current situation better than many other stocks.

1: Realty Income

Realty Income (O) is a triple-net lease REIT that primarily invests in retail spaces. Its properties are leased to pharmacies, post offices, dollar stores, convenience stores, and so on. These generally are resilient businesses that are not threatened too much by either e-commerce or by a potential recession — consumers might even flock more towards dollar stores in a recession, for example.

Realty Income’s “real asset” business model of owning real estate that is partially financed via debt makes the company a solid inflation hedge. After all, high inflation makes the value of the company’s properties rise, while debt is getting inflated away over time. Neither recessions nor inflation is thus a major threat for Realty Income. The company has also managed the pandemic very well, generating new record FFO per share in both 2020 and 2021. The current year will be another record year according to management’s guidance, with FFO per share being forecasted at close to $4.00.

At $63 per share, Realty Income is currently trading at around 16x this year’s expected FFO, which isn’t a high valuation for a resilient, high-quality compounder such as Realty Income. The company’s dividend yield stands at 4.7%, which is around 3x the broad market’s yield. The company has hiked its payout for 26 years in a row, proving that even major crises do not threaten the company’s ability to provide a growing income stream.

2: Altria

Altria (MO) is a leading tobacco company that is focused on the US market. This eliminates currency risk, which is a major positive at a time when the strengthening US Dollar hurts companies that generate a large portion of their sales outside of the US.

Tobacco is a product that is exceptionally non-cyclical. Recessions, pandemics, trade wars, and so on do not hurt demand for cigarettes and cigars, which is why Altria has a great growth track record spanning decades. In fact, there are studies that suggest that smokers do actually smoke more during recessions, making Altria a company with an ultra-resilient business model.

Through price increases, Altria has been able to generate reliable profit growth even though tobacco isn’t a high-growth industry. Due to the fact that demand for cigarettes and other tobacco products is very inelastic, price increases have not been a problem in the past, and I do believe that the same will hold true in the future. Altria’s management is, not surprisingly, forecasting that profits will continue to grow this year as well, forecasting new record earnings per share of $4.79 to $4.93, or $4.86 at the midpoint of the guidance range. This means that Altria is trading for just 9.7x this year’s earnings right now, which makes for an earnings yield of more than 10%.

A large portion of those earnings is returned to shareholders via dividends, as the dividend yield stands at a highly attractive level of 7.6% today — around 5x as much as what one can get from the S&P 500. Historic patterns suggest that Altria will hike its dividend in the next two months. Since the current payout ratio is 74%, which is below the target range of 80%, investors can expect a meaningful dividend increase of about 8% I believe [80%/74%].

3: AbbVie

AbbVie (ABBV) is a leading biotech company that is primarily active in the immunology and oncology spaces. Its shares are up more than 20% over the last year, but they have recently pulled back from their 52-week highs, which has made the valuation and dividend yield become more attractive again.

AbbVie’s biggest drug, Humira, will lose its patent protection in the US next year, which is why some investors are worried about the company’s future outlook. But Humira sales results in the EU, where patent protection has already expired, suggest that sales in the US should not fall off a cliff. Instead, Humira should remain a major cash cow for years, even once it has lost its patent protection. AbbVie has made a lot of progress in advancing its pipeline and bringing new drugs to the market to replace Humira’s revenue. This includes Skyrizi and Rinvoq, which mostly treat the same indications as Humira, but are better at doing it.

Between these two drugs, its growing oncology/hematology franchise, new business units added through the Allergan takeover, and a still very broad and deep pipeline, AbbVie should be able to grow its business meaningfully throughout the 2020s.

At the same time, the stock trades at less than 10x this year’s earnings right now, and AbbVie also offers a dividend yield of 4.1%, which is quite attractive when we consider the strong 5-year dividend growth rate of 18%. With a payout ratio of around 40%, there is still ample room for AbbVie to increase its payout over time, even before considering the earnings per share growth the company should deliver in the long run.

Demand for healthcare products and drugs is not really cyclical, which is why AbbVie should do reasonably well even when we get into a recession. Combined with the strong yield and low valuation, this makes AbbVie look like a compelling choice for the current environment.

4: Federal Realty Trust

Federal Realty Trust (FRT) is a retail real estate company that primarily owns properties in coastal markets in the United States. The company has raised its dividend for an excellent 54 years in a row, i.e. since the late 1960s. Through oil crises, recessions, bear markets, pandemics, and wars, Federal Realty Trust kept raising its dividend without pause, showcasing how resilient the business model is.

Retail itself isn’t necessarily resilient, although there are resilient segments in retail — such as convenience stores, dollar stores, pharmacies, and so on. Federal Realty Trust leases its properties to a diverse group of companies, without too much exposure to any single industry or company, which helps lower risks and which was an important factor for the company’s strong track record.

For the current year, management is forecasting funds from operations per share of $5.85 to $6.05, which was more than what Federal Realty Trust had been forecasting a couple of months ago. The reasons for the increase in its guidance are accretive acquisitions and strong demand for new leases for its properties, which implies that the potential upcoming recession is not hurting FRT so far.

Federal Realty Trust trades for around 16x FFO right now, which is not a high valuation for a high-quality REIT such as FRT, I believe. The company offers a dividend yield of 4.5% at current prices, which makes for attractive income generation potential.

5: Exxon Mobil

Exxon Mobil (XOM) is one of the largest publicly-traded oil companies in the world. With its business model that includes upstream (oil production), downstream (refining and marketing), and chemicals, Exxon Mobil is a diversified energy company that generates earnings across the value chain. That being said, the upstream segment is the most profitable one with commodity prices where they are right now.

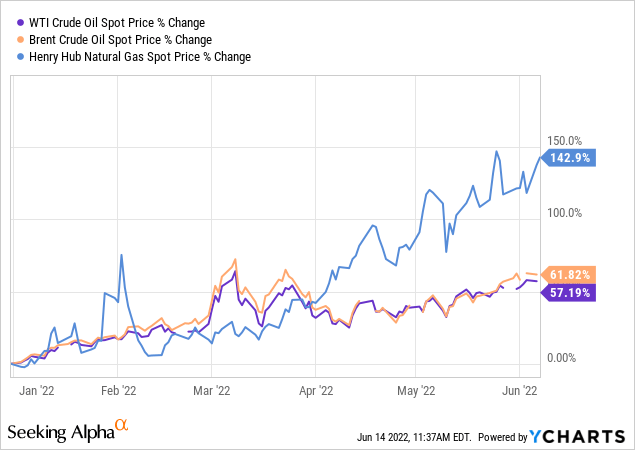

Exxon Mobil has cleaned up its balance sheet over the last two years, which allows the company to put more focus on shareholder returns going forward. Thanks to gigantic expected free cash flow with oil at $120 and natural gas at around $8, the company can pump billions of dollars per quarter into dividends and share repurchases. During the first quarter, XOM generated free cash flows of $11 billion, and that amount should be significantly higher in Q2:

Oil and natural gas prices are well above the average seen in Q1 so far, and refining spreads have also risen to record levels during Q2. But even if XOM were to generate “just” $11 billion of free cash per quarter, that would still make for a free cash flow yield of more than 10% at current prices.

With OPEC failing to raise oil production, it does not seem likely that oil prices will drop a lot in the foreseeable future. And XOM naturally also is a great inflation hedge, as even higher energy prices would mean even higher profits and shareholder returns for Exxon Mobil.

Takeaway

Equity markets are in trouble, but not all companies are impacted to the same degree. Going with inexpensive cash cows that have proven their reliability and their commitment to shareholders seems like a good idea in the current environment.

Be the first to comment