As part of our Be Greedy When Others Are Fearful series, Cash Flow Kingdom last wrote about Berkshire Hathaway (BRK.A)(BRK.B), Warren Buffett’s investment firm. Since Mr. Buffett is so good at picking solid long-term investments at fair prices, especially during times when the stock market offers some great deals, we thought we’d consider some of his top holdings.

In a recent interview that touched on the coronavirus subject, Mr. Buffett indicated he’s “not selling anything, why would you sell if you don’t have to?” and that, bank stocks are “very attractive compared to most other securities.” We believe that his stance of not selling during times like these is the correct one, at least as long as investors don’t have any urgent cash needs.

Buffett has historically been good at finding relative bargains in the stock market, thus looking at what Buffett has been doing over the last couple of years could be a good way to find investment opportunities. When doing so, we see that he has been buying Bank of New York Mellon (BK), Bank of America (BAC), and Goldman Sachs (GS) in the recent past:

Source: yahoo.com

In fact, it appears Buffett has more or less maxed out on Bank of New York Mellon, as reporting requirements, which become much more onerous once he would own 10%+ of the bank, prevent him from increasing his stake much further from the current level.

Bank of New York Mellon

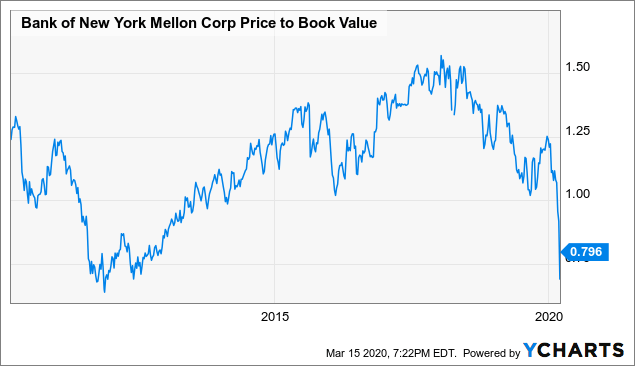

Bank of New York Mellon, despite Buffett’s purchases, is trading at valuations it hasn’t seen in the last 7 years:

Data by YCharts

Data by YChartsIf Buffett liked the stock at valuations that were much higher than the current valuation, does this mean that Bank of New York Mellon is a steal at current prices? We believe so. Let’s first look at why shares are trading at such a low price right here.

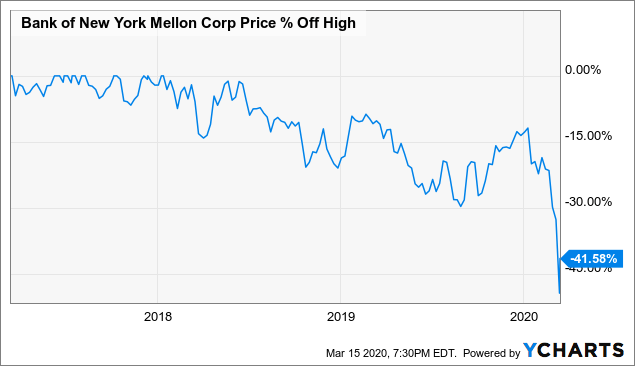

Data by YCharts

Data by YChartsShares are currently trading more than 40% below their all-time high, following a very steep drop over the last two weeks. This was caused by two factors: First, Bank of New York Mellon’s stock declined due to a broad market sell-off, which spared almost no individual stocks. Bank of New York Mellon’s beta is 1.16, which is why investors should expect that its stock will decline a lot during a market downturn.

There was, however, also a banking-specific reason for the big decline seen in the stocks of Bank of New York Mellon and many of its peers. Declining interest rates, primarily declining long-term interest rates, are a headwind for banks, as this can pressure their net interest margins. This, in turn, leads to lower net interest income, all else equal, which is a key contributor to banks’ top-line growth.

The yield on US treasuries has declined a lot over the last couple of months, especially during the last two weeks, which is why many investors worried about the future profitability of banks’ operations. Selling may have been somewhat premature, though, as things are not looking as bad as many investors fear. It is true that long-term rates have declined (the rates banks are charging their customers), but short-term rates have declined even more (the rates that banks are paying on deposits).

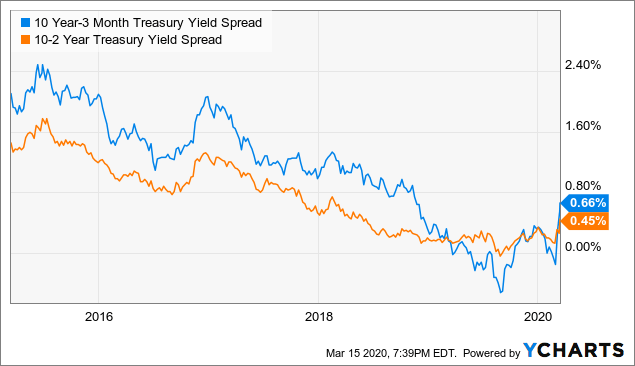

This becomes clear when we look at the spread between 10-year and 3-month treasury yields, and at the spread between 10-year and 2-year yields:

Data by YCharts

Data by YChartsIn both cases, the spread has widened over the last six months and is looking healthier than at the end of 2019. The recent large moves in interest rates may thus actually be beneficial for large banks, as the rates they pay have declined even more than the rates they are charging, which should lead to growing interest income, assuming nothing else changes.

Even if this trend were to reverse, however, Bank of New York Mellon would not suffer too much, though, as the bank is not overly reliant on interest income. Net interest income makes up a smaller portion of its revenues compared to most of its peers.

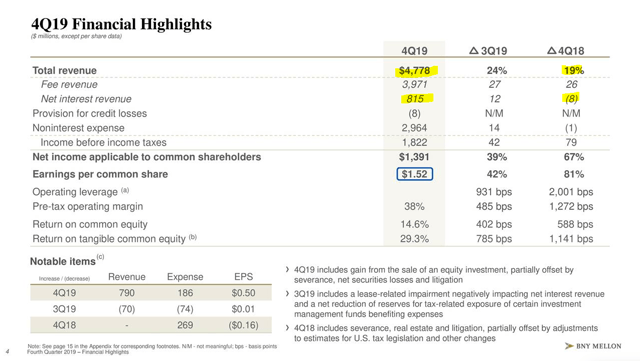

Source: Bank of New York Mellon presentation

Source: Bank of New York Mellon presentation

During the most recent quarter, interest revenues made up ~17% of all of the bank’s revenues. In a disaster scenario, where interest revenues decline by 30%, Bank of New York Mellon’s total revenues would thus decline by just ~5%, all else equal. During the most recent quarter, growing fee revenues more than offset the headwind from lower interest revenues, and the bank actually managed to grow its revenues by almost 20%, despite interest rate headwinds. This shows that current worries about the bank’s ability to generate revenues and profits could thus be exaggerated, and we believe that the outlook for the bank is not bad at all.

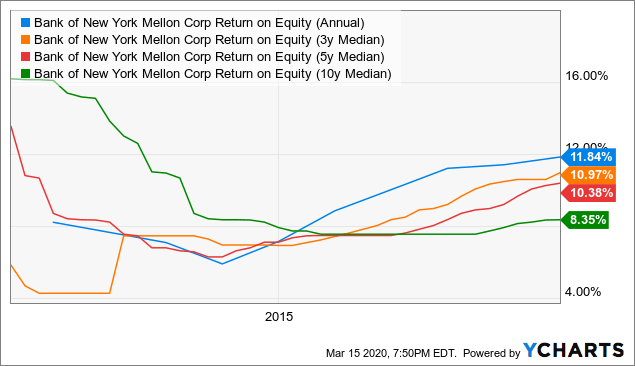

Data by YCharts

Data by YChartsBank of New York Mellon has been generating returns on equity of 12% during 2019, while the 3-year and 5-year ROEs are slightly lower, at 11.0% and 10.4%. The 10-year median return on equity, which includes a much larger timespan that started close to the financial crisis, is still not low at all, at roughly eight and a half percent.

Above we laid out why we don’t see a large negative long-term headwind to Bank of New York Mellon’s operations, but even when we assume that current ROEs will not be maintained, and return on equity will decline to just 8% (way worse than the returns in recent years, and even below the 10-year median), which is a quite bearish estimate, things don’t look bad at all.

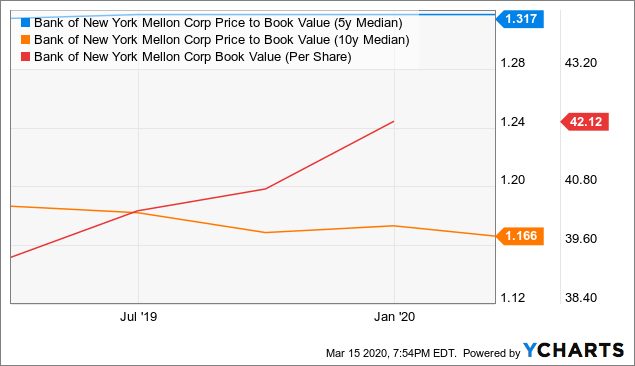

Data by YCharts

Data by YChartsThe bank’s current book value is just above $42 per share, while the bank’s stock has historically been valued at ~1.3 times book during the last five years, and at 1.17 times book over the last 10 years.

Even when we assume that Bank of New York Mellon will never trade at such a valuation ever again and that its long-term book value multiple will only be 1.05 (10% discount versus 10-year median), total returns over the coming years don’t look bad at all:

Bank of New York Mellon’s book value, compounded at 8% a year for five years, would be $62 at the end of 2024. If shares were to trade at 1.05 that amount five years from now, investors could be looking at a share price of $65, which is 91% more than the current share price.

Due to the fact that some of Bank of New York’s earnings are paid out via dividends, book value would, in reality, not grow this fast. Investors could, however, reinvest their dividends which would make their share count grow, and in the end, the result would be relatively similar: Even with somewhat conservative assumptions (below-average profitability and a below-average valuation), investors could see total returns of ~90% over the next five years, which would seem quite attractive.

Risks To Consider

No investment is without risk, and that is also true for Bank of New York Mellon. We don’t see any large immediate risks for now, but in case there is a steeper recession that is not V-shaped, rising bankruptcies could lead to higher defaults for the bank’s loans. In that case, profits and book value could get under pressure.

We don’t believe that the risk of a prolonged recession is large, which is also what many experts believe. Goldman Sachs (GS), for example, sees a recession during Q2, with a strong rebound in Q3 and Q4. It can not be ruled out that it takes longer for the economy to rebound, however, which is why investors should keep in mind that Bank of New York Mellon’s book value could take a hit in an ultra-bearish scenario.

On top of that, the stock will likely remain very volatile over the coming days and weeks, as investors will continue to react heavily to any coronavirus-related news. Volatility is not a bad thing per se, but those investors that want to avoid looking at 10%+ swings might prefer to wait for a time when markets are calmer before entering a position.

Takeaway

Bank of New York Mellon performed much better than its peers during the financial crisis; there was only one year during which the bank was not profitable; and the company hit pre-crisis levels of profitability shortly after that. The bank is thus not an overly risky pick among financials.

Right now many investors worry about the decline in interest rates we have seen over the last couple of weeks, but spreads between long-term and short-term rates have actually risen, which is a positive for banks’ profitability. The fundamental outlook is thus not bad, we believe, and yet the stock has dropped like a rock.

This is why we believe that we have a strong buying opportunity right here, as Bank of New York Mellon trades at a valuation that is almost absurdly low, and that should lead to compelling long-term returns, even when the bank’s profitability declines.

Our conservative estimates would still allow for double-digit total returns over the coming five years, which is why being greedy when others are fearful might be the right choice for investors thinking about buying Bank of New York Mellon’s stock.

Author’s Note: If you liked this article and want to read more from me, click the Follow button to receive notifications for future articles!

The Power of Multiple Cash Flow Streams

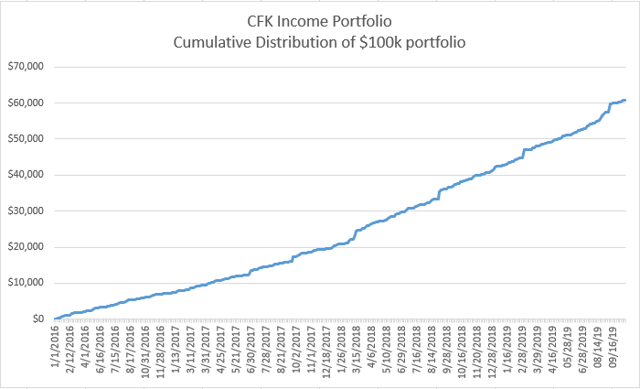

Jonathan Weber is covering the large-cap dividend sector for Cash Flow Kingdom: The Place where Cash Flow is King. From inception (1/1/2016), the CFK Income Portfolio has had a total return of 61%(versus 37% for the S&P 500) while generating a generous and very steady income stream.

The primary goal of our Income Portfolio is to generate an income yield in the 7% – 9% range. By focusing on underlying corporate cash flows, and overlaying sound money management strategy, we seek to produce a steady long-term dividend stream. Start your free two-week trial today!

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in BK over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Be the first to comment