peshkov

Baytex Energy (OTCPK:BTEGF) may be able to generate close to US$300 million in positive cash flow in the second half of 2022 at current strip prices. It should be able to increase its shareholder returns to 50% of free cash flow by early 2023 as it hits its next debt target then.

Like many companies, Baytex has been dealing with the effects of increased costs due to inflation in the strong commodity pricing environment. However, it has also produced excellent results from its Clearwater wells, which have outperformed type curve so far. The stronger than expected production from those wells helps largely offset the negative impact of higher costs on Baytex’s financial results.

Due to cost inflation and slightly lower oil prices, Baytex is on track to reach its CAD$800 million (US$615 million) net debt target one to two months later than what I previously expected. Baytex still looks to be a decent value at its current share price, with an estimated value of a bit over US$6 per share at long-term $75 WTI oil.

This report uses US dollars unless otherwise mentioned, while the exchange rate used in the report is US$1.00 to CAD$1.30.

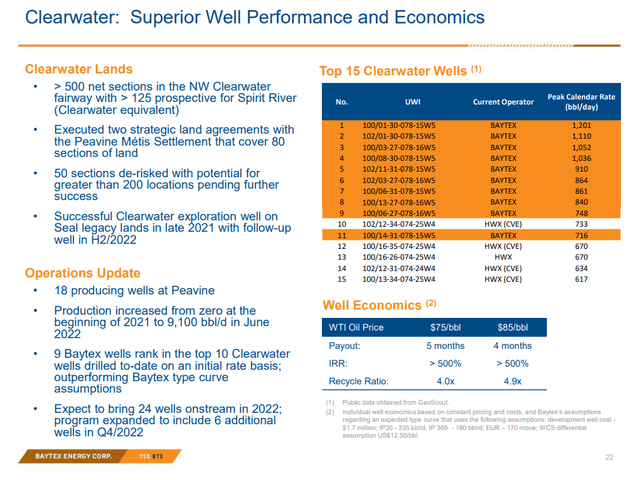

Strong Clearwater Performance

Baytex has managed to produce excellent results from its Clearwater wells. This has resulted in its Clearwater production increasing from zero at the beginning of 2021 to 2,300 barrels per day by the end of August 2021 to 3,200 barrels per day in Q1 2022 to 9,100 barrels per day in June 2022.

Clearwater Well Performance (Baytex Energy)

Baytex is confident that Clearwater production can be maintained at an average of 10,000 barrels per day with its five-year development plan, and perhaps higher than that given the outperformance versus type curve to date. It also believes that there is potential for its assets to support over 15,000 barrels per day of Clearwater production.

2H 2022 Outlook

Baytex expects approximately 86,000 BOEPD in average production during the second half of 2022. Baytex’s production split is approximately 41% light oil and condensate, 33% heavy oil, 9% NGLs and 17% natural gas.

At the current strip of approximately $91 WTI oil for the second half of 2022, Baytex is projected to generate US$1.094 billion in oil and gas revenues, while its hedges have an estimated value of negative US$134 million.

One thing to note is that around 63% of Baytex’s natural gas production comes from Canada, where prices have been quite volatile and have often been at a quite large discount to Henry Hub.

|

Units |

$ Per Unit |

$ Million USD |

|

|

Heavy Oil |

5,221,920 |

$70.00 |

$366 |

|

Light Oil and Condensate |

6,487,840 |

$90.00 |

$584 |

|

NGLs |

1,424,160 |

$33.00 |

$47 |

|

Natural Gas |

16,140,480 |

$6.00 |

$97 |

|

Hedge Value |

-$134 |

||

|

Total |

$960 |

Baytex is thus projected to generate US$293 million in positive cash flow in the second half of 2022 at current strip. Baytex has been dealing with some cost inflation, which have led it to revise its expense guidance upwards as well as expect capex to come in towards the high end of guidance.

|

$ Million USD |

|

|

Royalties |

$230 |

|

Operating Expenses |

$170 |

|

Transportation |

$19 |

|

Cash General And Admin |

$17 |

|

Cash Interest |

$28 |

|

Capital Expenditures |

$192 |

|

Leasing Expenditures |

$1 |

|

Asset Retirement Obligations |

$10 |

|

Total Expenses |

$667 |

Net Debt And Return Of Capital

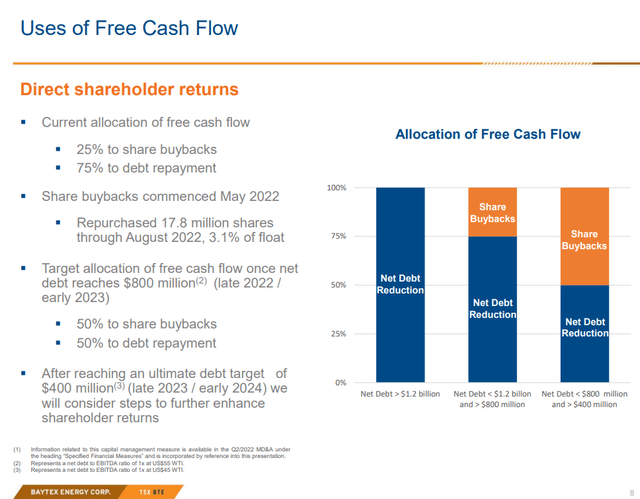

Baytex had approximately US$870 million in net debt at the end of Q2 2022. It is currently putting 25% of its free cash flow towards share repurchases, so that would give it US$73 million to put towards share repurchases (based on 2H 2022 results) while reducing its net debt to US$650 million by the end 2022.

Thus it should be able to reach the next step of its shareholder return plan (at CAD$800 million or US$615 million in net debt) during Q1 2023.

Baytex’s Uses Of Free Cash Flow (Baytex Energy)

This would result in Baytex allocating 50% of its free cash flow to share repurchases and 50% towards debt repayment after that point.

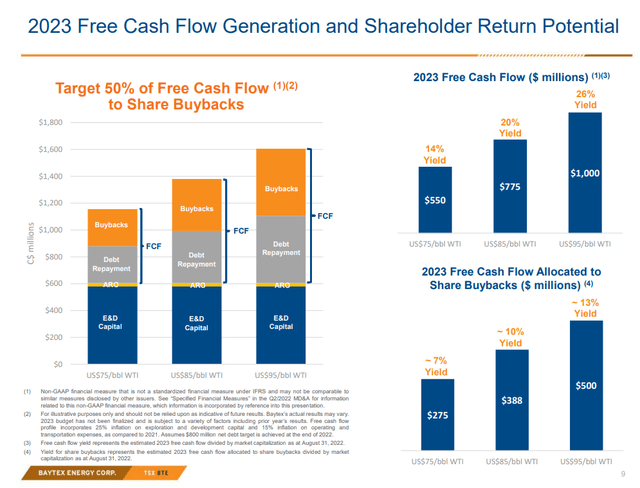

Potential 2023 Results And Valuation

Baytex believes that it can generate approximately US$525 million in free cash flow in 2023 at $81 WTI oil (current strip). For 2023, Baytex is budging for 25% inflation for its exploration and development capital and 15% inflation on operating and transportation expenses compared to 2021 levels.

At current strip, the impact of higher costs is largely offset by Baytex’s reduced hedges in 2023. Baytex has 9,500 barrels per day in 2023 oil hedges (three-way options) consisting of a sold put at US$62, a put at US$78 and a sold call at US$96.

A $1 change in oil prices (within the $78 to $96 range) affects Baytex’s projected free cash flow by approximately US$18 million.

Baytex’s 2023 Outlook (Baytex Energy)

Baytex would then likely hit its next net debt target of CAD$400 million (US$307 million) by early 2024.

I now estimate Baytex’s value at slightly above US$6 per share in a long-term (after 2023) US$75 WTI oil scenario. There could be some further upside if Baytex’s Clearwater wells continue to outperform expectations.

Conclusion

Baytex should be able to generate close to US$300 million in positive cash flow in the second half of 2022, along with around US$525 million in positive cash flow at current strip for 2023.

Based on Baytex’s previous comments, it will allocate roughly 50% of that 2023 free cash flow towards share repurchases. At a share price of a bit over US$5, Baytex would be able to repurchase around 9% of its outstanding shares during 2023.

Baytex’s estimated value is a bit over US$6 per share in a long-term $75 WTI oil scenario, with its Clearwater play potentially adding some more upside (outside of commodity prices).

Be the first to comment