peshkov/iStock via Getty Images

(Note: This article was originally posted in the marketplace newsletter on April 30, 2022 and has been updated as needed).

Baytex Energy (OTCPK:BTEGF) is getting the same profit boosts as is much of the industry plus one extra. Management announced a big increase in production from the low starting point on the Clearwater play. Those increases are likely to continue because the heavy oil play is unusually profitable even in times of weak pricing.

In the past, this company only had the Eagle Ford light oil play as a cash flow source because heavy oil margins tended to disappear to the point that management had to shut-in production. Then management acquired the Viking light oil play which was a tremendous financial help in the last downturn.

Now the Clearwater play promises to help cash flow during the downturn because of the unusually low-cost structure. Therefore, management will likely develop this heavy oil play at the expense of legacy production (heavy oil legacy that is) to additionally lower the corporate production mix cost. That means that profitability will increase along with Clearwater production as lower cost production replaces higher cost production. For shareholders, that means the stock will outperform the industry as profitability increases.

(Canadian Dollars Unless Otherwise Stated)

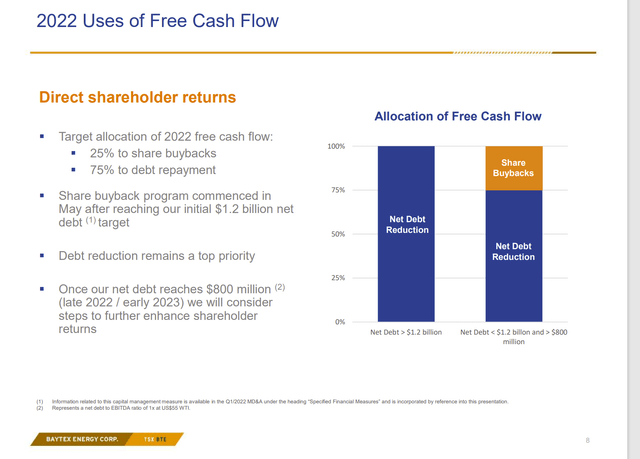

Baytex Energy Debt Reduction And Free Cash Flow Uses (Baytex Energy June 2022, Corporate Presentation)

Debt repayment will be a priority because even a very profitable heavy oil play still has the challenges of heavy oil. That means that during the next time of weak commodity prices the discount between heavy oil and light oil could expand to really pinch the cash flow available from producing heavy oil. The low-cost structure should enable the Clearwater heavy oil production to still cash flow adequately. But there remains is a larger risk that the production may have to be shut-in until prices recover sufficiently.

Therefore, the debt structure needs to be very conservative to cater to the shutting-in possibilities. Management is clearly catering to the conservative financial structure needs with the strategy shown above. This company, like many is unlikely to grow overall production until the balance sheet priorities have been met. The currently strong commodity price market ensures that will be fairly rapidly.

The other consideration is that management does not operate the Eagle Ford properties. Therefore, any capital budget is subject to the needs of the Eagle Ford activities first because the Eagle Ford is the most profitable. The change is that the Clearwater play is a clear second priority because of the profitability. It is very rare for a heavy oil play to be consistently more profitable throughout the cycle than is the case for the Viking light oil play. But under current assumptions, the Clearwater leases appear to meet that objective.

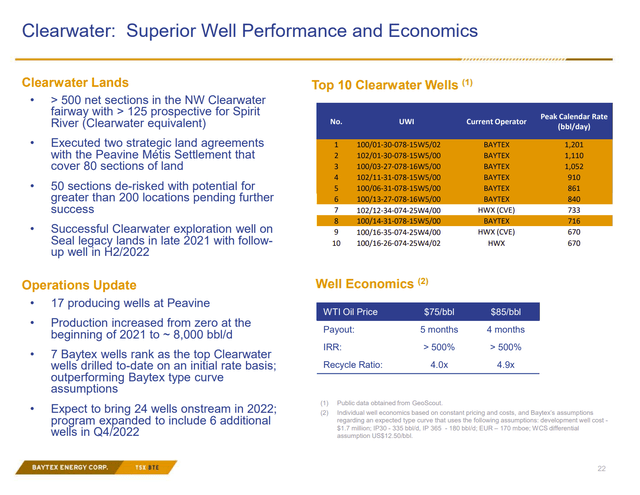

Baytex Energy Clearwater Operating And Profitability Characteristics (Baytex Energy June 2022, Corporate Presentation)

Management has come up with a new well design that they call Extended Reach Wells. These wells are even more profitable than the previous design. That will likely drop the play breakeven points lower. This play is getting a large majority of the heavy oil capital expenditures because of the profitability.

Right now, the production is rapidly rising from a small production base. So, the capital expended is still relatively small for a company of this size. However, the profitability characteristics shown above likely mean that the capital budget (spent on Clearwater) will grow at the expense of other legacy heavy oil plays and then at some point, management will likely have to make a decision as to the proper production mix because of the extreme profitability of this play.

Should management decide to grow the percent of heavy oil produced (and that is likely), then there will likely to be a decision that no long-term debt is acceptable (over very low) to accommodate the discounted pricing characteristics of heavy oil during times of weak commodity prices.

The extremely short payout combined with the profitability shown above will have an unusually large profitability effect on the company. Profits here will increase in excess of the favorable pricing environment that the whole industry is reporting.

In the latest first quarter report, management stated that Clearwater production had already reached 8,000 BOED which is roughly 10% of production. That happened in less than one year. Production is likely to continue to grow rapidly because profit characteristics likes those shown above for this play are extremely rare.

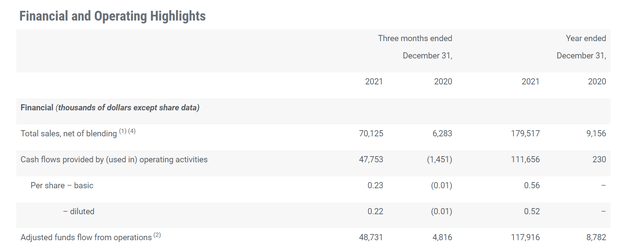

Headwater Exploration Cash Flow From Clearwater Wells Fourth Quarter 2021.` (Headwater Exploration Fourth Quarter 2021, Earnings Press Release) Headwater Exploration Production As Reported For the Fourth Quarter Of Fiscal Year 2021. (Headwater Exploration Fourth Quarter 2021, Earnings Press Release)

Some indication of the profitability can be shown by the quarterly report of Headwater Exploration (OTCPK:CDDRF). This company averaged a little more than 10% of the production of Baytex Energy. Yet the cash flow shown above is approaching approximately 20% of the cash flow reported by Baytex Energy in the first quarter (even though lower commodity prices predominated in the fourth quarter report). That outsized contribution is only getting better as commodity prices strengthen.

Baytex Energy has considerably more acreage and has more cash flow to use to develop this very profitable play. This play will be a significant “game changer” in that it will materially increase the profitability of Baytex Energy at all times except for some very extreme downturns.

Summary

Much of the industry is focused upon balance sheet repair. That includes Baytex Energy.

(Canadian Dollars Unless Otherwise Stated)

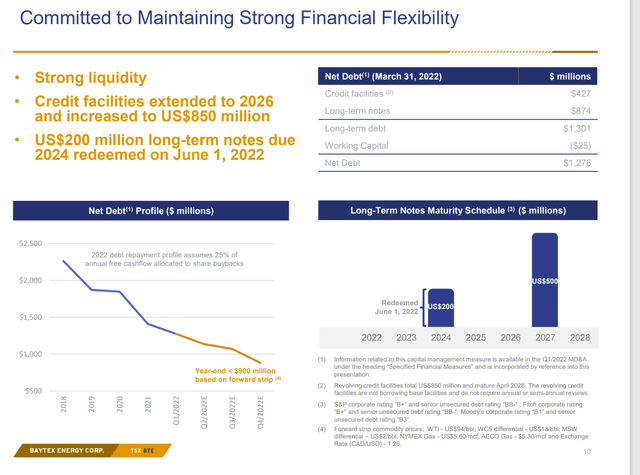

Baytex Energy Debt Level Projection And Assumptions (Baytex Energy June 2022, Corporate Presentation)

The company has a great profit opportunity in the Clearwater Heavy Oil play. But any increased participation in heavy oil necessitates a very conservative balance sheet structure because the heavy oil discount often expands to the point where the gross profit disappears. That usually necessitates the shut-in of production until heavy oil pricing recovers sufficiently.

The light oil plays of the Viking and the Eagle Ford would then likely provide cash flow until the industry recovery is underway. Therefore, management is correct to project a very low debt balance in the future. Competitor Headwater Exploration has a debt free balance sheet (for comparison purposes). Management only has to wait for enough cash to redeem the 2027 notes shown above.

The prospects for profit growth are above average industry prospects because of the Clearwater play. This discovery is yet another demonstration that very profitable acreage is still available in North America. Maybe that acreage is not always obvious. But these discoveries keep getting announced from time to time.

Even though oil and natural gas prices are at all-time highs, all we have to do at this point is let the free market operate. North America has many times the unconventional plays that it had with conventional. So, there is plenty of room for production to grow cheaply. As the extended reach wells demonstrate, technology is advancing to lower costs even more in this relatively young industry.

Once industry balance sheets are repaired (and under current conditions that is likely to happen fast) there is every indication throughout the industry that production will grow faster to eventually bring about the next cyclical downturn.

Heavy oil is in demand by the United States because our refining ability is unusually sophisticated. We as a country therefore import heavy oil while exporting the unconventionally produced light oil. We make money on the spread between premium light oil and discounted pricing heavy oil. That is likely to continue for the foreseeable future. The push for energy independence that currently predominates would significantly decrease the country’s profitability by erasing that profit we make (and worsen the balance of payments deficit). That needs to be a part of the future discussion of our industry strategy as a country.

Be the first to comment