Olemedia

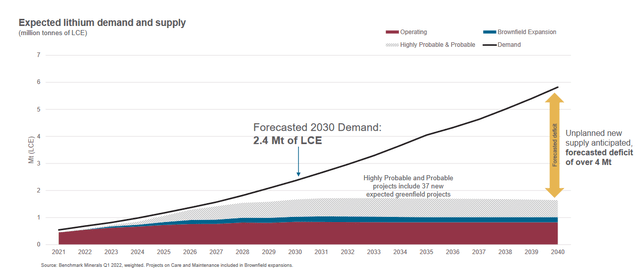

Most readers are probably well aware of the bull run that lithium prices have been on over the last year. That looks set to continue as electric vehicles sales, fueled in part by high energy prices, continue to grow in Europe, China, and North America. As it stands now, demand for lithium is currently far outstripping new supply coming to market, and that trend looks set to accelerate over the coming years. In fact, given the time it takes to develop a new mine, most forecasts now predict a lithium shortage lasting for over a decade.

These facts, and the investment opportunity that it creates, have resulted in many investors looking for an ETF product that will provide their portfolio with exposure to the lithium industry. The Amplify Lithium & Battery Technology ETF (NYSEARCA:BATT) is one such fund, with a mandate that includes investing in, “companies generating significant revenue from… battery metals & materials.” In this article, I’ll review the BATT ETF and discuss the degree to which it would provide an investor with exposure to the lithium industry.

Broad Mandate

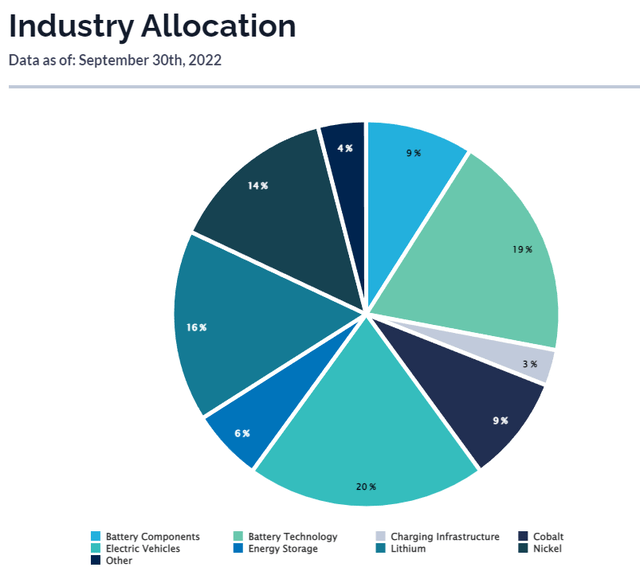

The first thing that any potential investor should know about the BATT ETF is that it has a very broad mandate. The fund, which has an expense ratio of 0.59%, seeks to follow the performance of the EQM Lithium & Battery Technology Index which is an index focused on EV battery supply chains. BATT’s September FactSheet lists the following three criteria that the ETF uses to guide the selection of potential investments:

- Companies deriving more than 50% of their revenue from the development and production of lithium battery technologies and/or battery storage solutions.

- Companies in the battery metals & materials supply chain that demonstrate beneficial interest in lithium battery technology.

- Companies deriving 90% of their revenue from the development and production of electric vehicles.

As is often the case with many indexes and investment funds, parts of the investment mandate are rather vague. While the first and third criteria are quantitative, the second criteria only refers to companies, “that demonstrate beneficial interest in lithium battery technology.” That can mean a lot of things and can include a lot of companies. However, that’s not necessarily a bad thing as it provides greater flexibility to invest in a wide array of companies in a fast-changing sector.

Where’s the Lithium?

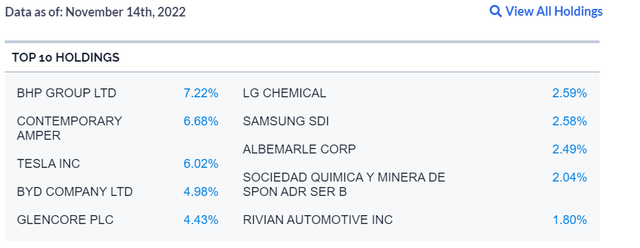

But it does lead to the question as to why a fund with so few constraints and the ability to invest anywhere in the lithium space, as well as a fund that has the word “lithium” in its name, has so few equity holdings in lithium producing companies. In fact, as of September 30th, the fund had only allocated 16% of its assets towards lithium producing companies. And Albemarle Corporation (ALB), its top lithium holding, ranked 7th on BATT’s list of top ten holdings as of November 14th.

amplifyetfs.com BATT Top 10 Holdings (amplifyetfs.com)

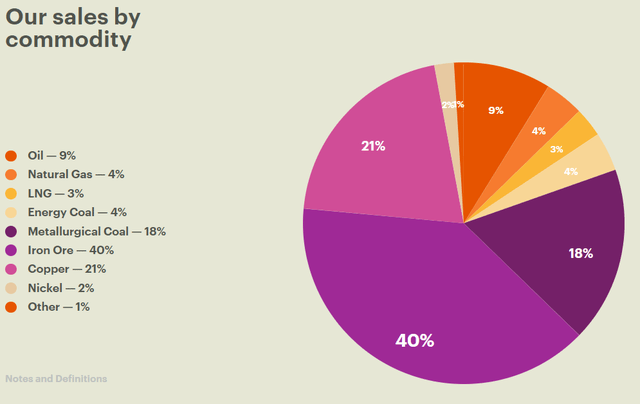

The fund currently counts BHP Group Limited (BHP) as its top holding. One assumes that the rationale for adding the BHP position to the portfolio relates to BHP being a large iron ore producer. Iron ore makes up 40% of BHP’s sales, and iron is central to the production of LFP batteries.

BHP Sales By Commodity (bhp.com)

Price Action

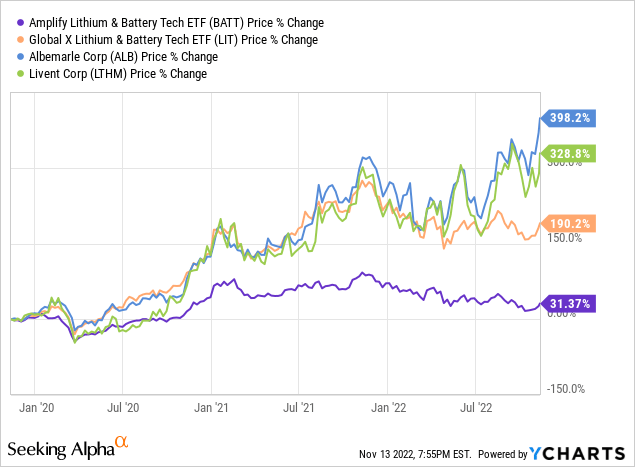

And, of course, there’s nothing wrong with focusing on miners producing other battery metals as well as the companies further downstream on the battery and EV supply chain. But potential investors looking to add lithium exposure to their portfolio and who are considering the Amplify Lithium & Battery Technology ETF as a vehicle to do so, should be aware of the ETF’s light lithium holdings and its underperformance of the lithium sector over the last 12 months. This underperformance can be seen in the exhibit below which compares the fund’s returns with those of Albemarle, Livent Corporation (LTHM), and the Global X Lithium & Battery Tech ETF (LIT).

Takeaway

While BATT provides investors with exposure to changes in the equity prices of a wide assortment of battery technology and battery metal producing firms, it provides relatively little exposure to equity in lithium miners. That’s rather surprising given the fund’s name. This has resulted in the fund drastically underperforming the broader lithium sector. For that reason, investors looking for lithium exposure would be better served to look elsewhere.

Be the first to comment