Douglas Rissing/iStock via Getty Images

Investment Thesis

MassMutual, through its subsidiary Barings LLC, is doubling down on the Business Development Company “BDC” sector, encouraged by the renewed interest in private equity “PE,” expanding the asset base of its newly acquired Triangle Capital -now called Barings BDC (NYSE:BBDC), through multiple acquisitions, including MVC Capital in 2020 and the Sierra Income merger last quarter, funded via new debt and equity offerings.

MassMutual’s transactions in the sector shouldn’t be read as a vote of confidence in BDCs as an investment. Instead, a sign of an active sector and strong PE demand. MassMutual’s exposure to the BDC industry is fundamentally different than yours. Unlike common shareholders profiting from dividend distribution and stock price appreciation, portfolio managers, such as MassMutual (through Barings LLC) and Blackstone (BX), collect a fixed-rate management fee regardless of performance. The bigger the fund, the bigger the profits.

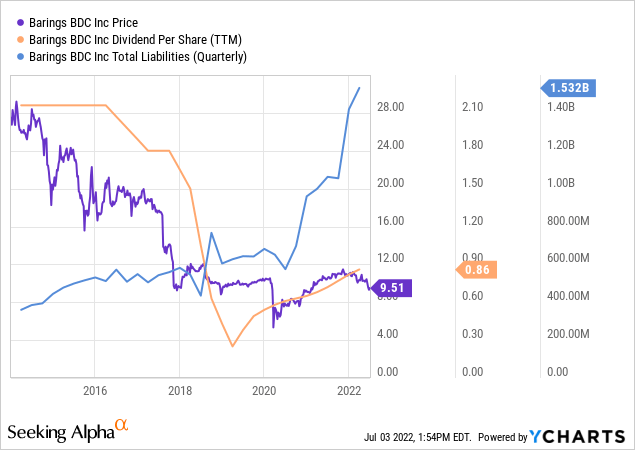

It is too early to judge Barings’ performance. Although the new management almost tripled dividend distribution since taking over operations, this comes from a low distribution base. In absolute terms, dividends are down 40% since pre-acquisition levels. In other words, until now, dividend increase is more attributed to leverage and conservative distribution policy in the early days of the transaction rather than any reflection of operational success.

Before acquiring Triangle Capital, Barings LLC had no experience managing BDCs, and its PE experience was limited to the PE funds it ran as registered companies. Despite its short operating history, BBDC has some unique characteristics that we explore in more detail below.

Our hold rating mirrors BDDC’s quality portfolio, conservative NAV estimates, discount to book value, solid origination platform, relatively low borrowing costs, weighed against increasing recession prospects, high leverage, and peer competition.

Portfolio

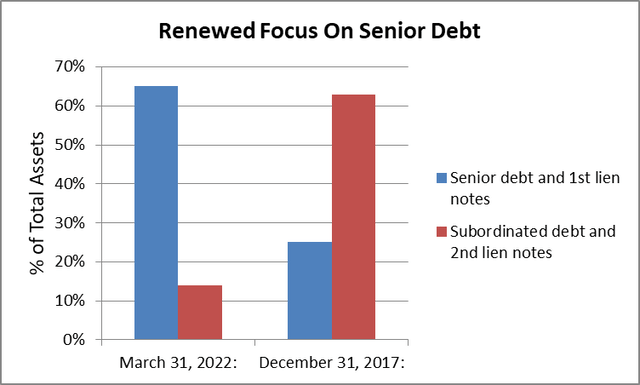

BBDC’s new management made welcomed changes in the portfolio composition in terms of debt priority, focusing on first-lien instead of the second lien and subordinated debt carried by its predecessor.

Author’s estimates, based on company filings

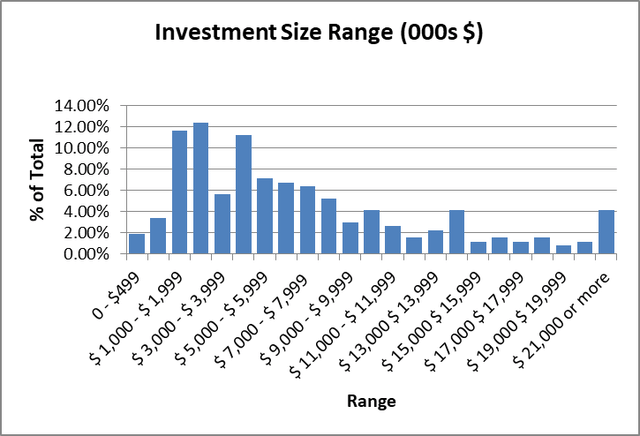

BBDC holds a well-diversified portfolio consisting of approximately 274 portfolio companies, five joint ventures, and 8 Collateralized Loan Obligation funds. Like its predecessor, its focus is mainly on the lower middle market, representing companies with annual revenue between $10 to $250 million. A typical BBDC debt investment is a 1st or 2nd lien debt between $1-9 million, with two-thirds of BBDC’s debt investments falling within this range.

Author’s estimates, based on company filings

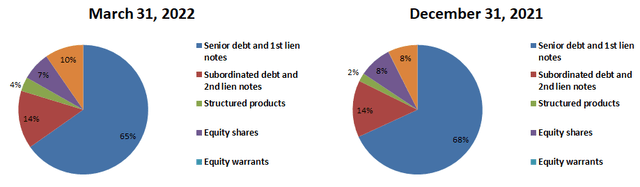

The recent Sierra acquisition (closed Q1 2022) expanded BBDC’s portfolio fair value “FV” by $436 million but hasn’t changed the overall composition in terms of asset classes, thanks to management’s efforts in tweaking the portfolio by working with Sierra management to dispose of a significant portion of structured products in the months before the closing date. This proactive approach to portfolio management was also present in past acquisitions, demonstrating a systematic and disciplined investment strategy.

Author’s estimates, based on company filings

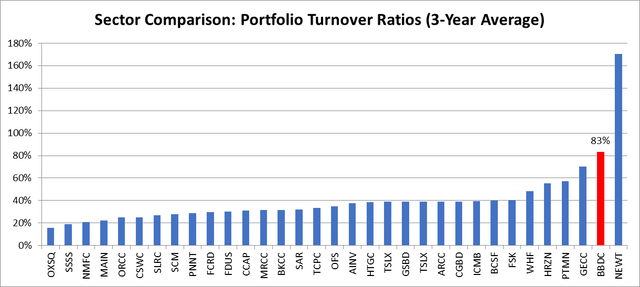

Another unique feature of BBDC is its above-average portfolio turnover, giving some assurance on fair value estimates’ alignment with market values, which can differ because of reliance on management’s estimates and good faith. Secondly, high turnover offers an index on management’s ability to originate loans.

Author’s estimates, based on company filings

Revenue Trends

Generally, a BDC’s investment income is a factor of its income-bearing assets multiplied by the weighted average yield. BBDC saw its asset base expand by $600 million (at cost), mainly due to the Sierra acquisition, contributing to a 27% increase in interest income. The company also profited from a jump in dividend yields, from $72,000 to $7.7 million, driven equally by asset expansion and extraordinary dividend income from its 16% interest in Thompson Rivers LLC, its mortgage lending joint venture.

Floating interest rate is the sector’s standard practice of lending. Most of BBDC’s interest-bearing assets are tied to a benchmark rate index to protect fair values as interest rates change. Although LIBOR, which remains the underlying benchmark for most of the sector’s lending, rose from 0.2% to 0.96%, BBDC’s weighted average yield remained stable at 8.1%. This is because most of the company’s debt investments incorporate an interest rate floor, often set at 1%. LIBOR only exceeded the 1% threshold in Q2. Thus the benefits of rising interest rates are more likely to be felt in the next earnings release. We saw similar dynamics for Gladstone Capital (GLAD), Horizon Technology (HRZN), OFS Capital (OFS), and Fidus Investment (FDUS), all reporting decreasing weighted average yields on debt investment due to competition, despite rising interest rates.

Balance Sheet

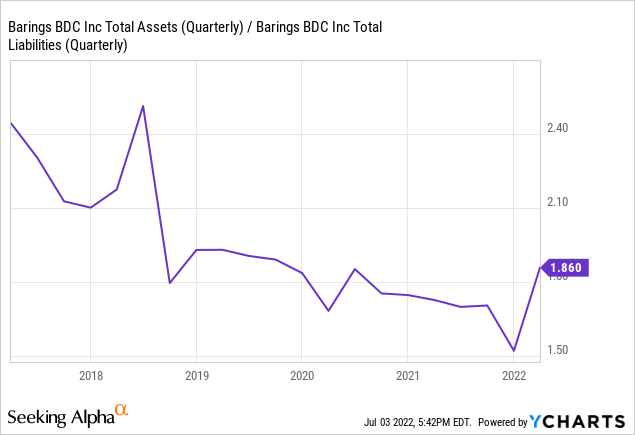

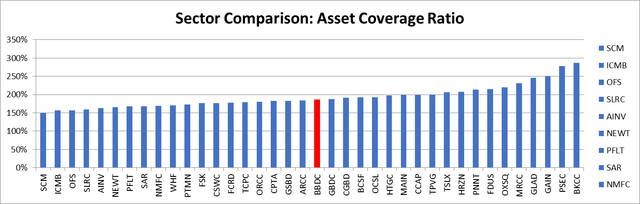

Like many of its peers, BBDC increased leverage after a change in regulatory requirements under the Trump administration, which saw asset coverage ratio mandates decrease from 200% to 150%. BBDC leverage’s proximity to peer average doesn’t say as much about its balance sheet as it does about the high leverage of the sector. Taking the Assets/Liabilities ratio as a proxy for regulatory asset coverage, a 20% fall in the fair value of BBDC’s portfolio, say from a recession, will force management to raise equity to meet regulatory leverage thresholds. One can only imagine the amount of dilution when a BDC is pushed to raise capital at a time of economic turbulence.

Despite its asset quality, discount to NAV, and conservative fair value estimates, I believe that BBDC doesn’t offer an attractive risk/reward balance given the current macroeconomic environment. However, if you wish to gain exposure to the US middle market today, BBDC is one of the better picks in the sector.

Author’s estimates, based on company filings

Summary

BBDC will likely increase the dividend in the coming quarters as benchmark rates remain high, exceeding weighted-average floor rates on its debt securities since April this year. These dynamics are likely to be mirrored in the Q2 results.

The company trades at a 20% discount to book value, despite high portfolio turnover increasing alignment of fair value estimates with market prices. Since taking over management, Barings LLC enhanced portfolio quality, replacing subordinated debt with 1st lien securities.

Our concerns stem from BBDC’s high leverage, standing near regulatory asset coverage ratios. Fair values are likely to decline during a recession. A 20% reduction in fair value will render BBDC incompliant with leverage regulatory mandates. pushing management to raise equity during market turbulence, increasing the risk of dilution.

Be the first to comment