ThamKC/iStock via Getty Images

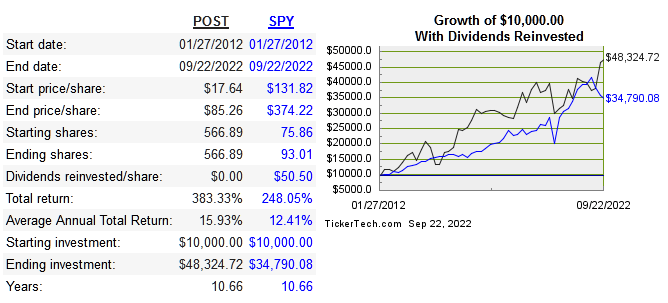

Post Holdings Inc (NYSE:POST) IPO’d its subsidiary, BellRing Brands (BRBR), in 2019 but the focus of this article is on Post versus its peers, not the parent company vs. subsidiary. The iconic brand has a well-known legacy, but the current version of this company was spun out of Ralcorp in 2012. Its segments break down into Post Consumer brands, Weetabix, food service, refrigerated retail, and BellRing Brands. The global cereal market is estimated to grow at 3.7% till 2030. Below is the share price since IPO:

dividendchannel

Below are the return on capital metrics:

|

Company |

Median 10-Year ROE |

Median 10-Year ROIC |

EPS 10-Year CAGR |

FCF 10-Year CAGR |

|

POST |

1.4% |

0.6% |

6% |

12.4% |

|

37% |

10.4% |

6.2% |

4.1% |

|

|

24.9% |

10.3% |

6.5% |

4.7% |

|

|

44.1% |

11.8% |

3.1% |

-1.4% |

|

|

11.5% |

5.1% |

5.1% |

0.1% |

Source: QuickFS

Capital Allocation

There is no clear product advantage between any of the big cereal companies. The gaining and losing of market share won’t be driven by pure innovation. Capital allocation is extremely important with these mature companies. M&A will always play a big part for the biggest companies in this industry. Knowing what the right configuration of brands should be is virtually impossible, and the individual brands tend to get traded back and forth between the big players like they are Pokemon cards.

They stopped paying out a dividend in 2020 and have yet to resume. A new round of repurchases was recently announced, but the stated intention is to hold them as treasury stock instead of retiring the shares. I don’t anticipate share count being meaningfully reduced in the next few years .

Moat

This company’s moat is only as strong as its brand power. On one hand, the brand power is real and can be seen quite easily. Inflation absolutely drives people in the lower cost private label and this trend is only growing. This doesn’t negate the fact that the most famous brands still remain intact. If there weren’t enough people choosing the name branded products, these businesses would eventually go extinct and private label would dominate.

The ability to raise prices helps gross margins, and cereal is one category that has been hit hard, with a 16% price increase Y/Y. I don’t expect previous revenue growth to increase with inflation being so high and persistent.

Risk

POST has three consecutive years of negative earnings from 2014-2016, yet has remained free cash flow positive throughout the past ten years. The growth of free cash flow has been strong, but long term debt has grown at 20.5% CAGR and share count has also doubled in the past ten years.

Returns on capital have been far below average and shows no signs of reversing. Operating margins have been inconsistent throughout and this is a major red flag. This along with high debt levels will keep growth stagnant. These are the biggest risks, even if net income remains positive for the next several years.

Valuation

Below is comparison of multiples:

|

Company |

EV/Sales |

EV/EBITDA |

EV/FCF |

P/B |

Div Yield |

|

POST |

1.5 |

10.2 |

49.6 |

1.4 |

n/a |

|

K |

2.1 |

13.4 |

23.9 |

5.8 |

3.2% |

|

GIS |

3 |

14.8 |

20.5 |

4.5 |

2.8% |

|

CPB |

2.2 |

11.8 |

18.5 |

4.3 |

3% |

|

CAG |

2.1 |

14.2 |

33.4 |

1.9 |

3.8% |

Source: QuickFS

From a pricing perspective, POST is mostly in line with its peers except for the FCF multiple. The growth of FCF is the best aspect of the company qualitatively, but it doesn’t deserve such a high multiple. Of the $11.5 billion in assets, 4.4 billion is in goodwill alone, and this should be kept in mind.

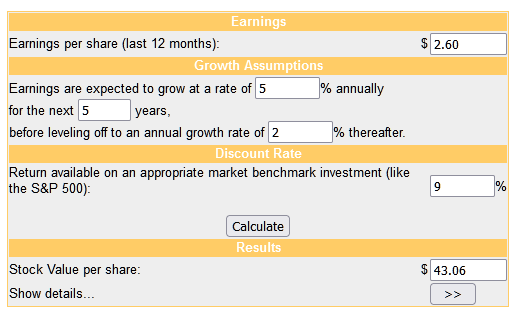

Next is the DCF model with very conservative growth estimates:

moneychimp

At current share price of 85.26, POST is clearly overvalued in terms of future earnings growth. Shares have beaten the market since the IPO, but the law of large numbers will slow down future growth and operating margins show no signs of stabilizing.

Conclusion

POST has a long legacy and their brand power has lasted for many decades. Looking forward from here, brand power won’t mean as much as it used to. With the 2019 acquisition of private label company, TreeHouse Foods, notwithstanding, inflation will drive more consumers to private label alternatives. Right now there is very little growth potential ahead, no room for margin expansion, and overvaluation in terms of multiples and intrinsically.

Long-term debt is higher than revenue, and the share count has doubled over ten years, showing that the growth might have simply cost too much. There needs to be more deleveraging and margin stabilization for me to be seriously interested in buying the stock. In spite of pretty good free cash flow growth, overall business quality is too low to be considered a long-term investment, regardless of price.

Be the first to comment