photocheaper/iStock via Getty Images

With Alibaba (BABA) taking so much heat from the CCP, I’ve advised investors to stay away. I suspect the company is a target for nationalization. But Alibaba is too good of a business to ignore if you are a long-term investor.

The solution to this problem is to find a tertiary method of investing in BABA without exposing yourself to the very real politically driven downside. My suggestion is to choose a small Chinese e-commerce stock that does business with Alibaba, one that has no risk of being seen as a monopoly by the CCP. After a deep dive into the ecosystem, I determined Baozun (NASDAQ:BZUN) – pronounced “baoh zwen” – to be my recommendation.

BZUN: A Safer Alternative for BABA Investors

First, a bit about Baozun as a tangential investment in Alibaba: Alibaba owns over 10% of BZUN, and thus an investment in BABA is partially an investment in BZUN. In addition, BZUN generates most of its business through Tmall. It also employs in its business Aliwanwan and Alipay, both all operated by Alibaba. Baozun is inextricably tied to Alibaba, making BZUN a logical alternative to BABA for investors worried about Chinese regulatory pressure in the e-commerce sector.

As part of the CCP’s five-year plan, monopolies in the tech space are being clamped down upon. This makes Chinese tech a highly risky equity class, along with Chinese tutoring, construction, and cryptocurrency – all areas that have recently seen increased restrictions. However, in the tech space, as long as you are not a monopoly – such as the case with BZUN – you are likely to emerge relatively unscathed.

Moreover, just yesterday, Beijing announced that Chinese tech companies listed on US exchanges are likely to subject to full US-side audits beginning this year. While this sounds nice on paper, it is unlikely to be 100% implemented, as large companies – such as Alibaba – are now tightly integrated with the Chinese government. For example, few would be surprised if US companies were denied a full audit of Alibaba’s due to – for example – Alibaba’s cloud servers having been tied to the CCP’s Ministry of Industry and Information Technology, thereby being considered “state secrets.” Baozun, however, is not so deeply integrated with the CCP and is likely to actually provide full audits, increasing the transparency of this particular e-commerce investment relative to its larger Chinese competitors.

Quantitative Bullishness

Seeing as BZUN has been punished in the stock market to an equal extent with regard to its larger peers, I’m inclined to believe that BZUN’s stock price has been unfairly deflated. Indeed, Chinese stocks trading on the US market are much more opaque to US investors when compared to US stocks and so bearish news about China or Chinese tech alone could drive down the prices of otherwise successful Chinese tech companies. I wanted to further analyze the idea that BZUN is likely to produce alpha in the months ahead via my go-to quantitative methods, including financial lexical analysis.

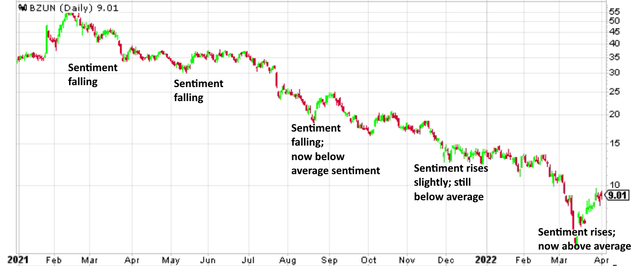

My preferred form of financial lexical analysis is the calculation of a sentiment score from earnings call transcripts. Much research in this field has shed light on the predictive ability of sentiment on future stock price. I’ve been running financial lexical analysis over earnings call transcripts to arrive at a sentiment score – essentially the difference between the number of optimistic statements and pessimistic statements, scaled by the length of the earnings call – and found strong predictive validity. (Here are a couple examples.)

I’ve run the same analysis on BZUN. Below, I’ve plotted the change in sentiment score upon BZUN’s chart.

The most recent sentiment score is not only an increase but is large enough to bring the sentiment score back above average. Management sentiment predicts a rebound in the stock price.

Mean reversion supports this idea. Mean reversion is a statistical idea that, when applied to stocks, essentially says that a stock underperforming against its peers will soon outperform, and vice-versa. BZUN is set to undergo 17% upward mean reversion to return to its expected trading price relative to its peers.

A 17% difference is quite large, and usually when I see such numbers I investigate the stock’s investor profile, which I define as the investors’ propensity to buy or sell on good or bad news. If a stock’s investors have a clear bias toward a certain action (e.g., taking profit on good news), mean reversion often does not apply, as the stock is structurally different (i.e., it cannot rise past a point that its investors determine to be a good profit-taking region).

I ran such an analysis on BZUN, comparing the stock’s movements against expected movements on novel events (e.g., news). I found that BZUN actually underreacts to both good news and bad news. That is: BZUN doesn’t sell off as much as expected on bad news and doesn’t rally as much as expected on good news.

Because the bias is symmetrical (read: does not lead to upward or downward pressure on the stock), mean reversion is likely. That is, we are looking at a statistically likely 17% upward movement in BZUN. Moreover, considering that the company is beaten down, still growing (GMV is up 14% just in the last quarter), and has rising management sentiment, I believe a bullish position is warranted.

The Play and Risks

Yet I want to hedge for downside risk, as BZUN clearly gets dragged down with the Chinese tech sector on the release of bad news, which is unpredictable. Even though the company is a solid one, any surprise announcement in the Chinese e-commerce industry is likely to spike volatility, deserved or not. As I believe BABA will be nationalized, this is a bearish catalyst for all Chinese tech stocks, and I wish to engage in an option strategy that will protect us against such a risk.

Here is my idea:

- Buy 2x May20 $10 calls

- Sell 1x Apr14 $7.50 call

The short Apr call covers the cost of the two long May calls (actually, you gain a net credit of $15). If BZUN continues to fall, you will profit, meaning there is no downside risk for this play; the loss potential is only realized if BZUN trends sideways. In addition, once BZUN rises above $10, your position is nearly equivalent to holding one lot BZUN stock – at no cost, of course, due to the position being opened at a credit.

The risk of this play is only if BZUN rises only slightly, not surpassing $10. But the mean reversion aspect of this play suggests BZUN will rise to nearly $11, which is why these calls make sense from my thesis’s perspective. In any case, we are aiming to maximize the upside profits without taking on downside risk, and the real maximum risk here is around $90, which will be realized if BZUN does not fall or surpass $10.

Let me know what you think.

Be the first to comment