Cindy Ord/Getty Images Entertainment

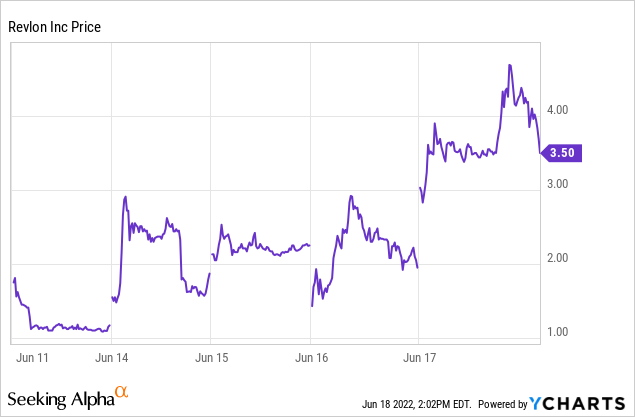

Revlon, Inc. (NYSE:REV) had a wild ride last week. Volume for just the last four days of the week totaled almost 356 million shares compared to a float of only 7.263 million, after deducting shares held by insiders and an institutional holder. That is about 49 times their float in just a few days. Despite Revlon filing for Ch.11 bankruptcy very late on June 15 (docket 1), the stock traded as high as $4.72 on Friday. Since Revlon has over $3.5 billion in debt, which has priority for any recovery, one has to wonder if traders are being rational bidding up the stock price.

Wild Trading

Revlon was the most active stock on Friday (17 June) with 146,309,474 shares traded. This is really shocking because after deducting 46,720,911 owned by board members (including 46,223,321 owned by Ron Perelman) and also deducting 1,368,181 owned by Mittleman Investment from their total 54,254,019 shares outstanding, the effective float is only about 7.263 million. Using FINRA data from just normal trading hours, approximately 52.4% of the shares traded were short sales on Friday. This might seem like a lot of short sales, but it is about average for Revlon, and it is not an unusual figure for most stocks. Often these short sales are kept open for only a few seconds. This is not the same as the published short interest figures.

Reasons for Wild Trading

Many assert that the trading last week was completely irrational, but there were actual issues that may have impacted trader’s thinking.

First, a very large Indian conglomerate, Reliance Industries, is considering buying Revlon according to ET Now. This has caused a lot of confusion. Reliance Industries would most likely buy Revlon’s assets – not actual Revlon Inc. – under a section 363 sale. Reliance’s offer, assuming it actually happens, would be the stalking horse bid and there would be an auction. This would be fairly close to what happened with JC Penney when they sold their assets in bankruptcy. The proceeds from the asset sale would be divided up under a Ch.11 reorganization plan that is expected to follow the normal priority “waterfall” for recoveries, with Revlon shareholders on the bottom.

Second, Reuters reported that:

Mittleman Brothers Investment Management, which holds about 3% of the company’s stock, expressed hope equity holders would manage a decent payout despite the bankruptcy. That could happen if Revlon manages higher sales that allow it to overcome supply chain issues, Chris Mittleman said in an email to Reuters

Mittleman has been very active in the past asserting minority shareholder rights against Ron Perelman. I would expect them to file a motion to have an official minority equity committee be appointed by the U.S. Trustee.

Mittleman raised a critical point. It seems that the primary reason for Revlon filing for bankruptcy was supply chain issues. Because so many different ingredients go into each product, just not being able to get one ingredient could cause delays in supplying their customers. If (again if) this supply chain issue is finally resolved, Revlon could become a much more viable cosmetic company. Part of their current problem is that their suppliers have been more likely to sell ingredients that are in very short supply to financially stronger competitors because the suppliers do not want to risk not being paid by Revlon. Under the Ch.11 bankruptcy code, vendors who now sell ingredients to Revlon will have priority administrative claims to get paid, which should make them much more willing to sell to Revlon.

Third, some traders who had a “classic capital structure” trade of going long the unsecured notes and shorting the common stock, may have found themselves unable to maintain the short side of their position and bought back their shorted shares. At the same time, others who were able to borrow the stock, opened classic capital structure positions.

Last, on the negative side, the NYSE commenced proceedings to delist Revlon under section 802.01D. According to the news release:

The NYSE will announce a suspension date and suspend trading at such time as i) the Company does not request a review by the Committee within 10 business days of this notice, ii) the Company determines that it does not intend to appeal, iii) the subsequent review of the Committee determines that the Company should be suspended, or iv) there are other material developments. After the suspension announcement, the NYSE would then apply to the Securities and Exchange Commission to delist the common stock.

This could mean that REV would no longer trade on the NYSE and would trade OTCPK as a “Q” stock. This could mean that many traders who use certain brokers, such as Robinhood, will not be able to buy Revlon stock, but they would be allowed to sell their stock via the brokerage firm. This often happens when companies file for bankruptcy.

I have not seen any request by Revlon to have the NYSE review the delisting notice. The current Revlon equity capitalization would not warrant a delisting. Since no restructuring support agreement – RSA has been filed that would indicate no recovery for equity, it is also hard to assert, at this point, that shareholders will get wiped out with any degree of certainty.

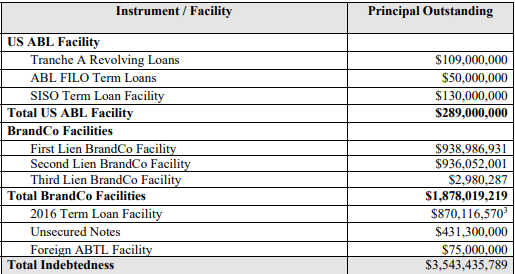

Way Too Much Debt

Unless there is some major positive development, it is unlikely Revlon shareholders get any recovery under a Ch.11 reorganization plan because there is just too much debt that has priority for recovery. Revlon has over $3.5 billion in debt that would have priority and that does not even include vendor claims, large bankruptcy legal fees, and DIP financing that all will have priority over shareholders.

Revlon Debt Structure

Revlon’s Debt (Kroll)

The Ad Hoc Group of BrandCo Lenders are in the “driver’s seat” for negotiating a Ch.11 reorganization plan because they collectively own 55% (docket 43) of the debt above the unsecured note class. Since that lender group collectively owns only about $10.5 million of the unsecured notes, it is unclear how willing they will be to give the unsecured note claim class a recovery.

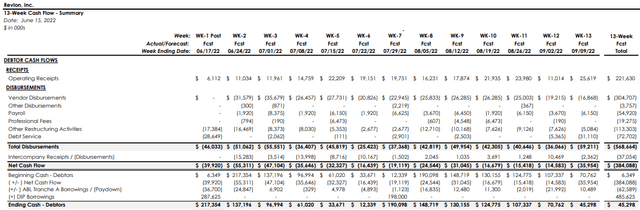

DIP Financing

Revlon is receiving $375 DIP financing cash and could get up to $575 million. Most of that money will be used to pay vendors because they only had $12.86 million cash when they filed for bankruptcy.

DIP 13- Week Cash Flow Projection (Docket 47)

13 Week Cash Flow Projection (Kroll)

DIP Loan Milestones

• November 1, 2022: Entry into a restructuring support agreement – RSA• November 30, 2022: Filing of an acceptable plan of reorganization and related disclosure statement• April 1, 2023: Entry of an order confirming a plan of reorganization• April 15, 2023: Substantial consummation of a plan of reorganization

The Wildcard – Citibank’s $900 Million Error

Most readers already know about how Citibank paid $900 million, which they claim was just an error, to holders of Revlon term loans. Holders of about $500 million of the term loans kept the money. Citibank sued [Citibank August 11, 2020 Wire Transfers, Case No. 1:20-cv-06539-JMF (S.D.N.Y.)] and federal Judge Furman ruled against Citibank (copy of decision). Citibank appealed. The appeal is still pending after oral arguments were heard on September 29, 2021.

I decided not go into the details of the legal issues, but they are based on “discharge-for-value” and a different 1991 case when payments were not returned, Banque Worms v. Bank America International (copy of decision).

This issue is important for unsecured noteholders because they could have about $500 million less debt that has priority for a recovery. It is less important for REV shareholders because any recovery they might get will most likely be via “gifting” from a higher priority class to the lower priority equity class.

Assuming the appeal goes against Citibank, the bank will try to assert subrogation rights for the $500 million. Insurance companies frequently use this right to get paid from negligent parties the money that the insurance company already paid their customer. In a footnote in a filed docket (docket 30) Revlon stated “In the event that the Second Circuit rules in favor of the Non-Returning Lenders, the Debtors reserve all rights and defenses with respect to any claim Citibank may assert against the Debtors.”

This appeal really needs to be settled soon because it will be difficult to create a Ch.11 reorganization plan without a resolution and it will be impossible to determine the proper plan voting results for the 2016 term loan claim class without knowing who is actually in that class.

Other Points

*David S. Jones is the bankruptcy judge. He is not the very well-respected Judge David R. Jones in Texas. He just was appointed to be a bankruptcy judge in early 2021. It is, therefore, hard to get a feel for how he might rule on issues. Prior to his appointment, he was in the U.S. Attorney’s Office for Southern District of N.Y.

*Four of the current Revlon directors do not even own Revlon stock.

*Ron Perelman is 79 and his daughter is Revlon’s CEO.

Quick Note on My Trading

As I stated in prior Revlon articles, I own the 6.25% 8/1/24 unsecured notes (CUSIP 761519BF3), which are actually a Revlon Consumer Products Corp. note issue. I sold some notes in late March 2022 as part of my portfolio reduction in long holdings and nothing specific to Revlon. I later sold more notes based on comments contained in their various Revlon filings. I still own some unsecured notes and plan to hold to “see what happens.” (They might become part of my “wallpaper collection” that I have accumulated over many decades of investing.)

Conclusion

The supply chain issue is more acute and lasting longer than I expected. Given the extremely high level of debt Revlon has, it was no shock that they filed for Ch.11 bankruptcy.

There are a lot of unknown variables in this bankruptcy case. The bankruptcy judge is new and unknown. It is unclear how viable a potential offer from Reliance Industries is, and that is based solely on one media report citing “sources.” How will the court rule on Citibank’s appeal? Revlon’s operations are still being greatly impacted by supply chain issues, and it is unknown when, if ever, this issue gets resolved.

Traders last week seemed to think they knew the answers to all these unknowns. I do not. Therefore, I am rating Revlon neutral, but Seeking Alpha requirement’s mean that I rate it a hold.

Be the first to comment