J. Michael Jones/iStock Editorial via Getty Images

Introduction

I’ve never covered Bank OZK (NASDAQ:OZK), one of America’s smaller stock-listed banks with a yield of 3.1%. This bank with a market cap of $5.0 billion has a fantastic dividend growth track record, a history of outperformance, and a good valuation. In this article, I will explain why I think it’s one of the better banks in the industry and which macro indicators I’m watching to explain why the stock is falling. Long story short, income-seeking investors will find a lot of joy in this bank as it combines yield and growth, which is something that’s hard to come by in the current market environment. Moreover, because growth is high, it’s a stock that even deserves a spot in growth-focused dividend portfolios.

Now, without further ado. Let’s look at the details.

Dividend Growth In Banking

I’m not a big fan of banking, in general. I own one banking stock named Huntington Bancshares (HBAN), which I bought in 2020. Most banking stocks follow the same pattern driven by rates and economic growth. It’s incredibly hard to find a bank that stands out – especially on a long-term basis. Growth measures are often incremental, as they include digitalization, small-scale M&A, and far-reaching services that go beyond traditional banking.

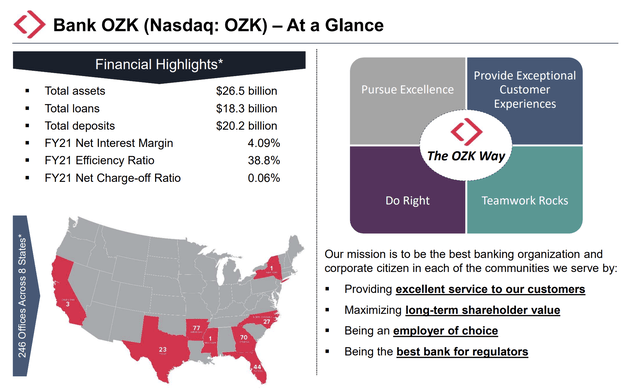

In the case of OZK, we’re dealing with a $5.0 billion market cap bank. This makes it America’s 30th largest stock-listed bank. The bank is headquartered in Arkansas with total assets of roughly $26.5 billion.

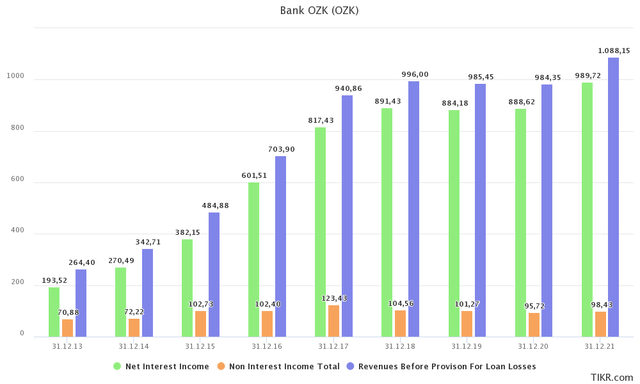

Unlike some larger banks, OZK is mainly focused on what banking is all about: loans. I visualized this using the graph below, which shows total net interest income, noninterest income, and the resulting pre-prevision revenues.

As of 4Q21, the company had roughly $17.8 billion in non-purchased loans. Non-purchased loans make up 97% of the company’s total loans with a yield of 5.8% as of 4Q21.

As a result of this, the bank is mainly dependent on three things. Loan growth, loan quality, and an improving efficiency ratio to make the best out of its loan-focused business model.

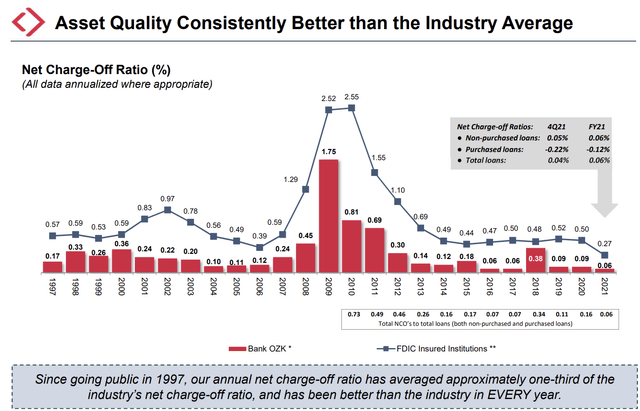

Going all the way back to 1997 when the company went public, it has beaten the industry average every single year when it comes to asset quality. In 2021, the company saw a decline in its net charge-off ratio to 0.06%. The industry average was 0.27%, which was already low. Note that neither the industry nor the bank saw a higher ratio in 2020 as the government stepped in to help businesses, using loan guarantees as well as related PPP loans.

The company’s nonperforming loans ended the 2021 year at just $35 million. That’s 0.19% of the total non-purchased loan volume.

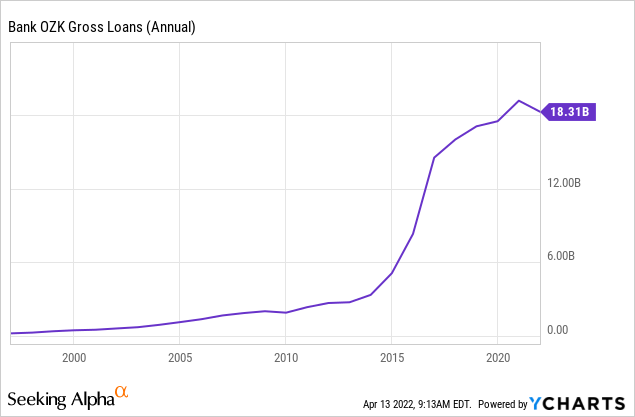

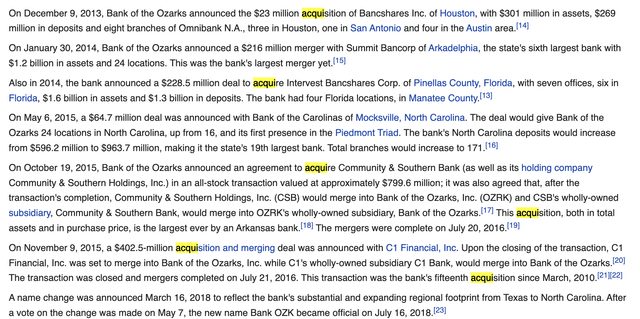

Total loan volume ended the 2021 fiscal year at $18.3 billion. This excludes Roughly $230 million in loan loss allowances and other adjustments to gross loans. Loan growth has been wild. Especially after the Great Financial Crisis, the bank has been on an aggressive acquisition streak.

For example, a quick highlight of the word “acquisition” on Wikipedia shows that the company has increased its regional banking footprint by acquiring smaller competitors. It’s very common for banks like OZK and it becomes increasingly more difficult to maintain growth this way once banks become larger. At that point, M&A also needs to be much larger. However, for the time being, this growth strategy works.

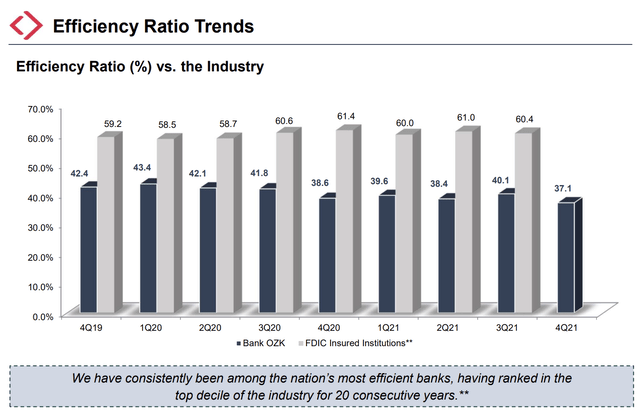

When it comes to the company’s efficiency ratio, it’s nothing short of impressive. The most recent comparison between OZK and its FDIC peers can be made using 3Q21 data, which shows an efficiency ratio of 40.1% versus 60.4%, which is truly impressive. The operating efficiency ratio shows how much it costs to run the bank. In this case, it’s non-interest expenses as a percentage of total revenue. In other words, the lower the better.

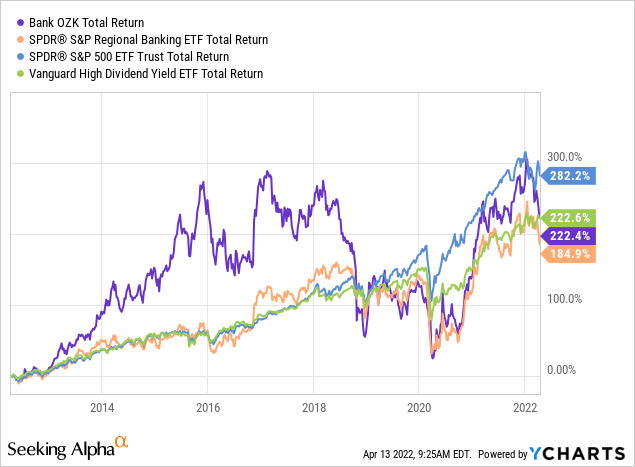

The good news is that this has resulted in outperformance – until the most recent trend in growth slowing that I will discuss in this article. Over the past 10 years, and including dividends, the stock has returned 222%. That’s not too bad. The regional banking ETF (KRE) has returned 184%. So, there’s your outperformance over peers. The Vanguard High Dividend ETF (VYM) has returned 222% as well. The S&P 500 has returned 282%, which is higher. However, going into this year, the OZK performance was similar.

It’s also worth noting that OZK hasn’t gone anywhere since the end of 2015. The company’s performance was wild prior to the 2018 global slowdown as it was backed by higher M&A volume and I believe just a better environment to grow the business. I can imagine that a similar environment returns after the ongoing decline in banking stocks ends.

However, I will discuss that in the “valuation” segment of this article.

OZK Dividend

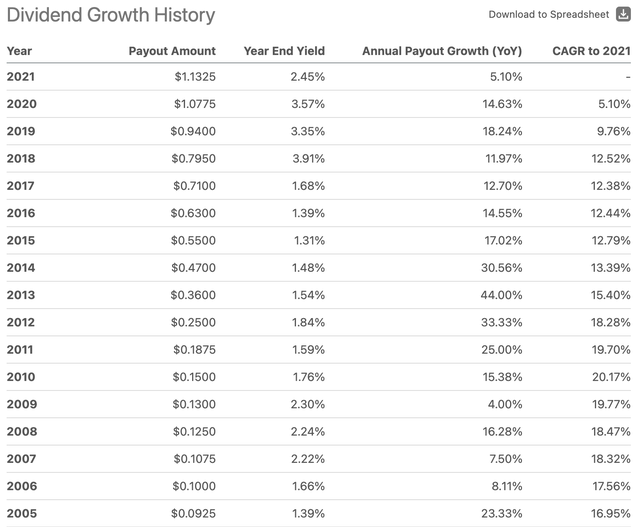

On April 1, the company announced its most recent dividend and a 3.3% hike. The company hiked by 3.3% to $0.31 per quarter. That’s $1.24 per year. Using the current stock price of $39.80, we end up with a yield of 3.1%.

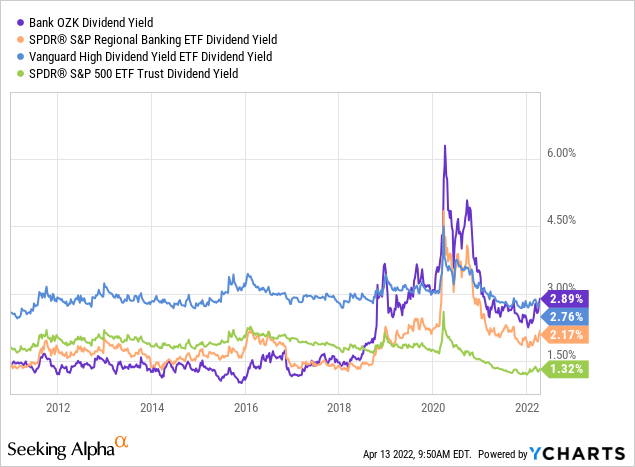

So, what does this mean? Is that a lot? Unfortunately, 3.1% is a lot. The S&P 500 is yielding just 1.3% as dividend growth was unable to keep up with capital gains after the 2020 pandemic sell-off. Meanwhile, the average regional bank is yielding 2.2%. The Vanguard VYM ETF I just mentioned is yielding 2.8%. OZK’s 3.1% is indeed a “high” yield. And even more important, it’s well above pre-pandemic levels, which is good for income-oriented investors.

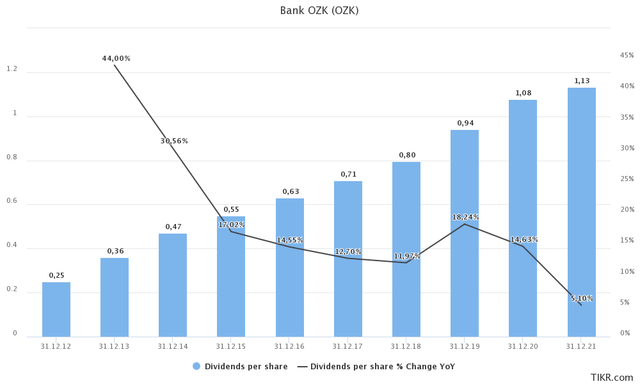

The good news is that dividend growth isn’t bad – at all. While dividend growth has come down a bit in the industry since the pandemic, the 10-year track record is great. Over the past 10 years, the dividend has increased by 18.8% per year – compounded. Most of it was caused by steep hikes in 2013 and 2014. The 5-year average is 12.1%. The 3-year average is 11.3%. I believe that the company can and will maintain 10ish% dividend growth going forward.

This is what the dividend history looks like going back to 2006. It’s based on Seeking Alpha data, which you can access here.

It gets better thanks to the company’s valuation.

Valuation – Finding An Entry

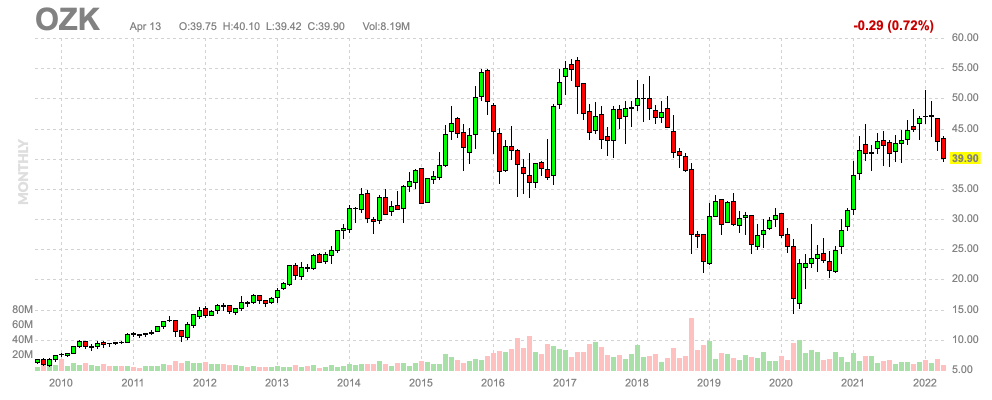

As you may have noticed when looking at the performance comparison chart, banking stocks are currently getting punished. OZK, for example, has dropped roughly 14% year-to-date.

FINVIZ

The stock has now fallen to early 2021 levels despite a surge in yields, which is not very common.

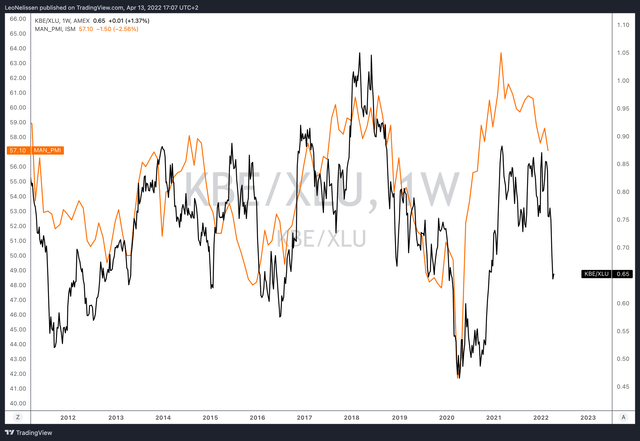

What we’re currently witnessing is portfolio repositioning. The chart below shows two lines. The black line displays the ratio between banking stocks as displayed by the banking ETF (KBE) and the utilities ETF (XLU). This ratio is pro-cyclical because banking stocks are more cyclical than utility stocks. In general, when rates rise, banking stocks outperform. That’s currently not the case as the graph below shows. This time rates are going up because the Fed is expected to hike rates aggressively. Yet, banking stocks are underperforming because the market expects this to end in a recession. Hence, I added the orange line in the graph below, which displays the ISM manufacturing index. This leading economic indicator has an almost perfect correlation with the KBE/XLU ratio. In general, banks are no-brainers whenever the ISM index bottoms, so watch for that going forward.

Right now, investors are de-risking their portfolios. This includes rotating money from banks to utilities – or from riskier assets into safer assets.

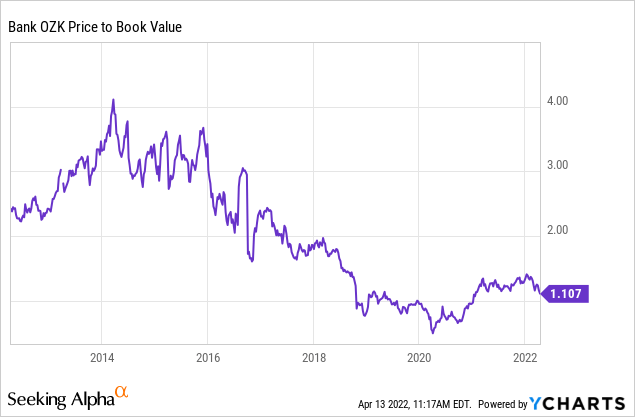

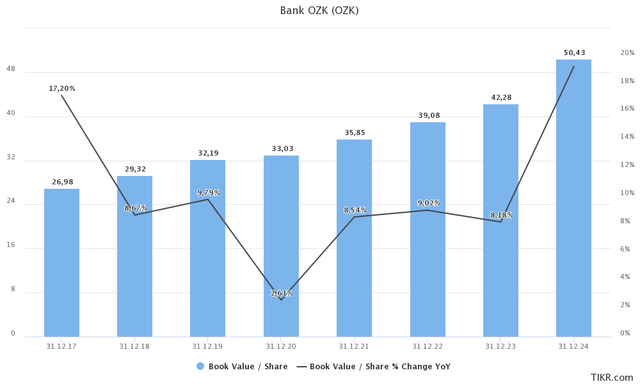

In the case of OZK, it has resulted in a better valuation. The bank is expected to end the year with a book value per share of $39.08. Next year, that number is expected to be $42.28.

This implies a price/book value of 1.02x and 0.94x, respectively.

This valuation is too cheap and I believe that OZK’s fair value is 15-25% higher, which would imply a $50 stock price.

However, I’m not sure the stock is going there quickly due to the downtrend in economic growth. If anything, we could see a move lower to the $30-$35 range as investors are de-risking their portfolios.

But that’s OK. This dividend yield is attractive and any further declines in this stock are buyable.

Takeaway

It’s a tough market for high-yield investors. Yields, in general, have dropped off a cliff after the pandemic started, leaving investors no choice but to move into more risky areas of the stock market.

The good news is that there’s still some quality high yield on the market. Bank OZK is one of them. This relatively small bank has a big footprint in lending, a very healthy loan portfolio, and a very high operating efficiency. The bank offers investors a 3.1% yield and decent dividend growth. Historically, the bank has also delivered outperforming capital gains, which I believe will continue going forward.

The valuation is attractive as banking stocks are in a tough spot due to an economic slowing trend. Higher rates are expected to hurt the economy, which includes lower expected loan growth, a weaker housing market, and related risks.

I believe that OZK offers opportunities for high-yield and dividend growth investors. The stock is cheap and any further dips are buyable. The best entry is if the ISM index bottoms, but that is hard to predict.

(Dis)agree? Let me know in the comments!

Be the first to comment