Spencer Platt/Getty Images News

Since my previous article a couple of months ago, Intercontinental Exchange (NYSE:ICE) has made some, quite immaterial, gains: about 1% from capital gains and 0.5% from dividends. To be honest, I think 1.5% in two months, which annualizes to slightly over 9% a year, is pretty all right (you can tell I’m not a very aggressive investor). Its price now stands at $102.54. Is it still a buy?

I believe ICE remains undervalued at the present, that it had a consistently excellent track record in the past, barring one odd blip which will be discussed later; and that its long-term future prospects are brilliant. In this article I explain why.

Company profile

ICE operates three lines of businesses: Exchanges; Fixed Income and Data Services; and Mortgage Technologies. In the Exchanges segment, ICE operates a number of regulated marketplaces for trading and clearing financial instruments, such as shares and derivatives (think the New York Stock Exchange, which it owns). In the Fixed Income and Data Services, ICE provides services such as fixed income pricing, reference data, indices, and analytics. In the Mortgage Technologies segment, ICE uses machine learning algorithms to provide streamlined and simplified solutions for mortgage lenders, which allow them to originate loans more efficiently.

They have minority stakes in subsidiary companies. Among them the point of interest is Bakkt, the black sheep of the family. I will touch on it briefly later.

Their main competitors are other exchanges based in the US, such as Nasdaq (NDAQ) and the CME Group (CME). They also compete against exchanges worldwide, such as the London Stock Exchange Group (LSEG) and Deutsche Boerse (OTCPK:DBOEY)

Some statistics at a glance, as of close of business on November. 10, 2022:

- Share price: $102.54

- Market cap: $54.3 billion

- P/E ratio: 22.7

- Debt / EBITDA ratio: 3.8

- Operating margin: 39.3%

- Profit margin: 14.4%

Upside case

In this section I describe why I believe ICE shares are undervalued.

DCF Valuation

I use the discounted cash flow method to estimate a fair value for ICE, and I find that the fair value of an ICE share is around 42% above its current price. I consider DCF appropriate to use for the valuation because in the last 10 years ICE has been profitable every year, and has paid out dividends in every year.

The DCF method gives the fair present value of a share as:

V0 = D1 / (r – g)

Calculating g

I estimate g, the sustainable growth rate for ICE, as:

g = RR x ROE

My review of sell-side analyst reports suggests that the median forward-looking return on equity (ROE) for ICE is slightly below 14.8%.

On a trailing twelve months basis (for the avoidance of doubt, from Q3 2021 through to Q2 2022), ICE has earnings per share of $4.51, and paid a dividend of $1.47. The retention ratio is calculated as retained earnings divided by earnings per share. In this case, I find that the retention ratio is 67.4%.

This yields a sustainable dividend growth rate of 10.0%. I note that this is materially above the S&P 500’s historical dividend CAGR of 6.5%, but it is materially below ICE’s historical dividend CAGR (14.2%), as well as its net profit CAGR (9.3%)–not only are exchanges profitable businesses, ICE is also nursing a number of promising ventures in the wings. Therefore, I consider 10.0% a reasonable estimate of ICE’s dividend growth rate.

Calculating D1

ICE pays dividends quarterly. Therefore, I set D1 as the sum of the four dividend payments in the next twelve months, which will occur in Dec. 2022, and Mar., Jun. and Sep. 2023.

ICE has already declared a dividend of $1.52 for the year 2022. Of this amount, they will pay the remaining quarter in December. Therefore, I set $0.76 as first half of D1.

I assume the dividend payments in 2023 will grow at the sustainable growth rate of 10.0%. Therefore, I set $0.418 as the quarterly payments for 2023. Quite nicely, it is also the median analyst forecast for ICE’s dividend payment for the year.

In this case, I set D1 as $1.64.

Calculating r

I estimate r, my required rate of return for ICE, as:

r = RFR + beta * (TMR – RFR)

Since the inception of the S&P 500 in 1957, it has provided investors with an annualized total return of 11.88%. I use the most recent Effective Fed Funds Rate for which data is available (as of November 2022) of 3.83% as the risk free rate. I note that ICE’s 5-year monthly equity beta is around 0.90.

Therefore, I calculate the required rate of return for ICE as

r = 3.83% + 0.9 * (11.88% – 3.83%) = 11.1%.

Calculating V0

In this case, the estimated fair value of a share is $1.64 / (11.1% – 10.0%) = $145.75. This is 42% above its current price of $102.54 as of Nov. 10, 2022: a substantial margin of safety.

I show my work in Table 1 below.

Table 1: DCF valuation

| EPS | $ | [a] | |

| Dividend in Year 0 | $ | [b] | 1.47 |

| Retention ratio | % | [c] = 1- [a]/[b] | 67.4 |

| ROE | % | [d] | 14.8 |

| Sustainable growth | % | [e] = [c]*[d] | 10.0 |

| Required rate of return | % | [f] | 11.1 |

| Dividend in Year 1 | $ | [g] | 1.64 |

| Fair value in Year 0 | $ | [h] = [g]/([f]-[e]) | 145.75 |

| Share price at valuation date | $ | [i] | 102.54 |

| Implied upside | % | [j] = [h] / [i] – 1 | 42 |

EV/EBITDA Valuation

As a cross-check, I use the EV/EBITDA valuation method to estimate a fair value for ICE, and I find that the fair value of an ICE share is around 26% above its current price. I favor the DCF approach (when it is feasible) over the EV/EBITDA approach, as the method of finding suitable comparables is, in my view, neither exactly a science nor an art, but something close to black magic–highly subjective and sensitive to manipulation.

Nevertheless, EV/EBITDA can be useful as a sense-check to the DCF approach. Let’s take a look.

I select five comparables for ICE: NASDAQ, CME, Cboe, the London Stock Exchange Group (LSEG) and Deutsche Boerse AG. In Table 2 below I note the values for their EVs, EBITDAs, and the corresponding ratios, as well as the average of their EV/EBITDA ratio of 16.9x. (Note that I cannot use Euronext, because it has negative EV.)

Table 2: EV / EBITDA ratios

| Comparators | EV | EBITDA | EV / EBITDA | |

| CME Group | $ b | 62.7 | 4.0 | 15.7 |

| Cboe Global Markets | $ b | 14.7 | 0.6 | 23.6 |

| NASDAQ | $ b | 36.7 | 1.9 | 19.7 |

| London Stock Exchange | $ b | 59.2 | 4.4 | 13.5 |

| Deutsche Börse | $ b | 40.4 | 2.6 | 15.5 |

| Average | 17.6 |

I apply the average ratio of 17.6x to estimate the fair value of ICE’s EV. I note that EV is the sum of market capitalization and total debt, less cash and cash equivalents. Therefore, I subtract, from my estimate of the fair value of ICE’s EV, the total debt, and then add back cash and cash equivalents, to arrive at a fair estimate of ICE’s market capitalization.

In this case, the estimated fair value of a share is $129.35. This is 26% above its current price of $102.54 as of Nov. 10, 2022, well below the value estimated from the DCF approach, but still a decent margin of safety.

I show my calculations in Table 3 below.

Table 3: EV / EBITDA valuation

| EBITDA | $ b | [a] | 4.9 |

| Fair value EV | $ b | [b] = [a] x 17.6 | 85.7 |

| Total debt | $ b | [c] | 18.4 |

| Cash and cash equivalents | $ b | [d] | 1.2 |

| Fair value market cap | $ b | [e] = [b]-[c]+[d] | 69 |

| Actual market cap | $ b | [f] | 54.3 |

| Implied upside | [g] = [e]/[f]-1 | 26.2% | |

| Share price at valuation date | $ | [h] | 102.54 |

| Implied fair value of share price | $ | [i] = [h]*(1+[g]) | 129.35 |

Downside case

In this section, I discuss the downside case for ICE.

Bakkt in peril

In my previous EV/EBITDA valuation approach, I estimated a $148.70 fair value for ICE using a 16.4x multiple. Why has the fair value dropped to $129.35 when I now use a higher, 17.6x multiple?

Clearly, EBITDA must have decreased. Specifically, whereas interest, tax, depreciation and amortization have not much changed, earnings that has, to be blunt, dived off a cliff.

The reason for that has been mentioned in my previous article: Bakkt Rekt. I wrote:

in their 2021 financial statement [ICE] noted, with smug self-satisfaction, that ‘We recorded a pre-tax gain on the (Bakkt) transaction of $1.4 billion’ (p. 105)…

So what gives? Bakkt’s share price, which plunged from a high of $42.56 to $2.56 as of Sep. 2, 2022. How did ICE put it, also in their 2021 FS? “We may not realize the expected benefits of our majority investment in Bakkt and the investment may introduce additional risks to our business due to its evolving business model.” (p. 20)

Yes, the collapse of Bakkt’s market value, and of the cryptocurrency market more generally, has materially and adversely affected ICE’s earnings, which took a $1.1 billion impairment on the value of its holdings in Bakkt in Oct. 28. But, really, it’s not so bad because it’s (i) as expected; and (ii) perhaps even not quite as bad as expected: after all, they recorded a $1.4 billion gain from the transaction, so there is theoretically $0.3 billion still left over.

To be clear, I believe Bakkt is a risky, and perhaps given the current economic climate a rather unwise, investment; and I believe it will probably continue to weigh down ICE’s performance. But I also think the worst of it is likely over. The lion’s share of Bakkt’s market cap is already wiped out.

The impact of the $1.1 billion impairment can be easily detected in ICE’s financial performance over time. For example, ICE’s revenue growth looks fine:

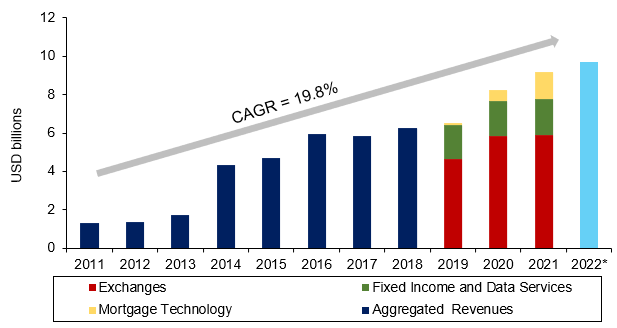

Figure 1: Historical revenue growth

I pro-rate 2022 revenue by multiplying revenues in the first three quarters by 4/3. (My analysis, based ICE financial statements)

If anything, its latest quarterly report for Q3 2022 indicates that it experienced a year-on-year growth in revenue from Q3 2021, from $2.28 billion to $2.39 billion, which, considering the turbulent economic climate, is a great signal of its underlying business strength. (Similarly, its operating profits, which are unaffected by Bakkt, rose from $892 million to $932 million in the same period.)

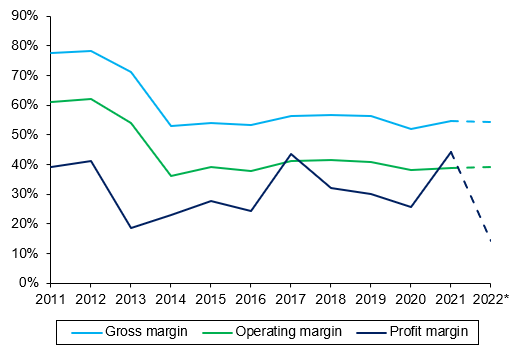

However, its profit margins dived sharply from 44% in 2021 to 14% in 2022. Worse, in Q3 2022 alone, it has negative profit margins of -7.3%. That’s the first time it’s registered a (quarterly) loss since it acquired NYSE in 2014.

Figure 2: Historical margins

I use Q1-Q3 average margins for 2022, and end-of-year margins for all other years (My analysis, based on ICE financial statements)

Inflation and interest rate risks

Given that inflationary forces are still likely to remain strong, the interest rate risks to ICE remain considerable. Ukraine and Russia continue to be at war, China sticks proudly to its frankly, in my opinion, insane policy of zero-Covid lockdowns, and the disappointing Republican performance in the midterms means the Democratic impulse to expansionary policies will likely remain unchecked.

As a result, inflation remains well above the 2% Fed target and will stay there for some time. Likewise, the Fed is likely to keep increasing its funds rate, as long as inflation remains high.

When interest rates are high, it is more attractive to keep money in a savings account, rather than use it for trading stocks and shares. Because of this, there may be lower trading activities, and hence lower sales, on ICE’s platforms. Higher interest rates also make mortgages less attractive to potential homebuyers, which may reduce the demand for ICE’s Mortgage Technology Services.

Finally, if and when a recession strikes, the stock market rout is certain to affect trading activities on ICE adversely. But, fingers crossed, perhaps the world may yet avoid a recession, at least in the US.

On the other hand, CPI inflation in October was 7.7%, and well below the 8.0% expected by economists. This may mark an inflection point in inflation: I believe the world is adjusting to the lockdown in China and the Russian invasion of Ukraine. If so, the inflationary shocks of these events will continue to decline. Then ICE may yet experience a resurgence in sales and profits as trading activities pick up again.

This prospect remains highly uncertain, but that is where the profit opportunity comes in. Once it becomes certain, one way or another, the market will price it in. Keeping tabs on inflation and interest rate movements will be crucial for investors of ICE.

Conclusion

I rate ICE a buy because, given what we are certain of now, I believe the fair value of ICE shares is around 42% above the current market value of their shares. But I do not rate it a strong buy, because there remains substantial risks. If you are a long-term investor, I do not believe you will regret having ICE in your portfolio; and I believe $102.54 is an attractive price to buy more ICE shares.

Be the first to comment