JHVEPhoto

Banks are the places with all the money. They’re where people save their money, deposit it to use for bills, and where they go to borrow money when they need to spend more than they have available at a given time. Many investors, no doubt, remember the Great Recession, when American bank stocks cut their dividends.

One of the more stable banks in the US, JPMorgan (JPM), cut its dividend by 87% in 2009. More recently, Wells Fargo cut its dividend by 80% in July 2020. American bank investors who are focused on dividend stocks likely still feel the pain if they owned these bank stocks over the past couple of decades.

Canadian Banks

This is where Canadian banks, specifically Scotiabank (NYSE:BNS), might provide more comfort for those who don’t want to see their healthy dividend payments drop like a rock. Canadian banks have stricter regulations than their free-market advocates to the south. And that is why many investors view them as more stable.

During the Great Recession, the Brookings Institution had the following to say regarding Canadian banks:

“The Canadian banking system has long been regarded by the IMF as a paragon of international best practices. The World Economic Forum recently ranked it the soundest in the world. And it looks better with every passing day. As during the Great Depression, when only a few inconsequential banks failed in Canada, the overall system has remained solvent and solid amid the current global crisis. Indeed, unlike several large U.S. banks these days, the sustained profitability of Canada’s is startling.”

The Canadian banks have held up well during recent recessions, and investors who focused on dividend payments hardly noticed. There are price fluctuations, but dividends in the major Canadian banks have stayed strong.

BNS Dividends

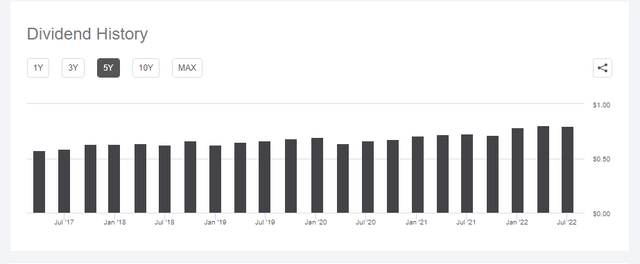

American investors might look at a chart of Scotiabank’s dividend over the past several years and see periodic drops, despite the overall growth in the quarterly dividend payment:

BNS US Dividend (Seeking Alpha)

However, this chart is in US dollars. Currency fluctuations can contribute to varied dividend payouts in foreign companies, and there is really nothing that American investors can do about it. I remember going to Banff National Park back in 2012 when the US dollar was at a low point. The US dollar and the Canadian dollar were pretty much even in terms of their purchasing power. Today, the US dollar is worth $1.29 CAD. This means the US dollar is about 30% stronger when compared to the CAD than it was 10 years ago.

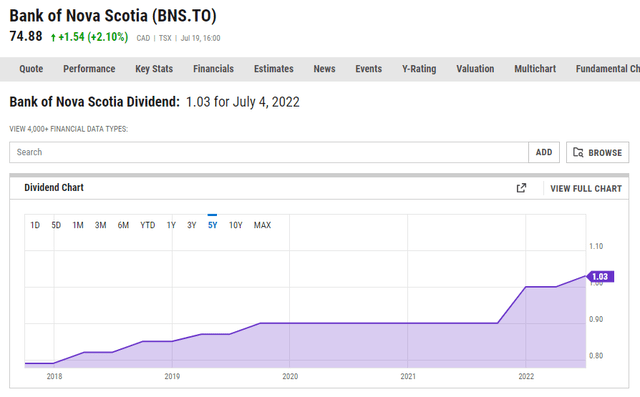

When looking at the last five years in Canadian dollars, there are no drops, although there was a period of about two years in which there was no dividend increase because of the uncertainty over COVID. Once things began to get back to a relatively normal state, the company resumed biannual dividend increases.

The bank has paid a dividend every year since 1833, and it only cut its dividend in the midst of World War II when asked by the government. Pauses to dividend growth like that seen in 2020 and 2021 are rare. Indeed, even at the depth of the Great Recession, when American banks were slashing dividends left and right, BNS grew its dividend between 2008 and 2009, albeit by a single penny each quarter. It left the dividend steady between 2009 and 2010 at $1.96 CAD, before increasing it again. However, this was much better than the treatment dividend investors in JPM received.

BNS Today

The price of Scotiabank has recently dropped, along with many other stocks, as the market has declined in recent months. However, at the beginning of this year, the stock hit an all-time record at $95 CAD per share. It recently hit bear market territory at a short-term low of $71.21 CAD. As of the close on July 19, investors could purchase a share at $58.13 on the US exchange, which is down from nearly $75 USD at the peak.

The forward dividend yield is now 5.65%, and this is much higher than it was just a few months ago. The payout ratio is less than half of earnings at 44.63% as of the close on July 19. The most recent quarterly report shows that revenue, net income, and return on equity are all higher over the numbers recorded in the same quarter in 2021. The EPS for the first six months of the year is also up over the previous year.

The stock’s price has gone down, but the company’s major numbers are improving. When market sentiment is low, it can be a great time to purchase a company to lock in a higher-than-usual dividend yield. As the dividend increases over time, as is likely with BNS, the yield on the original cost could really turn out to be impressive in a decade or two.

Scotiabank’s current EPS is $8.30 CAD, which stacks up quite well with the current dividend of $4.06. Additionally, the PE ratio is only 8.80, which indicates that it is a solid value at current prices.

Conclusion

This all indicates that BNS is a solid buy at current levels. For sure, it’s not as good a buy as it was in the COVID-induced selloff in early 2020, but it’s still a solid buy with a strong dividend. The company’s financials and the conservative regulatory environment in Canada indicate that Scotiabank should be able to continue its history of growing its dividend for the long run. The major concern for US-based investors (outside of major geopolitical dangers that might arise from wide-scale war or famine) is the currency exchange issue. This will lead to some short-term fluctuations in the dividend, but these should even out in the long run, and BNS should provide growing dividends for years to come. Better to buy when the price is down.

Be the first to comment