peterschreiber.media/iStock via Getty Images

Article Thesis

Major bank stocks have been pulling back in recent months. Rising interest rates should be a tailwind, however, all else equal. The yield curve has also steepened in the very recent past and is no longer inverted. Bank of America Corporation (NYSE:BAC) and Wells Fargo & Company (NYSE:WFC) are two of the largest banks in the United States. In this report, we’ll highlight their pros and cons and will see which stock might be the better pick for different types of investors.

How Are Bank Of America And Wells Fargo Different?

Both Bank of America Corporation and Wells Fargo & Company are major diversified banks. Still, there are noteworthy differences. Wells Fargo is more consumer-oriented, which means that it is not as exposed to the results generated in its trading businesses. Depending on the macro situation, this can be either a good thing or a bad thing. Wells Fargo, despite being valued at $175 billion, is also the significantly smaller bank among these two, as Bank of America is a $300 billion company — with its higher valuation being easily explained by its higher profits.

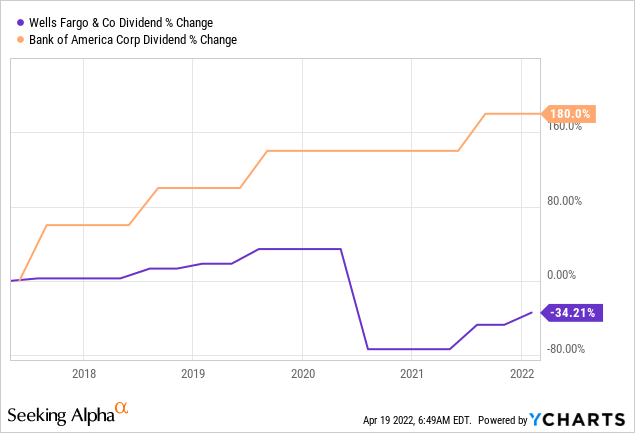

For income investors, the dividend track records of the two companies are important as well. Wells Fargo used to be an income investors’ favorite, but the company was forced to cut its dividend during the pandemic. It thus now offers a significantly lower dividend compared to a couple of years ago, whereas Bank of America has been able to raise its payout massively in recent years:

While BAC has hiked its dividend by close to 200% over the last five years, which includes a no-hike period during the pandemic, WFC’s payout has declined by a little more than one-third over the same time frame. That’s not a catastrophe, but still, some former income investors hold a grudge against Wells Fargo for failing to keep the dividend intact during the pandemic. Bank of America offers a slightly higher dividend yield today, at 2.2%, although Wells Fargo’s 2.1% dividend yield isn’t much lower, thus there is no clear winner from a yield perspective.

How Have Bank Of America And Wells Fargo Stock Performed?

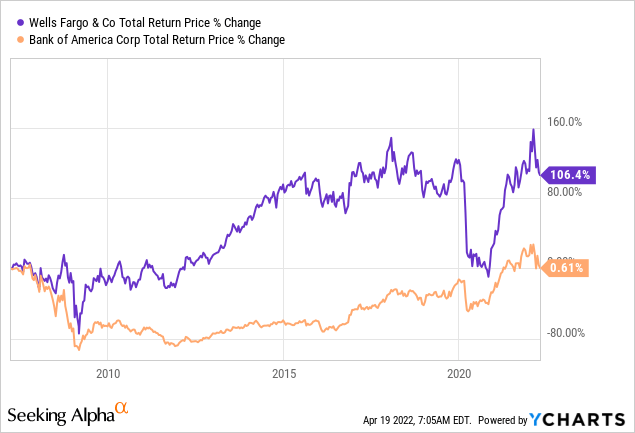

Due to the aforementioned issues Wells Fargo experienced during the pandemic, combined with its accounting scandal a couple of years ago, it significantly underperformed its peer in recent years.

Bank of America has clearly outperformed Wells Fargo over the last five and ten years, with a 90% to 4% (5 years) and a 400% to 85% (10 years) performance difference, respectively. When we take a longer-term view that includes the great financial crisis, the picture is different, however:

Neither stock was a good investment over those 15 years, but Bank of America has performed particularly badly, as there essentially has not been any meaningful return, even when we include dividends. WFC stock has delivered returns of 4.9% a year in that time frame, which is not especially bad, but which was still way less compared to what one could have gotten from many other investments in the same time frame.

BAC And WFC Stock Key Metrics

Both banks have reported their respective first quarter results already. Wells Fargo & Company saw its revenue decline by 2.6% year over year. This can be explained by the significant decline in the company’s non-interest income, which includes trading revenue, investment banking fees, and so on. Interest income, on the other hand, performed well, rising by around 5% year over year on the back of healthy loan demand and an increase in the bank’s net interest margin. Net interest margin increases are a key factor for driving bank’s revenue and profits in the long run, whereas non-interest revenue usually is more cyclical and sees more upswings and downturns. With interest rates rising, the net interest margin outlook for Wells Fargo and its peers is positive — generally, banks are quicker when it comes to raising the rates they demand compared to the rates they offer on deposits. Times of rising interest rates thus generally go hand in hand with expanding net interest margins, which should be positive for Wells Fargo’s core business.

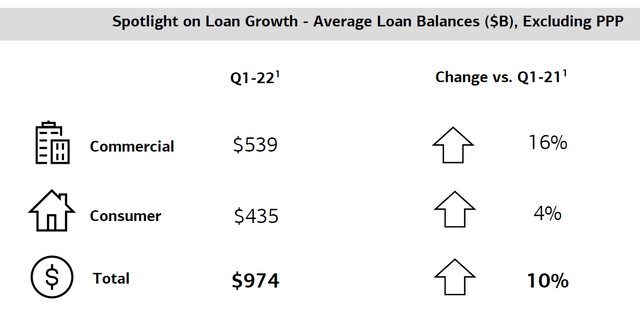

Bank of America Corporation saw its revenue perform better compared to Wells Fargo, as revenue was up 2% year over year, easily beating estimates. Bank of America experienced very encouraging loan demand growth, especially in the commercial space:

BAC report

Note: This excludes pandemic-related PPP loans.

Strong loan demand by the bank’s customers bodes well for revenues in the coming years as well, as many of the bank’s loans will remain on its books for years, thereby having an impact on results in future years as well. Both companies were less profitable than they were during the previous year’s quarter, but that can be explained by one-time effects to a large degree. Provision releases during the year-ago quarter had a positive impact on profitability then, for example.

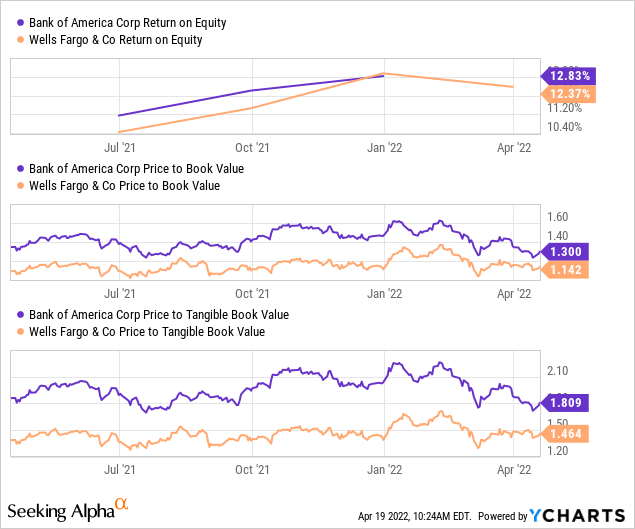

One of the best ways to evaluate the quality of a bank and to evaluate its valuation is looking at return on equity and the book value multiple the bank trades at.

The return on equity is at a very solid level in the 12%-13% range for both companies today. If one were to buy each bank at book value, this is the return one could reasonably expect in the long run, assuming there are no major changes to the banks’ cost structures etc. Neither BAC nor WFC trade at book value today, however. Bank of America is valued at 1.3x book value and at 1.8x tangible book value, whereas Wells Fargo trades at 1.15x book value and at 1.5x tangible book value.

From an ROE and book value multiple perspective, Wells Fargo seems like the slightly better pick — it generates comparable returns on equity but is trading at a lower valuation. When we consider its issues in the past years, that discount seems warranted, however. Bank of America has been the cleaner performer in the recent past and it did not have to cut its dividend, and thus the market assigns a somewhat higher valuation today.

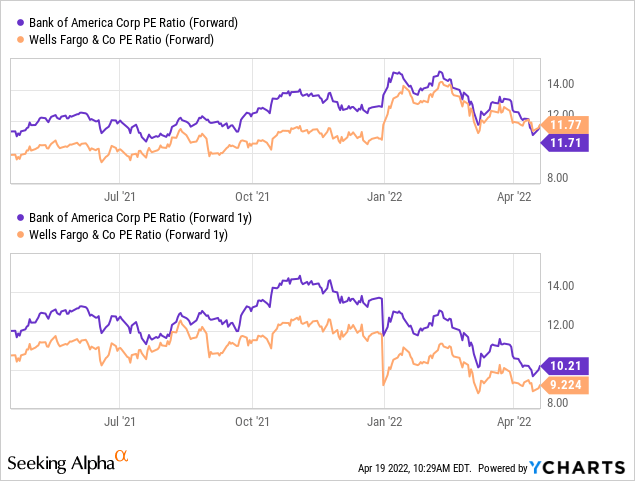

When we decide to value the two banks based on the profits they generate instead of based on their book value, we get the following picture:

Both companies trade at slightly less than 12x this year’s net profit today. In other words, both banks offer an earnings yield of around 8.5% at current prices — most of that should be returned to the company’s owners via dividends and buybacks over the coming year.

Looking at 2023, we see that both companies are expected to experience meaningful earnings per share growth, making them look quite inexpensive. Wells Fargo is forecasted to see its profits rise at a steeper pace in 2023, which is why its 2023 earnings multiple is even lower than that of Bank of America. Since the asset cap that was the result of the accounting scandal should get lifted, and since Wells Fargo’s cost cutting efforts should pay off increasingly, the assumption of faster earnings per share growth at Wells Fargo seems realistic to me. Investors should note that this faster growth and lower valuation comes at a price, however. Wells Fargo’s more troublesome recent history and its unconvincing dividend track record make it the higher risk, higher reward pick among the two banks. On the other hand, Bank of America is more of a lower-risk performer with a somewhat less pronounced return potential in a positive scenario. In a negative scenario, its lower risk could make BAC outperform. This is also showcased by the performance of the two banks during the pandemic — WFC fell more than 60% peak-to-trough in 2020, while BAC saw its shares drop less — and BAC recovered a lot quicker from the fall on top of that.

Are BAC And WFC Stocks Good Long-Term Investments?

As we have seen earlier, neither stock has been a great investment for those that bought prior to the Great Recession. Things have changed since then, however. Banks hold more equity and are thus less vulnerable to downturns, and harsher regulation has also reduced the amount of risks these banks take on. During the pandemic, we have seen that banks didn’t run into overly large problems on an operational basis, although their stocks still experienced selloffs.

Going forward, I do believe that investors can expect solid returns from both BAC and WFC. Neither company is expensive, they offer strong shareholder payouts via dividends in the 2%+ range and buybacks, and with the economy recovering and loan demand high, the two banks could expand their business meaningfully. Banking isn’t necessarily a very exciting industry, and no major bank will deliver the business growth rates that some of the fintech stocks are serving up. But between some business growth, their dividends, and a declining share count that increases each share’s portion of the pie, both WFC and BAC could offer returns in the 8%+ range going forward, I believe.

Is BAC Or WFC Stock The Better Buy?

Bank of America seems like the better pick for those seeking a lower-risk investment. A better dividend track record, no Fed asset cap, and fewer scandals make it the more suitable sleep-well-at-night pick. Wells Fargo is a somewhat higher risk pick, but if things go right, it could have more upside potential. Its cost cutting efforts could lead to more pronounced earnings growth compared to BAC and other major banks in 2022-2025, but there is no guarantee that these cost cutting efforts will be successful. Whether one prefers BAC or WFC thus depends on the risk appetite primarily, I believe. Neither company will double your money quickly, but both companies should be able to deliver solid returns in the long run.

Be the first to comment