Justin Sullivan

Bank of America (NYSE:BAC) has dramatically changed its business profile over the last 13 years, when the company first started integrating its Countrywide Financial and Merrill Lynch acquisitions. The company is far more balanced and conservative in its approach, allowing it to generate good returns, without the excessive risk profile of banks pre-Global Financial Crisis. This strategy has been validated numerous times, including in 2020 when despite the unemployment rate rocketing to 15% in 3 months, the bank still managed to post very solid profits. Higher interest rates are having a very positive impact on BAC’s net interest income that I don’t believe is fully reflected at current prices, allowing a good opportunity for long-term investors to accumulate shares.

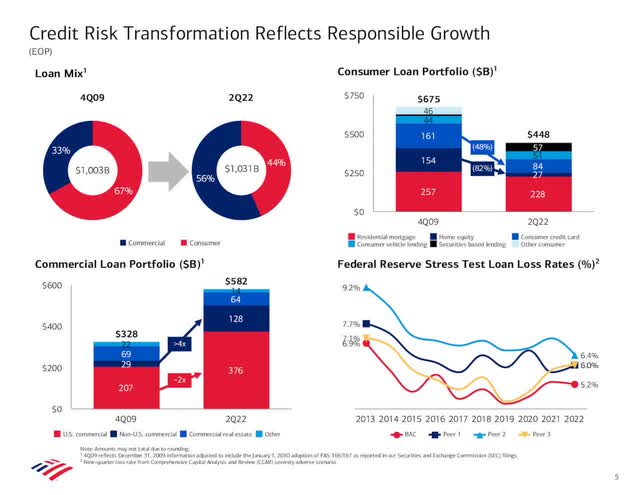

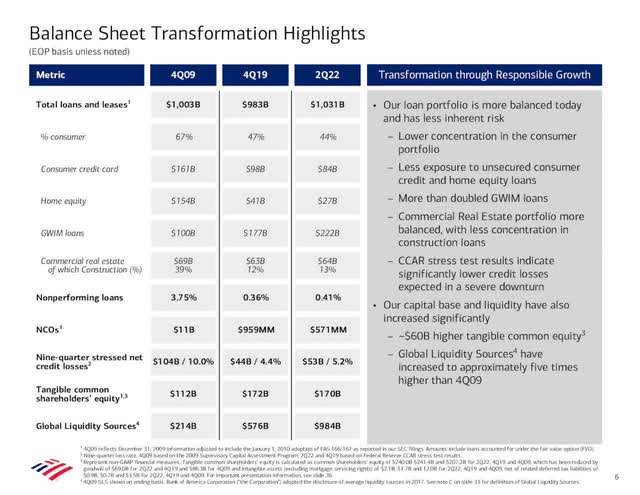

Consumer loans now account for 44% of total loans, as opposed to 67% in 2009. The credit card portfolio is down nearly 50% and the home equity portfolio is down about 80%. In the 4th quarter of 2009, 3.75% of loans were non-performing, versus only .41% in Q2 of 2022. Land development loans have decreased from $5B to $200MM, and secured residential exposure decreased from $11B to $150MM. Despite a lower risk profile, tangible common equity is up 52% and BAC has over 4x the liquidity.

Despite all of these undeniably massive changes in risk profile, every time there is a macroeconomic sniffle, the banks sell off as though history is going to repeat itself. Underwriting has been far better this cycle and the big banks have a variety of diverse revenue streams, which can offset weakness in other businesses when challenges emerge. Bank of America’s bread and butter is focusing on the actual needs of its core clients, as opposed to simply focusing on maximizing revenue. This means providing checking accounts, wealth management, purchase mortgages, etc., as opposed to trying to have number one market share in refinancing for instance.

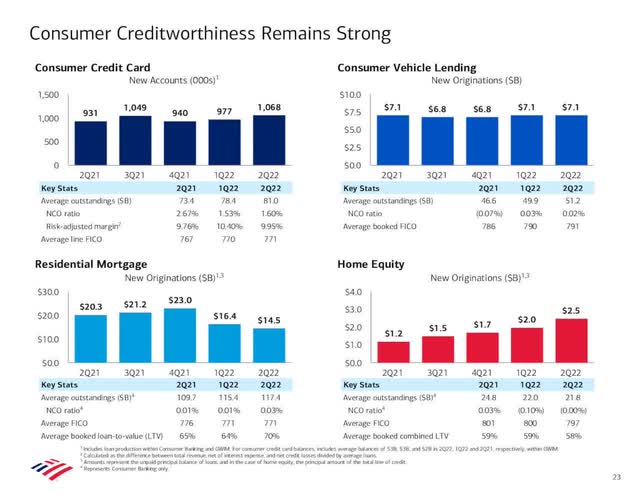

While just about everyone, including myself admittedly, seems to be in the recession camp, the actual data is much more of a mixed bag, especially with unemployment hovering around 3.6%. Consumers are still spending money at an aggressive rate, although the mix is changing more towards travel and entertainment, as opposed to things. Management said that the average deposit balance for most cohorts is higher than they were both last quarter, even including rising from May to June, showing that this is still a current trend, and it is multiples better than pre-pandemic. Lastly and just as importantly, there are no signs of deterioration in credit quality.

BAC 2nd Quarter Earnings Presentation

BAC Q2 Investor Presentation

On July 18th, BAC reported another quarter of solid results with total revenue, net of interest expense of $22.7B, up 6% YoY, resulting in net income of $6.2B, or $.73 per share. Net income was down due to the lack of a $2.2B reserve release that occurred last year, as well as a $2B tax adjustment. Pretax, pre-provision income increased by $1B (15%) YoY to $7.4B, which is the best gauge of underlying earnings power. Bank of America achieved a 9.9% ROE and a 14.1% ROTCE in the quarter, which was down both sequentially and YoY, mostly due to the lack of major reserve releases and very weak capital markets. Bank of America posted its 4th consecutive quarter of operating leverage, which has been a major priority of their grossly underrated CEO Brian Moynihan for many years now.

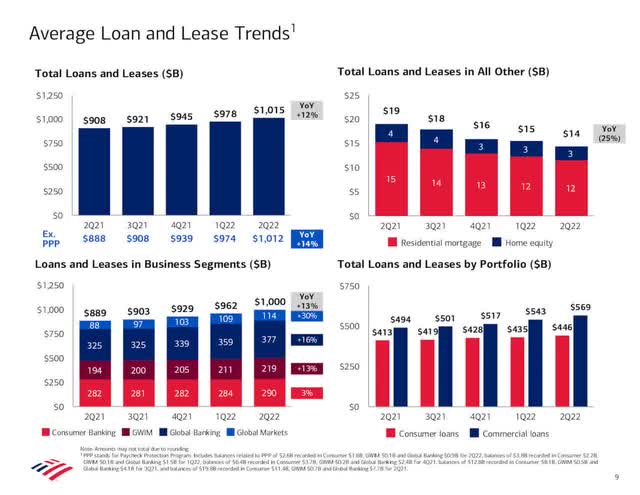

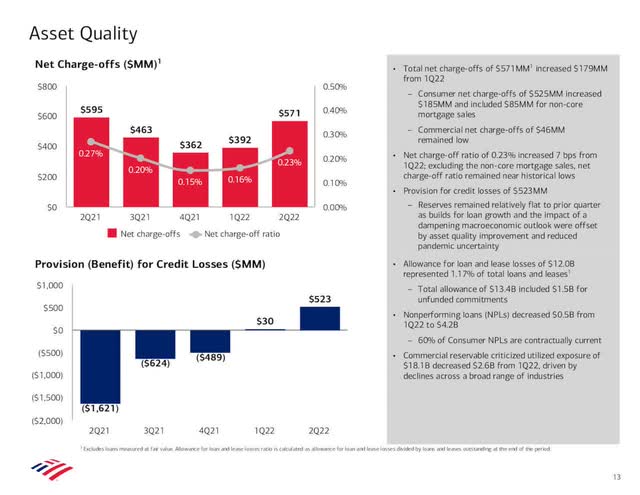

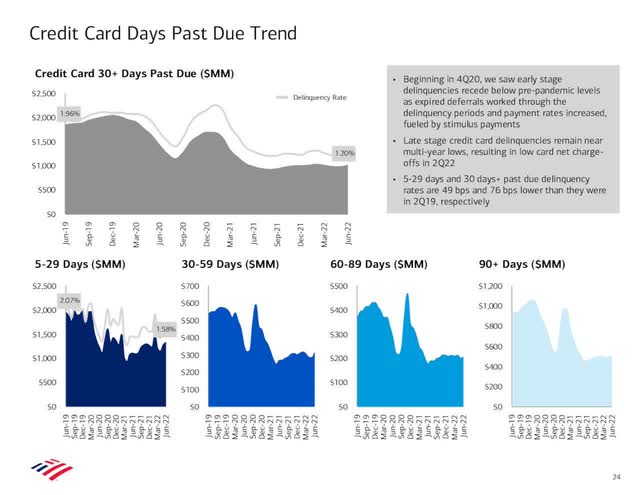

Net interest income of $12.4B was up by 22%, or $2.2B YoY, on the back of higher rates and strong loan growth. The net interest yield excluding Global Markets increased to 2.2%, from 1.83% YoY, and 1.99% in Q1. Management flagged that by the end of the year, the run-rate of quarterly NII could be closer to $15B, which augurs exceptionally well for Bank of America’s earnings power, as most of that should fall to the bottom line. Noninterest income declined by $1.0B, or 9%, on lower investment banking fees, mark to market losses on leveraged loans, and lower service charges. The provision for credit losses of $.5B, was up from a benefit of $1.6B at the same time last year. Net charge-offs actually declined 4% to $571MM, which is a ratio of just 23 bps, or roughly 50% below pre-pandemic levels when credit was still pretty solid. 92% of Bank of America’s commercial loan book is either investment grade or secured. Bank of America continues to do a good job managing expenses, with noninterest expense only increasing by $.2B, or 2% YoY, despite taking an approximately $425MM charge on regulatory matters. This is impressive performance in this inflationary environment where costs have been up big for most competitors.

BAC Q2 Investor Presentation

BAC Q2 Investor Presentation

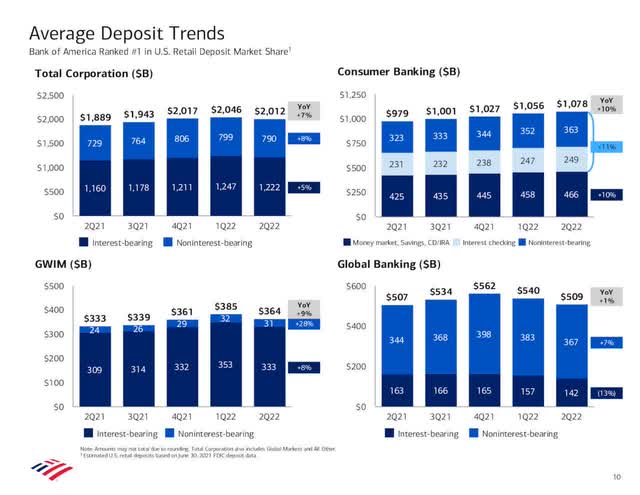

Loans and leases grew by $38B sequentially, while deposits decreased by $88B. While some might be worried about deposits dropping, it’s important to keep in mind that the global liquidity portfolio is still massively elevated at nearly $1T, up from $576B pre-pandemic. Holding too much liquidity hurts returns, so seeing a bit more balance is not a bad thing whatsoever. Consumer loans grew by the fastest quarterly pace in nearly 3 years and the bank added 240,000 new checking accounts in the quarter. Despite stocks having their worst first half in 5 decades, Wealth Management revenues amazingly still grew by 7% YoY and pretax margin expanded. The division added 5,100 new households and client balances now stand at $3.8 trillion, providing a high-margin and recurring revenue stream that is tough to match. Global Banking grew loans by 5% sequentially, or 20% annualized, which is just outstanding. BAC maintained its #3 market share in Investment Banking, albeit on a very weak quarter for the industry as a whole, due to constrained capital markets. Digital growth continued with sales up 20%, which management flagged as a major reason for continued expense discipline, despite the inflationary environment.

BAC Q2 Investor Presentation

BAC Q2 Investor Presentation

BAC Q2 Investor Presentation

In a rising rate environment where banks are printing money on net interest income, the biggest fear would be a recession, leading to elevated credit costs. I really don’t see this being much of an issue for BAC at this juncture given its loan portfolio characteristics and profile. If we do see a recession, I don’t think it will be as much of a credit-led recession like in 2008. The CET1 ratio improved to 10.5%, the SLR improved to 5.5%, and BAC has that $1T in global liquidity sources. The company paid $1.7B in dividends in Q2, while also repurchasing $1B in common stock. Bank of America ended Q2 with a tangible book value per share of $21.13 and a book value per share of $29.87. Both are slightly down relative to last year, mostly due to declines in AOCI from higher rates. BAC’s management sees NII growing by at least $900MM in Q3 and then even more in Q4, so let’s guesstimate $2B, which would give the bank a quarterly run-rate of just under $15B.

At a recent price of $32.26, BAC trades at just 9.7x forward earnings and 9.2x trailing earnings. This is a very cheap multiple for a company that can easily produce a mid-teens ROTCE consistently, and with an extremely low risk credit profile, relative to its recurring revenue streams. Mr. Market is giving no credit to the impact of higher rates and mostly seems to be factoring in pessimistic recessionary scenarios. I believe BAC is worth between $45-50 per share, as I think the company has ample opportunity to grow its pretax, pre-provision earnings over the next 3-5 years. Even if we do go into a recession, I think it will be just another example of Bank of America easily managing any additional credit reserves while maintaining a very profitable operation. Management indicated than its base reverse case, they are projecting unemployment to be at 5% at the end of the year, which seems reasonably conservative to me, barring a major collapse in the 2nd half of the year. It’s been said that banks are like utilities now with all of the regulations, and I don’t disagree with that sentiment, but if it is true, then the valuations should be quite a bit higher to reflect that lower risk profile like utilities. The bank pays a 2.6% dividend and can opportunistically buy back stock given its strong capital ratios. While the stock isn’t as cheap as Citigroup (C) relative to intrinsic value, it is still very attractive, and has a more balanced and diversified collection of businesses. Long-term investors would be wise to take advantage of this pessimism and buy BAC while it remains so beaten down.

Be the first to comment