JHVEPhoto

In our last article we said Atlas Copco (OTCPK:ATLKY) was expensive for a reason, that shares are rarely cheap, and that we would consider buying if they went down another 10-20%. Since then shares are down ~11.5% in dollars, and we are now getting tempted to buy the shares. In this article we’ll be more focused on the valuation, and recommend that readers not familiar with the company check our previous article.

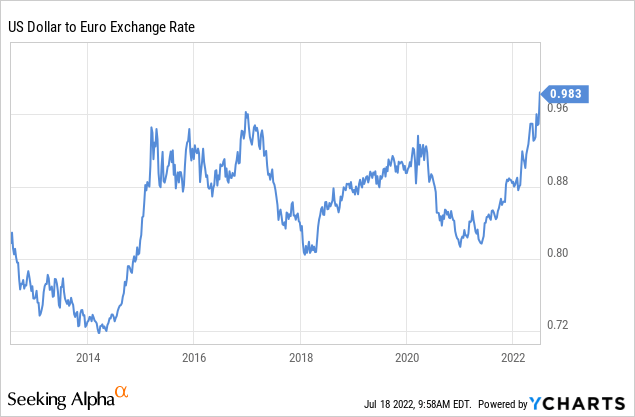

It is important to note that a large part of that decline is due simply to the strength of the dollar that has gained significantly against European currencies such as the Euro and the Swedish Krona, in which Atlas Copco AB trades originally. The strength of the dollar means that this could be a good time for US based investors to diversify into European equities. In any case, it has helped make Atlas Copco a lot cheaper.

Financials

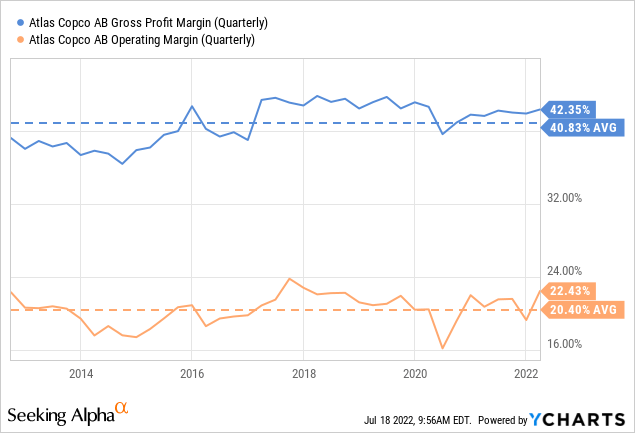

As a reminder of why we like Atlas Copco so much, it has incredibly high and stable profit margins, with operating margins that have been averaging over 20% for more than a decade. This is remarkable for an industrial company. Few of its peers have similar margins, one exception would be Illinois Tool Works (ITW), which also has superior margins, and both have much higher margins compared to competitor Ingersoll Rand (IR).

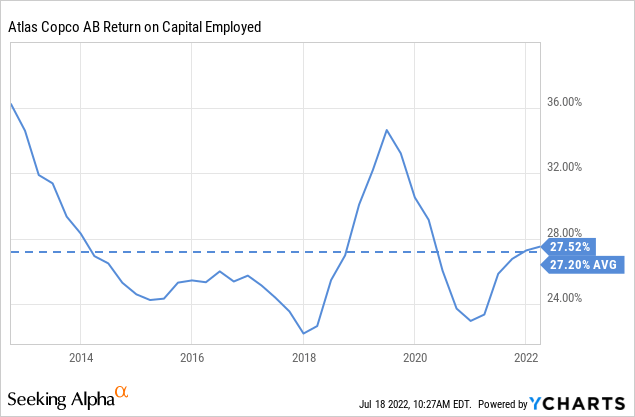

The quality of the company is also reflected in its impressive returns on capital employed, which have averaged ~27% over the last decade. This has enabled the impressive compounding that the shares have delivered over the last decade.

Growth

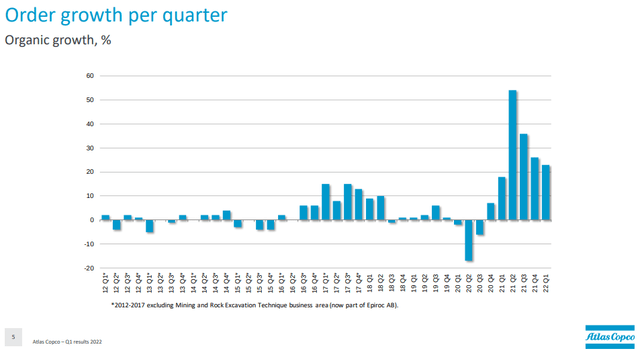

Atlas Copco is delivering not only superior financial results, but also a decent amount of growth. Growth is cyclical as can be seen in the order growth per quarter in the graph below. Still, it seems that on average growth has been accelerating for the company compared to previous growth periods.

The company should be less cyclical going forward after it split its mining, infrastructure and natural resources segments in 2018, and formed Epiroc AB (OTCPK:EPOKY), which is now a fully independent company.

For the near term outlook, Atlas Copco expects that the customers’ activity level will remain high, but that it will weaken compared to the very high level of the first quarter.

Atlas Copco AB Investor Presentation

Balance Sheet

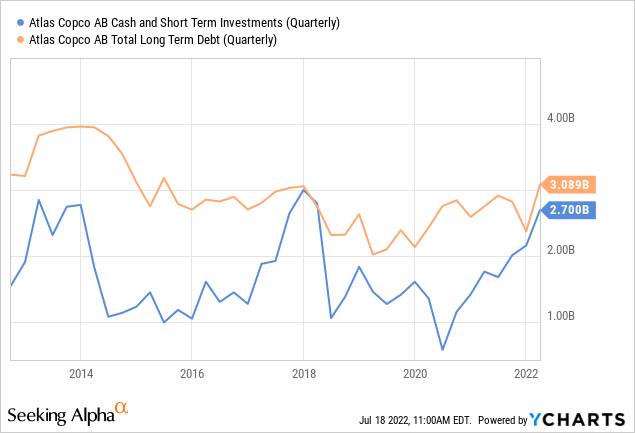

Atlas Copco’s balance sheet is very strong with almost as much cash and short-term investments as long-term debt. Atlas Copco has debt rating A+ from Fitch and A+ from Standard & Poor’s Corporation regarding long-term debt. The company has an Altman Z-score of 8.8x, it too reflecting its strong financial position and balance sheet, and that it is unlikely to experience bankruptcy any time soon.

Valuation

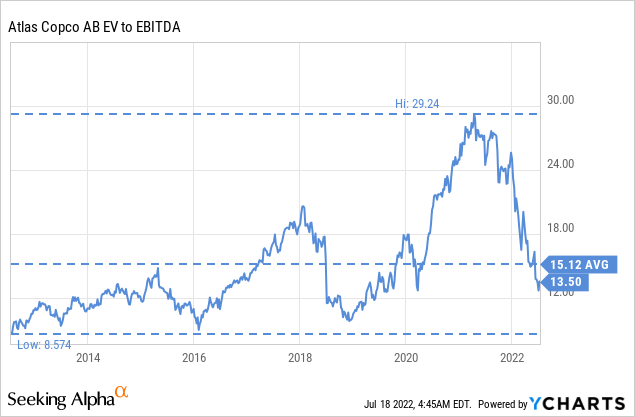

Compared to its historical valuation, and on absolute terms, shares appear attractively valued at ~13.5x EV/EBITDA. This is a similar multiple to where shares were trading during the worse of the Covid crisis, and below the ten year average of ~15x.

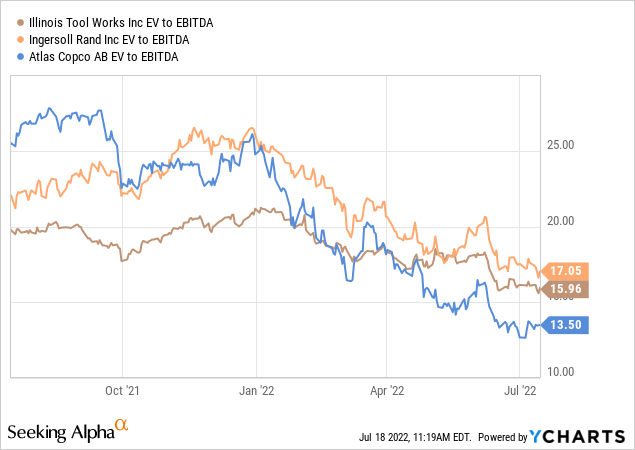

Compared to similar industrial companies like Ingersoll Rand and Illinois Tool Works, Atlas Copco is trading at a cheaper EV/EBITDA by several turns. Note that this has not always been the case, and even just one year ago Atlas Copco was the one trading at the higher valuation multiple.

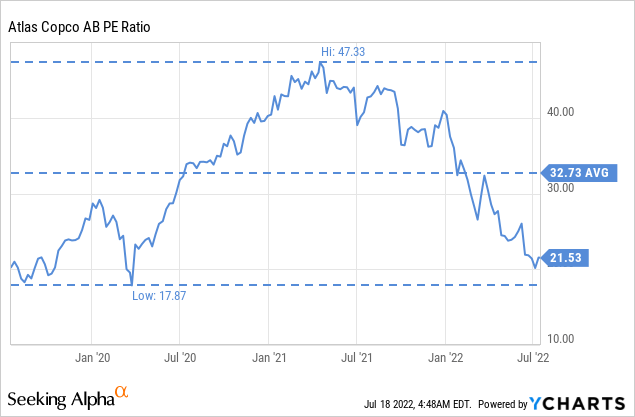

Atlas Copco’s price/earnings ratio also looks attractive at ~21x, a significant discount to the average of the last three years of ~32x.

The company normally pays about half its earnings as dividends, and the current yield is therefore ~2%, which we consider very reasonable given its safety and growth potential.

Risks

While we are not too worried about the strength of the balance sheet given its strong liquidity and high investment grade credit rating, we do worry a little bit about the cyclicality of revenues. Historically there has been a good amount of cyclicality, but this has been mitigated by the very variable cost structure that Atlas Copco utilizes, as well as the separation of some of the more cyclical parts into Epiroc. Still, the remaining segments that are highly concentrated in compressors and vacuum pumps have high customer concentration in sectors like electronics that remain cyclical.

Conclusion

Atlas Copco is an outstanding company that rarely trades at a cheap price. Right now we believe shares are offering a rare opportunity to buy them at an attractive valuation. They might not be a proper bargain, but they are priced reasonably enough to offer decent potential returns to long-term investors from current prices. We are considering buying the shares around current prices with the intention of holding them for at least a few years. We are also updating our rating to ‘Buy’ from ‘Hold’.

Be the first to comment