carloscastilla/iStock via Getty Images

Introduction

Bandwidth (NASDAQ:BAND), a small-cap stock ($300m market cap), has been one of the standout performers this week; the surge in the stock price comes on the back of stellar Q3 results, where the company also lifted its FY outlook.

Bandwidth – What’s To Like?

Enterprises around the world use Bandwidth’s APIs when they want to augment their respective software/applications with messaging, voice, and emergency support functionalities. This has been going on for a few years now, and BAND has managed to sign up some illustrious clients such as Google (GOOG) (GOOGL) and Microsoft (MSFT) during its lifetime.

Looking ahead, BAND looks well-positioned to flourish because the industry is currently in the midst of widescale digital transformation, where on-premise-based equipment and solutions are being migrated to the cloud. There’s ample scope for this to play out over many years, as we are currently only at the start of this shift. Bandwidth estimates that currently only 4% of global business phones and 16% of global call center agents are in the cloud.

BAND has also built-up considerable credibility as a CPaaS (Communication Platform As A Service) provider, as it was one of the pioneers in offering APIs built on its own network. API-enabled CPaaS will likely prove to be an ineluctable fabric of customer engagement going forward; Gartner believes that in another 3 years, 95% of enterprises around the world will likely integrate API-enabled CPaaS to drive home better customer engagement.

More crucially, BAND is the only CPaaS player in the industry that owns and operates a nationwide IP voice network in the US. What’s the prime benefit of this? Well, they can afford to price competitively and take market share from clients. I believe as recessionary headwinds gather at a faster pace, the low-cost offering of BAND could find plenty of takers. Since BAND is in control of the economics of their network, they could help clients cut their communication budget by around 50%!

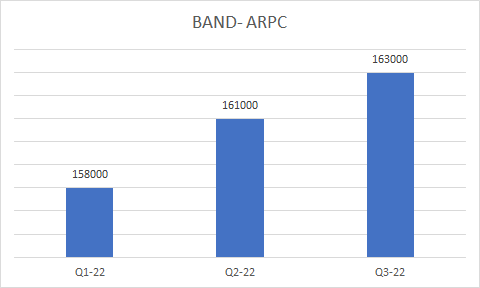

Management also needs to be credited for getting the sales force to do a better job of cross-selling and up-selling their products with existing clients. There’s also been a shift in the type of clients they’re going after, with a lower focus on smaller customers who are unlikely to spend much. This has been reflected in the average revenue per customer (‘ARPC’) which has been consistently trending up over these last few quarters.

ARPC- In $ (Quarterly Presentations)

Source: Quarterly presentations

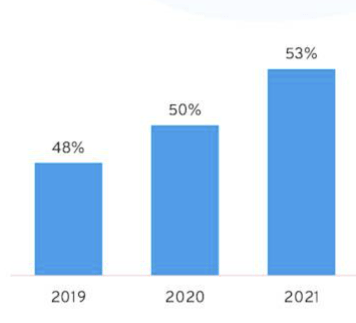

The improving trajectories of ARPC bode well for the company’s long-term desire to hit gross margins of 60%. Over the last couple of years, there’s been a 200-300bps annual improvement in Non-GAAP GMs, and in the most recent quarter, it came in at 57%.

Non-GAAP GMs (Q3 Presentation)

Closing Thoughts

For all of BAND’s merits, I would find it difficult to pursue a stock that just opened to a humongous gap of 32% and kicked on even further from there. Besides, recently, political campaign-related messaging has been a useful tailwind, but once that seasonality abates, I’d be curious to see if messaging’s share in the overall revenue could continue to grow. I believe it would be unrealistic to expect the overall messaging pie to maintain the 50% growth run-rate seen in Q3.

Nonetheless, the prudent strategy with BAND stock would be to wait for a pullback, and see if it bridges the gap (below the $12.7 level), or, if it is resilient enough to build some sort of floor above the gap.

Momentum investors may have a different take on things, and to better understand their rationale, I believe it’s also worth considering the backdrop ahead of this big move.

Firstly, note that the short interest was quite elevated; as of mid-October the % of float that was short was close to 19%; latest data shows that this dropped to less than 12%. Also consider that there’s another upside gap to breach post the $40 levels, but you’d need more than just short-covering to get there.

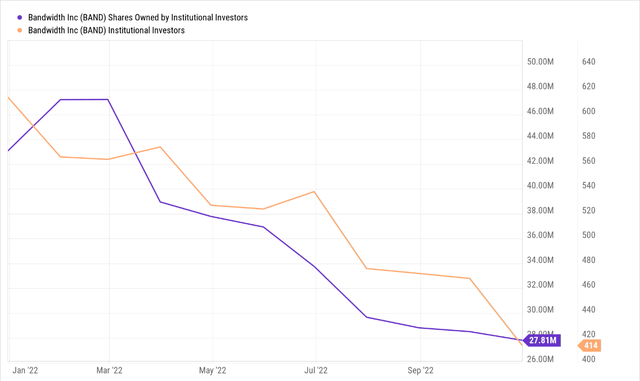

Could further buying pressure come from the institutional segment? For the stock to witness further sustained momentum, I believe the institutions must come back to the table. Just for some context, note that right through 2022, both the number of institutional investors, and the quantity of shares that they own had been on a declining trajectory; On a YTD basis, the number of institutions that own the stock is down by 33%, whilst the shares owned by them are down by 35%.

Given the gigantic volumes witnessed on Wednesday (typically the BAND share count only sees daily volumes of less than 500K, but on Wednesday, this was over 11m, around 3x as much as the volume witnessed post the difficult Q1 results), it would be foolish to think that only the retail cohort was behind the move.

What also works in Bandwidth’s favor are the current forward valuations, which are substantially lower than the historical averages. Despite the big move post results, on a forward price-to-sales basis the stock trades at less than 1x (0.8x to be precise), and this is almost 5x lower than the historical average of 3.9x! Bandwidth is priced as though sales growth has saturated but as per consensus estimates, this is a business that is poised to deliver 12% revenue CAGR through FY24.

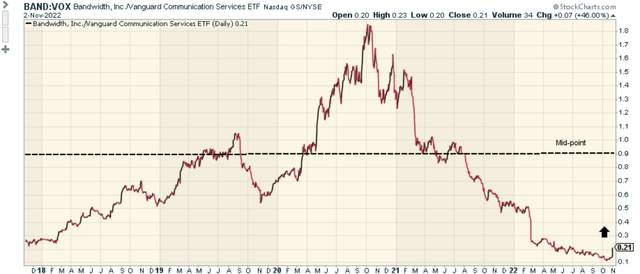

Finally, as a potential rotational play, BAND looks like an interesting pick vs its peers from the communication services sector. Note that the current relative strength ratio is still roughly 4x lower than the mid-point of the long-term range.

Be the first to comment