Viktorcvetkovic

Investment Thesis

Bally’s Corporation (NYSE:BALY) operates a gaming and entertainment business. The company has recently sold the two real estate properties to Gaming and Leisure Properties, Inc. (GLPI) for $1 billion. This deal can be a big positive for the company as it will increase the liquidity on the balance sheet, which can be used for the investment and acquisitions of the gaming business to boost the growth of the company. Currently, the company is not trading at an attractive valuation according to the fundamental valuation, and peer comparison.

Company Overview

Bally’s Corporation is a gaming and entertainment company that operates casinos, online gaming, and resorts. The company operates in three segments such as interactive and physical gaming, hotel, food & beverage and retail, entertainment & other. The gaming segment generates 80% of total revenue, while the hotel and food & beverage segments contribute 7% each. Retail, entertainment, and others contribute 6% of the total revenue. The company looks for acquisition and development ideas for new games. It has invested funds in interactive gaming, which it considers a strategic opportunity for future growth. The company offers entertainment and gaming experiences, including traditional casino offerings, iCasino, online bingo games, sportsbook, daily fantasy sports, and free-to-play games. Currently, the company owns 14 casinos with 14,900 slot machines, 500 game tables, 3,900 hotel rooms, and a horse racetrack. The revenue of the company has grown by 54.7% 3-year CAGR. It has a gross profit margin of 56.60% and an EBIT margin of 7.60%, which is considered a sign of low profitability. The company has recently made an agreement with gaming and leisure properties to sell real estate property of Rhode Island for $1 billion. I believe this event could have a significant impact on the financials of the company.

Sale of Two Rhode Island Properties for $1 billion

BALY recently announced that the company has entered into an agreement with GLPI to sell two real estate casino assets – BALY’s Twin River Lincoln Casino Resort and BALY’s Tiverton Casino & Hotel, which are situated in Rhode Island. After the sale of both the properties, BALY will lease back both the properties to operate all the gaming facilities. The company will receive $1 billion for this deal.

Both properties are expected to be added to the existing BALY’s Master Lease between GLPI and BALY’s, with a total rent of $76.3 million. GLPI agreed to pre-fund a deposit of up to $200 million, which will be credited or repaid to GLPI at the early closing and December 31, 2023, as part of an agreement to complete the baby’s acquisitions. BALY will also pay a $9 million transaction fee at closing. GLPI will obtain the real property assets of the Hard Rock Hotel & Casino Biloxi in Mississippi along with Tiverton for a net amount of $635 million and a total yearly rent for Tiverton and Biloxi of $48.5 million if all third-party authorizations and approvals for the acquisition of Lincoln are not timely received. In that case, GLPI would have the option, subject to obtaining the necessary consent, to acquire Lincoln’s real estate assets before December 31, 2024, for a purchase price of $771 million and an additional rent of $58.8 million.

I believe this deal can improve the liquidity of the company, which can help the company to acquire new business and develop new games that can contribute to the strategic growth of the company in the long term. This deal is significant for BALY as the company has a market cap of $1.14 billion, and the company will receive cash of $1 billion from this deal.

Key Risk Factor

Macro-economic elements: BALYS is especially sensitive to declines in consumer discretionary spending. Changes in the economy can have an impact on demand for entertainment and leisure activities, including gaming, and a slowdown in the economy can have a significant impact on consumer discretionary spending. Recessions, economic slowdowns, prolonged high unemployment rates, price increases, or consumer perceptions of weak or weakening economic conditions, among other unfavorable changes in general economic conditions, may reduce the disposable income of the consumers or lead to fewer people engaging in entertainment and leisure activities.

Quant Ratings and Valuation

Seeking Alpha

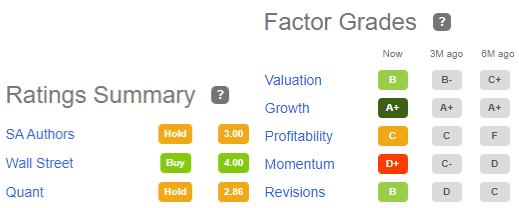

Seeking Alpha has a Quant rating of hold on BALY, which aligns with my investment thesis. The company has a B grade for valuation, which I agree with, and I think the company is richly valued when compared to its peers. The company has A+ growth, which I believe is likely to continue in the future, but it is not advisable to take any new position in the stock as the stock is trading at a significantly higher valuation.

BALY has a market cap of $1.15 billion, and the company is trading at a share price of $21.98, a YTD decline of 42%. With the FY22 EPS estimate of $0.91, the company is trading at a forward PE multiple of 24x. I believe the company is trading at a higher valuation than its peers like Golden Entertainment, Inc, with a PE multiple of 11.5x, and Monarch Casino & Resort, Inc, with a PE multiple of 14.5x. The company has good growth prospects, but the current valuation doesn’t justify buying the stock at this price. I recommend investors to wait for a correction in the stock price before taking any new position in the stock. The investors who already have a position in the stock should hold the stock for now.

Conclusion

I believe the sales of real property assets to Gaming and Leisure Properties will provide BALY with a solid long-term liquidity and a strong cash balance to invest in strategies for long-term growth. The company has good growth prospects but is overvalued at its current price levels compared to its peers. Also, with the speculation of recession getting stronger by the day, the company might face a slowdown in the short term. BALY is a good investment opportunity from a long-term perspective, but I believe the current price level is not a good entry point, and the investors should wait for a correction in the stock price before thinking about buying this stock. I assign a hold rating for BALY after considering all these factors.

Be the first to comment