V2images

Thesis

I expect a sharp rebound in China-based equities following a multi-decade low. And I favor Baidu, Inc. (NASDAQ:BIDU) as the most interesting single-stock pick.

Baidu is one of the Big Tech platforms in China and is currently priced at a market capitalization that has been already claimed in 2010, and an enterprise value touched already before the great financial crisis in 2008/2009. But since then, Baidu has managed to expand into exciting new growth verticals including AI, cloud, and autonomous driving.

Given Baidu’s ultra-cheap valuation, the company’s favorable exposure to government initiatives (AI, cloud, etc.), and favorable exposure to the China reopening story due to advertising, I believe that Baidu’s stock rebound could be fast and aggressive.

For reference, Baidu stock is down about 43% YTD, versus a loss of approximately 21.5% for the S&P 500 (SPY).

Q3 Could Surprise To The Upside

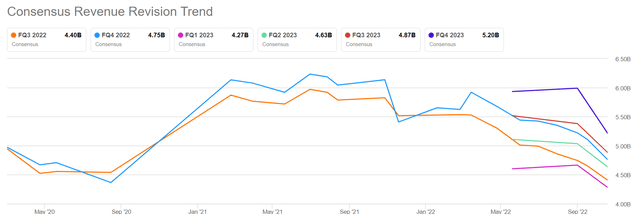

As of November 7th, 16 analysts have submitted their estimates for Baidu’s September quarter. Total sales are expected to be between $4.34 billion and $4.49 billion, with the average estimate being $4.4 billion. If an investor would assume the average as the anchor, Baidu’s Q3 sales are estimated to contract by about 12% as compared to the same quarter in 2021. EPS estimates are between $1.81 and $2.58. The average is $2.16, which would imply a year-over-year growth of negative 5.9%.

But, personally, I do not believe that analyst consensus estimates for Baidu are reasonable – they are too low in my opinion. Because, despite macro challenges and persistent Covid 19 lockdowns, China’s economy may already be in a recovery. In Q3, China reportedly grew 3.9%, versus 0.4% in Q2. Although some investors doubt China’s strong growth in the September quarter, the reporting likely aligns with what companies commented in Q2. Notably, Alibaba management highlighted that: (emphasis added)

Following a relatively slow April and May, we saw signs of recovery across our businesses in June … We are confident in our growth opportunities in the long term.

And in the analyst call, Chief Financial Officer Toby Xu added, that Alibaba’s business sees…

… [a] positive trend of recovery continuing through July

And also Baidu was positive going into the September quarter, as Robin Li, Baidu’s founder and CEO, said (emphasis added):

Since early June, we have seen signs of recovery as the control measures were gradually lifted. For example, the year-over-year decline of our ad revenues narrowed in June and July.

He added (emphasis added):

In June, our ad revenue started to recover, when the situation gradually improved, and July was better than June. In terms of ad verticals, some of ad verticals got hit really hard in April and May. That includes the retail sector, travel, local services and health care. Ad spending from these verticals has been picking up quickly since June.

Thus, there are good arguments to believe that Baidu’s Q3 quarter might surprise to the upside.

Poised For Long Term Value Accumulation

Even if Baidu’s Q3 quarter would disappoint, investors could still enjoy exposure to long-term tailwinds.

It is true that the political environment in China is somewhat “complex.” But investors should not disregard the country’s ambition to strengthen innovation and digitalization – which favors Baidu’s AI Cloud and Intelligent Driving business. With regards to these verticals, in Q2 management commented:

Baidu AI Cloud was again ranked the No. 1 AI cloud provider, according to IDC’s second half of 2021 report on China’s public cloud market report, issued in June 2022.

We aim to put a sizable amount of RT6 vehicles into operation in the year 2024.

And arguably, the current risk for a further internet/tech crackdown is low. Notably, premier Liu He pledged multiple times that the CCP is actively aiming to “support the healthy development of the platform economy” (here, here, here).

And in general, investors should consider that regardless of all the negativity surrounding the Chinese economy, the country’s outlook is far from bad. In fact, economists expect that the Chinese economy’s year over year growth will trend close to 5% through 2027.

For reference, I have written in more detail about China’s macro challenges here.

Valuation Is Ultra Attractive

Investors should also consider that every investment opportunity remains a function of validation – and BIDU’s pricing is simply too attractive to ignore even in the context of a challenging macro and political environment.

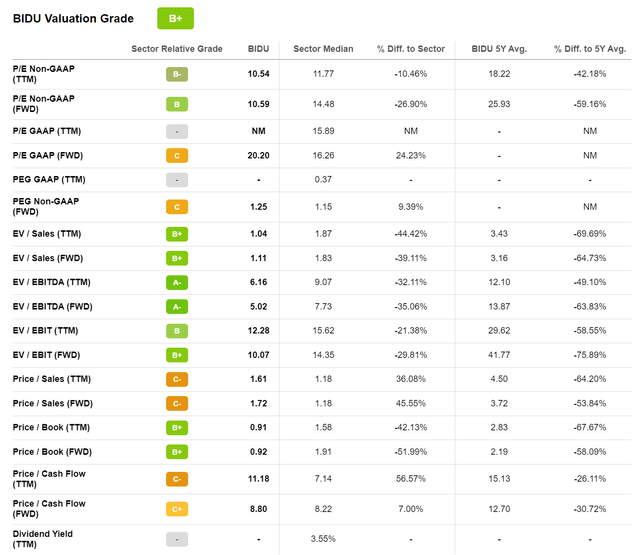

According to data compiled by Seeking Alpha, BIDU is currently priced at an EV/Sales of x1 and an EV/EBIT equal to x10.07. These multiples reflect a 40% and 30% discount to the Communication Sector. But if an investor would consider Baidu an IT company – as I do – then Baidu’s undervaluation would jump to above 50%.

On a multi-year perspective, Baidu is trading at price levels of 2010.

But since then, Baidu has “improved” a lot: the company has grown annual revenues at greater than 10%, accumulated some $10 billion of net cash, and developed exciting technology in autonomous driving, cloud, and AI.

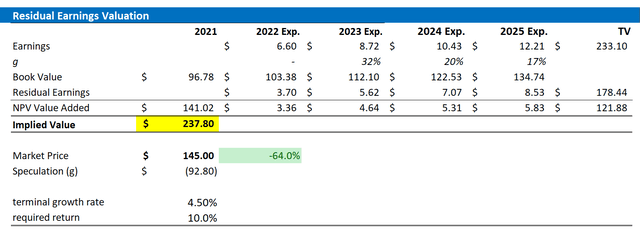

Personally, I continue to believe that Baidu should be valued fairly at around $237.80/share, which is anchored on a residual earnings valuation framework.

Analyst Consensus Estimates; Author’s Calculations

Investment Risks

As I see it, there has been no major risk update since I initiated coverage on Baidu stock. Thus, I would like to highlight what I have written before:

First, the economy in China is currently pressured by multiple headwinds including inflation, real-estate crisis and COVID-19 lockdowns. If the Chinese economy would slow more than what is expected and priced in, investors should adjust expectations for Baidu’s short/mid-term business monetization accordingly.

Second, China’s internet/tech companies are strongly exposed to regulatory risk. While the worst seems to be behind us, the elevated risk exposure persists.

Third, much of Baidu’s share price volatility is currently driven by investor sentiment towards Chinese ADRs and risk assets. Thus, Baidu stock price might show strong price volatility even though the company’s business fundamentals remain unchanged.

Conclusion

In my opinion, Baidu stock is deeply undervalued – not only with regards to current fundamentals, but also with regards to long term opportunities. But given a complex political and economic environment in China, what could serve as an upside catalyst for BIDU to trade in line with value?

There are two key arguments to consider. First, expectations for Baidu’s Q3 earnings, which are scheduled to be reported (some sources say the 16th) on 30th November (pre-market), are very low, and results could thus surprise to the upside. Second, if sentiment towards China-equities improves – perhaps due to Covid-19 reopening or the assumption of lower political risk premia – then Baidu stock might rally sharply.

Personally, I continue to believe that Baidu should be valued fairly at around $237.80/share.

Be the first to comment