zorazhuang/iStock Unreleased via Getty Images

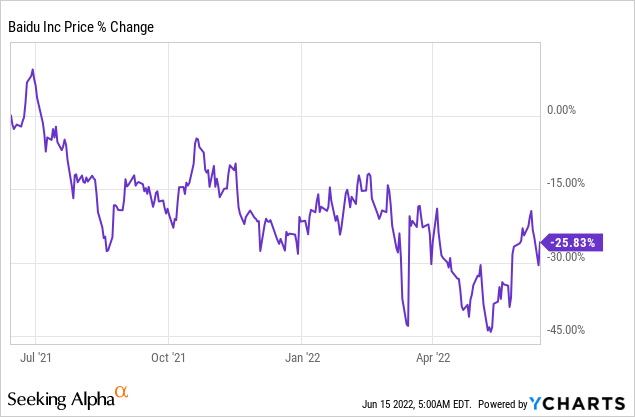

Baidu’s (NASDAQ:BIDU) shares have surged in May as investors take a risk with undervalued Chinese tech companies, but Baidu’s earnings prospects are still significantly undervalued. Baidu will continue to grow rapidly in its core marketing business and has an opportunity to accelerate its growth in the cloud segment. This is a follow-up article related to my previous work on Baidu. Because of Baidu’s deeply discounted valuation, shares have considerable revaluation potential!

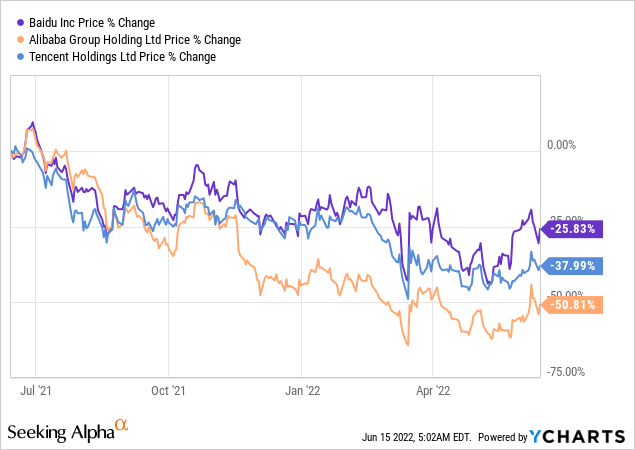

China’s big three tech companies are still out of favor

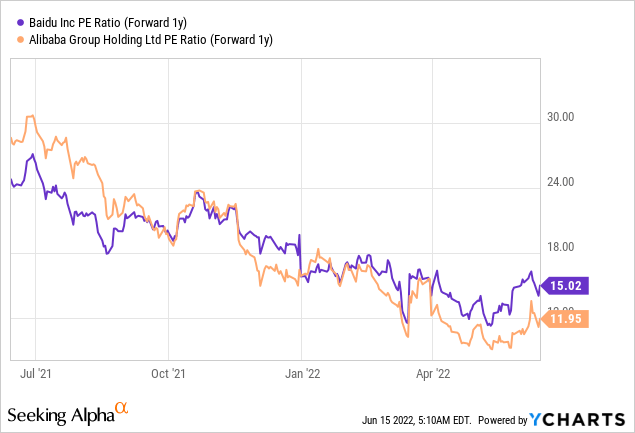

Investors in the Top Three Chinese tech firms — Baidu (BIDU), Alibaba (BABA) and Tencent (OTCPK:TCEHY) — have experienced steep losses over the last two years. However, Beijing’s crackdown on China’s largest businesses has eased and all three companies are ripe for a rebound. Over the last year, shares of Baidu have declined 26% while shares of Alibaba went through a 51% drop in pricing and Tencent saw a decline of 38%.

Short-term revenue challenges, but attractive long-term outlook in digital ad spending

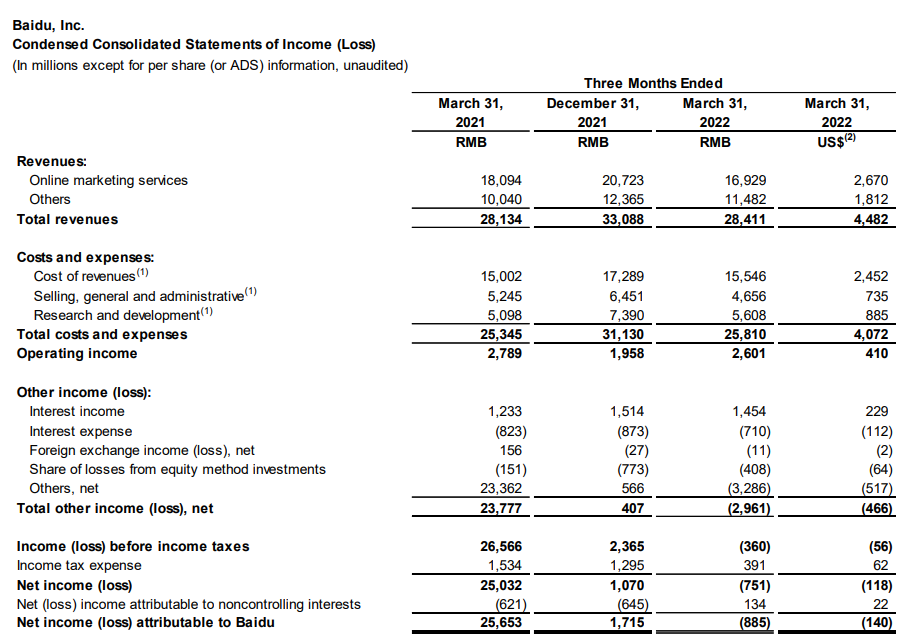

Baidu’s first-quarter earnings sheet showed that the company is facing top line headwinds, in large part because of the resurgence of COVID-19 which has led to entire cities getting locked down. These headwinds resulted in Baidu reporting only 1% year over year revenue growth to 28.41B Chinese Yuan which calculates to $4.48B. COVID-19 and a slowdown in the Chinese economy were largely to blame for Baidu’s weak performance in Q1’22 but these factors won’t affect Baidu’s revenue and earnings potential in the long term. I believe that once recent COVID-19 outbreaks are brought under control, Baidu is going to return to high single digit revenue growth, especially in its online marketing business. Revenues from the provision of online marketing services dropped off 6.4% year over year in the first-quarter to 16.93B Chinese Yuan ($2.67B).

Baidu

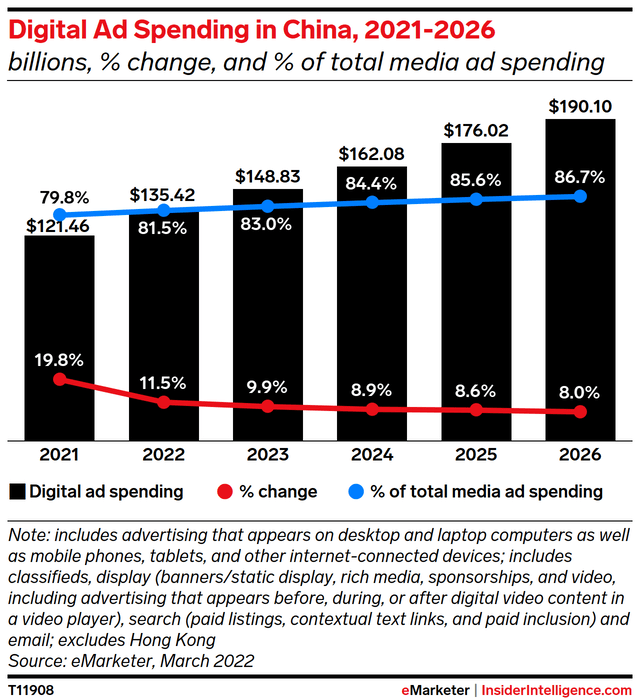

Online marketing services are Baidu’s bread and butter and responsible for the majority (60%) of revenues. Baidu’s search platform is the uncontested leader in the Chinese search market with a share of approximately 74%. Rivals are trailing far behind Baidu regarding market share and this strong position has been the reason for Baidu’s massive growth in the past. Despite a slowdown in ad spending, the long term outlook for the industry and Baidu is positive.

Set to become a more diversified enterprise, opportunity in the cloud segment

Unfortunately, the 1% revenue growth figure discussed above masks that Baidu is seeing rapid growth in its non-online marketing business. While online marketing revenues decreased 4% year over year to 15.7B Chinese Yuan ($2.47 billion), non-online marketing revenues, which are included in Baidu Core, soared 35% year over year to 5.7B Chinese Yuan which calculates to approximately $903M. Growth has been chiefly attributable to Baidu’s cloud and artificial intelligence businesses. The short and medium term growth prospects for Baidu in this market are great and the company is likely to see much stronger growth rates than in its search-related business going forward.

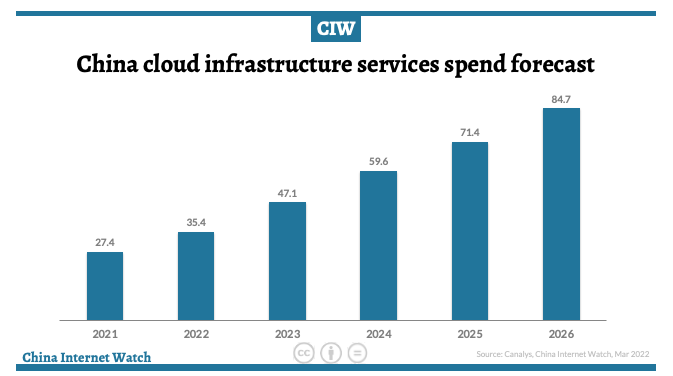

The Chinese cloud infrastructure market is expected to see 25% annual growth over the next five years to approximately $85B as more and more workloads shift online. Baidu is currently the fourth-largest cloud service provider with a market share of 9%. The top four cloud service providers control approximately 80% of the market with Alibaba said to have the largest market share of 37%, followed by Huawei with a share of 18% and Tencent which captured 16% of the market in FY 2021.

CIW

Strong growth in the cloud market could potentially result in an acceleration of revenue growth for Baidu in the coming quarters and give investors a justification to pile back into Baidu’s shares.

Baidu’s investments in the cloud sector as well as in segments like artificial intelligence and intelligent driving technology are set to make the company a more diversified company going forward that will depend less on online marketing as a profit source. While the online search market and the 632M MAU-strong Baidu App represent deep value for advertisers due to the projected rise in digital ad spending, the company has an opportunity to drive revenue and earnings growth in non-marketing related businesses going forward.

Discounted earnings growth

Baidu’s shares have been punished for slowing top line growth, especially in online marketing services. Concerns over a potential delisting and COVID-19 outbreaks in China have also weighed on Baidu’s valuation. Although the market has shown some renewed interest in Baidu in May, the firm’s shares are still widely undervalued. Based off of earnings, Baidu’s shares trade at 15 X next year’s expected profits. Baidu’s strong market position in search, I believe, provides stability while the cloud/AI business could drive revenue and earnings growth for Baidu going forward.

Risks with Baidu

The biggest risk for Baidu right now is slowing top line growth in the marketing business as well as deteriorating macro conditions in China’s economy. Increasing competition in the cloud market may also represent a risk for Baidu and the stock longer term. I am willing to change my mind on Baidu if the company were to see a material decrease in earnings growth due to headwinds in the digital advertising market.

Delisting risk is exaggerated

What I don’t see as a big risk for Baidu is that the firm’s shares will be delisted from the U.S. exchange. Under the Holding Foreign Companies Accountable Act, foreign companies whose audit papers can’t be inspected by the Public Company Accounting Oversight Board could be delisted from a U.S. stock exchange in the future, but only if the PCAOB can’t access the auditor’s working papers for three consecutive years. The clock started at the end of FY 2021, meaning a delisting is likely to happen only after FY 2024.

Final thoughts

Because of new COVID-19 outbreaks in China in 2022, Baidu has experienced revenue headwinds, especially in online marketing services, which I believe is holding back Baidu’s business only temporarily. Baidu has a very strong market position in search which stabilizes the business while Baidu’s cloud and AI businesses are seeing accelerating momentum. A strong outlook for growth in the Chinese cloud market as well as Baidu’s cheap valuation indicate upside revaluation potential for Baidu’s shares!

Be the first to comment