Paul Campbell

Main Thesis & Background

The purpose of this article is to evaluate the Invesco Build America Bond Portfolio ETF (NYSEARCA:BAB) as an investment option at its current market price. The fund is managed by Invesco, and it is designed to “track the performance of US dollar-denominated taxable municipal debt publicly issued by US states and territories”. This is a passive ETF, which is a contrast to most of the funds I normally review in this space, which are leveraged CEFs.

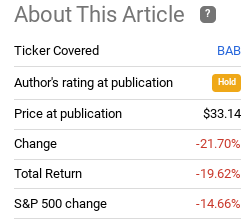

It has been a little over a year since I took a look at BAB. At that time, I reiterated a cautious stance on this fund. I saw a lot of interest rate risk and limited upside, and suggested investors avoid it. In hindsight, this was the correct move, but I erred in not being more bearish:

Fund Performance (Seeking Alpha)

Given all that has happened since September 2021, I thought another look at BAB was overdue. After review, I now see a buy thesis where a different before for a number of reasons. I will tackle each one in detail below.

Taxable Munis Have A Sizable Yield Edge

As my followers are aware, I have long been a holder of muni bonds. For the most part, my position is centered around tax-exempt options. But BAB holds a taxable basket, so we have to consider the pros and cons of this approach. Personally, I view the sector as a whole positively, so tax-exempt and taxable bonds have piqued my interest. But I would note that for those who primarily want tax-exempt income, then this probably is not the best bet for you.

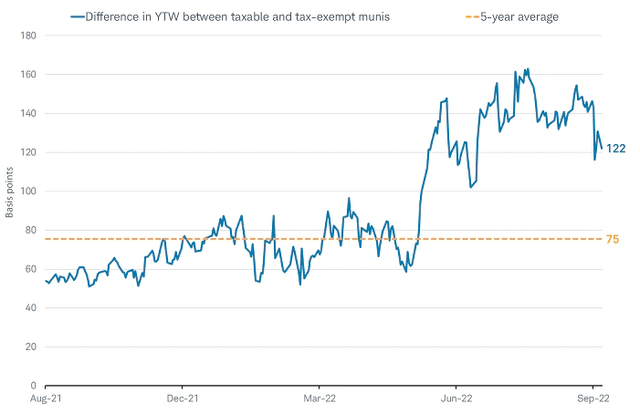

Still, there may be advantage to buying BAB at the moment despite the tax status of the underlying holdings. In relative terms, investors may actually be better off. This is especially true if one is in a lower tax bracket (meaning that the tax savings from tax-exempt bonds is not very lucrative) or if the ETF is held in a tax-deferred IRA, etc. This is amplified by the fact that the yield difference between taxable and tax-exempt munis is above its long-term average – suggesting relative value here:

Yield difference between taxable and tax-exempt Munis (Bloomberg)

The conclusion I draw here is that it makes sense to at least consider taxable options right now. The yield differential is high historically, so investors may be better off with these options depending on their own unique situation (tax rate, type of account, etc.). For me, this puts BAB back on my radar.

I Still Think Equity Hedges Make Sense

I now want to shift in to why I believe buying munis as a whole could be the right move for readers at this time. I think BAB is a reasonable option – but why consider munis at all? The primary reason for my exposure is to have tax-deferred debt. But BAB is a taxable basket, so there has to be a valid reason for owning muni bonds beyond just the tax savings when it comes to this ETF.

With this in mind, I would simply offer a reminder that IG bonds typically offer investors a reasonable equity hedge. This has not worked out so well in 2022 because inflation and higher interest rates have been pressuring stocks and bonds alike. This has bumped up the correlation between the two, leaving investors with fewer places to “hide” during equity routs – since bonds have been falling too!

However, this is a trend I expect to reverse back to normalcy with time. Ultimately investors buy stocks and bonds for different reasons and the headwind for higher interest rates is going to subside once the Fed hits its 3.5-4% target (in my opinion). My thesis is the Fed will hit this benchmark range by early 2023, and then pause of rate hikes. If so, bonds will benefit as rates stay stable – especially if the next move from the Fed is to cut rates.

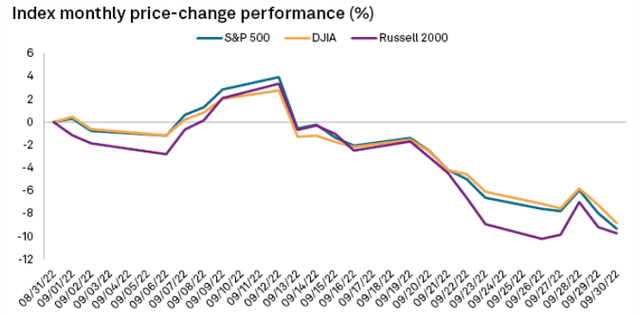

So, what does this mean for muni bonds? It suggests to me that buying equity hedges going in to Q4 2022 and 2023 should be an effective tactic. I don’t see the positive correlation between IG credit and equities to be a sustained phenomenon, so I believe building on positions like munis is the right move at the moment. To emphasize why, consider that we just wrapped up a terrible month for equities. The major indices in the U.S. hit correction territory for the month, which is a bit unnerving:

Index Performance (September) (S&P Global)

The begs the obvious question – why buy munis instead of equities? After all, equities are down sharply so perhaps that is the better play.

I wouldn’t argue with that logic, and I would indeed use the bear market as a time to add to quality equity positions. But in the meantime I am adding to muni positions as well – primarily as a hedge.

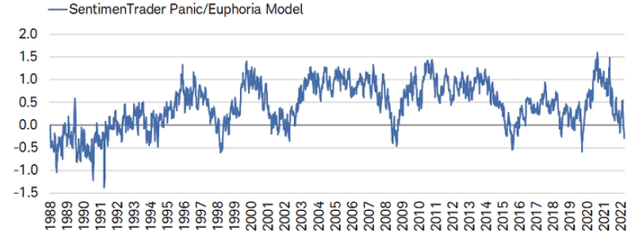

Why? Because I am concerned there is more downside in equities to come and I want to prepare for it. Despite the large-cap indices being in bear markets, investor sentiment is not yet near “panic” levels. I like to use that as a gauge to figure out when fear is at its greatest peak and to buy more aggressively. Yet, while sentiment has certainly taken a plunge, it is still well above the levels of fear we saw in 2020, and other bear markets before that one:

Sentiment Tracker (Charles Schwab)

The takeaway from me is that equities are likely to see more volatility despite the sharp drawdowns in prices. While “panic” levels have begun to open up buying opportunities, I see continued merit to hedges through Q4. This makes BAB a reasonable option, along with the muni sector more broadly.

Muni Supply Has Been Tight, A Key Tailwind

My next thought also has a macro-focus. This concerns taxable and tax-exempt munis both, but taxable munis in particular have seen the issuance decline as interest rates have risen. Simply, many taxable munis were a result of refinancing debt (called advanced refundings in the muni world). When such issuance lost its tax-exempt status as a result of the 2017 tax reforms, bonds that were refinanced became taxable.

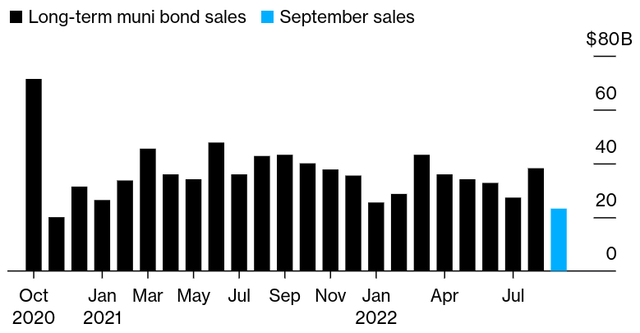

In 2022, the supply of new taxable munis has been depressed because interest rates have risen. Therefore, the incentive to refinance existing bonds has been reduced, resulting in far less taxable supply hitting the market. The following graph should put that in perspective:

Muni Bond Issuance (By Month) (Bloomberg)

Unfortunately, this has not translated into higher underlying bond prices in 2022 – yet. Typically, when supply declines, prices could rise, all other things being equal. But all other things are not equal right now. Investors have been fleeing the sector and outflows of muni ETFs and CEFs have been piling up. This has resulted in negative returns, despite the backdrop for supply being favorable for prices in isolation.

My takeaway here is I believe this is a tailwind going in to 2023. Muni bonds are sure to come back into favor, in my opinion. When retail and institutional investors begin to rotate back into the sector, the declining supply metric noted above will support underlying prices going forward because there will be fewer bonds available to buy than in months past.

Current Yield Has Been Rising

While the rising interest rate environment has been damaging to bond funds in terms of total return, the upside is that these funds have seen their current yields increase. This has been the result of a lower price (yields and price move in opposite directions) and that ETFs such as BAB have been able to pick up assets that offering higher yields. This allows BAB to offer a higher income stream to its investors as a result.

To illustrate, consider the current yield for the fund is in the 3.5% range. In addition, the Q3 distributions for BAB for 2022 are up about 4% compared to 2021 distributions during the same time period (Source: Invesco). I see this as further justification that building a position here is justifiable.

Not A Risk-Free Option By Any Means

While I have touched on a couple of positive points, I must take a moment to discuss the risks. This is a difficult investment climate for just about everything – stocks, bonds, crypto, commodities, you name it. When buying any asset right now, a consideration of what could go wrong is paramount for me.

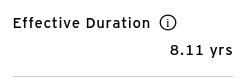

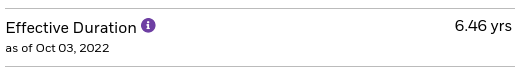

With respect to taxable munis, we should understand these have a fairly long average duration. The good news is BAB has seen its duration level (a measure of interest rate sensitivity) drop since my review last year. At the time, the duration was over 9 years. Today, that figure is roughly one year lower:

BAB’s Duration (Invesco)

This is a bit of a mixed bag. On the one hand a lower duration level is a positive in this environment. But the other side of the coin is that this duration metric is still elevated. This means BAB is more sensitive to changes in interest rates than many other products. Case in point, a tax-exempt counterpart is the iShares National Muni Bond ETF (MUB), which has a duration level markedly lower BAB does:

MUB’s Duration (iShares)

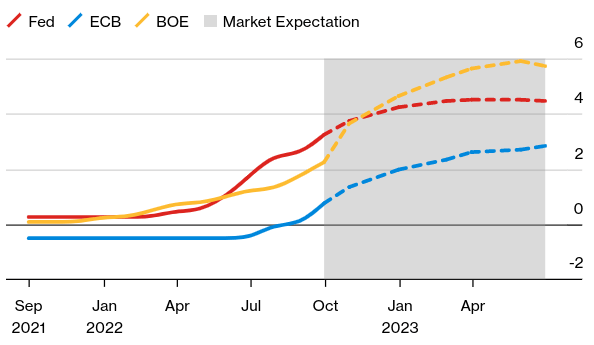

The reason why this is concerning is that we remain in an environment where interest rates on are the rise. Rate hikes are expected to continue by central banks in the developed world through the end of the year. The expectation is that rates will stabilize in 2023, but that is only an estimate at this point:

Actual (and Forecasted) Rates (Bloomberg)

What I am pointing out here is that interest rate risk remains as relevant as ever. I personally see the risk fading into the new year, as I believe central banks are going to be forced to pause given the excessive debt levels within those countries (United States included!). However, that doesn’t mean further pain won’t be forthcoming, so we have to factor that into our risk analysis.

Specifically, taxable munis have more risk here than their tax-exempt counterparts, which balances out the relative value I see within taxables. Simply, if interest rates rise more than expected, total returns for taxable munis will almost certainly be lower than tax-exempt munis. This is a key attribute to keep in mind.

Bottom-line

I believe the muni sector has some value and taxable munis in particular have an unusual yield advantage over their tax-exempt counterparts. BAB is made up of quality (mostly IG) assets, has an income edge over tax-exempt passive munis ETFs, and has less risk in this difficult investing environment because it is a non-leveraged fund. While the past year has been very painful for those holding BAB, I see brighter days ahead. As a result, I will be upgrading my rating for BAB to a “buy” going into the end of the year and also in 2023.

Be the first to comment