miglagoa/iStock Editorial via Getty Images

Azul SA (NYSE:AZUL) is recognized as the largest Brazilian airline by daily flights, serving the domestic market along with an expanding number of international routes. While the entire industry was crushed during the pandemic, the past year has been defined by a strong rebound amid easing Covid restrictions and pent-up leisure travel. On the other hand, the company has not been immune to the global trend of inflationary cost pressures including high fuel prices. The stock is down about 25% in 2022 amid the broader market volatility.

That being said, there are several reasons to look up and turn bullish on the stock. The first point is that energy prices have cooled off supporting an outlook for stronger earnings through the next year. We’ll also note that macro data out of Brazil has been encouraging, in many ways a bright spot compared to greater uncertainties for the rest of the world. We like AZUL because it offers exposure to a high-growth segment of emerging markets with climbing air travel demand. The company is supported by overall solid operating trends which have room to improve going forward.

AZUL Earnings Recap

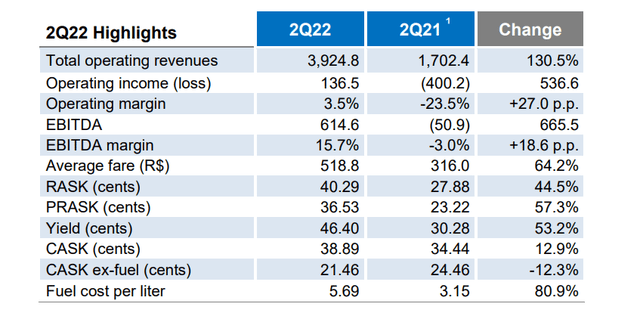

The company reported its Q2 earnings on August 11th with an adjusted net loss of BRL -2.6 billion, or approximately -$520 million at an exchange rate of BRL 5.00 per USD. The result considers financial expenses related to interest charges and FX volatility. Nevertheless, the takeaway here is the operating income of BRL 136.5 million has turned positive, reversing a loss of BRL -400 million in the period last year. Operating revenue of BRL 3.9 billion was a quarterly record for the company, climbing 130% from Q2 2021 which was impacted by the “Delta Covid wave” last year.

source: company IR

Azul is benefitting from a return of passenger traffic that has now exceeded 2019 pre-pandemic levels. With July data into Q3, passenger traffic is up 34% y/y. The other dynamic here is a 64% increase in the average ticket price reaching BRL 518 compared to BRL 316 in Q2 2021. The result has been a rebound in key operating metrics like the passenger revenue per available seat kilometer (PRASK) and passenger yield, both climbing by about 55% y/y. EBITDA at BRL 615 million compared to a negative -51 million in the prior year quarter tells the story of the ongoing turnaround.

We mentioned high fuel prices have been a challenge with the BRL price per liter in Q2 up 33% just from Q1 and double the level from 2019. Favorably, the more recent trend into Q3 with a drop in oil price benchmarks provides some visibility for even stronger financial results going forward. Management expects to realize gains as it continues to hike the average fare alongside local market conditions.

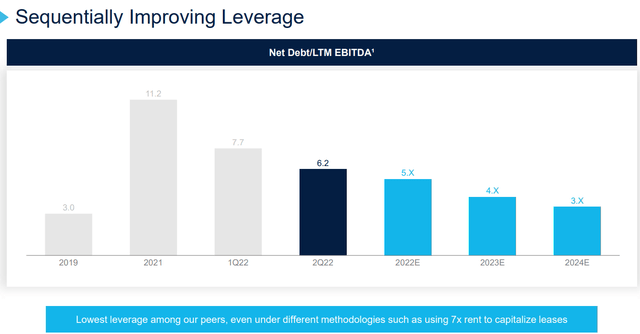

While management is not providing earnings targets, comments during the conference call projected optimism. Compared to an EBITDA margin of 15.7% in Q2, the outlook is for that to trend toward 30% over the next few years as operating conditions normalize and the company benefits from increasing capacity. With the company taking on significant debt during the pandemic, the expectation is for Azul’s leverage ratio to trend lower from 6.2x in Q2 to a more stable 3x by 2024.

source: company IR

Is Azul a Good Long-Term Investment?

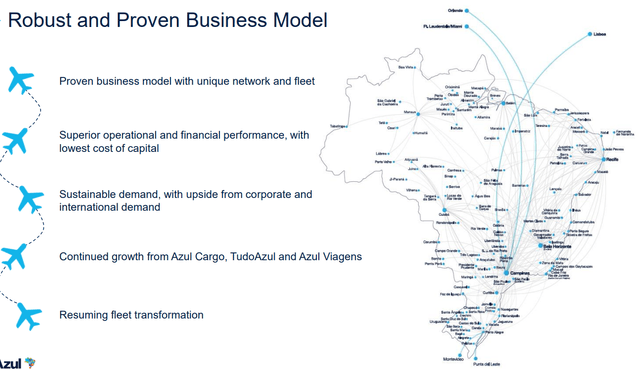

There’s a lot to like about Azul which has established itself as a reference point for global airlines. The company has won awards for customer service and consistency of on-time departures. An expanding fleet along with momentum from its cargo and “Azul Viagens” travel agency businesses highlight further growth opportunities.

source: company IR

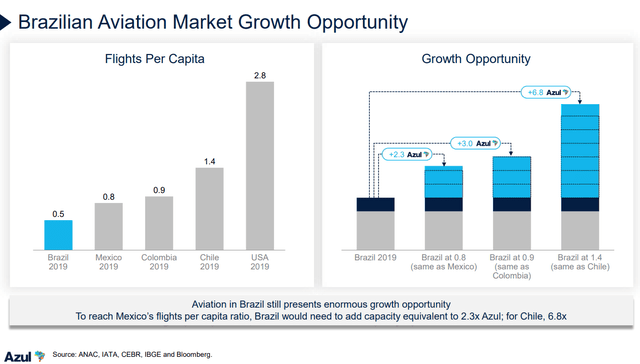

The single most important factor supporting a positive long-term outlook for Azul comes down to the Brazilian market dynamics. While aviation travel demand has been strong, the country still lags behind other Latam emerging markets. With 2019 data as a benchmark, Brazil averaged about 0.5 flights per capita compared to 0.8 in Mexico, 0.9 in Colombia, and 1.4 in Chile. Azul explains that the potential that Brazil’s aviation penetration simply converges to rates in Mexico would require nearly 2.3x the capacity growth from current levels. Azul, as a market leader with an extensive network, would be leveraged to this upside.

source: company IR

A bullish call on AZUL now largely requires the macro picture to cooperate including the economic conditions in Brazil. On this point, the latest data has been encouraging. Latin America’s largest economy appears to be a bright spot globally with GDP growth forecasts trending higher, in contrast to Europe, Asia-Pac, and even the U.S. which have been plagued with greater uncertainties and fears of a deeper recession. Some of the indicators were looking at suggesting the labor market in Brazil is strong with the lowest unemployment rate in seven years while the domestic consumer price index has surprised to the downside in recent months.

The setup here represents a positive operating tailwind for AZUL, but also some fundamental factors that should support a stronger Brazilian Real currency. Notably, the Real has appreciated around 8% in the past month based on these macro trends, bucking the theme of a stronger Dollar Index globally. This is a case where FX volatility as an underlying risk for all foreign stocks can work to the advantage of AZUL ADR investors.

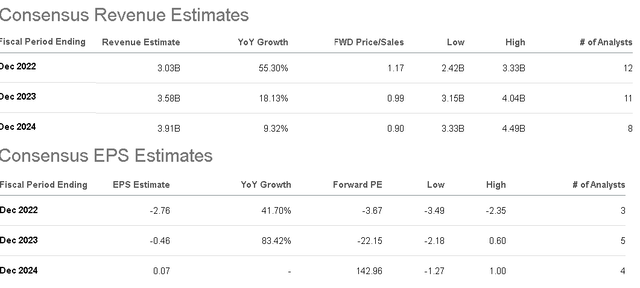

Brazil has its share of problems, but the opportunity here is that economic conditions evolve more strongly from what is a low base of expectations. AZUL is well-positioned to capture these trends with an upside to revenue and earnings estimates. According to the consensus, the forecast is for revenue to reach $3.0 billion this year, up 55% over 2021. While the company is not expected to be profitable until 2024, dragged lower by financial expenses, we see upside to the current estimates with a quicker deleveraging.

Seeking Alpha

Final Thoughts

We are bullish on AZUL and like the chart setup as the stock appears to be breaking out from a long-running downtrend that started about one year ago. The momentum has turned positive with AZUL up a fantastic 60% over the past month from a low under $7.00 in late July. The potential that AZUL can reclaim the $16.00 stock price level, last reached in early April, can represent upwards of a 50% upside from here. Longer term, the combination of solid operating trends, improving financials, and the rebounding macro picture out of Brazil can carry shares even higher.

Seeking Alpha

To be clear, there are plenty of risks to consider. Brazil as an emerging market has frustrated investors historically. Azul’s debt position and high current leverage ratio keep it in a more speculative category. It’s fair to assume shares will remain volatile for the foreseeable future. A deteriorating macro outlook or a further depreciation of the Brazilian Real currency can open the door for another leg lower in the stock. Monitoring points over the next few quarters include fuel price trends, monthly passenger traffic statistics, and performance metrics like the PRASK.

Be the first to comment