Dilok Klaisataporn

Axsome

Price is what you pay. Value is what you get. – Warren Buffett

Author’s Note: This article is an abridged version of an article originally published for members of the Integrated BioSci Investing marketplace on September 29, 2022.

In early-stage biotech investing, the main drug (i.e., crown jewel) of the pipeline is the most important determinant of your investment success. After all, its success validates the efficacy/safety of both the drug and the technology platform. More importantly, it determines whether the management can execute. Asides from the crown jewel, there are supporting molecules that (once they reached advanced clinical investigations) can deliver substantial value.

That being said, I want to revisit a stellar growth company dubbed Axsome Therapeutics, Inc. (NASDAQ:AXSM). As you know, Axsome recently gained approval of its lead medicine AXS05 for major depressive disorder. Interestingly, the supporting molecule (i.e., AXS07) is also clearing the regulatory hurdle in the next few quarters. In this research, I’ll feature a fundamental analysis of Axsome and share with you my expectation of this intriguing company.

Figure 1: Axsome chart

About The Company

As usual, I’ll present a brief corporate overview for new investors. If you are familiar with the firm, I recommend that you skip to the next section. I noted in the prior research,

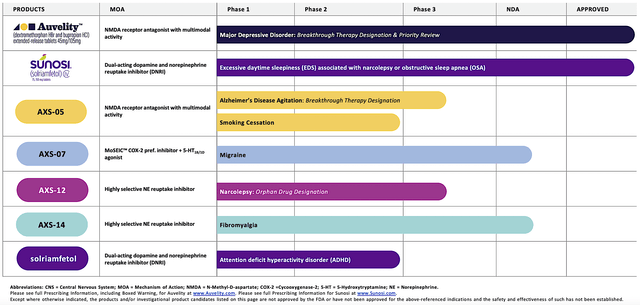

Operating out of New York, Axsome dedicates its efforts to the innovation and commercialization of novel medicines to fulfill the unmet needs in psychiatry. Powering the pipeline are four promising molecules in development, including AXS05, AXS07, AXS12, and AXS14. As the crown jewel of this pipeline, AXS05 is either being assessed or approved for various disorders such as major depressive disorder (“MDD”), agitation associated with Alzheimer’s disease (“AD”), and smoking cessation. By experimenting with multiple uses for a single drug, Axsome can maximize the value of its innovation. That is to say, it increases the chances at least one indication would become a bonanza. That aside, there is also another new and commercialized drug (i.e., the Sunosi acquisition).

Figure 2: Therapeutic pipeline

AXS05 As The Crown Jewel

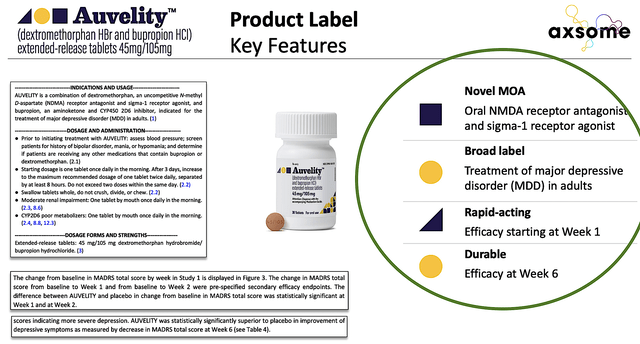

As you know, AXS05 triumphed against the odds and thereby gained FDA approval for MDD. As shown in the figure below, Auvelity has a broad product label and excellent product differentiation. That is to say, Auvelity is the first oral NMDA receptor blocker and a sigma-1 receptor agonist – representing the first novel mechanism of action approved in 60 years.

Auvelity works magnificently as efficacy was observed early as Week1 on the drug. In contrast, other antidepressants require at least 4-6 weeks to kick in. Putting all that together, Auvelity can capture a significant percentage of the $16B global depression market.

Figure 3: Auvelity’s product label

Migraines

Though not the most important molecule, AXS07 can add substantial value to Axsome’s prospects. To appreciate AXS07, you should go over the generalities of migraine. Often sensitive to light and sound, Migraine headache is characterized by a throbbing pain on one side of the head with accompanying nausea and vomiting as well as vision problems.

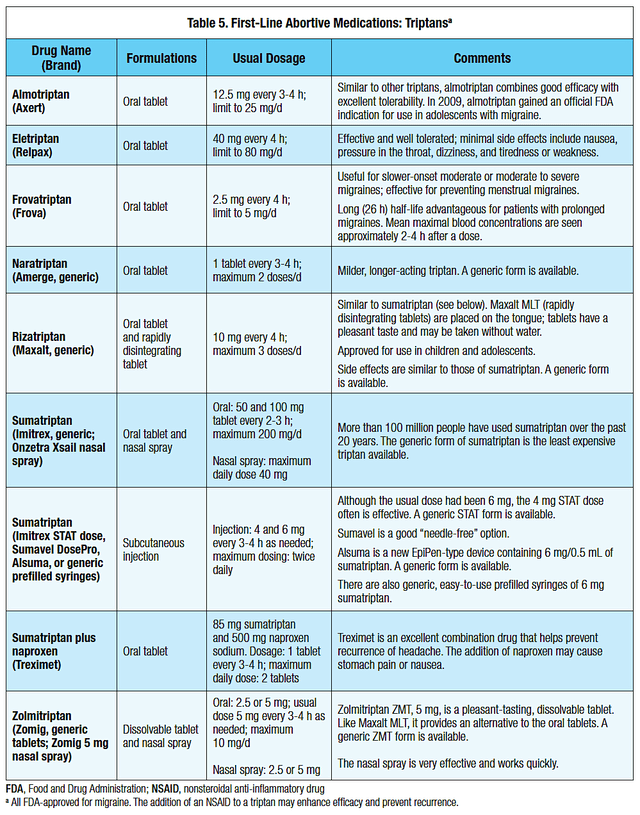

For treatment, it is managed with both “abortive” and “preventative” drugs. As shown below, the bread-and-butter abortive treatment would be a “triptan” that can be given alone or in combination with a pain medication.

Figure 4: Migraines treatments

AXS07 For Migraines

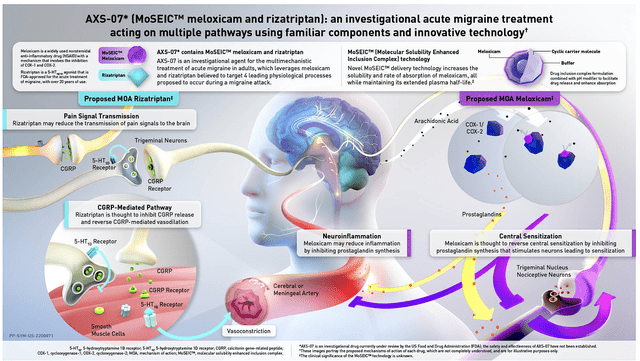

As you can imagine, AXS07 is poised to deliver the silver bullet for migraines. That is to say, AXS07 leverages on the MoSEIC technology that combines both rizatriptan (a great triptan) with meloxicam (an excellent pain medicine). The said combo would deliver an edge over competing treatment options.

Specifically, AXS07 attacks multiple targets associated with migraines. And, the MoSEIC technology improves the solubility plus absorption of meloxicam while maintaining its long half-life. Simply put, this drug gives patients a convenient answer that has prompt and sustained relief.

Figure 5: AXS07 mechanism of action

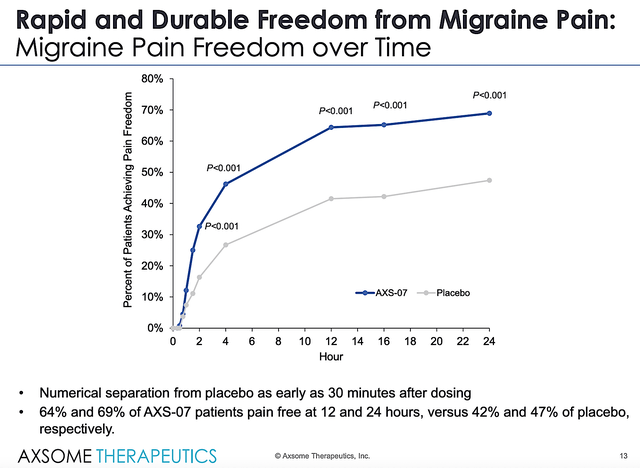

In both the Phase 3 (MOMENTUM and INTERCEPT) trials, AXS07 demonstrated rapid and robust improvement in migraine symptoms compared to placebo and controls. From the figure below, you can appreciate the rapid and significantly higher percentage of patients who enjoy fast/durable pain free.

Figure 6: Strong INTERCEPT data

Clearing Regulator Hurdles for AXS07

Despite the great data, AXS07 received a Complete Response Letter (i.e., CRL) from the FDA back in May this year. Leading by prudent management, Axsome wasted no time in reaching out to the FDA. Their efforts paid off, as Axsome announced on September 29 that the company finished its Type A meeting.

During the said meeting, the FDA discussed with Axsome the path forward for AXS07. Axsome confirmed in the PR that actions needed to ameliorate the NDA resubmission were related to the Chemistry, Manufacturing, and Control (i.e., CMC). Specifically, there were no clinical trials requested. You can see that saves Axsome precious years of development and tremendous capital.

Going forward, Axsome would simply need to provide the Agency with the stability data on newly manufactured commercial scale batches of AXS07 in the resubmission package. To be thorough, Axsome may also provide other available clinical pharmacology data

With the path ahead essentially cleared, Axsome is anticipated to execute a Class 2 filing in 3Q this year. Given that the Class 2 resubmission gets a 6-month review, you can anticipate an approval by either 1Q or 2Q next year. Highly enthused with the development, the CEO (Dr. Herriot Tabuteau) remarked,

We are very pleased with the outcome of the Type A meeting which clarifies our approach to resubmitting the NDA for AXS07 for the acute treatment of migraine. We appreciate the FDA’s thoughtful engagement and look forward to a successful resubmission. The World Health Organization categorizes the disability from severe migraine attacks on the same level as that from quadriplegia, dementia, and acute psychosis. If approved, AXS-07 would provide an important new treatment option for the millions of people living with this debilitating condition.

Forecasting Upcoming AXS07 Approval

Leveraging my Integrated system of forecasting, I ascribed a 70% (i.e., strongly favorable) chance of approval for AXS07 early next year. I based my forecasting on AXS07 mechanism of action, the disease context, available data, my decades of experience, and most importantly: my intuition. Essentially, you can expect that approval is forthcoming.

Migraines Market

Growing at a 9.9% CAGR, the global migraines market should reach $12.9B by 2027. As you anticipate, the US would take the majority of the market shares. The other countries (France, Germany, Italy, Spain, UK, and Japan) would garner the other significant percentages.

With AXS07 upcoming approval, it’s likely to cut into a significant percent of the market. After all, AXS07’s drugs demonstrated extremely strong efficacy and excellent safety in high-quality clinical trials. More importantly, the drug differentiates itself from competitors.

Financial Assessment

Since I previously went into great detail about the financial side, I’ll only briefly go over the most salient metrics for 2Q202 earnings here. Notably, Axsome procured $8.8M in revenues compared to none for the same period a year prior. Moreover, the research and development (R&D) registered at $15.7M and $14.5M, respectively.

Furthermore, there were $41.4M ($1.06 per share) net losses compared to $32.2M ($0.86 per share) declines for the same comparison. With the total cash position of $102M – plus on top of the $8.8M revenue and against the $48.0M quarterly OpEx – Axsome is likely to raise capital in the coming quarters.

Potential Risks

Since investment research is an imperfect science, there are always risks associated with your stock regardless of its fundamental strengths. More importantly, the risks are “growth-cycle dependent.” At this point in its life cycle, the main concern for Axsome is if the company can quickly ramp up sales for Auvelity. As a small company “going at it alone” in commercialization, there is significant risk that Axsome won’t be able to fully unlock Auvelity value.

The other risk is whether or not Axsome can secure AXS07 approval early next year. As I strongly believe in its approval prospect, I ascribed only a 30% chance of regulatory failure. Additionally, the other significant risk is that Axsome may raise capital soon.

Concluding Remarks

In all, I maintain my buy recommendation on Axsome with a 4.8 out of five stars rating. Being no stranger to beating the odds, Axsome is a story of investment success. This stellar growth biotech garnered approval of Auvelity for MDD. With Sunosi, Axsome should enjoy a significant revenue increase in the coming quarters. As a prudent growth biotech, the company rapidly expands the aforementioned drugs’ label. Meanwhile, the recent meeting with the FDA indicates that approval of AXS07 for migraines is highly likely to come early next year.

Amid this bear market, you can expect Axsome to still deliver more positive catalysts. Specifically, Axsome would publish positive news regarding Auvelity’s ACCORD trial trials for Alzheimer’s dementia in the next few months. There are also other catalysts like the upcoming trial data for AXS12 as a treatment for narcolepsy in 1H2023. You also get to see AXS12 advancement for fibromyalgia as the company is poised to file an NDA next year.

Be the first to comment