Chinnapong Axsome

The future is never clear. – Warren Buffett.

Author’s Note: This article is an abridged version of an article originally published for members of the Integrated BioSci Investing marketplace on July 05, 2022.

In biotech investing, there is extreme volatility which makes it unfit for short-term-oriented investors. If you have a long-term outlook, certain biotech stocks like Axsome Therapeutics (NASDAQ:AXSM) can deliver you tremendous returns in the long haul. That is to say, these stocks would rally and decline in response to fundamental changes associated with their investing thesis. If the investment thesis remains intact, the share price would trend much higher over the years. In this research, I’ll feature a fundamental update and reassessment of Axsome. Moreover, I’ll share with you my expectation of this stellar growth equity.

Figure 1: Axsome chart

About The company

As usual, I’ll present a brief corporate overview for new investors. If you are familiar with the firm, I recommend that you skip to the next section. I noted in the prior research:

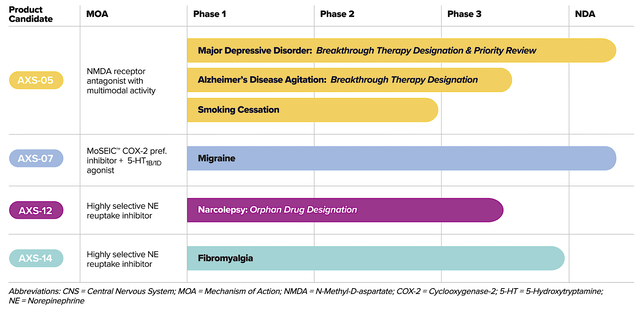

Operating out of New York, Axsome dedicates its efforts to the innovation and commercialization of novel medicines to fulfill the unmet needs in psychiatry. Powering the pipeline are four promising molecules in development, including AXS05, AXS07, AXS12, and AXS14. As the crown jewel of this pipeline, AXS05 is being assessed for various disorders such as major depressive disorder (“MDD”), agitation associated with Alzheimer’s disease (“AD”), and smoking cessation. By experimenting with multiple uses for a single drug, Axsome can maximize the value of its innovation. That is to say, it increases the chances at least one indication would become a bonanza. That aside, there is also another new and commercialized drug (i.e., the Sunosi acquisition).

Axsome

Figure 2: Therapeutic pipeline

AXS05 for MDD

Shifting gears, let us analyze the latest development of the crown jewel, AXS05. After all, it decides the fate of your Axsome investment. On this front, the uncertainty relating to AXS05 for MDD caused the stock to tumble substantially. Last year, Axsome stated in their 2Q filing that the FDA notified deficiency in AXS05 filing for MDD. Consequently, that prevented the agency from issuing a decision for its August 22 Prescription Drug User Fee Act (PDUFA). Moreover, it precludes a discussion of labeling requirements.

Like rays of light that cleared the cloud of doubts, the good news came to shareholders on June 24 this year when Axsome filed with the SEC its latest corporate update. Specifically, the company received from the FDA the proposed labeling of AXS05’s NDA for MDD. Axsome precisely mentioned that it is “reviewing the proposed labeling and will reply to the FDA to secure final labeling agreement.”

You might be thinking what exactly does that mean? Well, it’s important that you read the tea leaves to stay ahead of the market. Accordingly, you can anticipate that approval is coming soon. For labeling discussion to occur, it’s logical to say that the FDA must have already made its decision to approve AXS05. As such, it seems like the rest is now simply paperwork for labeling requirements.

From the clinical viewpoint, an approval makes sense because AXS05 demonstrated extremely robust data for treatment-resistant depression (i.e., TRD). For TRD, the patient does not respond to most drugs. And, their best choice is to get an electrical shock in their brain via a procedure known as electroconvulsive therapy (i.e., ETC). Given that AXS05 can treat the most aggressive form of depression (i.e., TRD), managing the less severe form of depression (i.e., MDD) should be a much lower hurdle.

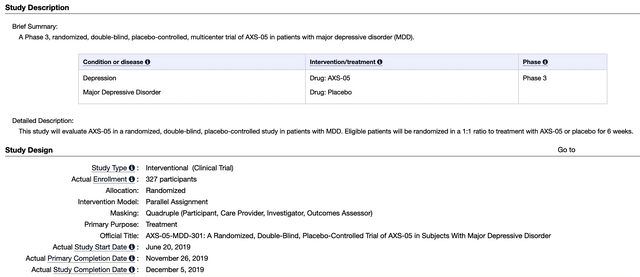

New GEMINI Data For AXS05

Asides from the aforesaid development, Axsome presented the Phase 3 GEMINI trial data for AXS05 in MDD at the American Society of Clinical Psychopharmacology (ASCP) 2022 Annual Meeting held virtually. As a high-quality trial, GEMINI assessed the efficacy and safety of AXS05 in 327 patients suffering from MDD. Notably, the study’s primary endpoint was the Montgomery-Asberg Depression Rating Scale (MADRS) score from baseline to week 6.

Figure 3: GEMINI trial

Keep in mind, this is an ad-hoc (i.e., post-study) analysis that looks at the specific anhedonia symptoms. Characterized as a lack of sex drive, anhedonia is a common condition that affects as many as 75% of patients with MDD. When these patients are depressed, they no longer have a desire for sexual intercourse. As anhedonia is quite bothersome, it’s important that AXS05 can ameliorate anhedonia to improve the patient’s quality of life. In the aforesaid trail, AXS05 demonstrated the following results:

The change from baseline to week 6 on the MADRS anhedonia subscale was significantly greater with AXS-05 than with placebo (-9.70 points vs. -7.22 points; p=0.001).

The improvement was rapid with the change on the MADRS anhedonia subscale from baseline to week 1, the first time point assessed, being significantly greater with AXS-05 than with placebo (-4.44 points vs. -2.69 points; p<0.001).

Response, defined as at least a 50% improvement on the anhedonia subscale, was achieved by a statistically significantly greater proportion of patients treated with AXS-05 than with placebo at week 1 (p<0.001) and at every time point thereafter.

At week 6, response on the anhedonia subscale was achieved by 54% of patients treated with AXS-05 compared to 36% of patients treated with placebo (p=0.002).

As you can imagine, post hoc analysis data is not high quality. Nevertheless, it supports the efficacy of AXS05 as a stellar drug for MDD. Hence, it further enhances the investing thesis of Axsome. As a general rule-of-thumb, the more supportive data for the drug, the better. And, it’ll help AXS05 to gain FDA approval as well as commercialization success.

Sunosi Acquisition Update

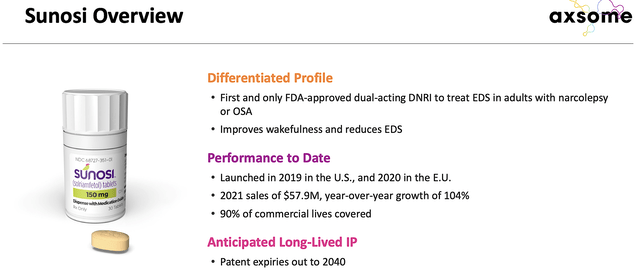

On June 28, Axsome also held a Key Opinion Leaders (i.e., KOL) virtual event to update the status of AXS05 and the solriamfetol (Sunosi) acquisition from Jazz Pharmaceuticals (JAZZ). Again, the product labeling discussion signifies AXS05’s upcoming approval for MDD. That aside, the firm went into a deeper presentation relating to the unmet needs of excessive daytime sleepiness where Sunosi can fill the void.

Approved back in 2019, the dual-acting dopamine and norepinephrine reuptake inhibitor (Sunosi) boosts wakefulness in adults having excessive daytime sleepiness due to narcolepsy or obstructive sleep apnea (OSA). Now, the OSA prevalence is huge. Research estimated that there are 15-30% of men and 10-15% of women in the world suffer from OSA.

In the 30-69 years old group, there are 936M people and 425M people having mild and moderate OSA, respectively. You don’t even need to look at the statistics to know that this condition is highly prevalent. After all, it is associated with obesity, and people in the developed world are becoming increasingly overweight as well as obese.

With the aforesaid acquisition, SK Biopharmaceuticals (the discoverer of the drug) still retains the rights to 12 Asian markets like Korea, China, and Japan. Interestingly, Sunosi earned the “orphan” drug designation in the U.S. which means that it can enjoy a premium reimbursement. On average, orphan drugs are reimbursed at $150K annually to foster innovation in this rare disease space.

For Fiscal 2021, Sunosi already generated $57.9M which represents a 104% year-over-year (YOY) growth. That is quite significant, as the upcoming commercialization would transition Axsome into a revenue-generating company. When you couple that with AXS05’s marketing for MDD, you can expect the company to generate substantial sales.

As Axsome can leverage on the existing physicians who are already used to prescribing Sunosi, the AXS05 launch process would be more successful than you anticipated. That is to say, the company doesn’t have to build all the sales/marketing efforts from scratch.

Figure 4: Sunosi therapeutic profile

Competitor Analysis

Regarding competition, Axsome competes against many established and emerging innovators. A notable competitor is Intra-Cellular Therapies (ITCI) with its stellar medicine, Caplyta, and others. There’s also Jazz Pharmaceuticals. Regardless of competitors, Axsome has differentiated medicines that confer a competitive edge. For instance, the company’s MoSEIC technology-based drugs give them an efficacy/safety advantage over other “me too” molecules. Asides from product differentiation, there is plenty of space for many players in the psychiatric medicine sector.

Financial Assessment

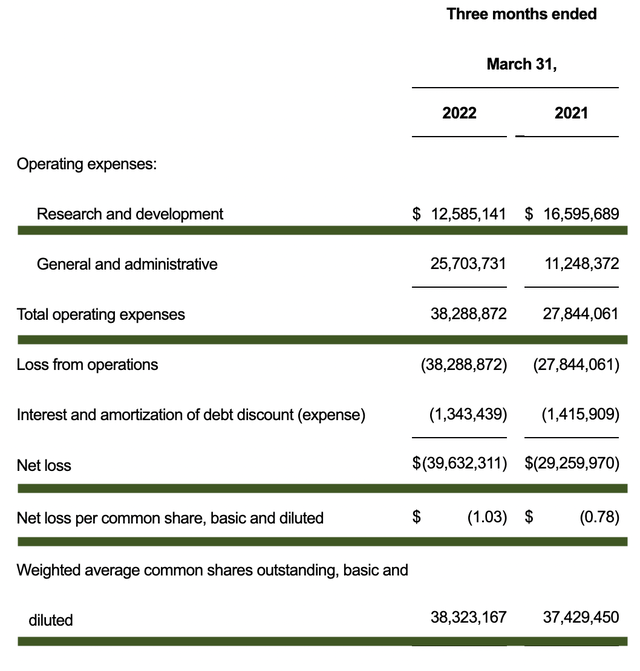

Just as you would get an annual physical for your well-being, it’s important to check the financial health of your stock. For instance, your health is affected by “blood flow” as your stock’s viability is dependent on the “cash flow.” With that in mind, I’ll analyze the 1Q 2022 earnings report for the period that ended on March 31.

Like other developmental-stage biotech companies, Axsome has yet to generate revenue. As such, you should look at other more meaningful metrics. That being said, the research and development (R&D) tallied at $12.5M compared to $16.5M for the same period a year prior. I generally like to see an increasing R&D trend. However, it’s understandable for Axsome’s R&D to trend down because the bulk R&D for AXS05 is already completed.

Additionally, there were $39.6M ($1.03 per share) net losses compared to $29.2M ($0.78 per share) decline for the same comparison. The wider bottom-line depreciation reflects the increased expenses for Axsome, as the company is transitioning from a developmental to commercial-stage operator.

Figure 5: Key financial metrics

About the balance sheet, there were $84.7M in cash, equivalents, and investments. On top of the $300M term loan facility, there should be adequate capital to fund operations into 2024. Notably, the OpEx would continue to increase because it takes significant capital to build an in-house sales/marketing team.

While on the balance sheet, you should assess if Axsome is a “serial diluter.” After all, a company that is serially diluted will render your investment essentially worthless. Given that the shares outstanding increased from 37.4M to 38.3M, my math reveals a 2.4% annual dilution. At this rate, Axsome easily cleared my 30% cut-off for a profitable investment.

Valuation Analysis

It’s important that you appraise Axsome to determine how much your shares are truly worth. Before running our figure, I liked to share with you the following:

Wall Street analysts typically employ a valuation method coined Discount Cash Flows (i.e., DCF). This valuation model follows a simple plug-and-chug approach. That aside, there are other valuation techniques such as price/sales and price/earnings. Now, there is no such thing as a right or wrong approach. The most important thing is to make sure you use the right technique for the appropriate type of stocks.

Given that developmental-stage biotech has yet to generate any revenues, I steer away from using DCF because it is most applicable for blue-chip equities. For developmental biotech, I leverage the combinations of both qualitative and quantitative variables. That is to say, I take into account the quality of the drug, comparative market analysis, chances of clinical trial success, and potential market penetration. Qualitatively, I rely heavily on my intuition and forecasting experience over the decades.

|

Molecules and franchises |

Market potential and penetration |

Net earnings based on a 25% margin |

PT based on 37.7M shares outstanding and 10 P/E |

“PT of the part” after appropriate discount |

|

AXS05 for MDD |

$1B (estimated based on the $16B global depression market and $7.9B MDD market) | $250M | $66.31 | $53.04 (20% discount because you’re waiting for approval soon) |

| AXS05 for Alzheimer’s agitation | $2B (estimated based on the $25B global Alzheimer’s market) | $500M | $132.62 | $66.31 (50% discount because the drug is still in Phase 3 trial) |

| AXS05 for smoking cessation | Waiting for it to advance before valuing | N/A | N/A | N/A |

| AXS07 for migraines | $1B (estimated based on the $78B US migraines market) | $250M | $66.31 | $53.04 (20% discount because you’re waiting for approval soon) |

| Sunosi for EDS | $250M (Estimated 25% actualization of the $1B peak sales) | $62.5M | $16.57 | $14.08 (15% discount) |

| AXS12, AXS14, etc | Will wait for more development | N/A | N/A | N/A |

|

The Sum of The Parts |

$186.47 |

Figure 6: Valuation analysis (Source: Dr. Tran BioSci)

Potential Risks

Since investment research is an imperfect science, there are always risks associated with your stock regardless of its fundamental strengths. More importantly, the risks are “growth-cycle dependent.” At this point in its life cycle, the main concern for Axsome is if the company can gain approval for AXS05 in MDD. Due to the recent regulatory update (i.e., the labeling discussion), I believe that the risks are substantially deleveraged.

The other concern is whether Axsome can successfully launch AXS05. It’s tough for a small company to “go at it alone” in commercialization due to the limited sales/marketing resources. It also takes significant time to build a relationship with physicians to foster more prescriptions. Nevertheless, the fact that Axsome can leverage Sunosi would enhance the success of AXS05. That aside, there is a risk that other supporting molecules won’t generate positive data and thereby fails to gain approval.

Concluding Remarks

In all, I maintain my buy recommendation on Axsome with a 4.8 out of five stars rating. Despite some setbacks, the investing thesis of Axsome Therapeutics is playing out prudently. With ongoing label discussions, the lead medicine (AXS05) is set to gain approval for MDD. At this point, you can expect approval to be forthcoming. Soon, Axsome would transition to become a commercialized stage operator. The Sunosi acquisition itself would then boost revenues in the coming quarters. In 1H2023, there would be more news relating to AXS05 label expansion for AD agitation. Precisely speaking, you are likely to hear something from the Phase 3 ACCORD trial that studies AXS05 for AD agitation. Around that time, other supportive molecules like AXS12 for narcolepsy would post results. Axsome is also projected to submit an NDA for AXS14 for fibromyalgia next year.

Be the first to comment