MicroStockHub/iStock via Getty Images

The last time we wrote on AXIS Capital Holdings Limited (NYSE:AXS), we were neutral on its common equity. Having picked it up at a discount to tangible book value in the past, we were reluctant to chase it at a premium and preferred to bid our time and pick up some of its brethren instead. We summarized our concerns on the common issue before moving on to the preferreds. We said:

One area of concern might be the strong inflationary trends we have seen. Some smaller players like Universal Insurance Holdings Inc. (UVE) have certainly taken a decent sized hit from this problem as replacement costs trend higher than expected (but within policy limits). Our take is that for the big players with such pricing trends, this is not an issue. Rising interest rates are also boosting non-operating income on the portfolio and this should act as an offset. We have generally only tried to pick up AXIS at a deep discount to book value. Last time we sold a cash secured put that would have got us the entry at 0.8X tangible book value. We remain on the lookout for opportunities on this and other insurance names.

Source: Preferred Shares Getting To The Right Spot

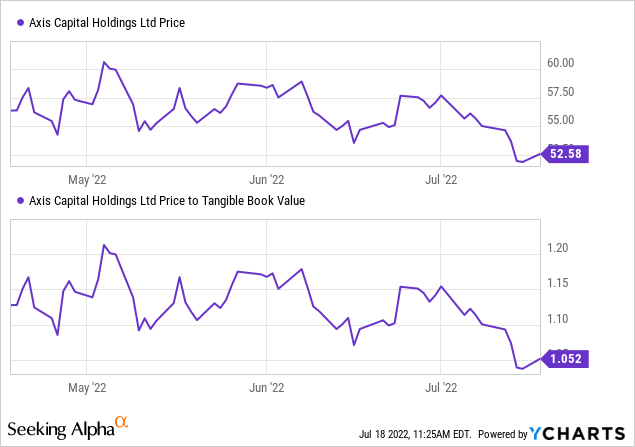

The stock has fallen since then, but it still trades at a premium to its book value.

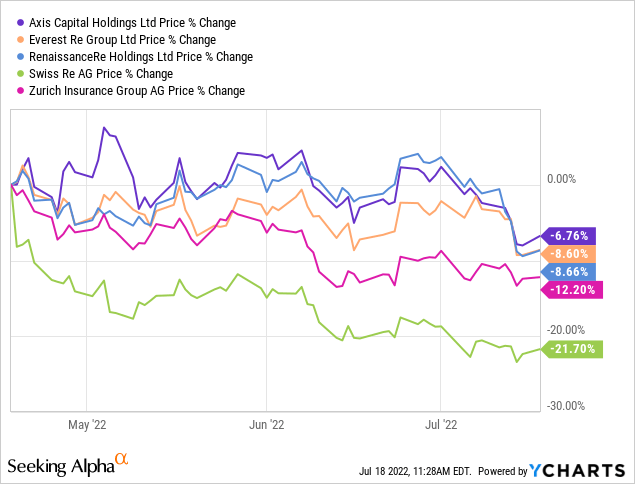

AXS has also shown its resilience amongst its competitors.

Are we bullish at this price despite the premium? Were we impressed with its performance against its Goliath competitors or do we think this one has room to fall more? What we discuss next, in a nutshell is, “Are we there yet?”

The Drop In Book Value

Curious investors must be wondering about the drop in book value. After all, we had a nice profitable quarter, why was the book value lower? AXS holds mainly high quality bonds on its balance sheet and those took a hit from higher rates as well as widening credit spreads.

Diluted book value per share decreased by $3.81 in the quarter to $51.97. This was principally driven by net unrealized losses related to increased treasury rates and the widening of credit spreads. While the increase in rates has impacted our book value per share, it’s encouraging that new money yields are now higher than our portfolio yield and bodes well for future investment income growth.

Source: AXS Q1-2022 Press Release

Higher rates are generally good for the company and we agree with their assessment here. They hold bonds till maturity and these higher rates will help future returns. Hence the drop in book value can be seen as temporary.

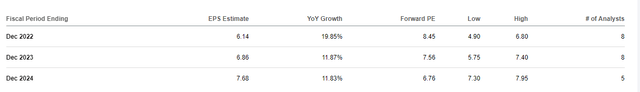

Earnings Estimates

Insurance and reinsurance rates are exceptionally strong right now. AXS had previously reported double-digit increases across all lines. The earnings estimates below might prove conservative all things considered.

Seeking Alpha

The stock appears very cheap even based on those but we have to remember one thing. Those estimates are for a “normal” year. As anyone who is not living on Mars knows, we have not had anything close to “normal” for some time. From hurricanes to winter freezes to COVID-19 work disruption claims, insurers have had their hands full. Odds are high that AXS does average at least $5.50 a year in earnings over the next several years, but it can be lumpy. We overall like the valuation here, especially with the drop in book value being temporary.

A Sale?

We love the insurance and reinsurance companies as they are very attractively priced right now. That said, if AXS is planning a sale of its reinsurance segment, we are not sure whether we would like the new company.

Axis Capital is preparing to sell its ~$3bn GWP reinsurance segment, as CEO Albert Benchimol prepares a major strategic repositioning of the Bermudian as a specialty insurer, this publication can reveal.

Source: Insurance Insider

That headline was 3 months back and right before the Q1-2022 conference call. Obviously the analysts jumped in to ask what was on everyone’s minds.

Meyer Shields

Albert, I hope you’ll indulge me in this. I’m sure you saw yesterday that there was a news article talking about AXIS considering a sale of AXIS Re. And I was wondering, first of all, whether you can comment on how you’re thinking about that broadly. And secondly, when there are articles like this out there, whether they’re realistic or not, do they have any impact on day-to-day operations at the reinsurance unit?

Albert Benchimol

Yes. Look, Meyer, as you know, I can’t comment on market rumors and speculation. It should go without saying that we’re always focused on value and positioning the company for success and we have and will continue to act with those objectives in mind.

But as you can see from the performance that we delivered, we’ve demonstrated that we’re committed to driving top-tier return on capital. I think the performance that we’ve been showing in terms of our improvements over the last few quarters and this quarter provides real evidence that we’re delivering on our promise.

I want to say I’m incredibly proud of the work that our team has done to strengthen our reinsurance business. They’ve delivered on the ambitious task of improving the quality and reducing the volatility of our reinsurance business. And now AXIS Re is well positioned to deliver very attractive returns.

As to the second part of your question, look, this is a business where occasionally, we get crazy rumors out there, and one of the things that we found is that the best response is to keep your head down, focus on providing value to your customers and your partners and distribution, and that works.

Source: Q1-2022 Conference Call Transcript

We read that as a “soft no”, but we cannot rule things out just based on that. One possibility here is that AXS did go shopping but current market conditions created a lot of lowball bids, forcing the company to pull back.

Verdict

AXS continues to execute well and operating income was $180 million in Q1-2022. Operating return on equity was over 15% and that was generally a fantastic quarter. We like the stock here as we think this could be acquired completely by Warren Buffett. This would be replica of what happened when Berkshire Hathaway (BRK.A) (BRK.B) went shopping the last time.

We are stamping a buy here with the caveat here that we don’t think the reinsurance segment will be sold on a stand-alone basis. If it is, we will reassess what is left after that deal.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment