kentoh/iStock via Getty Images

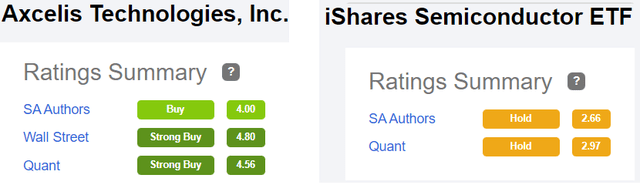

Unlike peers like Intel (INTC), which manufactures processors or memory chips, Axcelis Technologies, Inc. (NASDAQ:ACLS) is a semiconductor equipment play specializing in ion implant systems. This may seem a bit complicated, and I will provide more details later on, but, this does not prevent it from being much more favorably rated than the iShares Semiconductor ETF (SOXX), as pictured below.

Thus, this thesis will explore the reasons for these bullish positions, by going through financial results, valuations, and in light of the CHIPS Act, which includes $52 billion of incentives for onshoring semiconductor supply chains back onto American soil.

At the same time, I make sure to check supply chain challenges and currency headwinds due to the fact that in the second quarter of 2022(Q2), 55% of the company’s system (equipment) shipments were to China, and 84% to the rest of the world.

I start by providing insights into the business.

A Semiconductor Equipment Play

First, ion implant originates from the field of materials engineering processes and involves implanting ions from one material into another one thereby changing its physical, chemical, and structural properties. Without going into too many details, this makes possible implantation of transistors on top of the silicon wafers, for example by using Axcelis’ Purion implanters. Thus, with its equipment used for producing chips, the company is classified as forming part of the semiconductor equipment industry.

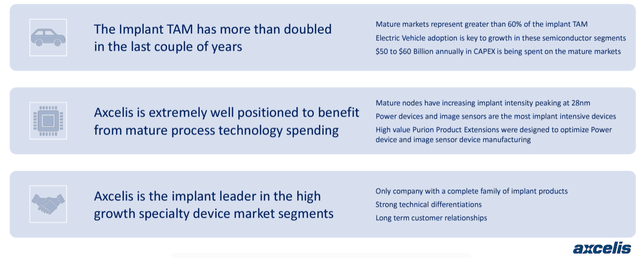

Second, looking at TAM or total addressable market, Axcelis has more than doubled during the last two years, as pictured below. It includes mature process nodes for EVs (electric vehicles), helped by the higher Capex spent by car manufacturers for their semiconductor divisions expected to grow by $50 to $60 Billion annually.

For investors, the mature process nodes are sized at 40 nanometers and above and do not necessarily require the most sophisticated manufacturing processes like leading-edge nodes (like 7nm) used for smartphones. Mature nodes also called lagging nodes are mostly (at 90%) used in the automotive industry for power management controllers, image sensors, and components such as LCD drivers. In this respect, Axcelis is profiting from higher automotive demand due to EV cars boasting much higher chip density than their older-generation ICE (internal combustion engine) counterparts.

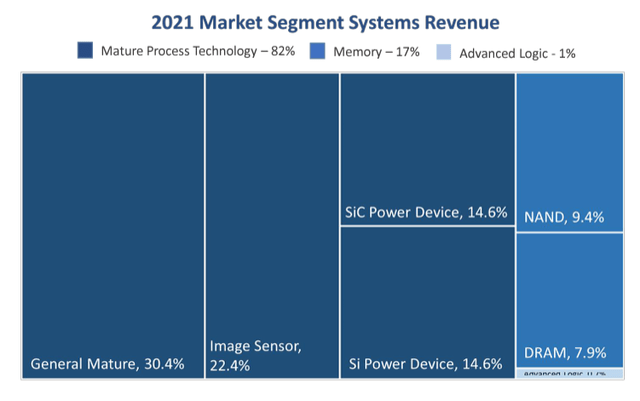

Furthermore, Axcelis’ mature process technology segment is made up of 84% system shipments, with the remaining consisting of devices to produce memory chips such as NAND (14%) and DRAM (2%). In addition to selling devices, the company has diversified into customer support including upgrading services, all grouped under its CS&I business which brought $55.8 million in Q2, or 25% of total sales in a supply-constrained environment as further detailed below.

Supply Chain and Currency Headwinds

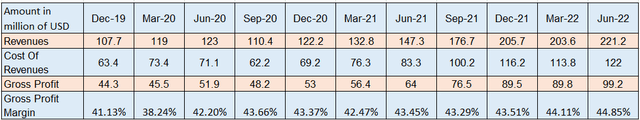

Despite facing a challenging supply chain and logistics environment, the fact that revenues of $221.18 million (table below) beat guidance by $6.82 million shows the ability to meet shipment dates. Additionally, the fact that the gross margin was 44.8%, or “well above the company’s guidance,” also indicates that the company did not incur exceptionally high freight costs. In fact, profitability was also higher due to a more favorable product mix and better CS&I margins.

Quarterly Income (Seeking Alpha)

However, looking into Q3, whose financial results will be reported on November 2, a gross margin of approximately 42% is expected, due to a less favorable product mix compared to Q2 and the impact of supply chain-related costs.

Now, with China having extended lockdowns to some of its major cities as part of the authorities’ strict zero Covid policy, the management expects a recovery only in 2023 with a gross margin of approximately 42.5% for fiscal 2022. This figure which accounts for the impact of supply chain and logistics headwinds is below 2021’s 43.24%, but, we must forget that last year’s comparison was made with 2020, which was a low year.

Pursuing further, currency headwinds for the first half of the year were $9.0 million compared with $3.4 million for H1-2021. That translates into nearly a 200% increase in foreign currency exchange losses, and since the dollar pursues its unrelentless upside driven by a hawkish Fed, do expect further pains for the whole of 2022.

As mitigatory actions, the management is continuously looking at ways to help offset logistics costs, but, this may prove difficult as customer satisfaction, or sending shipments to Far East destinations in time, remains the top priority. Outside of the cost reduction measures, the aim is also to derive higher revenue from CS&I, which comes with higher margins compared to selling implant systems. Also, continuously upgrading the Purion ion implanter range of products with higher efficiency extensions can also help.

However, investors may have to factor in higher overhead costs as the new constant for U.S. companies exporting to the rest of the world, in addition to the cyclical nature of the semiconductor industry.

Navigating Downturn Risks

There have been some reports of a downturn in the industry due to factors like higher inflation, economic slowdowns globally, as well as China’s aggressive Covid strategy disrupting the supply chain. However, this demand problem has mostly impacted the advanced logic market (leading edge), to which Axcelis has minimal exposure, with its memory segment only representing 16% of sales in Q2, as I mentioned earlier. This is down from 17.3% for the whole of 2021 as shown in the diagram below, and looking forward to Q3, this should decrease further, to 5%, as bookings were predominantly (95%) for mature process technology.

Also, at the time of Q2’s earnings call on August 4, the company had a strong 12-month backlog of above $850 million, the majority of which was for 2023, with some extending to 2024 as well. To put things into perspective, this is well above 2021’s revenues of $662.4 million.

Market Segment Systems (Seeking Alpha)

Furthermore, as seen above, the company derived 14.6% of revenues from selling ion implant devices to Silicon Carbide (“SiC”) manufacturers in 2021.

For investors, SiC is replacing traditional silicon low power electronics, especially in EVs as it can extend the range (distance covered) of a vehicle by 10% as I had explained in my thesis on Wolfspeed (WOLF). It can also be used for industrial applications with billions of dollars of market opportunities, but, there is also the competition Axcelis faces from Wolfspeed and even Qorvo (QRVO) after the latter’s acquisition of United SiC.

Valuations and Key Takeaways

Therefore, the company faces supply chain risks and currency headwinds, but given that it prioritizes customer satisfaction, it could beat revenue estimates of $224.38 million, possibly by absorbing some of the additional charges incurred instead of passing it on to the customer. Conversely, this could impact profitability, resulting in a miss of the higher end of the EPS target of $1.10-$1.15, unless it is able to profit from a fall in shipping rates.

Furthermore, its earnings date of November 2 coinciding with the FOMC (Federal Open Market Committee) meeting for interest rates may not augur well in terms of volatility, especially if the Federal Reserve maintains its hawkish tone. Therefore, there are downside risks.

Shifting to a positive tone, as a chip equipment manufacturer, Axcelis should benefit significantly from the $52 billion Chips and Science Act along with companies like Lam Research (LRCX). This is already translating into additional bookings for the 2023/2024 period, as several customers (chip producers) plan new fabs and or expansions for existing ones.

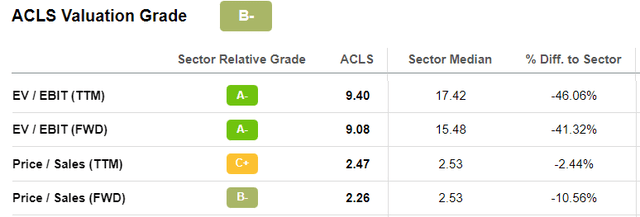

In the meantime, the company has to exercise cost control and financial discipline, and for this purpose, it has been able to reduce its operating expenses as a percentage of revenue by more than 10% in the last eight quarters. This improvement has resulted in a trailing EBIT margin that is three times the median for the IT sector, which, by the way also includes Intel. The latter’s stock surged last week after it announced a cost-cutting plan.

Therefore, in a period where the Fed is aggressively tightening monetary, investors will probably favor companies that are more likely to improve profitability. For this purpose, Axcelis’ EV/EBIT is more than 45% undervalued with respect to peers, as shown below. Making a 20% adjustment, I obtain a target of around $72 (59.87 x 1.2) based on the current share price of $59.87.

Valuation grades (Seeking Alpha)

However, this remains a high price target in view of the volatility which has been gripping semiconductor stocks since the beginning of 2022, even those that fit into the value strategy.

For this matter, with around 76% of sales derived from the Asia Pacific region, Axcelis is not immune to geopolitical risks in case tensions with China escalate further. Up to now, the U.S. has only restricted the export of leading-edge technology like AI GPUs or the equipment needed to produce them, but, in case a Chinese competitor emerges, the company is likely to suffer from a loss of market share. In the meantime, its Purion devices are essential to China for sustaining the growth of its automobile industry. Here, one of the company’s advantages is that it proposes the full range of products and support services for ion implants alongside giant Applied Materials (AMAT), Japan’s Nissin Ion Implantation, Taiwan’s Advanced Ion Beam Technology, and a few others.

Finally, with government spending programs incentivizing semiconductor companies to build foundries on both sides of the Atlantic Ocean, and the electrification of the automotive industry progressing at cruising speed, the semiconductor equipment play has two solid ingredients to mitigate possible cyclicality risks over the longer term. For this purpose, Axcelis Technologies has a strong backlog, too.

Be the first to comment