steverts

Avista Corporation (NYSE:AVA) is a regulated electric and natural gas utility that provides services to customers in the Pacific Northwest and Alaska. The utility sector has long been considered a safe haven for investors due to its incredibly stable cash flows, which is something that could be increasingly appealing as the United States appears to be heading into a recession. Avista Corporation also boasts a very attractive 4.23% dividend yield that could add to the company’s appeal given the current conditions. When we couple this with a reasonable valuation, there may be some reasons to acquire a position in the company today. This thesis is reinforced when we take a look at the company’s balance sheet, which is remarkably strong, and the company’s focus on renewables, which has proven to be a fairly popular investment thesis over the past few years. Admittedly, there has not been a significant change to my thesis as I presented in my last article on the company. However, Avista has since released its first-quarter results and an updated investment plan so this article will provide updates to the analysis based on this new information.

About Avista Corporation

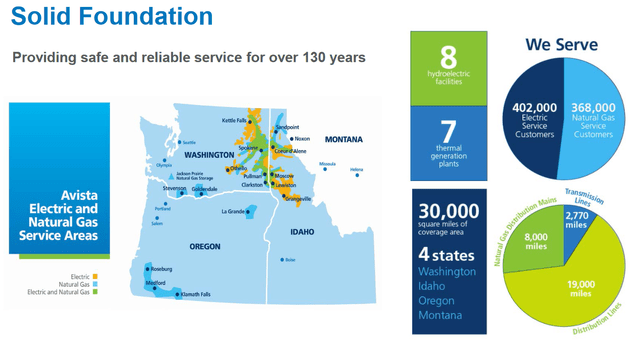

As stated in the introduction, Avista Corporation is a regulated electric and natural gas utility that operates in the Pacific Northwest and Alaska. This includes the states of Oregon, Washington, Idaho, and of course Alaska:

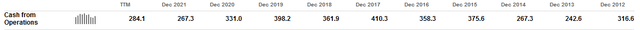

Admittedly, much of the company’s coverage area is fairly rural as the company does not actually serve any of the major cities in any of the three Pacific Northwest states. This is evident in the fact that the company only has 402,000 electric and 368,000 natural gas customers across the region. This small size does not prevent the company from enjoying the characteristics that we tend to appreciate with companies like this, such as generally stable cash flows. We can see this by looking at the company’s operating cash flows over the past years:

The reason for this should be obvious. After all, electric and natural gas service is something that is generally considered to be a necessity for our modern way of life. As such, most people will prioritize paying their utility bills ahead of purchasing discretionary products during times when money gets tight. When we consider that there are a growing number of signs that the American economy is entering into a recession, this is something that could make Avista a far more attractive investment than something that is exposed to discretionary spending levels.

We can see from the numbers above that Avista is almost evenly split between electric and natural gas customers. This is something that is quite nice to see because both of these products are to a certain degree seasonal. This is most evident with natural gas as it sees much higher consumption during the winter than during the summer. This is because the primary use of natural gas is space heating, which is only really needed during the winter. Although electricity is consumed year-round, it sees its highest consumption during the summer months due to people wanting to run air conditioners. The fact that Avista is almost evenly split between these two products should help to balance out these seasonal fluctuations and allow the company to enjoy reasonably stable revenue and cash flow during every quarter of the year. With that said though, there may be some market participants that would prefer the company to focus much more heavily on electricity than on natural gas. This is because of the common view that electrification will soon render fossil fuels such as natural gas obsolete. While this idea is being heavily promoted by politicians, futurists, and activists, it has little basis in fact as we will see later in this article. Overall, the company’s relatively balanced split between electricity and natural gas is very nice to see.

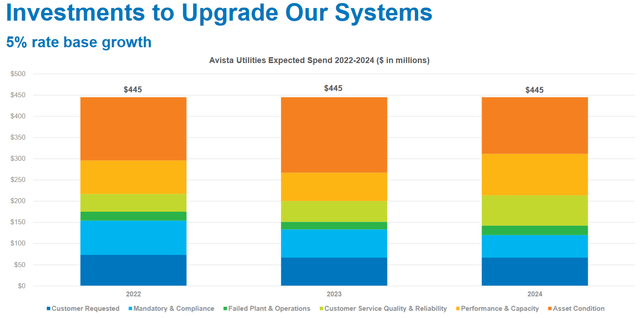

Avista Corporation is well-positioned to deliver growth going forward, which is quite nice because stability alone is not good enough for most of us. The company will be accomplishing this by growing its rate base, which is the value of the company’s asset upon which regulators allow it to generate a specified rate of return (usually around 10%). As this rate of return is a percentage, any increase in the size of the rate base allows Avista to increase the prices that it charges its customers in order to earn that rate of return. Avista Corporation is planning to grow its rate base by spending money on upgrading and modernizing its infrastructure. In fact, the company is planning to spend $445 million in each of the next three years on this task:

This is a very curious timeframe for the company to present as most of its peers provide their investors with five-year capital spending programs as opposed to merely three years. However, the firm has stated that it intends to grow its earnings per share at a 4% to 6% compound annual growth rate over the long term. As such, it seems likely that the company’s capital spending will be somewhat more than the amount needed to grow its rate base at that rate in order to overcome the effects of depreciation and asset retirements. Assuming that the company manages to achieve this growth rate, investors should expect to receive a 9% to 11% total annual return over the long term when we consider both the earnings per share growth and the dividend, which is very attractive for a utility.

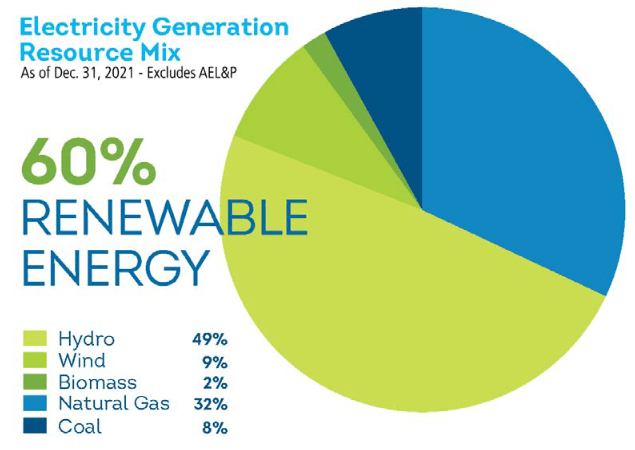

One area in which Avista Corporation is focusing a great deal of effort is on the development and deployment of renewable sources of energy. Although this is certainly not unusual for a utility, Avista is being much more aggressive than most as the company aims to achieve fully carbon-neutral electricity generation by 2027, which is somewhat more aggressive than the 2030 plan that we discussed in the last article. The majority of the company’s peers are not planning to achieve this until at least 2040. Avista Corporation is largely on track to achieve this as the company currently obtains 60% of its electricity from renewable sources:

Avista Corporation

One of the major reasons that Avista Corporation already generates a substantial amount of “green energy” has to do with the geography of the Pacific Northwest. The region has a substantial number of rivers that are sufficiently powerful to be dammed and generate electricity through the use of hydropower. Unfortunately, the use of hydropower is quite limited despite it being the most reliable source of “green power” that we have. This is because all of the rivers that actually can be dammed for this purpose have been, so it is quite difficult for the company to increase its generation in any significant way using this technology. This has forced Avista Corporation to use other sources in order to increase its “clean energy” generation capacity. The methods that it has chosen are, unsurprisingly, wind and solar. Since 2012, Avista Corporation has put two wind projects capable of producing 249 megawatts of electricity into service. The company has also put two solar plants with a total generation capacity of 28 megawatts into service. The company has stated that it intends to put more of these projects into service over the next few years in order to achieve its already-mentioned carbon-reduction goals, although it has provided any specifics at this time.

Avista Corporation is one of the few utilities that is committed enough to increase the dominance of renewables to invest in things outside of the renewable space. Admittedly though, these investments are substantially less than the amount that the company is investing into its infrastructure. In 2021, the company invested $17 million and plans to invest $15 million in 2022, followed by another $14 million in 2023. One of the most significant of these ancillary projects is the South University District Development Project, which is being constructed in Spokane, Washington. This is a fairly large real estate project that is being developed by Avista and others to promote a sustainable lifestyle among some of the college students in the area. The hallmark of the project consists of a zero-energy and zero-carbon cross-laminated timber building along with an energy innovation center coordinating utility grid operations with tenants and building operators. The company provides no other information than this and neither does the website created by the city planning commission to discuss the project. Overall, it sounds as though the goal here is to develop a self-contained “sustainable living” community, which has long been a goal of many environmental activists.

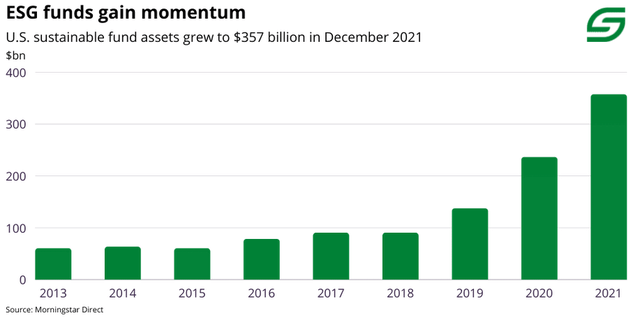

Over the past several years, an enormous amount of money has been poured into environmental, social, and governance funds that ostensibly invest in companies with goals focused on “sustainable” operations. As of December 31, 2021, these funds had $357 billion under management, which represents a steep increase over the $236 billion that they had at the end of 2020:

Sustainfi/Data from Morningstar

The amount that these funds have globally is much more impressive, with Morningstar reporting that environmental, social, and governance funds had a whopping $2.74 trillion under management globally at the end of 2021. When we consider the buying power that this money provides, it is little wonder that so many companies have been emphasizing their sustainability and diversity credentials over the past two or three years. In the case of Avista Corporation, the enormous amount of money that these funds possess could work to the advantage of its shareholders. This is because Avista is one of the most “green-focused” utilities in the United States, which may attract the attention of the management of these funds. If they start buying, this could very easily drive up the company’s share price. This same attention could also put a floor on the stock price since they might buy on any dips since it could make the stock begin to look cheap. It should be easy to see why anyone that owns the stock would like this.

Fundamentals Of Electricity And Natural Gas Utilities

As we have already seen, Avista Corporation’s utility business is largely split between electric and natural gas. As such, it may be a good idea to take a look at the fundamentals of these companies. This may be especially important today because there is a misperception that electrification will soon render fossil fuels such as natural gas obsolete. At its core, electrification refers to the conversion of things that are traditionally powered by fossil fuels to the consumption of electricity instead. The most commonly targeted sectors for conversion are transportation (electric vehicles) and space heating. The latter of these is the primary use of utility-supplied natural gas so we can see why the belief exists that natural gas utilities will soon be rendered obsolete.

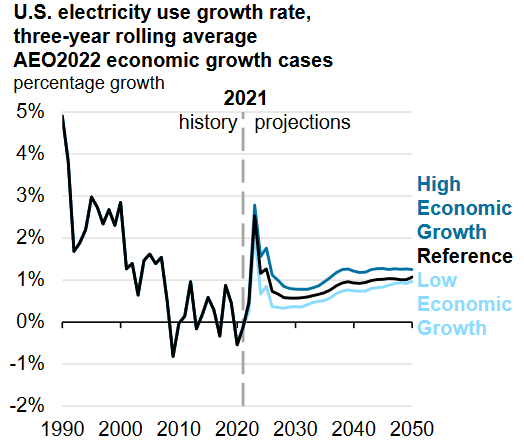

Unfortunately for the proponents of electrification, the United States Energy Information Administration does not believe that this trend will play out anywhere near as quickly as has been promoted. According to the agency, the national demand for electricity will only grow at a 1% to 2% rate over the next thirty years:

U.S. Energy Information Administration

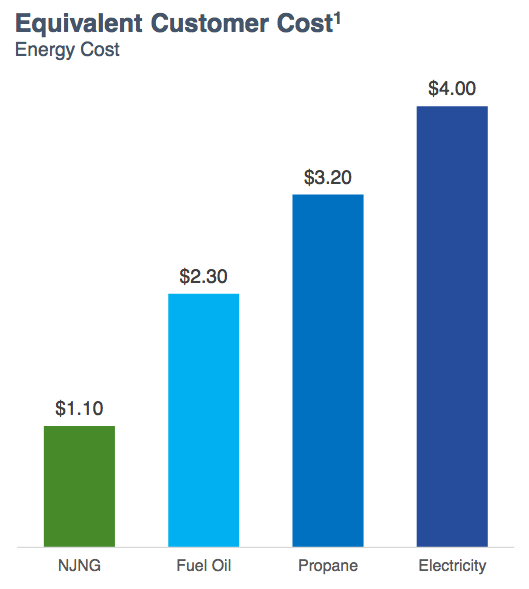

This is nowhere close to the growth rate that would be seen if wide swathes of the economy were to convert from fossil fuels to electricity. I showed in a previous article the increase in consumption that electric cars alone would cause as proof of this. Thus, the agency does not appear to believe that electricity will replace fossil fuels anytime soon. The agency is likely correct about this, which may mean that Avista’s natural gas business will not be obsolete in the near future. One simple reason for this is that natural gas is far more efficient at producing heat than electricity. This is why it can be almost four times as expensive to heat a building with electricity compared to natural gas:

New Jersey Resources/Data from EIA

It seems highly unlikely that anyone will be willing to see their heating bills go up to this degree simply to reduce their natural gas consumption, which is certainly true for people of limited means. In areas such as the one that Avista serves, winters can get especially cold so heating with electricity would be extremely expensive. Thus, it seems likely that investors do not have to worry about Avista’s natural gas infrastructure becoming worthless for many years.

Financial Considerations

It is always important to look at the way that a company finances itself before making an investment in it. This is because debt is a riskier way to finance a company than equity because debt must be repaid at maturity. Since this is usually accomplished by issuing new debt to get the money to repay the old debt, the company’s interest costs could increase after the rollover depending on market conditions. In addition, a company must make regular payments on its debt if it is to remain solvent. Thus, a decrease in the company’s cash flows could push it into financial distress if it has too much debt. Although utilities like Avista Corporation tend to have remarkably stable cash flows, this is still a risk that we should not ignore.

One method that we can use to analyze a company’s financial structure is the net debt-to-equity ratio. This ratio tells us the degree to which the company is financing its operations with debt as opposed to wholly-owned funds. It also tells us how well the company’s equity can cover its debt obligations in a bankruptcy or liquidation situation, which is arguably more important.

As of March 31, 2022, Avista Corporation had a net debt of $2.521 billion compared to $2.2333 billion of shareholders’ equity. This gives the company a net debt-to-equity ratio of 1.13. This is a marked improvement over the 1.22 ratio that the company had the last time we looked at it, which is quite nice to see. Here is how that compares to some of the company’s peers:

| Company | Net Debt-to-Equity Ratio |

| Avista Corporation | 1.13 |

| DTE Energy (DTE) | 2.08 |

| Eversource Energy (ES) | 1.39 |

| Exelon Corporation (EXC) | 1.57 |

| Entergy Corporation (ETR) | 1.37 |

As we can see, Avista Corporation is much less dependent on leverage than many of its peers. This is nice to see, particularly from a risk-aversion perspective because it positions the company to better weather any potential recession or another event that causes a cash flow decline. Overall, investors likely have nothing to worry about with respect to the company’s debt.

Dividend Analysis

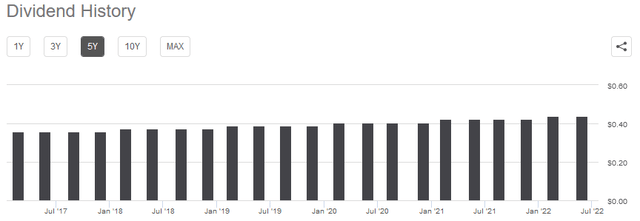

One of the biggest reasons that investors purchase shares of utility companies is because of the relatively high dividend yields that they tend to possess. This is certainly the case with Avista Corporation as the stock’s current 4.23% yield is substantially higher than the 1.52% yield of the S&P 500 index (SPY). In addition to this, Avista has a long history of steadily increasing its dividend:

The fact that the company consistently increases its dividend is very appealing in inflationary times, like what we are currently seeing in the United States. This is because inflation is constantly reducing the number of goods and services that we can buy with the dividend that we receive. Thus, over time it may feel like we are getting poorer and poorer. The fact that the company increases the amount of money that it sends to its investors helps to offset this effect and keeps the purchasing power of the dividend that we receive relatively steady. As is always the case though, it is critical to ensure that the company can actually afford the dividend that it pays out. After all, we do not want it to be forced to reverse course and cut the dividend since that would reduce our incomes and most likely cause the stock price to decline.

The usual way that we judge a company’s ability to pay its dividend is by looking at its free cash flow. A company’s free cash flow is the amount of money generated by its ordinary operations that is left over after it pays all its bills and makes all necessary capital expenditures. This is the money that it can use for things such as reducing debt, buying back stock, or paying a dividend. In the first quarter of 2022, Avista Corporation reported a levered free cash flow of $68.0 million, which was more than enough to cover the $32.0 million that it paid out in dividends. It was also a substantial improvement over the negative $83.1 million that the company had back in the fourth quarter. However, Avista’s first quarter of any year usually has a much higher free cash flow than any other quarter. This is because that quarter contains the coldest months of the year when natural gas is seeing its heaviest use, resulting in that business getting much more cash coming in than at any other time of the year. Thus, it may make sense to look at the company’s trailing twelve-month free cash flow to get more accurate information about what Avista Corporation can actually afford. In the trailing twelve-month period ended March 31, 2022, Avista Corporation had a negative levered free cash flow of $88.7 million. This is obviously not enough to pay any dividend but the company still paid out $120.8 million in the period.

However, it is not unusual for a utility to finance its capital expenditures through the issuance of debt and equity while covering its dividend using operating cash flow. This is due to the incredibly high costs of constructing and maintaining utility-grade infrastructure over a wide geographic area. In the trailing twelve-month period, Avista Corporation reported an operating cash flow of $284.1 million, which was easily enough to cover the $120.8 million that it paid out in dividends and leave the company with a large amount of money left over for other purposes. Overall then, the dividend is likely to be reasonably safe. Investors should not have to worry about a cut in the near future.

Valuation

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to earn a suboptimal return on that asset. In the case of a utility like Avista Corporation, one metric that we can use to value it is the price-to-earnings growth ratio. This is a modified version of the familiar price-to-earnings ratio that takes a company’s forward earnings per share growth into account. A price-to-earnings growth ratio of less than 1.0 is a sign that the stock is undervalued relative to its forward earnings per share growth and vice versa. However, there are very few companies that have a ratio that is that low in today’s overheated market. This is especially true in the slow-growing utility sector. Thus, it makes the most sense to compare Avista’s ratio to that of its peers in order to see which company offers the most attractive relative valuation.

According to Zacks Investment Research, Avista Corporation will grow its earnings per share at a 5.89% rate over the next three to five years. This gives the stock a price-to-earnings growth ratio of 3.58 at the current price. Here is how that compares to its peer group:

| Company | PEG Ratio |

| Avista Corporation | 3.58 |

| DTE Energy | 3.43 |

| Eversource Energy | 3.29 |

| Exelon Corporation | 2.72 |

| Entergy Corporation | 2.56 |

As we can see, Avista Corporation is the most expensive company out of this group but admittedly it is not completely out of line with DTE Energy or even Eversource Energy. It has a much higher yield than either of those two though, which could make the stock more attractive in the eyes of some investors since it positions the company to boast a higher total return. Avista is also the only company on this list that has gotten notably more expensive than the last time we looked at it. This could be evidence that the environmental, social, and governance funds have begun to look at it more fondly in relation to the rest of the sector and thus act as confirmation of the thesis that was presented earlier in the article.

While I can certainly see an argument for waiting to see if the stock dips a bit before buying in, it does not appear to be ridiculously overvalued at the current price. If we compare it to a much more expensive company, such as Hawaiian Electric Industries (HE), then Avista’s valuation looks even more reasonable. Overall, I am comfortable with it at the current price.

Conclusion

In conclusion, Avista Corporation has a lot to like. It is one of the most heavily renewable-focused utilities in the sector, which gives it the potential for investment from the environmental, social, and governance crowd. That could prove to be a positive for the stock price considering the amount of money possessed by this group. Avista offers much more than simply renewable opportunities, however, as it also boasts a remarkably strong balance sheet, high dividend yield, and a reasonable valuation. Overall, this utility appears like a very attractive investment as the nation heads into a recession.

Be the first to comment