breakermaximus/iStock via Getty Images

One reason I cover Avient (NYSE:AVNT) nearly every quarter is because I feel it doesn’t get the attention it deserves with only a few other writers that have shown interest initiating coverage of the stock over the years. For a company in transition to be a big player in the field of sustainability, I am a little surprised at the lack of interest given that it is very profitable even as it pursues noble causes.

In this article I wanted to discuss some of the reasons why I am bullish on Avient so that my readers can understand the underlying factors that make it a compelling addition to nearly any investment portfolio.

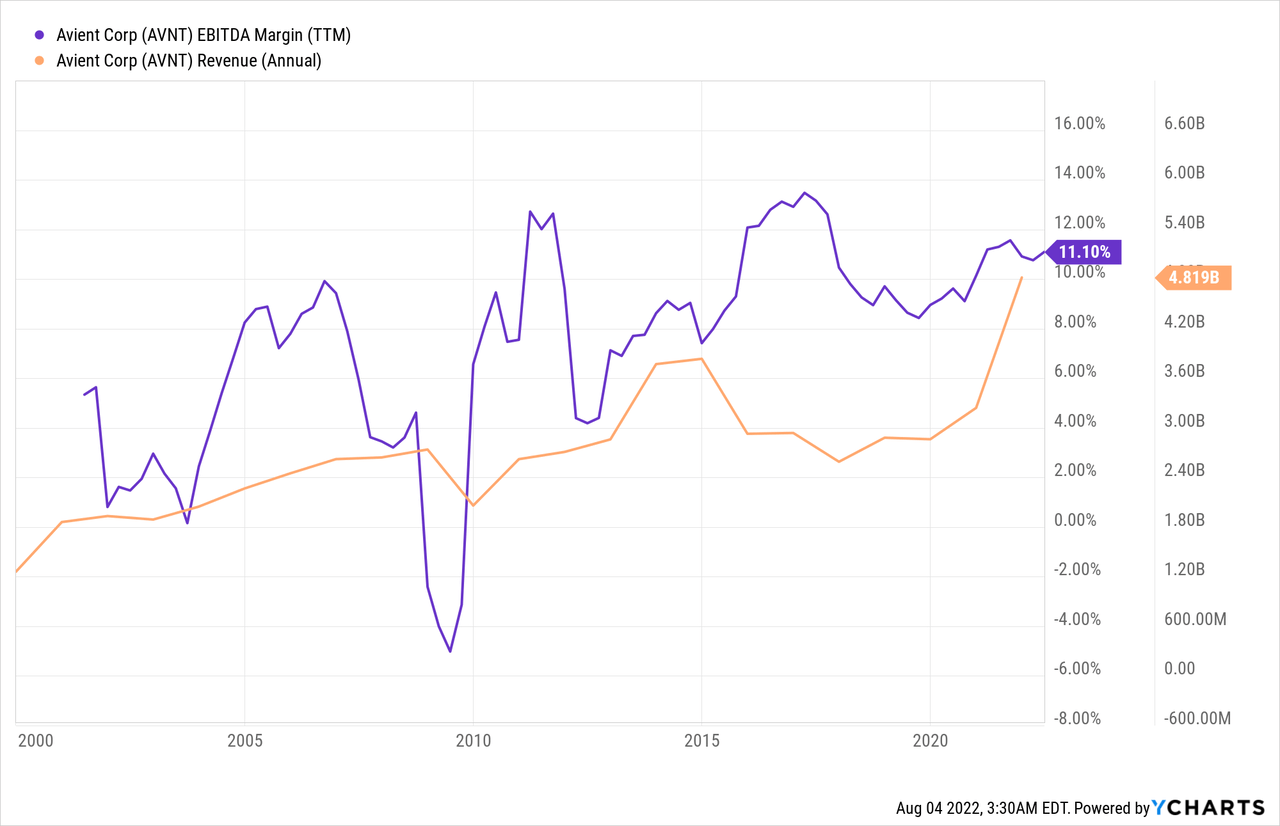

Revenue Growth and Improving EBITDA Margins

Revenue growth has been steadily trending in a positive direction with an absolute explosion/increase that came with the Clariant Masterbatch acquisition. I also look to the EBITDA Margin which essentially shows us how well the company converts its revenue into profit. EBITDA Margin should also see a major improvement after Dyneema closes and the distribution segment is sold.

Revenue growth will take a major step backwards with the purchase of Dyneema and the sale of the Distribution segment. I will explain why this makes sense in the section covering operating margins.

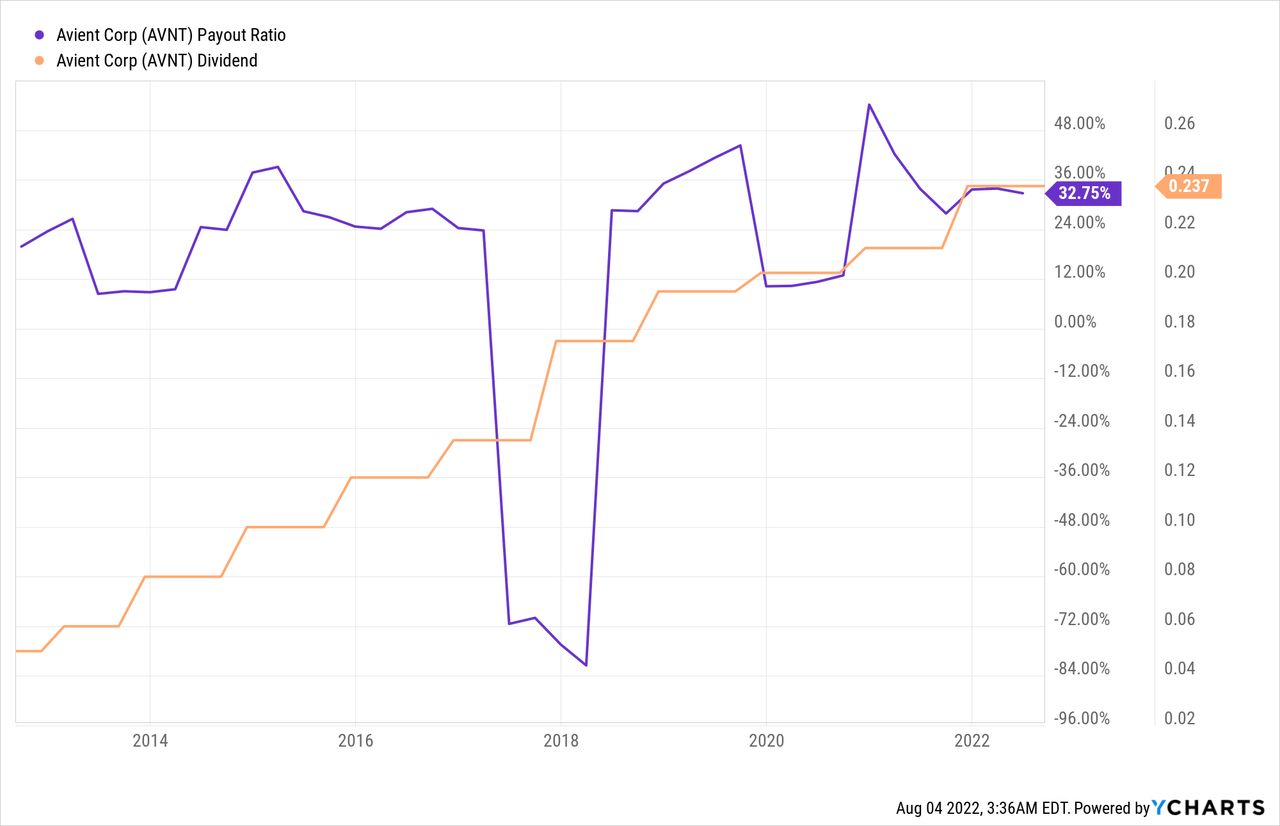

Safe Payout Ratio and Growing Dividend

Secondly, Avient consistently maintains a safe payout ratio while also growing its dividend at a modest clip. This is a characteristic held by my favorite companies because it is possible to compromise by offering a safe payout ratio and grow the dividend at a reasonable pace. Avient’s payout ratio has traditionally targeted 30% and has been able to increase the quarterly dividend to more than 4X the original payment over the course of a decade.

With EPS of $3.50/share for FY-2022, this would result in a payout ratio of 27.1%. Should the company want to maintain a payout ratio near 30% we would be looking at a 2022 dividend increase of 10.5%.

Compelling Acquisition Track Record

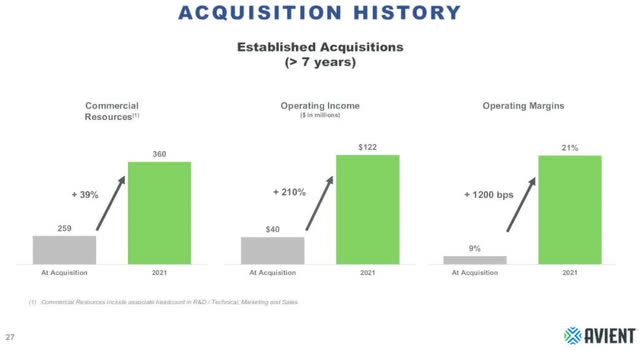

Some companies aren’t great at making acquisitions (the company that always comes to mind for me is AT&T (T)) but Avient has a track record of being able to make strategic acquisitions and convert them into wildly profitable operations. Management has demonstrated the desire to grow the company without sacrificing quality of their operations by making large-scale acquisitions that don’t live up to the hype.

In my previous article Avient: Major Upside From Improved Margins And Generous Dividend Growth I noted that management provides investors with an interesting look at how the company has benefited from acquisitions that are more than seven years old. The item that stands out the most to me is the major improvement in operating margin at the time of acquisition compared to where it is now.

AVNT – Acquisition Operating Margins (AVNT May 2022 Investor Presentation)

At the time of acquisition, these purchases were offering operating margins of 9%. This means that for every $100 of sales the company was generating nine dollars of operating income. The same acquisitions after at least seven years now offer operating margins of 21% or $21 of operating income for every $100 of sales.

Avient’s most recent acquisition of Clariant Masterbatch has seen EBTIDA margins at the time of acquisition improve rapidly from 11.9% to 16.2% and resulted in $54 million of synergies in 2021 alone.

Improved Operating Margins

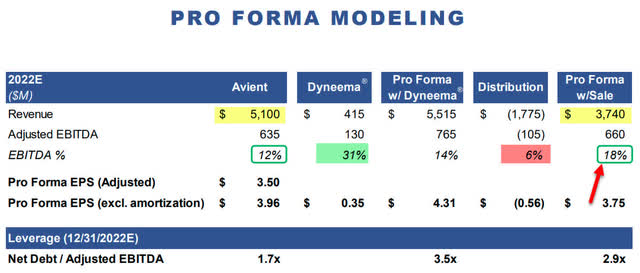

As I mentioned previously, I like to see strong revenue growth but revenue growth for the sake of revenue growth means absolutely nothing to me. In fact, I would much rather see revenue growth drop if EBITDA margins are going to increase since this ultimately means that the company is likely moving away from easily replicated and low-margin products/services into specialized products/services that are patent protected (the Dyneema acquisition will more than double the number of patents held by Avient from 1200 to 2500) and therefore much more difficult to replicate by competitors (let’s call this expanding the moat).

It is expected that the Dyneema acquisition will result in the exact scenario mentioned in the previous paragraph. Below is an image of the pro forma modeling of Avient as it currently stands, after the Dyneema acquisition (and before the sale of the distribution segment), and Avient after the sale of the distribution segment is complete.

AVNT – Dyneema Pro Forma Modeling (AVNT – May 2022 Investor Presentation)

Highlighted in yellow above we can see that Avient is expected to see a major drop in revenue with the sale of its distribution segment (this segment is currently responsible for generating approximately 35% of revenue while only contributing 16.5% of EBITDA). Dyneema will offer less than one fourth of the revenue compared to the distribution segment but will provide a greater adjusted EBITDA (pro forma w/ sale of Distribution shows Dyneema contributing only 11.1% of total revenue while bringing in a whopping 19.7% of adjusted EBITDA).

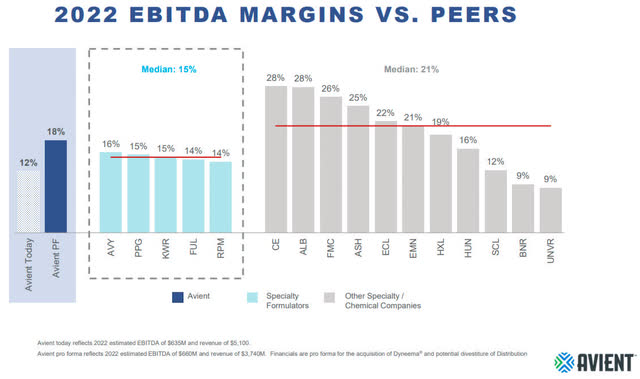

As a whole, Avient will go from generating $12 of operating income per $100 of revenue to generating $18 of operating income per $100 in revenue. Even more important, this doesn’t even factor in the potential growth of Dyneema under Avient’s control. The image below shows how Avient will soon have one of the highest EBITDA margins when compared to other specialty formulators.

AVNT – EBITDA Margin Peer Comparison (May 2022 Investor Presentation)

Conclusion

I see Avient as company that pays a modest dividend and has essentially transformed itself into an entity that offers specialty services that are difficult to replicate (which will translate into stronger revenue growth and higher profitability).

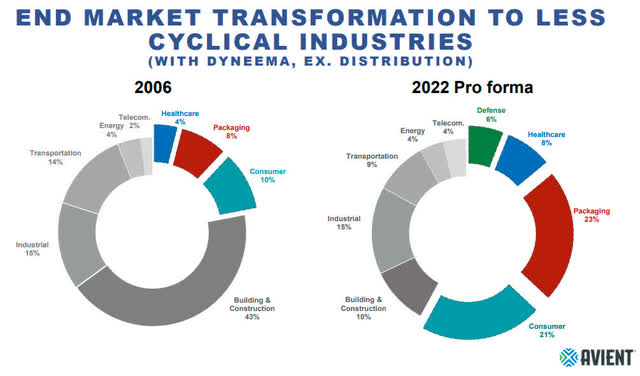

Avient’s transformation has allowed them to gain access to new markets (for example, the acquisition of Dyneema will offer exposure to the defense sector) that are more stable and less cyclical.

Avient Pro Forma Sector Exposure (Avient Q2-2022 Earnings Report)

I really like to see increased exposure to packaging and healthcare because these sectors aren’t as price-sensitive during an economic downturn. Reducing exposure to building and construction (originally represented over 40% of AVNT’s sector exposure and will be down to 10% with the purchase of Dyneema and the sale of the Distribution segment).

There is a lot that will play out over the next two months which is why I wanted to write this article now. Management has already conveyed that there are a handful of potential buyers interested in the Distribution segment and we should know more after the second round of bidding is completed in August. Simultaneously, we will hopefully see the Dyneema acquisition close as early as September 1st, 2022.

With the recent pullback from record highs this makes Avient a Strong Buy. With the sale of the Distribution segment 2022 will be the first year that Avient will truly be a specialty company in the sense that 100% of adjusted EBITDA will be derived from specialized products/services.

Short-term prospects suggest adjusted EPS of $3.50 (Dyneema acquisition and sale of Distribution segment) and I believe it is reasonable to use the P/E ratio of 18x-21x for shares in the short term which would amount to a share price of $63-73.50/share or an upside of just under 46.5% to 70.4% by the end of the year.

My clients John and Jane are long AVNT.

Be the first to comment