TommL/E+ via Getty Images

Published on the Value Lab 3/4/22

Avid Technology (NASDAQ:AVID) is a company we thought about at some point at pandemic lows, with household names like Pro Tools and Sibelius for creators likely to get a wind of COVID-19 trends with people consuming more media than ever before due to being inside all the time. We wish we’d gone through with the idea, as the stock has rocketed since then, but Avid remains quite an interesting prospect. With the shift to subscription based services delivered through the cloud continuing and causing improvements in cash flow generation and margin, we think that this high ROIC business actually deserves its quite high multiple and then some. While we don’t see a major catalyst to bridge the value gap, we do like this company, and think there’s value here.

Looking at the FY

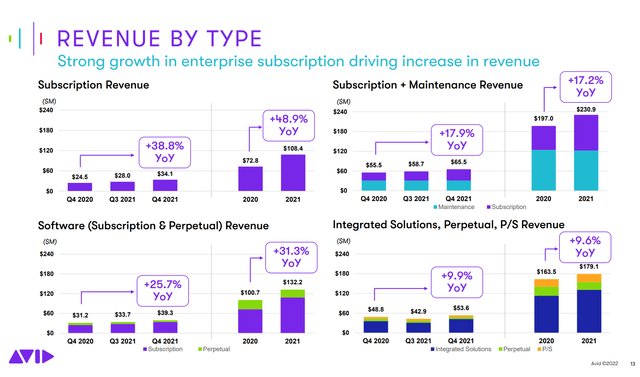

The different segments have been hard to keep track of, but first there’s the subscription revenues, which are the revenues that come from subscriptions from clients paying to have ongoing cloud based access to different Avid software. Then there’s maintenance revenues, which gets added to this in the disclosures, and these are contracts that allow especially enterprise customers to rely on fast response times and pretty integrated customer service to ensure that operations using Avid tools can go smoothly. These maintenance contracts typically go bundled with the subscriptions, or might be sold as an enterprise solution to cover all Avid software. Subscription and maintenance revenue, which is a recurring revenue source, now dominates the mix at almost 60% of revenue, with growth of 17% in this segment being driven by subscriptions. These segments together comprise the higher margin segments that Avid is trying to increase their dependence on. It is also the segment that has higher exposure to independent creators and smaller studios.

Segments (Q4 2021 AVID Pres)

On the flip side, there are the integrated solutions, perpetual license and P/S revenue. This revenue is primarily associated with Azure linked services in media storage, media production and other elements of both hardware and software required for companies to be able to deliver a full media production. This segment has been more exposed to shortages in the semiconductor and electronics industry due to the hardware component, but has nonetheless delivered nice growth. Examples of the sort of business done here is with larger broadcasters that need a platform to help with workflow of creative staff and editors, and the software to actually do the work with.

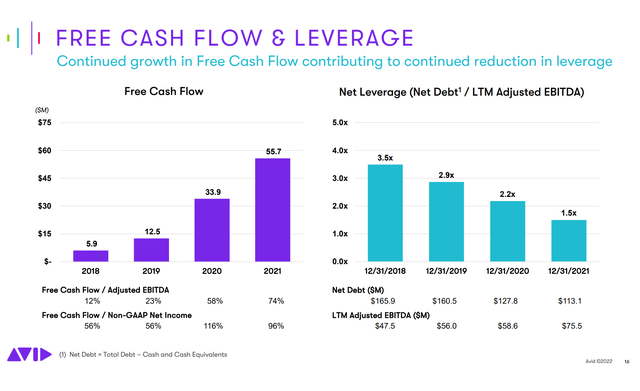

The increased focus on subscription based revenues has meant both an improvement in marginality but also an improvement in cash flow generation due to high unearned revenue balances, shown by the improvement in cash flow conversion metrics, with the latest figure being 74% on EBITDA.

FCF Generation (Q4 2021 AVID Pres)

Gross margins also improved by 300 BPS YoY with EBITDA margins improving by about 30 BPS, despite the increase in R&D associated with readying platforms for more conversion of valuable customers from the perpetual license to the subscription model. We think that about 1.8% addition to margins is possible on an EBITDA basis as perpetual licenses continue to be a deprecated income source in favour of the subscription model, and as scale increases due to a quite rosy revenue picture also increases margins. We think that a strong end-market picture as well as success in converting customers to a higher margin and more comprehensive and useful solution is going to further improve the fundamental picture, and is the value that we are trying to assess against the business’ multiple.

Thinking About Avid’s Valuation

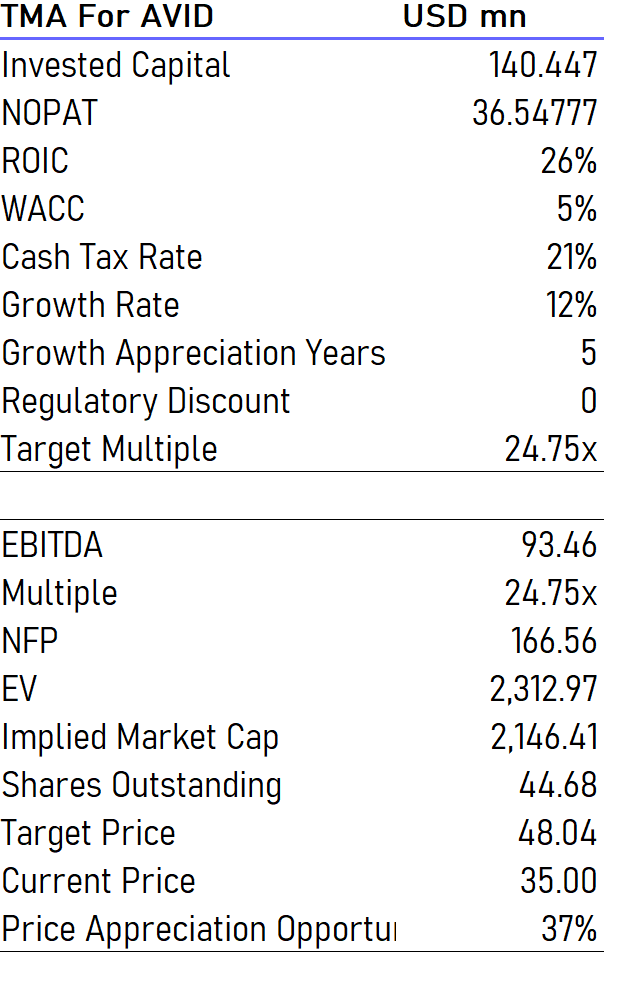

The company has been returning 50% of its FCF in the form of share repurchases, and the high amount of cash generation is going to allow the company to use that capital at high rates to maintain ROICs for the business. A shareholder deficit, driven by high amounts of share repurchases, has been the current vector by which ROICs have been supported. However, with R&D and M&A being other modes of reinvestment, the company has lots of options as it continues to pivot into a subscription business model. We think that strength in media and entertainment should keep the business’ high ROICs at these levels for a reasonable number of years. Having that growth appreciation period, and using CAPM inputs, we can do a target multiple analysis to see what the fair multiple of the business would be given revenue outlook and the improvement in margins that we can model.

Target Multiple Analysis (VTS)

Running very capital lite and also employing a subscription business that is innately cash generative means that a pretty high multiple can be justified, especially when growth can be expected to power this cash generation engine. While a 37% upside suggests that the company has a sufficiently attractive fundamental profile to justify a higher valuation, TMA is based on DCF style logic, and we should be aware to take any resulting figures with a grain of salt.

Conclusions

What you really need on top of a TMA upside is some sort of catalyst. In the case of Avid, we don’t see a distinct enough catalyst to justify jumping in. However, continued growth in media and entertainment is a way by which Avid can continue to justify its growth story and its growth multiple, and as long as growth can continue unabated, there could be a return opportunity here nonetheless. Avid is not particularly exposed to anything unforeseen where the promised improvements in sales and margins wouldn’t be delivered upon without too much risk. While there are some seasonality effects that might reveal Q1 2022 to be sequentially weaker, with strong finishes to the year, we expect that the growth in media and entertainment in our lives should continue to support Avid’s SaaS and subscription approach to providing creators and larger studios with the tools to be able to deliver productions. However, we don’t take the bet here since there isn’t an obscure second order angle that could help us excavate high probability returns. We’d rather take larger stakes in our current holdings.

Be the first to comment