Sundry Photography/iStock Editorial via Getty Images

Published on the Value Lab 9/4/2022, relevant data updated for this release

Avaya (NYSE:AVYA) is a bit of a tough nut to crack. It went bankrupt in 2017, sold its enterprise network business, started offering its communications suite on the cloud and has been making the transition from selling perpetual licenses to subscriptions. It carries a large debt load that has harangued profitability, but has nice markets. It could make for a deleveraging story as its cash generation profile improves. The topline stagnation hides the true performance of the business, which is quite strong. Trading cheaply, we have become quite interested in the Avaya story as the price retreats massively to pre-COVID levels.

Why Investors Should Be Interested in AVYA

The company offers a communication suite that’s useful both as an enterprise collaboration platform but also for contact centers that clients might need to deal with their customers. They are transitioning into becoming a software company rather than a hardware company, which is what they were fully focused on in 2017 at the cusp of their transition and at the end of their bankruptcy proceedings.

The software is again focused on the very topical digital collaboration markets. To be more specific, and to understand their position in the value chain, it is actually quite a backend suite that allows non-technical individuals to build workstreams and configure applications on its platform for whatever communication and collaboration needs that client might need for internal processes or interfacing with clients. In the most reductive terms, imagine Avaya as providing a platform for a bespoke Zoom, with APIs and the whole lot for clients. It also supports chatbots and other tools that have become fashionable in driving engagement and for marketing purposes.

The other big change that Avaya is making is to its business model, where they are shifting from perpetual license models + maintenance and support revenue to a subscription model. This is not very different from what Adobe (ADBE) has done and what Avid Technology (AVID) is in the process of doing. This has two effects that are both positive. The first is that it is a better way to create recurring revenue, rather than hoping a customer upgrades to a license for a newer version or for the support and maintenance revenue that a customer might need, but won’t want. It also allows you to rebill clients that may have gone dormant and made them assets once more. Naturally, in order to fight a bear case that rebilling is all that’s occurring, new business is key to see.

This process is the reason why the topline is stagnating. Naturally, subscription revenue, especially of newly added subscriptions, is going to be less than the sale of a perpetual license. So a stagnating topline despite growth in new business and greater share of recurring subscription based revenues does make sense. It also means that revenue will converge onto ARR once the company reaches critical mass, and that ARR figures overshoot the revenue figures for now as that develops.

Valuation and Conclusions

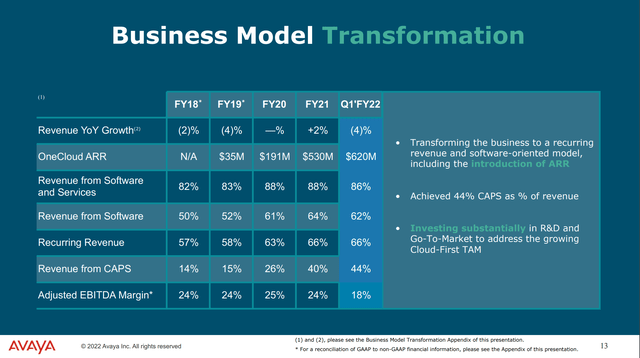

The CAPS revenue, which is what they call the revenue from the new model, is now 44% of overall revenue as of Q1 2022, and this will continue as the company’s reported ARR figures continue to grow.

Transformation (Q1 2022 Earnings Pres AVYA)

This is also coming from new business, which is critical for investors to see as it means that customers aren’t simply being flipped from one model to another, and that rebilling effects is inflating growth. Consider the following exchange from the Q1 2022 earnings transcript.

Lance Vitanza

Okay, great. Thanks. And just my follow up is the 1,400 new logos that you added in the quarter. And I apologize if I missed this, but could you give us at least a rough sense for how many of those new logos are taking One Cloud ARR services?

Kieran McGrath

Well, essentially just by – just looking at it, it’s well over 60% are actually going for either cloud or a subscription hybrid offering.

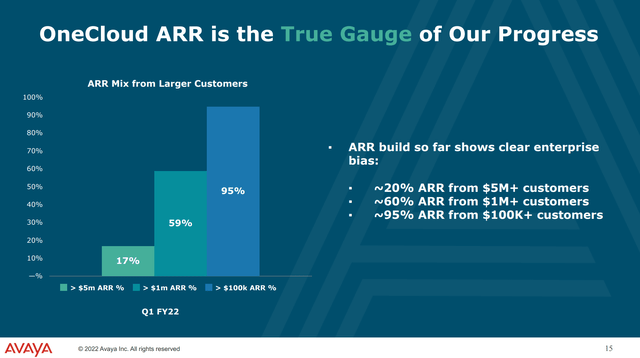

New business is coming on quite rapidly, and it’s from large, new customers too given the developments in customer size.

Large Clients (Q1 2022 Earnings Pres AVYA)

Profitability is fundamentally good as seen from the EBITDA margins given by the company. However, cash flows are being decimated by the very meaningful debt burden accounting for more than 66% of the company’s EV.

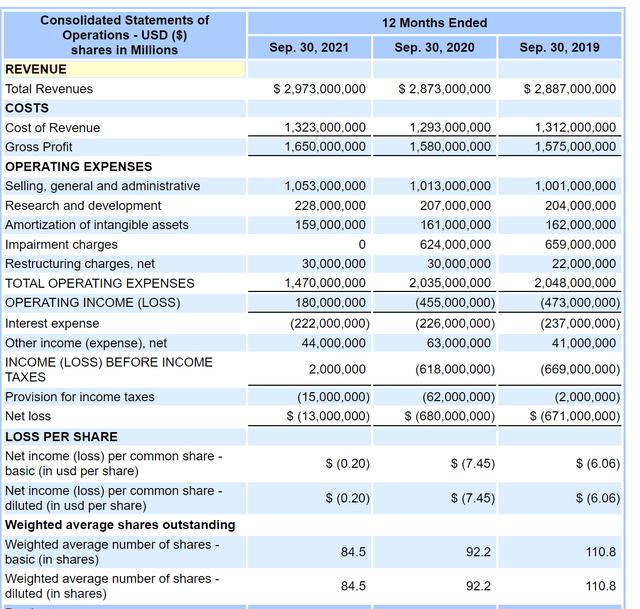

AVYA Income Statement (10-K 2021 FY)

At least operating profitability is clearly improving when ignoring those transitory one-off impairment effects.

In terms of valuation, the company trades very cheaply at around 5x EV/EBITDA. We think that the floundering topline is currently understated, and that as revenue converges onto ARR in this quite fast growing market profitable growth will become far more evident, and cash generation more pronounced thanks to the subscription model. At such a low multiple, a changing growth profile could cause it to expand. Moreover, high amounts of leverage can magnify shareholder returns in the case of a revaluation. However, interest rate risk should be considered, with interest rates effectively at quite high levels around 7%. Rate hikes will be an issue for the company’s deleveraging path, and its substantially declined stock means other ways of raising capital could be costly.

AVYA Stock Price (Google Finance)

The stock currently trades at pre-COVID levels, which flies in the face of the fact that enduring shifts in work modes plays in AVYA’s favour, as does general digitalisation. While there are risks due to the size of the debt load, we think this is quite a high return opportunity that investors, and indeed we, will consider closely.

Be the first to comment