Sundry Photography

Earlier this week, ailing digital communications solutions provider Avaya (NYSE:AVYA) disclosed ongoing discussions with creditors “regarding a comprehensive resolution to strengthen the Company’s balance sheet and position the business for long-term success.“

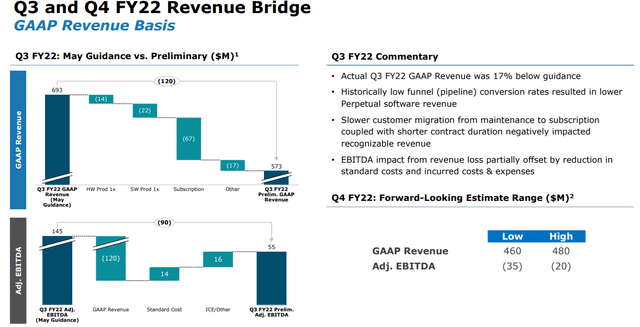

Avaya also provided an update on Q3/FY2022 results and issued abysmal Q4 guidance with revenues projected to decrease by almost 40% year-over-year:

Company Presentation

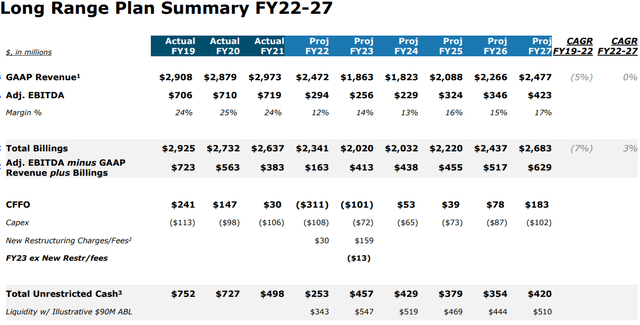

For fiscal year 2022, the company now projects negative free cash flow of approximately $420. For FY2022 and FY2023 combined, cash usage is expected to approach $600 million which includes almost $200 million in restructuring charges:

Company Presentation

Even after proposed restructuring actions, free cash flow is expected to remain negative until fiscal year 2027.

Please note that liquidity projections in the slide above are based on a number of assumptions:

- Receipt of $385 million under new secured term loan facilities less applicable issuer discounts and fees in January 2023.

- Favorable amendments to the RingCentral (RNG) partnership structure.

- Receipt of $50M from an IP monetization transaction closing in Q4/FY2023.

- An illustrative ~$90M of availability under the company’s asset-backed credit facility throughout the forecast period.

Over the past couple of weeks, the company and certain creditor groups have exchanged term sheets for both out-of-court and in-court restructurings.

But with key creditor groups not supporting an out-of-court transaction, Avaya is likely to file for chapter 11 in the not-too-distant future.

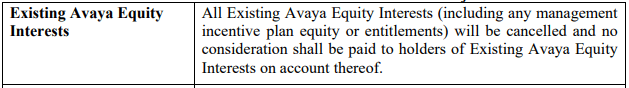

According to the term sheet provided by certain holders of the company’s term loans and its 2028 senior secured notes, secured creditors would become the new owners of the business thus wiping out existing equity holders:

Company Presentation

At the end of Q3, the company’s unrestricted cash balance amounted to $253 million with total liquidity of $343 million, insufficient to deal with projected cash outflows going forward.

Moreover, the restructured business won’t be able to support Avaya’s massive $3+ billion debt load going forward, so there’s not much of a choice for the ailing company.

Bottom Line

Judging by this week’s disclosures, Avaya is likely to file for bankruptcy in the near future with secured creditors about to emerge as the company’s new owners thus wiping out existing equity holders, very much as projected by me in late July.

Given this issue, I think investors should sell existing positions and move on.

Be the first to comment