Michael Smith/Getty Images News

Since I last wrote about B2B unified communications and contact center telephony firm Avaya (NYSE:AVYA) in early June, it has been anything but quiet. The original thesis was that a successful bond offering would provide Avaya with the capital it needed to retire its 2023 convertible bonds, extending maturities to 2027 and 2028, thereby removing any near-term bankruptcy risk and giving the company adequate liquidity and time to complete its business model transformation from one time perpetual sales to a SaaS recurring subscription model.

Avaya ultimately did raise $600 million, split between an 8% $250 million Exchange Note, convertible at $4.30 (232.50 shares per $1,000 Notes) and provided management the ability to settle in cash, common shares or any combination thereof. Given Avaya lacks liquidity to settle in cash at this point, I assume they would issue common shares provided the conditions set forth in the Exchange Note Indenture are met (more on this below). The remaining $350 million came in the form of a term loan due in 2028 at 10% over the secured overnight financing rate.

The company disclosed on July 14 that it closed the financing and managed to retire $129 million of the 2023 bonds, leaving $221 million outstanding and leaving adequate cash in escrow to satisfy the rest.

Then on July 29, Avaya made a surprise and shocking announcement: it fired its former CEO and hired highly regarded communications industry veteran Alan Masarek to lead Avaya’s SaaS transformation while also disclosing that the Q3 financial results missed consensus expectations for revenue and adjusted EBITDA. The company also withdrew formal guidance for the remainder of FY2022.

That led to the company’s June bond offerings being challenged (and dropping in price precipitously), apparently based on the assertion that Avaya didn’t provide adequate disclosures to lenders based on updated knowledge of its business conditions. Both Avaya and the $350 million B3 term loan lenders lawyered up following the drop in bond prices (which have since begun to recover). The 2023 notes cratered from 95 on July 22 to 17 on August 15, and the last trade was at 44.50 on September 14. The volume on the 2023 bonds has essentially dried up, indicating to me that negotiations on a debt deal with the 2023 bond holders is likely getting close to being finalized.

My belief is the “financial noise” described by new CEO Alan Masarek is largely centered on GAAP revenue recognition rules for SaaS contracts vs committed ARR which led to the large Q3 miss, but doesn’t provide a clear snapshot into the health of the underlying business which is primarily based on the continued growth in ARR and customer wins. Avaya closed 1400 new logos in Q3 which Mr. Masarek described as an acceleration over Q2.

Separately, I understand a previously disclosed $400 million win over 7 years with a large financial services company (which included a large cohort of partners, and as such, a low margin deal) went stale and this was disclosed to the lenders during the due diligence process such that it provides a piece of evidence that Avaya’s financial health was fully disclosed and that Avaya should be free to use the $600 million raised to satisfy the 2023 bonds and general corporate uses.

To add to the “financial noise,” Apollo Global Management (APO) is reportedly buying the 2028 bonds according the WSJ, and attempting to force Avaya into bankruptcy although I understand not all the other lenders are in alignment with Apollo. Nor are Avaya’s shareholders — Theodore King, an education software entrepreneur and Avaya’s single largest shareholder as of mid-August — commented on Twitter that he believes Avaya’s Board should categorically reject any “loan to own” offer from Apollo, and seek to implement its new business plan under Mr. Masarek’s leadership.

To that end, Avaya announced on September 6 that it implemented a cost savings campaign to remove $250 million in annual costs (primarily job related) to create a more agile organization while it reinvents and invests in its product road map while restoring near term adjusted EBITDA to $500 million. The company also hinted there could be incremental cost savings in other areas outside the United States.

So with all that said, and after a strange series of events since June, I believe we are back at the point of the original thesis: that Avaya presents a compelling risk/reward based on the company hinting that completing the 2023 bond redemption could be “weeks” away, thereby extending maturities to 2027 and 2028 and removing near term bankruptcy risk such that the equity can potentially re-rate considerably higher.

Avaya VP Channels, John Lindsley (Channel Futures)

The 2027 Exchange Notes

As part of the June debt refinancing, Avaya first disclosed on June 23 a $150 million 8% Exchange Note with an Exchange Price of $4.30, or 232 shares per $1,000 Notes. As part of that deal, the institutional investor — Brigade Capital — was subject to a Standstill Obligation described in the 8-K to which they are precluded from trading Avaya equity linked securities.

Brigade Capital Standstill Obligation (SEC 8-K)

Curiously, the next day on June 24, Avaya issued another 8-K which indicated it upsized the $150 million Exchange Note to $250 million, while downsizing Brigade Capital to $125 million and spreading the remaining $125 million to a second salvo of institutional investors. Also, the June 24 8-K did not include any language related to a Standstill Obligation.

That same day on June 24, Avaya shares traded down 25% on 20 million shares of volume. It certainly appears that the hedge funds who participated in the upsized Exchange Note and who weren’t subject to a Standstill Obligation began shorting Avaya shares to hedge the conversion feature of the Exchange Note on that day between prices of $3.70 and $2.60.

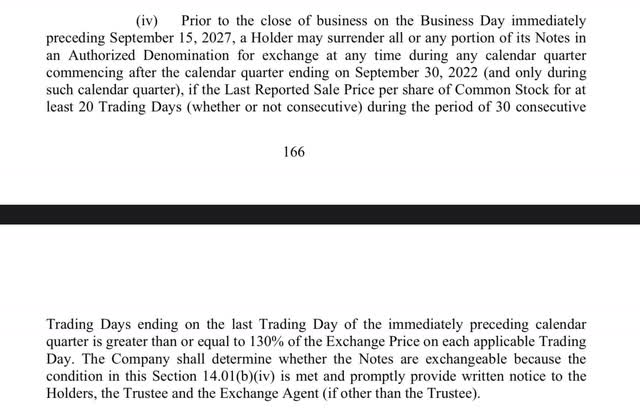

Yet the mechanics of the Exchange Note are such that those hedge funds who are short Avaya shares via a market neutral hedge on the conversion feature of the Exchange Notes they hold are precluded from exchanging the Notes into shares until AVYA trades over 130% of the Exchange Price ($4.30) — or $5.60 per share — for 20 of 30 Trading Days preceding the end of a calendar quarter, starting October 1, 2022.

Exchange Note Indenture (Exchange Note Indenture)

That condition has not been met to exchange the notes in October, so the next window to exchange the notes is January 2023, provided AVYA is over $5.60 for the 20 of 30 trading days preceding December 31, 2022. Put another way, those Exchange Note holders are naked short AVYA shares until they can convert their notes to shares. Should AVYA shares begin to move back to ~$3 where the Exchange Note holders started their hedging campaign on June 24, those who are short with market neutral hedges will have to cover via open market buys as they won’t be able to deliver shares via the Exchange Notes until at least January 2023.

This is the essence of what could create a potential “short squeeze” and has another positive effect: it allows Avaya to deleverage by $250 million and save $20 million interest annually if AVYA shares appreciate over the $5.60 level outlined in the Indenture and notes are exchange for equity. While this would create some dilution to the equity, the benefits of the deleveraging event would outweigh the dilution in my view, particularly for shareholders buying in at levels under $4.30.

Conclusion

With trading volumes increasing and clear bid support under the shares since the new, long-term oriented anchor shareholder (and no investment mandate or need to report monthly, quarterly or yearly results to investment partners) coupled with the mechanics of the market neutral hedging via the Exchange Notes, I believe there could be a significant mean reversion opportunity in Avaya shares as Mr. Masarek executes his plan and bankruptcy fears recede.

If the company does indeed announce some positive developments around entering FY2023 with a clean financial slate in the days or weeks ahead, I believe it could result in an appreciable move higher in the stock for both fundamental and technical reasons given the high short interest, limited free float and high trading volumes.

Moreover, given Avaya is currently delinquent on its Q3 10Q filing and the company warned about its ability to continue as a going concern (likely at the direction of Avaya’s auditing firm, PwC), this likely caused forced selling in the stock in July and August. Issuing the 10Q, paying off the 2023 bonds and illustrating in detail its fully funded FY23 business plan could result in the removal of language around the going concern. In other words, once the 2023 bonds are redeemed and taking into account the $250 million cost cuts coupled with Avaya’s largely recurring revenue streams now, the company should have adequate liquidity to operate for more than 12 months and warrant the removal of the going concern warning.

These issues could prevent some institutions from currently investing in the shares, so if each is remediated, it could provide additional institutional buying pressure. And lastly, if Avaya shares increase over $5 per share, that could remove another potentially restrictive condition that allows institutions to buy Avaya shares.

Be the first to comment