Erik_V

Introduction

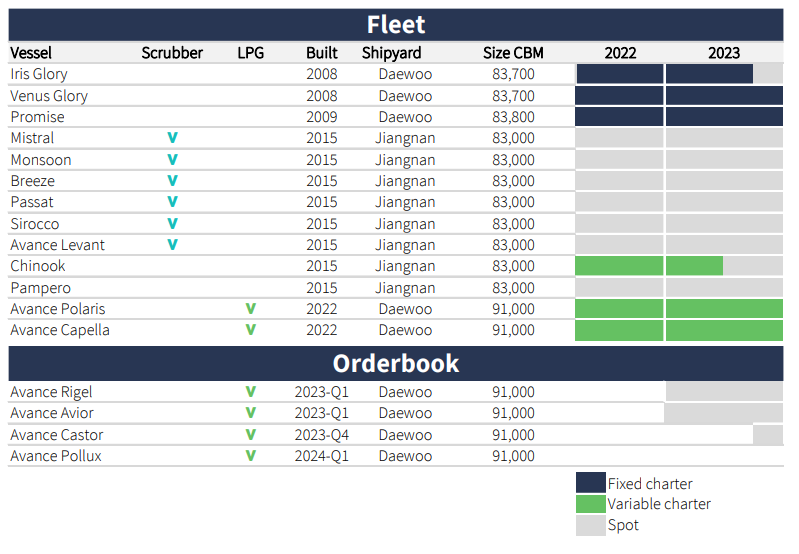

Avance Gas (OTCPK:AVACF) is a Norway-based operator of Very Large Gas Carriers (‘VLGC’), operating a fleet of thirteen vessels with an average age of less than eight years. I have avoided the LPG shipping market over the summer and I explained the thesis in my article on BW LPG (OTCPK:BWLLF) where I wasn’t sure how the company would perform during the summer and on a longer term basis as almost four dozen new VLGCs will be delivered to their owners in 2023. Avance Gas is a smaller competitor of BW LPG and could be an equally interesting vehicle to gain exposure to the VLGC shipping rates which are now gaining ground ahead of the winter season in the northern hemisphere.

Yahoo Finance

Avance Gas has a primary listing in Norway where it is trading with AGAS as its ticker symbol. The average daily volume is just over 100,000 shares per day but volumes are picking up as attention is returning to the VLGC segment. The average daily volume in the past five days is approximately 200,000 shares per day. Avance Gas is trading in NOK and at the current USD/NOK exchange rate of 10.5, Avance Gas is trading at approximately US$6/share. As Avance reports its financial results in USD, I will use the US Dollar as base currency throughout this article.

A look back at the H1 results shows strong free cash flows

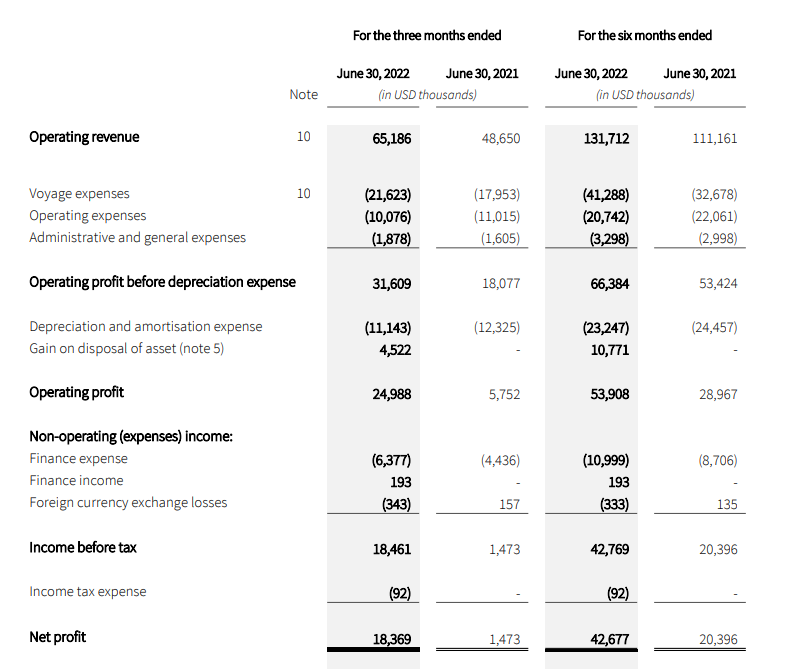

Avance Gas reported a total revenue of in excess of $65M during the second quarter which is roughly the same revenue it was able to record in the first quarter of the year despite lower TCE rates. The delivery of the Avance Polaris and Avance Capella, two newbuilds, during the first quarter helped as Q2 was the first full quarters these new vessels contributed to the total result.

Avance’s relatively modern fleet has a big advantage: the operating expenses are pretty low at just over $8,000 per available day. The G&A expenses are also low at less than $2M per quarter ($3.3M in the entire first semester) while the depreciation expenses add an additional $11M to the operating expenses. This means the total all-in cost to keep the vessels running is less than $20,000/day. Including depreciation but excluding debt service.

Avance Gas Investor Relations

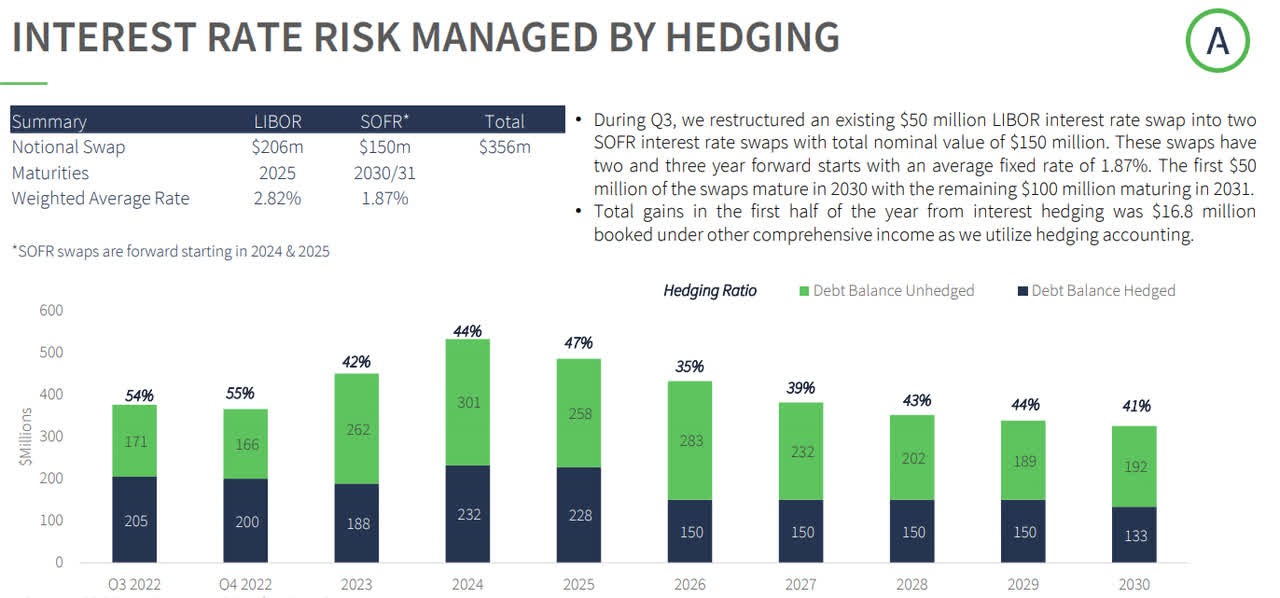

The debt is actually relatively cheap and will remain manageable as the company has an active hedging program in place. While this will not prevent any interest rate increases, it should shield Avance Gas from some pretty severe swings. The net income in the second quarter was $18.4M, which represents an EPS of $0.24 per share. The net income of $42.7M in the entire first semester was $0.557/share. Avance Gas paid a dividend of $0.20 per share in Q1 and Q2. This means the $0.40 in dividends is already higher than the $0.26 paid for FY 2021. That’s great, but keep in mind about a quarter of the H1 income was generated through the gain on the sale of old assets.

Avance Gas Investor Relations

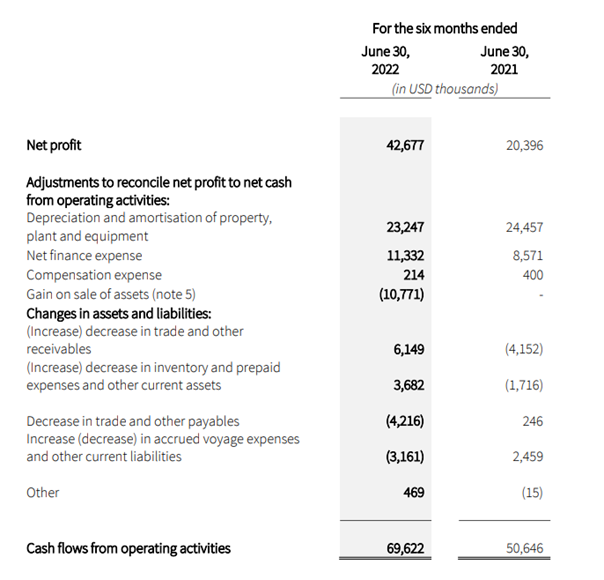

The sustainability of the dividend obviously also depends on the cash flows. We see the company generate a total of $61.3M in operating cash flow in the first half of the year, but the starting point is the ‘cash generated from operations’. The footnotes provide a more detailed breakdown of how this cash flow was generated. According to the breakdown, this included a $2.9M contribution from changes in the working capital.

Avance Gas Investor Relations

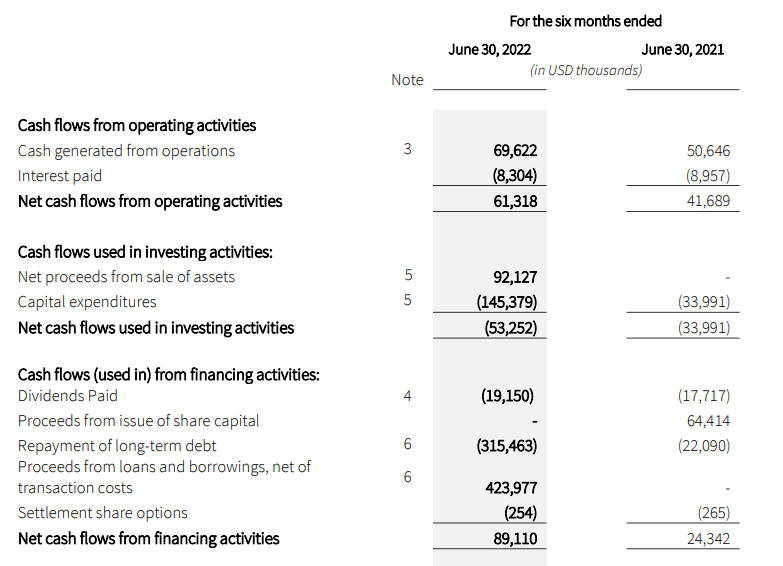

This means that adjusted for these working capital changes, the operating cash flow was $66.7M And this went a long way to cover the capital expenditures for four newbuild vessels that are currently under construction. Three new vessels will be delivered in the current semester, the final vessel will be delivered in the first quarter of next year.

Avance Gas Investor Relations

While the capex was obviously higher than the operating cash flow, that’s fine as the entire capex was related to the newbuild vessels. We already saw the depreciation expenses in the first half of the year were just over $23M and if we would use that as pro-forma sustaining capex, Avance Gas would have generated about $33M in free cash flow. That’s approximately $0.43 and fully excludes the gain on the sale of older vessels.

The free cash flow will likely accelerate the next few quarters as Q3 will likely be pretty decent (although perhaps weaker than Q2) but the daily charter rates are off to a good start in the current quarter.

Q3 may be a bit weaker but spot rates are trending up and new VLGCs will soon hit the water

When Avance Gas announced its Q2 results, it mentioned it expected a Time Charter Equivalent rate of $32,000/day for Q3. That seems to check out with the average charter rates provided by Fearnleys with a stable month of July, a relatively weak month of August but a much stronger month of September as the quarter ended with a VLGC spot rate of approximately $60,000/day.

Avance Gas Investor Relations

That’s why I think Avance Gas may surprise to the upside when it publishes its Q3 results, and we can likely also look forward to a strong fourth quarter thanks to the company’s exposure to the spot market. Right now, the VLGCs are chartered at in excess of $60,000/day on the spot market and although the fourth quarter is only two weeks old, this bodes well for the rest of the winter.

That’s great in the short term, but what about the longer term? Almost 50 newbuilt VLGCs are expected to hit the water next year (and three of those will be delivered to Avance Gas). While this is a substantial increase (14% of the current fleet) let’s also not forget dozens of the existing vessels have reached a respectable age. According to Avance Gas 47 vessels are over 20 years old while 30 vessels are older than 25 years. Needless to say, those 30 vessels could be scrapped soon.

Avance Gas Investor Relations

Let’s also not forget the new vessels that will be delivered are dual fuel VLGCs and have been contracted at ‘very attractive levels compared to the newbuilding prices’. Assuming a margin of $20,000/day (based on a conservative TCE of $30,000/day and an operating cost of $10,000/day), these three new vessels could add in excess of $20M in cash flow per year. At $50,000/day, this increases further to almost $45M per year.

Investment thesis

Avance Gas has a very generous dividend policy but at an average TCE of approximately $37,000 per day, the dividend is more than fully covered, even if we assume the sustaining capex equals the depreciation expenses. At the current share price of just under 63 NOK, the stock is trading at almost exactly US$6/share and at less than 4 times earnings based on the current fleet situation and a TCE rate in the mid-30,000 per day. The book value per share as of the end of June was $7.55/share and I think this book value undervalues the assets. The company sold two 2008 built VLGCs earlier this year for around $22- 25M each but recent reports indicated that a 2009 built vessel recently changed hands (and was purchased by the same buyer who bought one of Avance’s vessels) for $50M.

This makes Avance Gas pretty appealing, even after the recent run-up in its share price.

Be the first to comment