cemagraphics

I’m in the mood to check on GATX Corporation (NYSE:GATX) again, so I’m going to check on GATX Corporation again. Way back in early February of this year, I put out an article suggesting that the dividend was a bit shaky, and that the valuation was unwarranted. Since then, the shares have returned about 11% against a 10.7% loss for the S&P 500. That sounds terrible, but I feel a need to unpack that relative performance a bit. As of late September, the shares were actually down about 17.5% from the time that I published my article, and they’ve exploded higher since. The market obviously “sees” something it likes, so I want to spend some time trying to discover that for myself. I’ll check out the most recent financial report, and I’ll look at the valuation again. Additionally, I want to write briefly about my experience with short puts here, because I’m always interested in offering up examples of how these instruments enhance returns while lowering risk.

Welcome to the “thesis statement” portion of my article. I offer this so you have the option to get the gist of my thinking very quickly, and so might not have to wade through the entirety of my article. You’re welcome. For the life of me, I can’t find what the market’s so excited about. After all, the company missed both EPS and revenue projections during the most recent quarter. The company has not yet returned to pre-pandemic levels of profitability, the capital structure is in much worse shape, and the coverage of contractual cash obligations is not particularly great in my view. In spite of this, the market is paying near record levels for these shares. In my view, this is not a great combination. The shares are so far above reasonable valuations, I can’t recommend selling puts, though I do spend some time writing about my history with these instruments as a way to both brag about my risk adjusted returns, and to highlight the power of these instruments once again.

Financial Snapshot

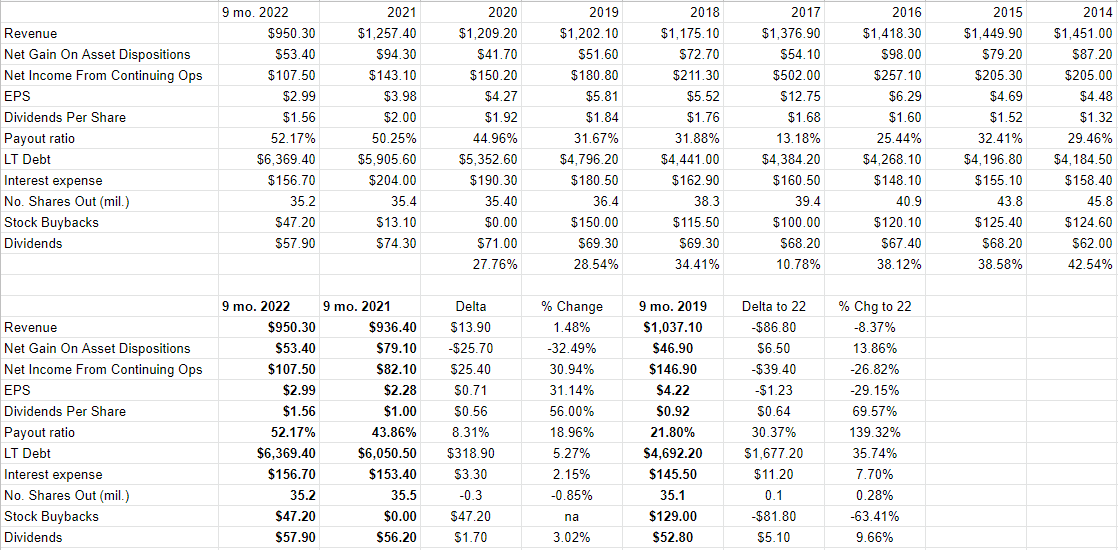

I’d characterize GATX’s recent financial performance as “lackluster.” Sales for the first three quarters of 2022 were up by about 1.5% relative to the same period in 2021, and net income was up massively, from $82.10 million to $107.5 million. The biggest single driver of this uptick came from a swing in the share of affiliates earnings net of taxes. Last year it was a negative $21.6 million, and it contributed a positive $14.8 million this year. So far, so good, but if we expand our frame of reference, things look rather soft. The company has not yet recovered to pre-pandemic levels, as evidenced by the fact that revenue for the first nine months of this year were about 8.4% lower than they were in 2019, and net income was off by just under 27%.

In the teeth of this seeming inability to get back to pre-pandemic levels, the capital structure has deteriorated fairly significantly, with long term debt at a multiyear high. Specifically, there’s about $319 million more debt in 2022 than there was in 2021, and long-term debt is higher by about $1.677 billion today than it was in 2019. This obviously increases the risk here, and I think investors need to be compensated for taking on that risk with a very reasonable valuation.

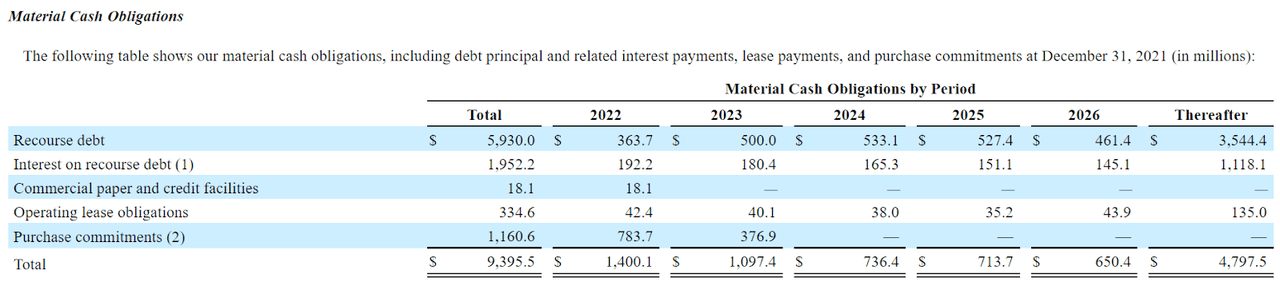

To drive this point home, because I’m a big fan of belaboring a point, I’ve plucked the following table from page 48 of the latest 10-K for your enjoyment and edification. Over the next year, the company has to come up with about $769 million. They generate an average of $456 million in cash from operations in a given year, while spending about $757 million in investing activities. That offers some clues about the growing indebtedness in my estimation. In fairness, the company has $596.3 million in cash on the books at the moment. So, they’ll likely be able to meet next year’s obligations, but the margin isn’t overly large in my estimation. To repeat myself, I’d need to be compensated for this lack of coverage with a cheap stock price.

GATX Material Cash Obligations (GATX latest 10-K) GATX Financials (GATX investor relations)

The Stock

My regular readers know that I consider the company and the stock to be very different things. If you’re new here, it’s time to let you in on this idea, too. I consider the stock and the company to be very different things. The company takes a number of inputs, adds value to them, and sells the results to someone else for a profit. The stock, on the other hand, is a traded instrument that reflects the crowd’s long-term views about the strength of the business. Additionally, the stock is affected by a number of variables that have little to do with the business, including changing interest rates, the crowd’s desire to own “stocks” as an asset class etc. In my experience, the only way to profit trading stocks is to spot discrepancies between the crowd’s views and subsequent reality. If the crowd is too pessimistic, for instance, it makes sense to buy and then ride the price higher as new information is eventually digested. If the crowd is too optimistic about a company’s future, it’s best to avoid the name in my view. The level of optimism or pessimism in a stock is reflected in the valuation. If the crowd is optimistic, the shares are not cheap.

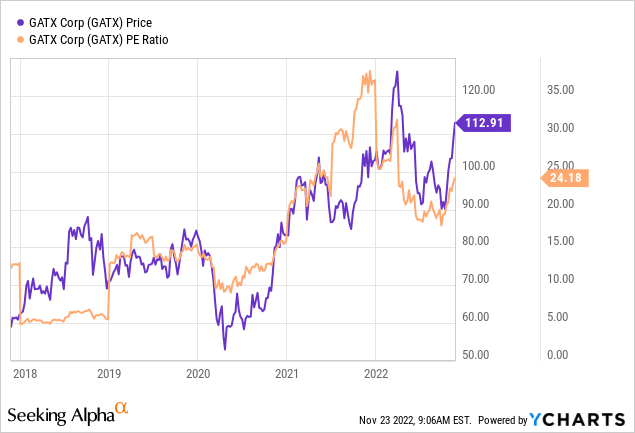

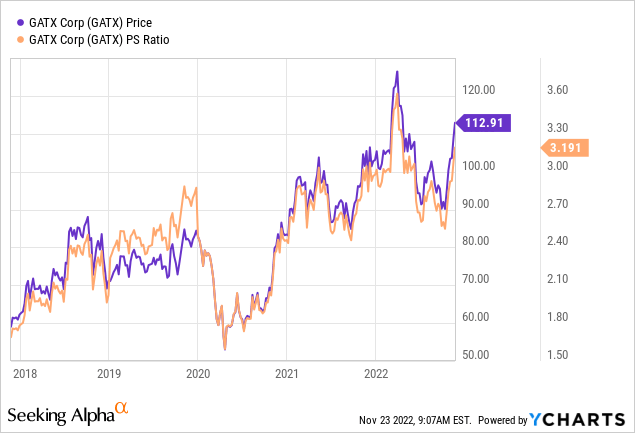

I measure the cheapness (or not) of a stock in a few ways, ranging from the simple to the more complex. On the simple side, I look at the ratio of market price to some measure of economic value, like earnings, sales, and the like. I want to see the shares trading at a discount to both the overall market, and to their own history. In case you don’t have your “Almanac of Doyle’s Trades” in front of you, I’ll remind you that I eschewed the shares previously because they were trading at a price to sales ratio of about 2.9 times. That meant that the market was willing to pay $2.9 for $1 of sales of this company that hasn’t yet returned to pre-pandemic levels. They’re now about 10% more expensive on that basis, per the second chart below. I think it’s also worth noting that the market is paying near record levels for $1 of earnings.

Coincident with the fact that the market is paying near records for $1 of earnings, it’s paying $3.19 for $1 of sales. This is extraordinary in my estimation, in light of the fact that the company has still not recovered to pre-pandemic levels of revenue or profitability.

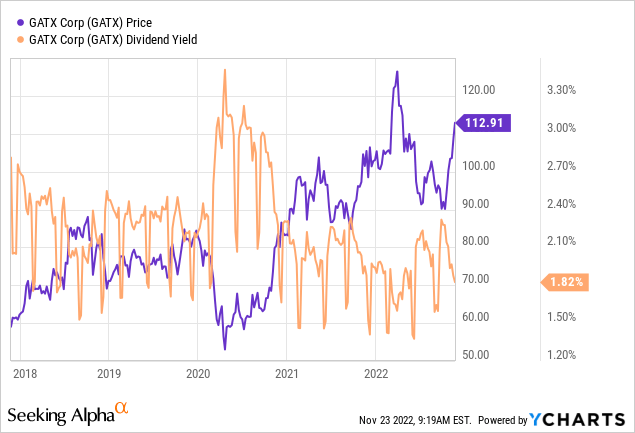

While the market’s paying more for sales and earnings, it’s getting less in terms of a dividend yield per the following:

In addition to looking at ratios, I want to try to work out what the market is “thinking” about a given investment. If you read my stuff regularly, you know that the way I do this is by turning to the work of Professor Stephen Penman and his book “Accounting for Value” for this. In this book, Penman walks investors through how they can apply some pretty basic math to a standard finance formula in order to work out what the market is “thinking” about a given company’s future growth. This involves isolating the “g” (growth) variable in this formula. In case you find Penman’s writing a bit opaque, you might want to try “Expectations Investing” by Mauboussin and Rappaport. These two have also introduced the idea of using the stock price itself as a source of information, and we can infer what the market is currently “expecting” about the future.

Applying this approach to GATX at the moment suggests the market is assuming that this company will grow earnings at a rate of ~8.75% in perpetuity. I consider that to be a fairly optimistic forecast, especially in light of the fact that the business hasn’t returned to pre-pandemic levels. Given the above, I can’t recommend buying at current levels.

Options Update

Just because I don’t like the shares at current levels, doesn’t mean I don’t see value here. I’d be very happy to buy this stock at a reasonable price. This was my thinking earlier when I sold 10 March 2022 puts with a strike of $65 for $1 each. While I did not earn as high a return as shareholders did, I took on significantly less risk. This is because my short puts were a “win” no matter the outcome. Had I been exercised, I would have bought this business for a net price of $64, which I would find very compelling. Since the shares remained above $65, I simply pocketed $1,000. That’s also not a terrible outcome.

While I like to try to repeat success when I can, I can’t recommend short puts at the moment because the share price is so far above reasonable valuations as to make the exercise pointless. I mention my experience with short puts to remind investors that if they’re not yet familiar with these powerful instruments, I think they’d be wise to become so. If the valuation is not too far out of whack, they offer great risk adjusted returns in my view.

Be the first to comment