Khanchit Khirisutchalual

Lumentum Holdings Inc. (NASDAQ:LITE) will likely benefit from the recent demand for virtual environments for work. Besides, LITE serves innovative and growing industries like the EV battery industry or new automotive 3D sensing technologies. Under normal circumstances, with successful closure of recent acquisitions, LITE’s fair value would stand at close to $86 per share. I see some risks from supply chain issues and logistics. However, the current market price does look cheap.

Lumentum

Headquartered in San Jose, California, Lumentum is a designer of optical and photonic products enabling optical networking and laser applications. LITE’s components are present in many of the telecom, enterprise, and data center networks that we all use today.

On the company’s website, there is a list of applications that use LITE’s devices. The list includes EV batteries, automotive 3D sensors, and many other innovative industries. Considering the growth of the company’s target industries, I believe that many investors would enjoy having a look at the company.

Source: Company’s Website

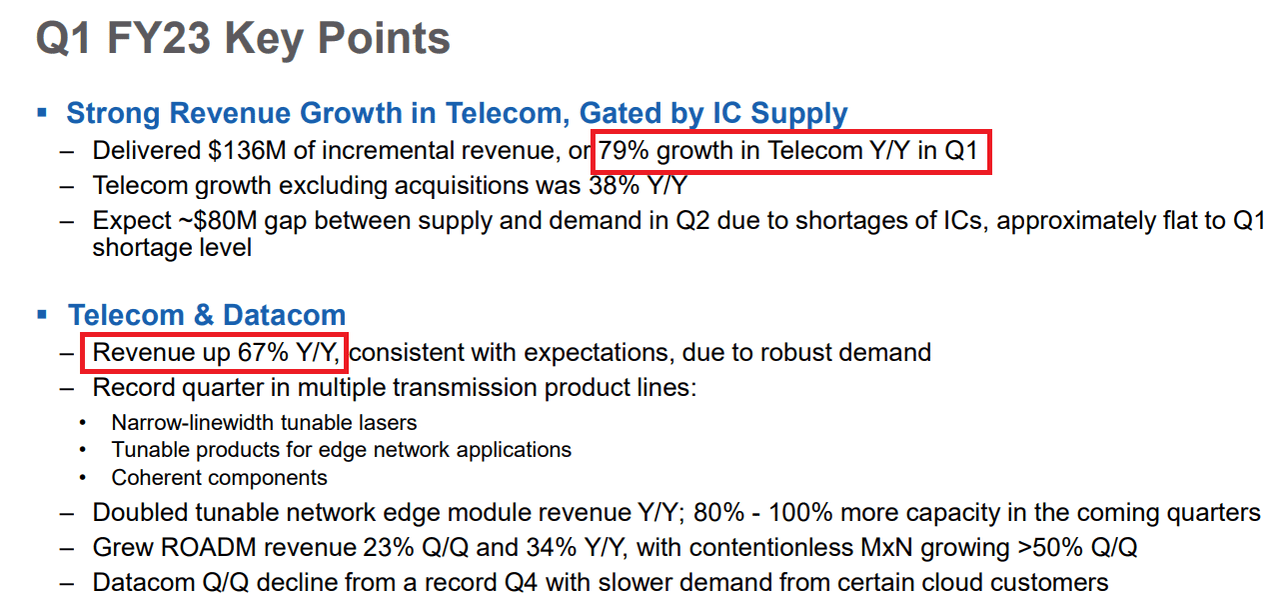

Recent Quarterly Results Include 79% Growth In Telecom Revenue Y/Y And Beneficial Estimates From Analysts

In Q1 2023, LITE reported strong growth in telecommunications with $136 million and a year-over-year growth of 79%. Besides, management also reported doubled tunable network edge module revenue and 80%-100% more capacity in the coming quarters. Finally, ROADM revenues increased 23% quarter on quarter. I believe that the report was quite optimistic.

Source: Q1 FY23 Earnings Presentation

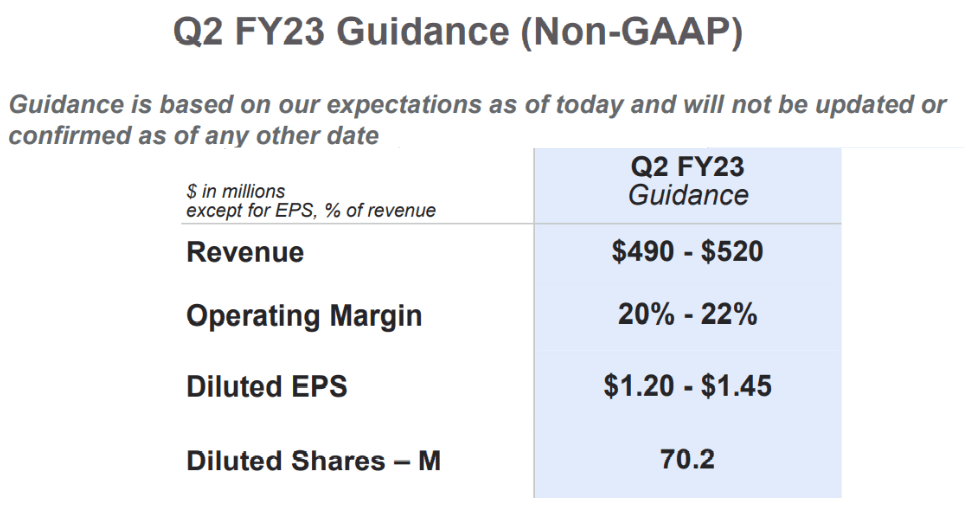

The guidance given for the second quarter of 2023 includes a revenue of $490-$520 million, an operating margin of 20% to 22%, and diluted EPS of $1.20-$1.45. I used some of these figures in my financial models.

Source: Q1 FY23 Earnings Presentation

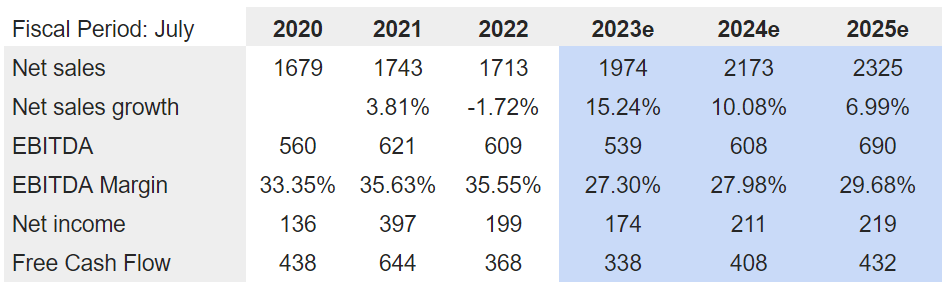

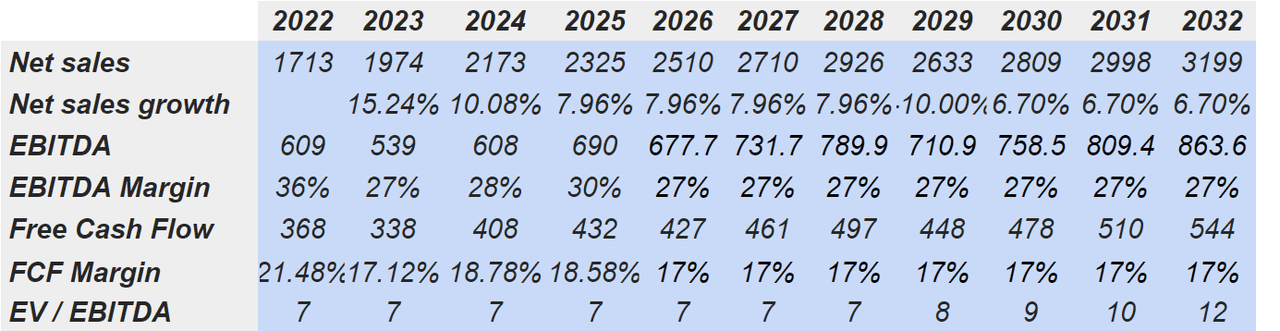

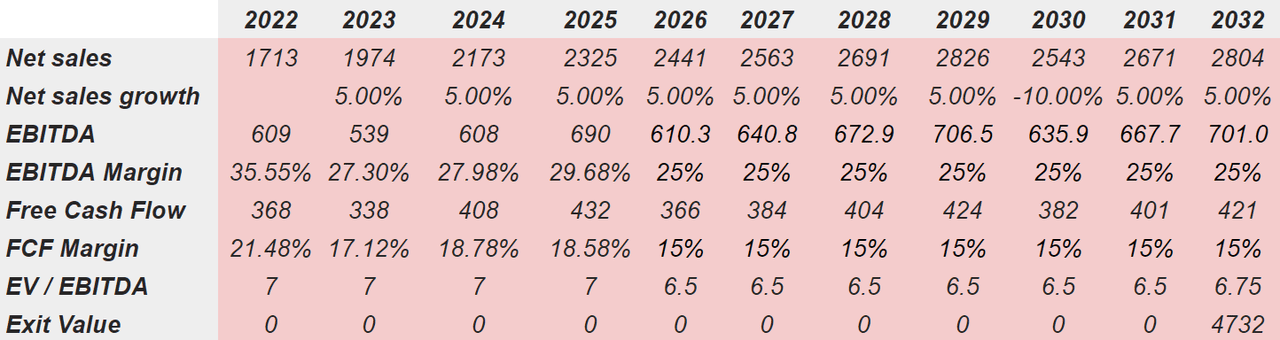

Analysts foresee, for 2025, net sales of $2.32 billion with sales growth of 6.99%, EBITDA of $690 million, and EBITDA margin of 29.68%. Net income would also stand at $219 million together with a free cash flow of $432 million.

Source: marketscrener.com

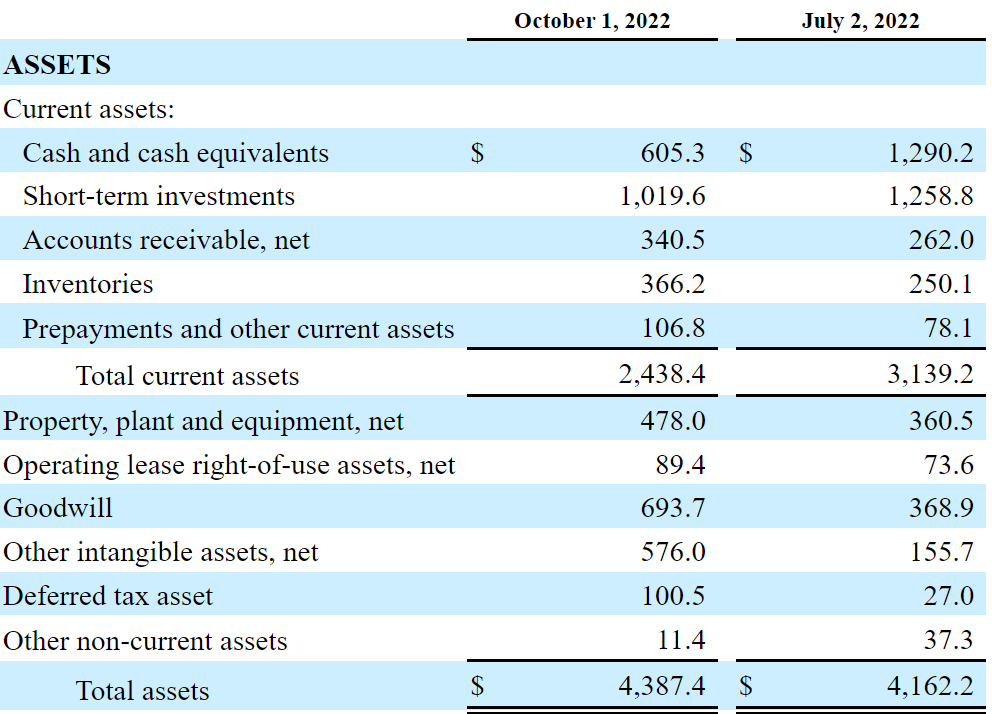

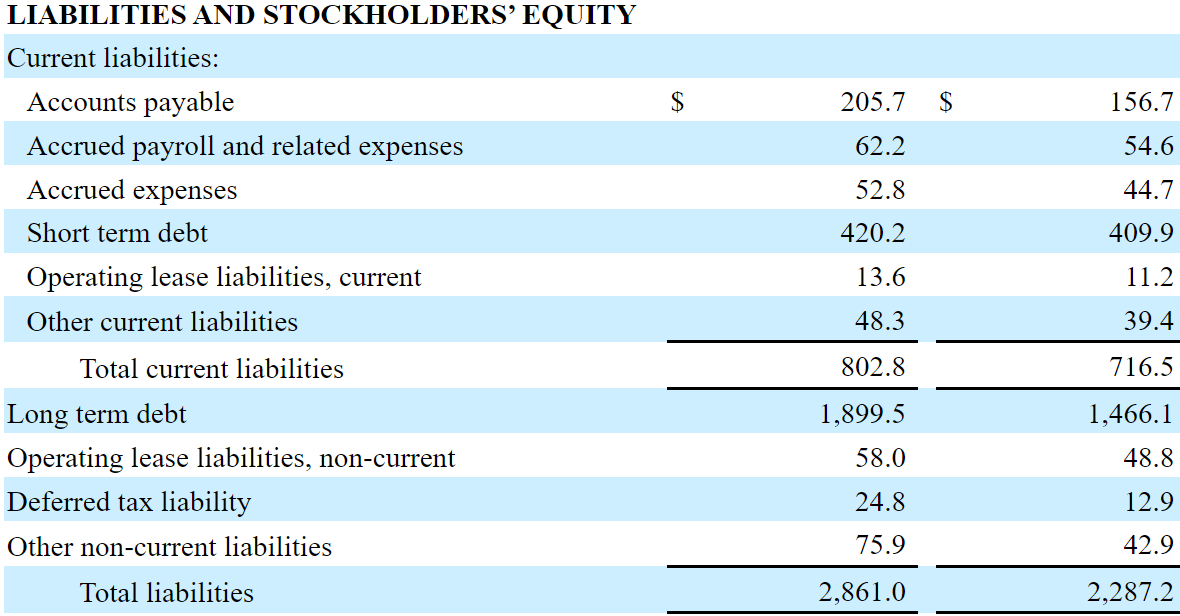

LITE Reports A Lot Of Cash In Hand And Short-term Investments

As of October 1, 2022, cash and cash equivalents stand at $605.3 million with short-term investments of $1.019.6 billion. Accounts receivable is equal to $340.5 million with an inventory of $366.2 million. The total current assets amounted to $2,438.4 million, which is close to three times the total amount of current liabilities. In my view, the company will likely not have a liquidity issue in the future.

Property and equipment are worth $478 million with a goodwill of $693.7 million and intangible assets worth $576 million. In sum, total assets are equal to $4.387 billion, which is close to 2x the total amount of liabilities. In my view, the balance sheet appears very solid.

10-Q

The liabilities include accounts payable of $205.7 million and short-term debt of $420.2 million. Finally, long-term debt is equal to $1.8 billion with the total liabilities of $2.861 billion. Considering future free cash flow expected, I am not at all concerned about the total amount of debt.

10-Q

More Need For Bandwidth Growth And Successful Acquisitions Would Likely Bring The Stock Price Up To $86 Per Share

Under normal conditions, I believe that LITE will likely grow because of the need for bandwidth growth. As society requires extensive use of the internet, the demand for LITE’s products would be more. As a result, LITE will obtain revenue growth. I believe that economies of scale would help enhance or maintain LITE’s EBITDA margin.

Virtual meetings, video calls, and hybrid in-person and virtual environments for work and other aspects of life will continue to drive strong needs for bandwidth growth and present dynamic new challenges that our technology addresses. As manufacturers demand higher levels of precision, new materials, and factory and energy efficiency, suppliers of manufacturing tools globally are turning to laser-based approaches, including the types of lasers Lumentum supplies. Source: 10-k

Under this case scenario, I also assumed that LITE will successfully obtain the synergies expected from previous acquisitions. Let’s keep in mind the acquisition of Oclaro and NeoPhotonics. There is a significant amount of goodwill accumulated in the balance sheet. The company’s acquisitions in the past were not small.

In December 2018, we completed the acquisition of Oclaro, Inc., a provider of optical components and modules for the long-haul, metro and data center markets.

On August 3, 2022, we completed our merger with NeoPhotonics Corporation, which we expect to expand our opportunities in the market for optical components used in cloud and telecom network infrastructure. Source: 10-k

Under normal circumstances, I assume that LITE will grow as much as the photonics market, which is expected to grow at a CAGR of 7.96% from 2021 to 2026. The sales growth included in this case scenario will be close to this figure.

The photonics market was valued at USD 773.64 billion in 2020, and is expected to reach a value of USD 1208.72 billion by 2026, at a CAGR of 7.96% from 2021 to 2026. Source: Globenewswire

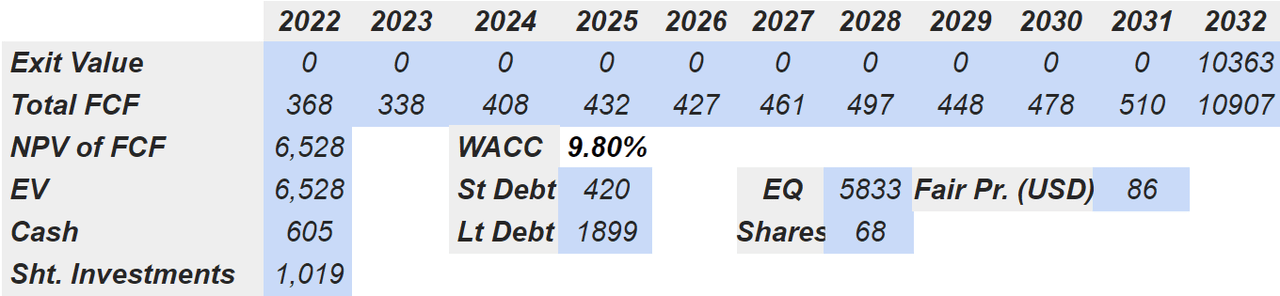

Under my previous assumptions, I included net sales growth of 15% in 2023 and around 10%-6% sales growth from 2024 to 2032. Also, with an EBITDA margin of 27% and a FCF margin of 21%-17%, I obtained FCF around $368 million and $544 million.

Bersit’s DCF Model

Now, if we include an EV/EBITDA multiple of 12x, the exit value in 2032 would stand at close to $6 billion. The sum of future FCF would be around $4.9 billion. If we sum cash worth $605 million and short-term investments around $1 billion, and subtract the debt, the equity valuation would stand at $5.8 billion. Finally, the implied price would be $86 per share.

Bersit’s DCF Model

Manufacturing Delays, Lack Of Innovation, Or Rapid Technological Changes Could Push The Stock Down To $37 Per Share

LITE could suffer disruption and delays with its manufacturing partners. The company warned about these issues because they happened in the past. In my view, LITE might suffer a decrease in the revenue expected. Clients or business partners may stop working with the company, or the brand may be damaged.

In addition, we have experienced disruption and delays with our manufacturing partners, for example in Malaysia, limitations were imposed at certain times on which businesses could operate and the amount of the workforce permitted to perform manufacturing operations, and in the third quarter of fiscal 2022, we experienced a temporary factory closure in China. Source: 10-k

It is also worth noting that an increase in logistics costs due to inflation would significantly affect the company’s business model. Let’s keep in mind that LITE manufactures some of its products. As a result, LITE’s FCF margin would most likely decrease, which would lower LITE’s stock fair valuation.

There are also restrictions and delays on logistics, such as air cargo carriers, as well as increased logistics costs due to limited capacity and high demands for freight forwarders.

We manufacture some of our finished good products as well as some of the components that we provide to our contract manufacturers in our China, Japan, Thailand, U.K., and San Jose, California manufacturing facilities. Source: 10-k

Finally, lack of innovation, rapid technological changes, and the emergence of new competitors could significantly reduce the company’s future revenue line. Prices in the industry may also decline because there are too many actors offering the same technologies. As a result, LITE’s FCF margins would also decline.

The markets for our products are characterized by rapid technological change, frequent new product introductions and enhancements, substantial capital investment, changes in customer requirements, continued price pressures and a constantly evolving industry. Historically, these pricing pressures have led to a continued decline of average selling prices across our business. Source: 10-k

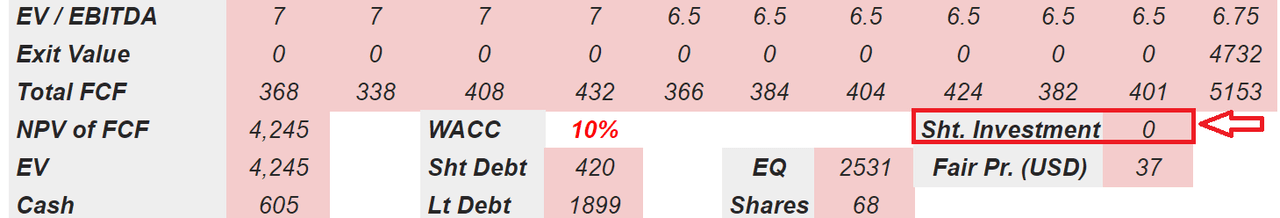

Under the previous conditions, I included sales growth close to 3.5%, which I believe is quite pessimistic. I also assumed an FCF margin close to 15% and 2032 EV/EBITDA close to 6.75x. My results include 2032 net sales close to $2.8 billion and 2032 FCF of around $4.215 million.

Bersit’s DCF Model

The sum of future FCF discounted at 10% implied a NPV of $4.25 billion with an equity valuation of $2.5 billion and a fair price of $37 per share. Let’s note that I tried to be as conservative as possible in this case and didn’t take into account the short-term investments.

Bersit’s DCF Model

My Takeaway

With the recent increase in the need for virtual environments for work, I believe that LITE will likely find significant demand for its products. In my view, LITE’s exposure to the EV battery industry and the new automotive 3D sensing technologies will likely enhance revenue growth. If we also assume successful closure of acquisitions, the fair price could be close to $86 per share. Yes, there are risks because the company’s manufacturing facilities are not in the United States. However, I believe that the stock price could be much higher.

Be the first to comment