JHVEPhoto/iStock Editorial via Getty Images

Introduction

Goldman Sachs likes Automatic Data Processing Inc. (NASDAQ:ADP). I’m not using this fact as clickbait but because it goes well with my own view on dividend growth. Automatic Data Processing – hereafter frequently referred to as “ADP” – offers something for everyone. The stock is a long-term double-digit dividend growth stock with a 2.0% yield, which is decent. Moreover, the company has an extremely healthy balance sheet, a fantastic business model, high free cash flow, a fair valuation, and a history of low-volatility outperformance, which is one of the best things an investor can add to his/her portfolio. This article will walk you through my thoughts and make a case for a dividend growth investment in ADP. So, bear with me!

The Importance Of Dividend Growth

Last month, Goldman Sachs made a list of stocks consisting of stocks with above-average dividend yields, high projected DPS (dividends per share) growth, and moderate payout ratios. The median dividend growth rate on its list was 11%. I referred to the list in the introduction, but you can access it here as well.

Besides the fact that ADP was on that list, I cared about the company’s comments regarding dividend growth:

LTM dividends have not declined year/year outside of a recession in over 60 years,” Kostin said. “Looking ahead, our forecast implies 6.7% CAGR dividend growth over the next ten years, significantly above market pricing of 0.4%.”

“We continue to recommend investors own stocks with high dividend yield and growth,” he added. “Dividend stocks currently trade at attractive valuations and have historically outperformed during periods of elevated inflation.

I know that these comments were made more than a month ago, which means expectations probably have come down a bit. Yet, the core of these comments is still extremely valid.

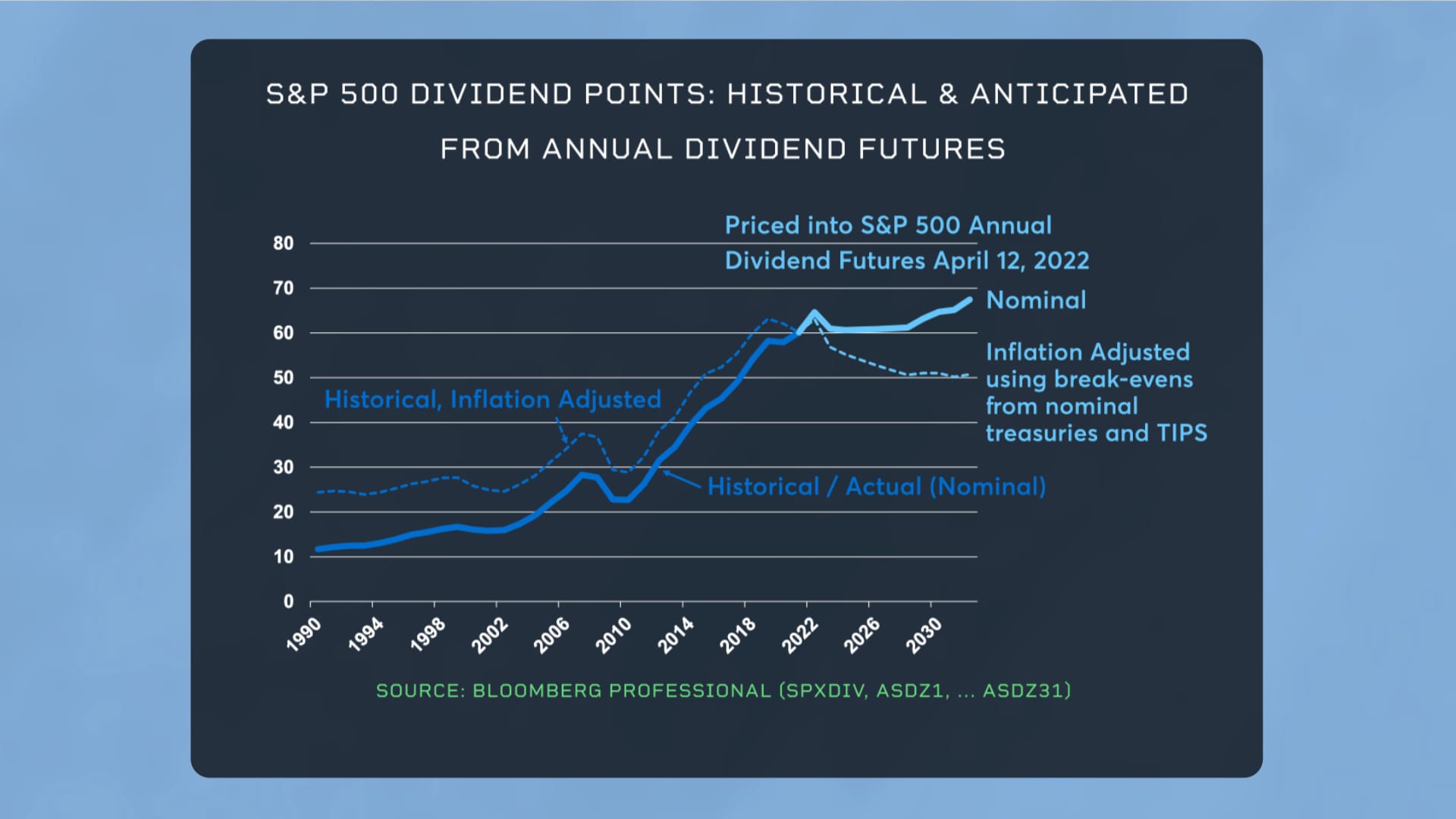

For example, low dividend growth expectations are indeed an issue. In this case, Goldman Sachs mentioned 0.4% dividend growth expectations. The graph below displays CME Group’s (CME) S&P 500 Annual Dividend Futures, which predict a significant slowdown in nominal dividend growth beyond 2030 (the light-blue line). When adding inflation expectations (nominal inflation-protected bonds), we end up with the first (expected) longer-term decline in real dividend growth in decades.

CME Group

As I’ve said in other articles, these numbers are prone to change. If the economy improves, these expectations will come up. However, for now, we can assume that dividend growth will indeed remain an issue based on slower economic growth, or as CME puts it:

In short, rising producer prices, wages and interest rates combined with slowing growth in consumer spending and investment, appear to have made investors pessimistic about future dividend growth.

In other words, while I’m a dividend growth investor in general, I believe that in these times, it’s very important to focus on strong companies that can deliver strong dividend growth to offset long-term inflation.

Now, before I give you ADP’s numbers, let me quickly discuss another theme that applies to ADP: low volatility.

Low Volatility

On June 6, I wrote an article covering Microsoft Corporation (MSFT) based on the importance of dividend growth and low volatility investing. I highly recommend reading the first part, which covers the details of dividend growth and volatility investing – even if you don’t care about Microsoft.

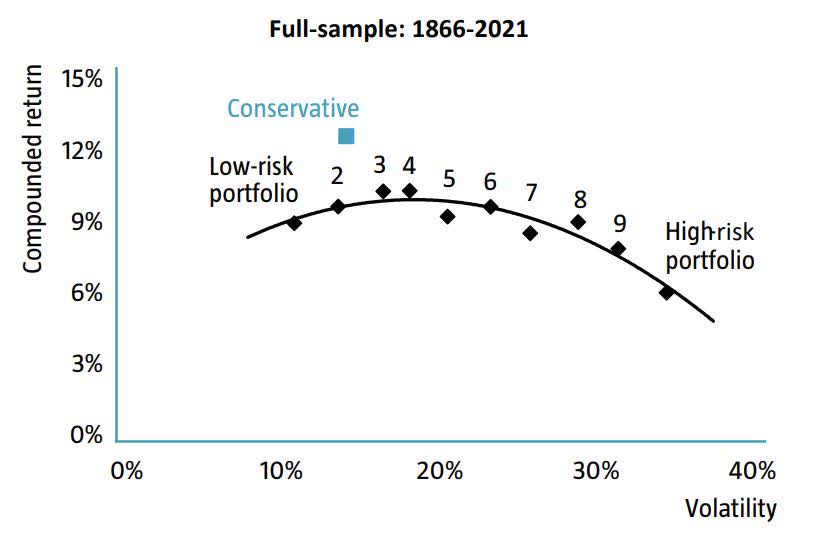

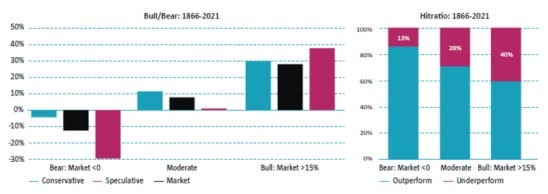

One of the charts I used in that article is the one below, which shows that the riskier a portfolio, the lower the compounded return in the long term. In this case, the risk is defined as volatility.

ROBECO

In general, one would say that this does not make sense. After all, investors want to be rewarded for taking higher risks – meaning outperforming capital gains. However, that’s not what history tells us. The graph below (my apologies for the bad quality) displays that conservative (low volatility) stocks outperform both the market and speculative stocks during bear markets and “moderate” markets. They tend to underperform speculative stocks during bull markets. However, downside protection is all that matters.

ROBECO

Automatic Data Processing has both high dividend growth and subdued volatility.

Automatic Data Processing – Low Volatility Outperformance

ADP is truly an impressive company. Founded in 1949, the company is still one of America’s most trusted dividend growth stocks. This company operating in the staffing & employment services industry is a leader in Human Capital Management (“HCM”) software and solutions.

The basic idea of this $86.6 billion market cap company was (and still is) to help clients focus on their business by freeing them up from certain non-core tasks like payroll. Today, the company has more than 900,000 clients in 140 countries, covering more than 38 million paid employees.

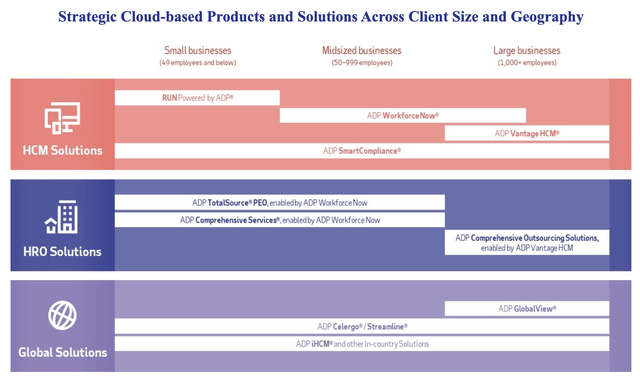

The company has two reportable business segments that cover HCM Solutions, HRO Solutions, and Global Solutions.

Automatic Data Processing

According to the company:

Employer Services. Our Employer Services segment serves clients ranging from single-employee small businesses to large enterprises with tens of thousands of employees around the world, offering a comprehensive range of technology-based HCM solutions, including our strategic, cloud-based platforms, and HRO (other than PEO) solutions. These solutions address critical client needs and include: Payroll Services, Benefits Administration, Talent Management, HR Management, Workforce Management, Compliance Services, Insurance Services and Retirement Services.

Professional Employer Organization. Our PEO business, called ADP TotalSource®, provides clients with comprehensive employment administration outsourcing solutions through a relationship in which employees who work for a client (referred to as “worksite employees”) are co-employed by us and the client.

One of the key benefits is the fact that the company sees a $150 billion total addressable market, which is growing at 5-6% per year. The company expects to exploit this market better than its peers as it sees 7% to 8% long-term organic revenue growth leading to 10% to 12% adjusted annual EBIT growth. EPS growth is expected to be 11% to 13% based on 1% annual net share buybacks. When adding the company’s 2% yield, this should, technically, result in 13% to 15% annual total shareholder returns.

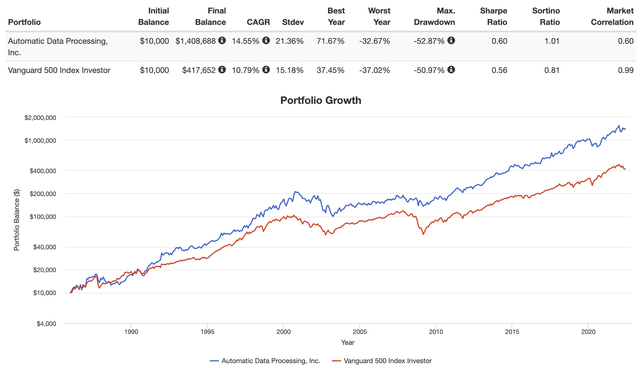

When adding the company’s solid business model, we get a stellar performance since 1985 that brings us low volatility outperformance. Since 1985, the stock has returned 14.6% per year, including dividends. This is almost 400 basis points above the S&P 500. The good news is that the standard deviation is just 21.4%, with the worst year being better than the S&P 500’s worst year. The max drawdown was just barely worse than the S&P 500’s worst drawdown. Be aware that we’re comparing a single stock to a basket of 500 stocks. These numbers are really impressive and it results in a higher volatility-adjusted performance versus the S&P 500 (higher Sharpe ratio).

Portfolio Visualizer

Additionally, if we go back just 5 years, not a lot has changed. ADP is still returning 19.4% per year (S&P 500 13.2%) with a standard deviation of 22.5% (16.4% S&P 500).

With that said, the company’s capital allocation plans are very transparent and clear.

- Organic reinvestment. The company is looking to invest roughly $1 billion in Systems Development & Programming, boosting innovation R&D by 10% per year between FY2018 and FY2021. This is one of the reasons why the company remains at the top of its game, leading to outperforming sales growth rates as I already briefly discussed. The company also invests in a bigger salesforce, more efficient marketing, and related services.

- M&A. The company is constantly looking for acquired growth. In FY2018, the company invested $615 million to acquire Global Cash Card and WorkMarket. In FY2019, the company bought Celergo for $120 million.

- Shareholder cash returns. After organic growth and M&A opportunities have been taken care of, it’s time to reward the shareholder. However, instead of giving you the details here. I’m going to dedicate the next segment to shareholder returns.

The Dividend (Shareholder Returns)

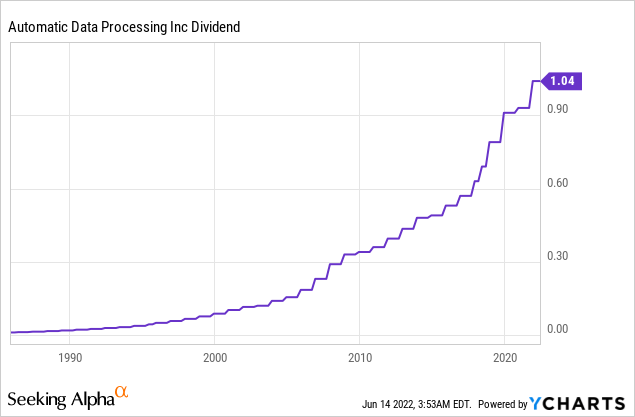

ADP targets a dividend payout ratio of 55-60%. The company has raised dividends for 47 consecutive years. In other words, the company is three hikes/years away from “Dividend King” status.

Moreover, the company uses buybacks to return additional cash. Over the past 10 years, the company has repurchased roughly 1% of its shares per year, which really adds up over time. It also supports earnings per share, hence rewarding shareholders indirectly.

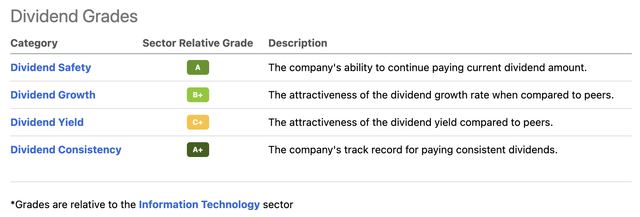

Adding to that, the company has a very good-looking dividend scorecard. This table provided by Seeking Alpha compares certain (financial) numbers and ratios to its sector peers; in this case, information technology. The company obviously scores high on consistency. However, it also scores high on safety and growth, which are related issues.

Seeking Alpha

Why are these issues related? Because the company has high free cash flow (high safety) and management that’s willing to distribute excess cash to shareholders (growth).

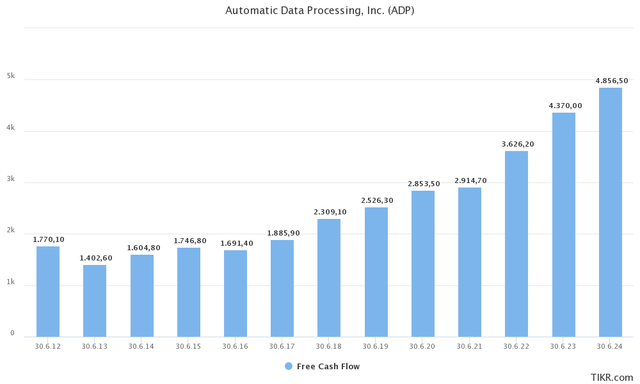

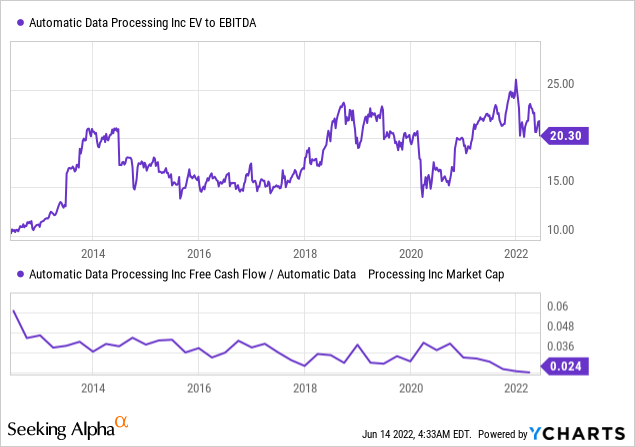

Between FY2012 and FY2024E, the company is growing FCF by 8.0% per year, which is remarkable. In Its FY2023, the company is set to do $4.4 billion in FCF. This would translate to an implied free cash flow yield of 5.1% using the company’s $86.6 billion market cap.

TIKR.com

In FY2024, the implied FCF yield could be 5.7%.

What these numbers mean is that there’s a lot of cash left after investing in the business (FCF is after CapEx and operational costs) and distributing cash to shareholders.

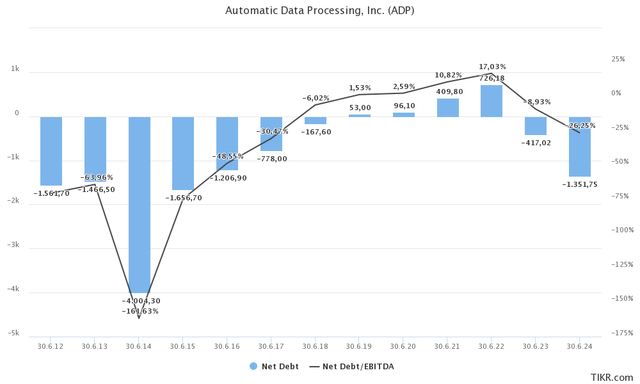

If we assume a 5.1% implied FCF yield, we can deduct a 2.0% dividend yield and 1.0% buybacks, which gives us 2.1% in excess cash. This means the company’s balance sheet is increasingly healthy. This fiscal year, the company is expected to end up with $726 million in net debt (gross debt minus cash). that is less than 0.2x EBITDA. Next year, net debt is expected to turn into net cash. The same happened prior to FY2019. Back then, the company engaged in M&A, which caused debt to soar. I assume the company will do the same in the years ahead if it finds suitable targets.

TIKR.com

These numbers also support high dividend growth.

Over the past 10 years, the average annual dividend growth is 11.5%, which is decent. The 5-year average is 12.6%. On November 10, 2021, the company hiked by 12.0%, which means the double-digit growth streak is not in danger.

So, what about the valuation?

ADP Stock Valuation

The current market environment is vicious. The S&P 500 is once again in a bear market. Personally, I haven’t been worried for a second. Most people know by now that I have 95% of my net worth invested in my dividend growth portfolio. While I’m also “suffering”, I trust my research and the fact that I focus on quality companies. They will do well as soon as the market rebounds.

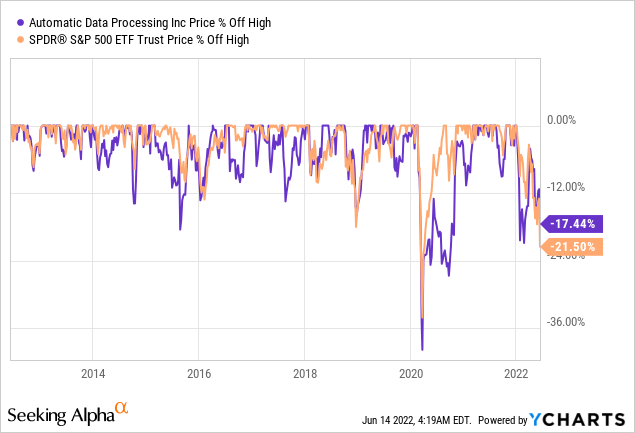

ADP is down 17.4% from its all-time high, which means it’s doing better than the S&P 500 – related to my low-volatility comments in the first half of this article.

The company’s equity is valued at $86.6 billion. When adding $420 million in expected FY2023 net cash, we end up with an enterprise value of $86.2 billion. That’s 18.3x FY2023 EBITDA. Using FY2024 numbers ($1.4 billion net cash, $5.15 billion EBITDA) gives us a multiple of 16.6x.

16.6x FY2024 EBITDA isn’t “cheap” by any means. However, the implied FY2023 FCF yield of 5.1% I calculated in this article is high. It’s one of the highest it has been over the past 10 years. This means that shareholders are not overpaying for cash, which is key in dividend growth investing. Moreover, double-digit long-term EBITDA growth justifies paying close to 15x longer-term EBITDA.

So, how would I deal with ADP?

Takeaway

Goldman Sachs likes ADP because of the dividend growth it brings to the table. In this article, I looked at it from my own point of view, and I have to admit, ADP does indeed offer tremendous value.

ADP offers everything I like in a dividend stock. The company has a long history, but its business portfolio is up-to-date, catering to modern business needs related to efficient operations.

The company aggressively invests in organic and acquired growth, which comes with high (expected) outperforming sales growth and double-digit EBITDA and net income growth.

This fuels an already juicy free cash flow yield used to maintain 47 years of consecutive dividend growth and long-term buybacks. The company’s dividend growth rate is back in double-digit territory, with a dividend yield of 2.0%, which is a good basis to achieve long-term total return outperformance.

Since 1985, the company has not only outperformed the market by a wide margin, but it has also done it without exposing investors to high volatility. This is the key to long-term wealth generation.

The valuation does not scream “deep value”, however, it’s fair given the circumstances.

Given the volatility and uncertainty of the stock market, I advise new investors to break up their initial ADP investment. For example, buying 25% now and adding gradually over time to reduce entry risk. If the stock continues to fall, investors can average down. If the stock suddenly takes off, investors have a foot in the door.

(Dis)agree? Let me know in the comments!

Be the first to comment