PhonlamaiPhoto/iStock via Getty Images

Autoliv, Inc. (NYSE:ALV) is the world’s largest supplier of automotive safety systems. The company designs, produces, and supplies passive safety systems such as airbags, steering wheels, and seatbelts to the automotive industry. The company was founded in 1953 and is headquartered in Sweden. Today, we are going deep into Autoliv based on the fact that the company pop-up in our latest screening based on a higher dividend yield and a lower P/E ratio compared to its peers.

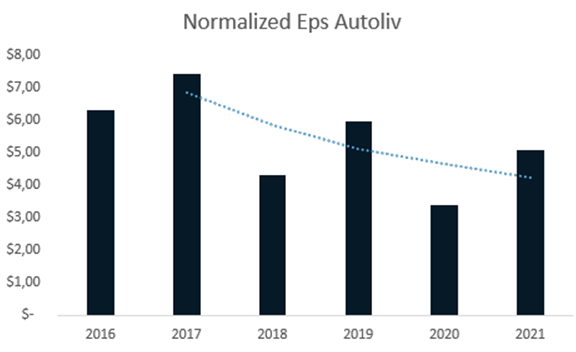

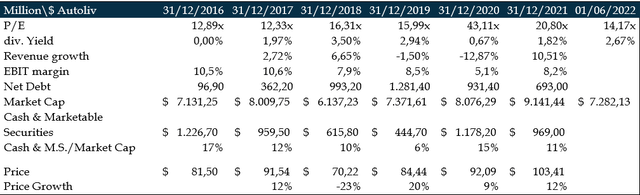

During the last 5 years and after having normalized the EPS, we see that the ratio has continued to deteriorate.

Mare Evidence Lab analysis

Given the automotive cycle maturity, this is unsurprising. But what about the future then?

What we really like about Autoliv is its quality and dominant position in the market for safety (this is evident from the $203 million fine paid in Europe for anti-competitive behavior). These were not exactly peanuts, but it is a testament to product quality and high barriers to entry in the business. In 2018, GM also awarded Autoliv as a top supplier, even though the company had to recall some airbags for problems due to “a deviation in airbag inflator initiator generant mix ratio.” which was caused by moisture and heat. We have to say though that Autoliv made mostly “precautionary recalls” whereas other players like the defunct Takata have gone bankrupt due to lawsuits for defective products.

Moreover; if we are going to a car dealer, car delivery is up to a year from now. Automotive car manufacturers need once again to build up inventories to speed up production (we suggest reading this article from the Economist).

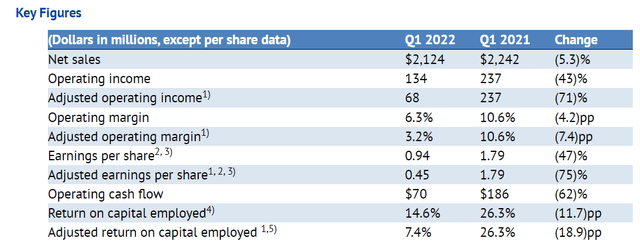

Compared to a few competitors like ZF (German private company), Joyson (Chinese), and Hyundai Mobis (Korean), we clearly see that on average Autoliv has a cost advantage, though it is also true that Autoliv has lower revenue generation. However; in the last Q1 report, we see a significant decline in marginality. First-quarter adjusted EPS was at $0.45, very much below Wall Street analyst expectation of $1. Adjusted operating margin significantly dropped to 3.2% – guidance consensus was at a 6% range. This was due to raw material price increases and higher freight costs. The only positive note was top-line sales which were just down by 1% with a positive performance compared to the whole sector. Autoliv has always had a competitive advantage but management is guiding for a soft Q1 too. We were not surprised, Europe is the hardest hit with car production significantly down, in this specific environment, our internal team have a preference on premium OEMs, where companies have the ability to increase price over volume constraint. Based on the three-month account and ahead of the Q2 results, our internal team lowered the 2022/2023 EPS estimates to $3.60 and $8 from $6 and $9.

Conclusion

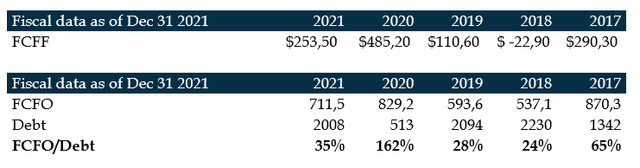

With the ongoing war in Ukraine that has particularly impacted OEM production in Europe and the inflationary pressure at global level, our internal team has lowered 2022 company’s guidance. What we like about the company is its quality and innovation and the market in which Autoliv operates (and the positive track record). We’ve computed the FCFF and the debt coverage and what emerges is that, while the company is liquid, its ratios are not outstanding and do not provide a very solid ground for a stable growing dividend as we like to see.

There are also two main concerns: margin recovery and sales growth. Management is negotiating to raise prices for H2 and still expects a bad Q2 – Q1 FCF was negative and stood at $42 million. Based on management guidance, we lowered the EPS estimate and we derive a target price of $70 per share based on the adj. EPS of 2022/2023.

Be the first to comment