Australian Dollar Talking Points

AUD/USD struggles to recover from the flash crash as COVID-19 puts pressure on the Reserve Bank of Australia (RBA) to implement lower interest rates, and the exchange rate may face a more bearish fate as the outbreak curbs the growth outlook for the Asia/Pacific region.

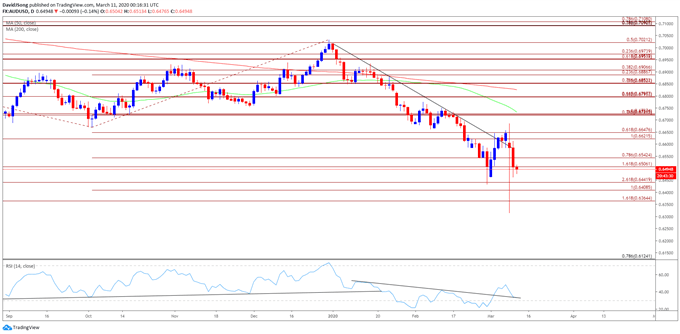

AUD/USD Outlook Clouded with Mixed RSI Signal Following Flash Crash

AUD/USD crashed to a fresh yearly low (0.6314) as the coronavirus shows no signs of slowing down, and the ongoing shock to the global supply chain may continue to drag on the Australian Dollar as the International Monetary Fund (IMF) warns that “authorities should be ready for a coordinated response, including using fiscal stimulus jointly with both conventional and unconventional monetary policy measures.”

The IMF insists that that the RBA’s “main policy options would include quantitative easing through purchases of government debt securities, mildly negative policy rates, and targeted conditional lending operations to banks,” but went onto say that “negative interest rates would be a very unlikely choice, as they were generally not seen as effective in Australia’s context.”

In turn, the RBA looks poised to cut the official cash rate (OCR) to the effective lower bound (ELB) of 0.25% at the next meeting on April 7 especially as the ASX 30 Day Interbank Cash Rate Futures reflect a 100% probability for a rate cut.

It remains to be seen if lower interest rates along with unconventional monetary tools will stave off a recession as Treasurer Josh Frydenberg pledges to announce a fiscal stimulus program over the coming days, but the weakening outlook for the Asia/Pacific region may continue to drag on the Australian Dollar as the IMF emphasizes that “Australia is especially exposed to a deeper-than-expected downturn in China.”

With that said, the Australian Dollar may face headwinds ahead of the next RBA meeting, but recent price action instills a mixed outlook for AUD/USD as the Relative Strength Index (RSI) deviates with price and breaks out of the bearish formation from earlier this year.

Recommended by David Song

Forex for Beginners

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss potential trade setups.

AUD/USD Rate Daily Chart

Source: Trading View

- Keep in mind, the monthly opening range has been a key dynamic for AUD/USD in the fourth quarter of 2019 as the exchange rate carved a major low on October 2, with the high for November occurring during the first full week of the month, while the low for December materialized on the first day of the month.

- The opening range for 2020 showed a similar scenario as AUD/USD marked the high of the month on January 2, with the exchange rate carving the February high during the first week of the month.

- However, the flash crash has made the opening range for March less relevant, with the Relative Strength Index (RSI) offering a mixed outlook for AUD/USD as the oscillator deviates with price and breaks out of the downward trend from earlier this year.

- Lack of momentum to close below the Fibonacci overlap around 0.6410 (100% expansion) to 0.6440 (261.8% expansion) may produce range bound conditions as the rebound from the start of the month fails to produce a closing price above the 0.6620 (100% expansion) to 0.6660 (38.2% retracement) region.

Recommended by David Song

Traits of Successful Traders

— Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong

Be the first to comment