DKosig

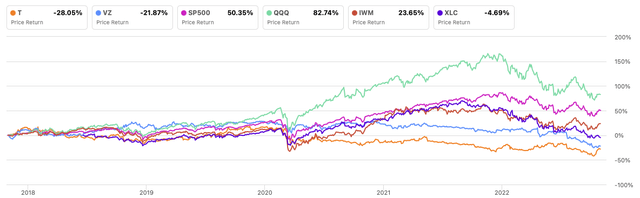

The communication services sector is the worst performer in the past year, losing close to 40% of its value, and is seemingly still in difficulty as the sector is reportedly a laggard also in the past few months, while other sectors have begun to perform relatively better. The telecom services industry, despite it having been more resilient from a yearly perspective, is recently among the major losers of the group. The industry is characterized by high market barriers in terms of investments in infrastructure, marketing expenses, and customer care, as well as stringent government regulations and restricted licenses, very low switching costs with a homogeneous offer among a rather saturated market, and consequent higher buyer power, but globally a relatively higher price-inelasticity of the demand, as those services are considered part of a modern living and became necessary in both the private and professional life.

finviz

finviz

The two selected companies are the largest telecommunication providers worldwide in terms of revenue, and the market leaders in the US. Based on the transmission type, in 2021 the telecom service market was estimated to generate 76% of its revenue from wireless services, while 24% from wireline services. AT&T (NYSE:T) is leading the mobile services market in the US, with 44.1% market share of wireless subscriptions in Q2 2022, followed by Verizon Communications (NYSE:VZ) with 31% and T-Mobile US (NASDAQ:TMUS) with 23.9%.

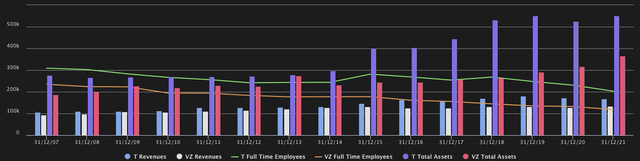

Author, using TIKR

The global telecommunication market is forecasted to grow at a 5.1% Compound Annual Growth Rate [CAGR] through 2031, while North America, Europe, and the Asia Pacific region are contributing a combined 70% of the actual market size of approximately $1,700B, the LAMEA region is projected to lead the growth with 6.4% CAGR over the estimation period. The sustained market growth is driven by the overall rise in mobile data traffic, the broad adoption and development of cloud computing and its related applications, the development of 5G networks and high-speed fiber optics deployment, as well as the mass adoption of the Internet of Things (IoT), the development of smart cities, and the greater integration and acceptance of Artificial Intelligence [AI] and Machine Learning [ML]. While the markets in India, China, and Indonesia are mostly growing by increasing the market penetration of telecommunications users, consequently establishing Asia Pacific as the dominant region for the forecasted period, rapid technological developments are driving the market expansion in North America and Europe.

An in-depth company comparison

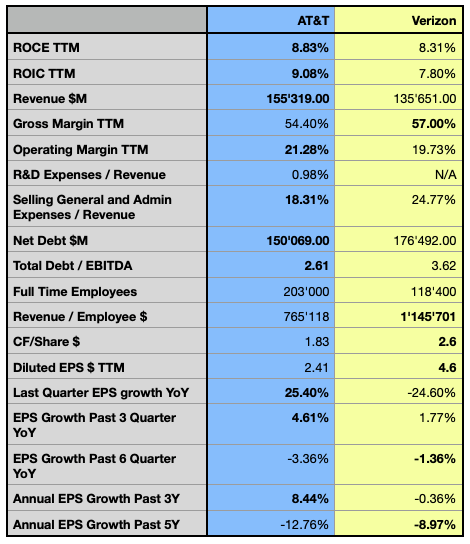

Author, using data from S&P Capital IQ

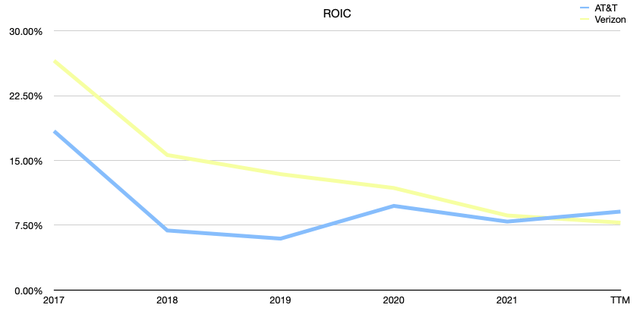

The financial comparison highlights major similarities but also some differences between the two telecommunication giants. In terms of their Return on Invested Capital [ROIC], a very important metric I consider when pondering an investment decision, as a company must be able to consistently create value to be a sustainable investment, AT&T seems to gradually increase its capital allocation efficiency over the past few years after a massive drop in 2018 in the wake of the merger with Time Warner. Although Verizon has been more efficient in the past, the metric has been continuously declining, until recently dropping under the competitor’s level. Both companies, while having a similar efficient core business, demonstrate also having quite efficient cash management, observed in the relatively narrow spread between their ROIC and the Return on Capital Employed (ROCE) with both companies reportedly owning a similar cash position of $2.4B by AT&T and $2.1B by its peer. As we will see later, both companies’ ROIC is at risk of being lower than their Weighted Average Cost of Capital [WACC], a rather alarming sign, as that would mean that the companies would seemingly destroy value for their investors instead of building it. Verizon has seemingly a higher exposure to this risk, which I estimate at 90% in my modelization, while I consider it at 40% for AT&T.

Author, using data from S&P Capital IQ

Although reporting a stagnation of this metric from 1.16% CAGR in the past 5 years to 0.06% CAGR in the past 3 years, Verizon reports a better gross margin. AT&T’s gross margin growth decelerated from 0.40% CAGR in the past 5 years to -4.54% CAGR in the past 3 years, as its pricing power is seemingly more impacted by the recent events, while also in the past 10 years, the company reported a lower gross margin than its competitor. On the operational side, the companies have different profiles, as AT&T demonstrated being capable of increasing its operational profitability by 6% CAGR in the past 3 years, while Verizon’s operating margin growth is decelerating by 3.67% CAGR over the same period.

Author, using data from S&P Capital IQ

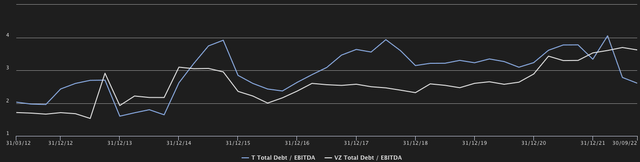

Verizon reportedly has a more cash-rich business than the analyzed peer, reporting also a better dividend payout profile, with its dividend yield seen at 6.93% and 2,07% CAGR over the past five years, while T’s dividend yields 6.01% with -3.71% CAGR over the same period. Verizon also reports significantly higher EPS, while in those terms, AT&T has had a more positive development over the most recent quarters and the past few years. Both companies are massively relying on debt for sustaining their business as their industry is highly capital-intensive, with AT&T only recently offering a better picture in those terms, as it reported a leverage of 2.61x compared to Verizon’s metric standing at 3.62x, still far from its announced target for 2025 at 1.75-2.0x, while in the past few years the latter reported overall a lower leverage ratio.

Author, using TIKR

The stocks’ performance

Considering both stocks’ performance in the past 5 years, T reported a loss of 28.05%, while VZ performed slightly better but still lost 21.87% over the analyzed period. Both stocks significantly underperformed all most significant references, with the S&P 500 (SP500) returning approximately 50%, and the Nasdaq technology index, tracked by the Invesco QQQ ETF (QQQ) marked almost 83% performance, while even the broader market reference tracked by the iShares Russell 2000 ETF (IWM) performed significantly better. Despite reporting a negative performance as well, the more specific Communication Services Select Sector SPDR Fund (XLC), could overall establish itself much better than the two industry leaders.

Author, using SeekingAlpha.com

Both stocks have suffered from consistent relative weakness in the past few years, with AT&T being particularly weak, while Verizon has been more resilient, and could report more periods of relative strength. Despite that, in the last few months, the two stocks seem to diverge, and T is seemingly building significant relative strength, while VZ is still suffering from an extended sell-off. In the next section, I will show how the next few years are forecasted to play out for both companies and if the actual stock price may offer a better opportunity, while also assessing the possible risks in different scenarios.

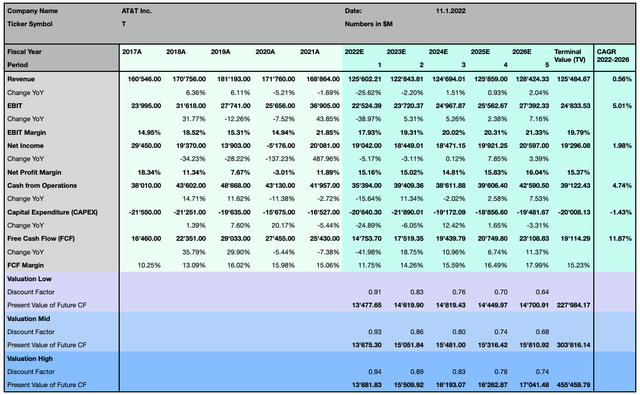

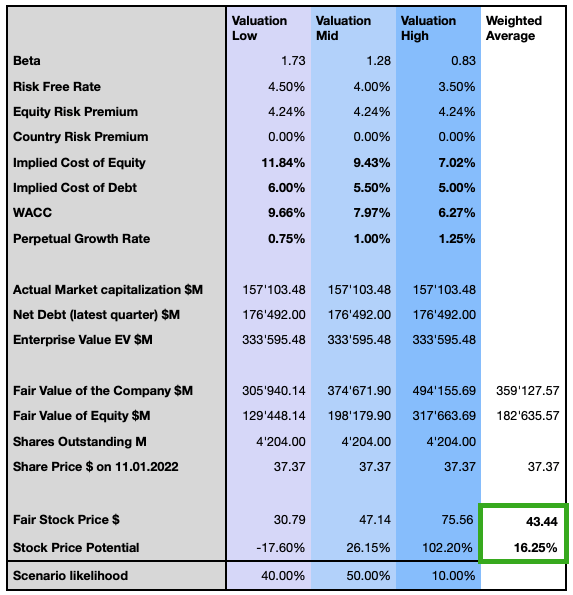

Valuation

To determine the actual fair value for both company’s stock prices, I rely on the following Discounted Cash Flow [DCF] model, which extends over a forecast period of 5 years with 3 different sets of assumptions ranging from a more conservative to a more optimistic scenario, based on the metrics determining the WACC and the terminal value. As forecasted by the street consensus, AT&T is anticipated to generate a significant 11.87% Free Cash Flow [FCF] CAGR over the coming 5 years, with slightly increasing operating profitability at 5.01% CAGR, while its net profit and revenue are projected to expand even slower at respectively 1.98% and 0.56% CAGR.

Author, using data from S&P Capital IQ

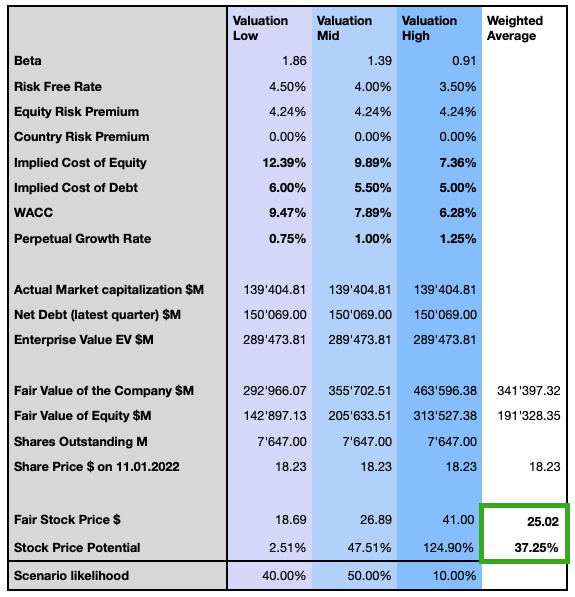

The valuation takes into account a tighter monetary policy, which will undeniably be a reality in many economies worldwide in the coming years and lead to a higher weighted average cost of capital.

Author

I compute my opinion in terms of likelihood for the three different scenarios, and I, therefore, consider the stock to be significantly undervalued with a weighted average price target with about 37% upside potential at $25.

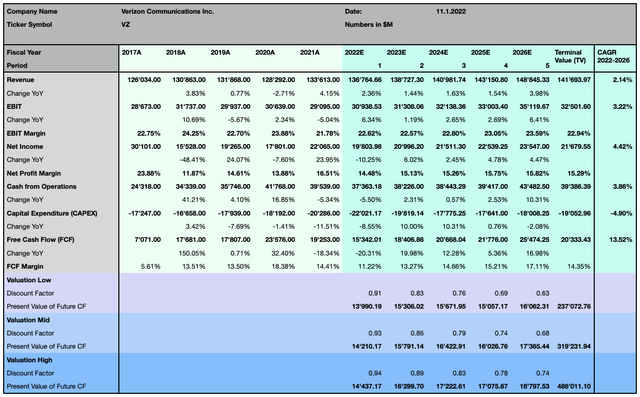

Verizon is forecasted to expand slightly faster, with its sales growing at 2.14% CAGR over the next 5 years, and its FCF is seen expanding at 13.52% CAGR. Its net income is expected to average around the same levels as the analyzed peer, while in terms of operating margin, the company is overall expected to perform better.

Author, using data from S&P Capital IQ

I then consider the same three scenarios affected by the company’s fundamentals and by the exogenous factors.

Author

When considering the weighted average price target, the two modelizations suggest that AT&T’s stock may offer a higher expected return, while Verizon’s expected stock performance is seen as 16% higher than the latest closing price, or at about $43.45. VZ’s modelization emphasizes also the risk of a significantly lower return in the less optimistic scenario.

Investors should consider that those forecasts are based on a relatively conservative assumption in terms of perpetual growth rates, higher discount rates, and the recent trend in increased interest rates, which reflects the actual situation and forecast possible scenarios. An inversion of this trend would change this perspective and value the company at a higher price.

Outlook and Risk discussion

Both companies have great opportunities ahead, quantified by an estimated $460B total addressable market [TAM] by Verizon, an increase of $120B from 2021 with $30B seen as an opportunity by 2025, mostly coming from the development of private networks, edge computing, and increasing demand in enterprise solutions. AT&T is greatly capturing opportunities in the field of fiber and 5G transformation, as the demand for bandwidth continues to accelerate, not only among consumers but increasingly from businesses, with the company quantifying the upcoming set of verticals with $20B addressable TAM by 2026 generated by next-generation factories, a massive increase in telehealth usage, while the company is positioning itself as the market leader in the EV and autonomous cars industry transformation with a market share of over 80% in the transition to connected cars.

The industry is highly capital-intensive, and investments in future-oriented growth vectors are of primary importance for companies in order to maintain their competitiveness and achieve their goals. Their capital structure is highly dependent on debt, and despite most of it being denominated in USD at fixed rates, increasing interest rates can impact their credit facilities. The high dependence on the US as a single market exposes the companies to a major risk in terms of economic downturn and country-specific policies or regulations. Other than through a major international acquisition, I don’t see the companies significantly penetrating other regions, as the most relevant markets are already covered by strong local players.

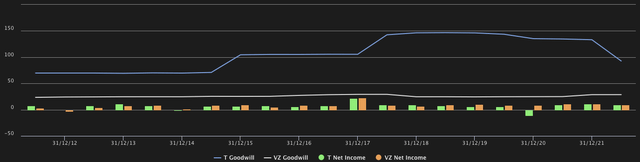

Both companies carry significant goodwill in their balance sheet, while AT&T bears the highest risk in those terms, even though the company recently divested its entertainment business Warner Media. The risk of a possible future meaningful impact on the profitability of the companies has to be considered.

Author, using TIKR

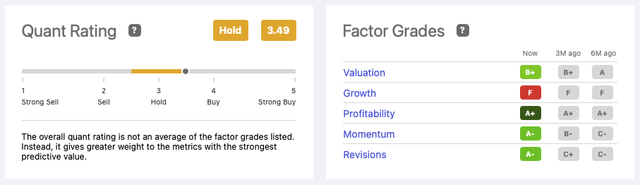

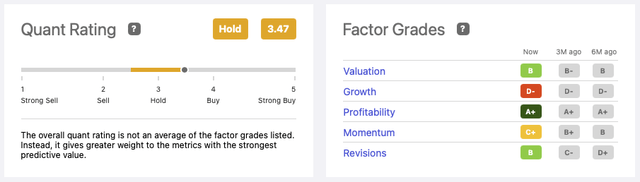

Both companies are rated with a Hold rating from Seeking Alpha’s Quant Rating, while AT&T with a score of 3.49 has an overall higher ranking in the industry, in fourth position, while Verizon with a score of 3.47 is ranked in position six.

SeekingAlpha.com

As we already saw in the paragraphs before, both companies’ Achilles’ heel is their future growth, which is at risk of stagnation if not supported by sustained capital expenditures and the companies’ ability to substantially generate FCF in an increasingly capital-intense market.

SeekingAlpha.com

The Verdict: Which stock is the better buy?

The two analyzed companies are two leaders in the telecommunication service industry, with their respective strengths and weaknesses, but also offering inherent opportunities with their correlated risks. From an investor’s point of view, it’s important to consider the company’s ability to create value for its shareholders, while minimizing the risks. Past performance is not a guarantee for future results, and despite VZ overall performing better than its competitor in the past few years, it seems that its actual stock is priced more fairly than T’s. The rather conservative modelization hints at a greater potential for AT&T, as the company will also seemingly be capable of increasing its operational profitability, optimizing its capital efficiency, and reducing its risk exposure in terms of goodwill while carrying less financial leverage. Both companies offer an interesting dividend payout profile, while in those terms Verizon seems to perform better. Overall I consider AT&T’s actual fundamental profile showing more improvements and I expect the company to perform better in the future, estimating its fair price at $25 with an upside potential of 37%, as its massive investments and the recent step to disinvest its entertainment segment and focus on its core business, will likely show significant results in the coming few years. Despite both companies offering a rather positive profile for investors in the telecommunication services industry, I consider AT&T to be my favorite stock pick among the two analyzed companies.

Be the first to comment