DNY59/E+ via Getty Images

Co-produced by Mark Roussin for High Yield Investor

For years, AT&T Inc. (NYSE:T) has been a position found in many retirees’ portfolios. However, after numerous acquisition missteps that have not added value and instead just added debt, the company has fallen out of favor for many investors.

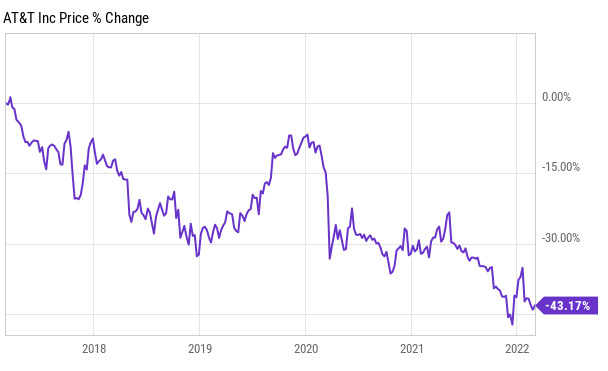

Over the past five years, shares of AT&T have fallen over 40%:

AT&T is a dying stock (YCharts)

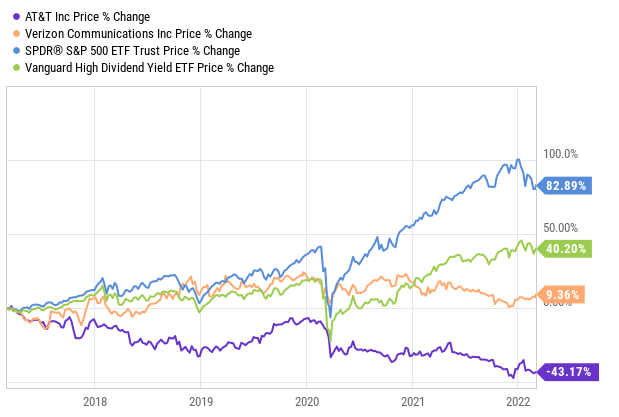

For comparable purposes, shares of competitor Verizon (VZ) have climbed 9% with the great S&P 500 (SPY) climbing over 80% over the same time frame. AT&T has long been a high-yield dividend stock, having a yield that has long hovered north of 6%. The Vanguard High Dividend Yield ETF (VYM) has climbed 40% over the past five years.

AT&T is a huge underperformer (YCharts)

All this goes to show you that AT&T has been a laggard, and that is putting it politely. The question now is, where does the stock go from here?

AT&T – From Failed Acquisitions To Spin-Offs

In early February 2022, the company announced more details into how they would “spin-off WarnerMedia in a $43 billion transaction to merge its media properties with Discovery and also cut its dividend by nearly half.”

The company has made a number of acquisitions over the years that have failed to add value to the business. As an example, the company acquired DIRECTV for $67 billion in 2015 right before streaming started to take shape.

As more and more companies came out with streaming platforms, the legacy satellite operator was being left in the dust. Consumers found that streaming was a way to build a package that was cheaper and only for what they wanted.

Nowadays, when it seems like every media company under the sun has a streaming app, you have to wonder if consumers are saving money. I know plenty of people that have subscriptions to the following: Sling TV, Prime (AMZN), Disney+ (DIS), Netflix (NFLX), Paramount+ (PARA), HBO Max, Peacock, and more. All those together can really add up.

Streaming is very competitive (Netflix)

In 2017, AT&T again made another media acquisition when it bought Time Warner for $107 billion (including debt), adding massive amounts of debt in just two years between the acquisitions. Since purchasing Time Warner, the company has quickly noticed it messed up and has been fighting to get some sort of return back. The company has sold off WarnerMedia assets such as real estate, its stake in Hulu, and some European businesses for a total of $5 billion.

And now we are here, AT&T will be spinning off WarnerMedia, in which current AT&T shareholders will still own 71% of the new company, which will be called Warner Bros. Discovery. For each AT&T share you own, you will receive 0.24 shares of the new company.

AT&T shareholders will also be seeing their dividend income cut as well once the transaction closes. Currency, shares of T pay an annual dividend of $2.08 per share and that will be dropping to $1.11 post-spin-off. This is very unfortunate, especially for retirees that enjoyed receiving their quarterly dividend payments.

However, the company is hoping that the transaction will allow them to get back to their roots of focusing on their wireless network business. This has been the gripe with me over the years when it comes to AT&T. I had owned shares for a while but started losing faith in the management team and their vision for the business, which led me to sell my shares prior to this transaction being announced. Looking back, I guess I can say I got a bit lucky having sold shares around $31.50 (Mark Roussin).

Legacy AT&T Vs. Warner Bros. Discovery – Which Company Has More Upside?

Now that the company is splitting up its assets, as an investor, it makes you wonder which of the two companies will provide more upside for investors. On one end, you have legacy AT&T returning to focus more on its bread and butter, which is more focused on wireless and data. Then, on the other end, you have the new Warner Bros. Discovery that will be this new media player flush with some great content.

AT&T is splitting assets into two companies (WarnerMedia)

As you can see in the image above, the new company has some great offerings along with all the rights that are packed in with HBO Max.

DC Comics is one of those rights and they recently released into theaters The Batman, which has been wildly successful across the globe. After two weeks of being out in theaters, the film has grossed over $250 million here in the States and over $500 million worldwide.

However, although the new company will have some great content, it will also have a large debt impact. One of the biggest concerns with AT&T over the years has been the failed acquisitions they have made have led to large amounts of debt. When the deal closes, it is expected that a huge chunk of that will be passed over to the new Warner Bros. Discovery company.

Undoubtedly, given the content libraries that are joining forces within the new company, growth is well within reach, but the big question will be how quickly the company can grow to lower the debt levels. As we have seen with the likes of Netflix and Disney+, the dollars that will need to be invested in future content certainly add up in a big way, so the new company has a tall task in front of them to perform.

HBO Max alone got a slow start in the streaming space, although HBO GO was already running, but nonetheless, competition is extremely fierce in the space with the likes of Netflix and Disney+ leading the way.

On the other side, we have AT&T turning its focus back away from the media and entertainment side of things. Over the years, one thing cannot be denied and that is the fact that A&T is a cash flow generating machine. Although cash flow has been strong, sky-high debt combined with a sizable dividend payment and failed acquisitions has got us to where we are now. We have a spin-off of the media assets and a cut to the dividend.

In terms of debt, the company reported $178.6 billion in total debt at the close of 2021, which was offset by $21.2 billion of cash.

In terms of cash flow, the company generated $25.4 billion of free cash flow in 2021, which will be needed based on the capital expenditures the company is planning in the next few years. The company discussed in their investor day their plan to continue investing in 5G and fiber broadband.

When it comes to the dividend, prior to the dividend cut, the company was essentially financing its large dividend payout and was pretty much forced to cut the dividend that so many have come to love, but it was a necessary move.

There is no question that AT&T will grow at a slower pace, but management has put together a plan to invest now to attain future growth. However, it gives me pause to see the numbers the company is planning to spend after seeing how they have “reinvested” dollars in years past, which have failed on nearly every level.

Management has been tough to rely on and with an inflated balance sheet, high debt, and large capex planned, they will need to prove the turnaround to gain investors’ trust back.

Investor Takeaway

When it comes to AT&T, the question is not whether or not the stock is trading at a cheap valuation or not, it is whether company management can set out a realistic plan that they can execute all while adding shareholder value.

Closing the transaction for WarnerMedia will lighten the debt load on AT&T’s books, which is a good start, and they are expected to have a debt to EBITDA ratio of 2.5x by the end of 2023.

Once the transaction closes, AT&T shareholders will see their annual dividend go from $2.08 per share down to $1.11 per share, which will aid in the planned capital expenditure plans the company has to invest in broadband and 5G expansion.

With the planned 5G investment, company management believes their network will cover 200 million people in the US by the end of 2023. In terms of broadband, they expect to reach 30 million customers by the end of 2025.

After the company’s investor day, analysts cheered the company with notes such as:

- Morgan Stanley: “AT&T is one of the best values in our coverage universe with a pro forma dividend yield of over 6% (at a 40% payout ratio), a double-digit free cash flow yield.”

- Citi: “We believe AT&T can close some of the valuation gaps to its large-cap wireless competitors.” Price target: $29

- Raymond James cheered the “simplified story” $32 Price Target

- BofA was the most bullish post-Investor Day as they noted the stock was a “deeply discounted asset” Price target of $36

Many analysts were bullish after investor day, but reading many of the notes, you can still see the pause some have. The story or the “plan” sounds great, but can company management execute? That is what you have to ask yourself as an investor, and for me personally, I am willing to take the wait-and-see approach when it comes to AT&T.

Be the first to comment