Justin Sullivan/Getty Images News

The AT&T (NYSE:T)/Time Warner merger never really made much sense to me. The telecom giant paid an exorbitant $85 billion for the media juggernaut. While AT&T had a decent plan to sell HBO subscriptions, the company mismanaged the Time Warner merger. As a result, AT&T’s stock has been worse than dead money over the last five years, down by roughly 50%. Due to AT&T’s heavy-handed management approach and other mishaps, the Time Warner merger turned into a disaster.

Therefore, it’s good news for AT&T shareholders that the company is on its own again and can focus on its core business. Moreover, it’s even better news for Warner Bros. Discovery (NASDAQ:WBD) shareholders, as the New Company looks significantly undervalued, has substantial growth prospects, and will likely appreciate considerably. I own both stocks, but I am now increasing my WBD stock position.

The Two Stocks

In November, I wrote an article about AT&T and its spinoff of the WarnerMedia unit. Finally, we have two stocks, AT&T and the New Company, Warner Bros. Discovery “WBD” six months later.

AT&T

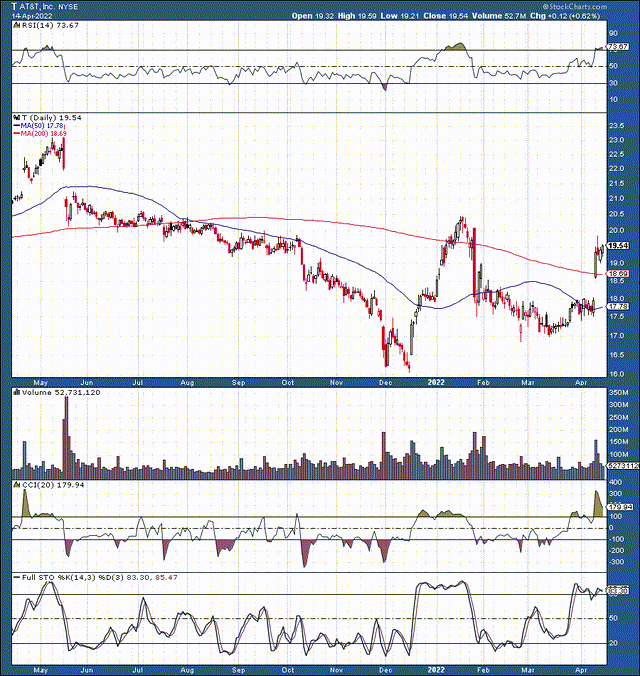

T (StockCharts.com)

AT&T’s chart has been rocky, but we recently saw a positive bump after the spinoff. The stock has jumped by about 12% in just days. Also, the stock is considerably higher (approximately 20%) from its November/December double bottom. Furthermore, we may have witnessed a long-term low at around $16 (spinoff adjusted). Now that the uncertainty is behind, AT&T’s stock can begin rebuilding and probably continue to move higher from here.

Warner Bros. Discovery

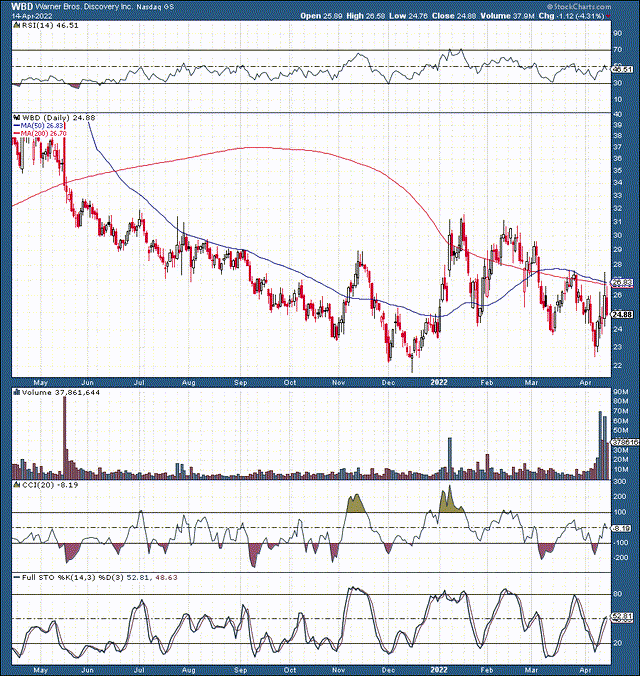

WBD (StockCharts.com)

The New Company, “WBD,” began trading several days ago at around $23-24. We see price action before the spinoff because we’re looking at Discovery’s stock recently transitioned into WBD. While Discovery shares were not doing too well on their own, the combined company can do much better, and the stock likely has considerable room to appreciate from here.

WBD’s Bright Prospects

WBD has a unique content combination. The merger unites HBO Max with Discovery Plus, offering viewers some of the best content in movies, series, news, reality TV, and more. The combined media giant will have three streaming services: HBO Max, Discovery+, and CNN+. Furthermore, the company also has Warner Bros. studio and numerous cable channels such as TNT, TBS, Food Network, TLC, Discovery, Travel Channel, MotorTrend, Animal Planet, Science Channel, New Line Cinema, Cartoon Network, Adult Swim, HGTV, HBO, and more.

Content (WarnerMedia )

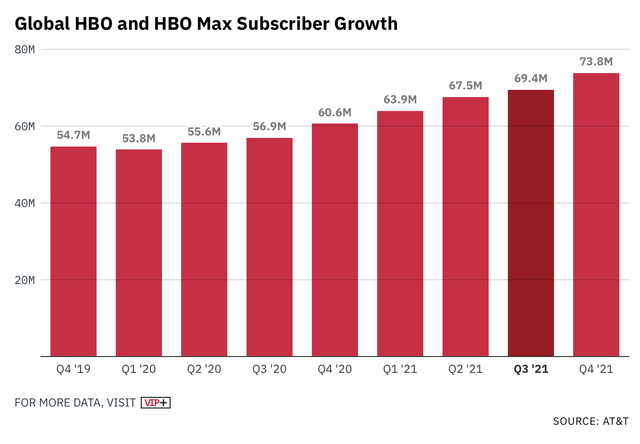

Additionally, the company has compelling streaming numbers. First off, the HBO platform is well monetized, as it charges $10 per month with advertisements or $15 per month without ads. Moreover, at the end of 2021, HBO Max had 74 million streaming subscribers, and Discovery+ had an additional 22 million streaming subscribers. These are impressive numbers, and WBD should continue growing its streaming business as it attracts more customers at home and abroad.

Subscribers (AT&T)

There are more than 3 billion Internet users globally, and 74 or 22 million is not a very significant percentage. Also, if we compare Netflix’s (NFLX) subscriber statistics, the company had around 222 million subscribers at the end of 2021. This dynamic illustrates a great deal of market share to capture for WBD, and the market will not get saturated for a long time.

Analysts’ estimates are for around $50 billion in revenues for WBD this year. Furthermore, WBD’s revenues will likely rise by about 7%-12% YoY in 2023. If the company builds on its growth momentum, it can continue delivering robust growth in future years. The stock’s valuation is only about $63 billion today, as the company is trading at only around ten times forward EPS estimates and roughly 1.2 times expected sales. These are remarkably low valuation ratios for a company in WBD’s position, implying that shares are grossly undervalued now.

In comparison, Disney (DIS) trades at a forward P/E ratio of around 30 and has a forward sales ratio of roughly 2.7. Netflix also trades at a P/E ratio of about 30 but has a P/S ratio of about 5. Therefore, we see that WBD’s nearest competitors trade at ratios 2.5-5 times higher. It’s difficult to explain this vast disconnect, but it appears like WBD’s stock price can double, and it will still be substantially less expensive than Netflix or Disney. Therefore, I suspect we can see much more upside from WBD as we advance.

AT&T Learning From Its Mistake

AT&T may have overpaid for Time Warner in the first place. $85 billion and a battle with the Justice Department to spin WarnerMedia back off for a much smaller sum several years later is not a good deal. AT&T’s management reportedly refused to listen to Warner Media execs. Therefore, the company made many mistakes during and after its merger with Time Warner. An arrogant, know-it-all attitude is never a winning recipe, especially when a complex merger of two very different company cultures. AT&T is an old grey suit and tie telecom giant that focuses on cutting costs to increase efficiency.

In contrast, Time Warner has a more creative and laid-back atmosphere. Imposing its company culture on Time Warner likely stifled creativity and brought on detrimental unintended consequences rather than having a positive effect. We see AT&T’s negative impact on Time Warner’s valuation as the company was bought out for $85 billion and spun off for roughly half that amount.

To avoid further merger disasters, AT&T should focus on its core businesses. Additionally, if it wants a growth boost, the company should consider investing in firms that have similar company cultures and have businesses that resemble AT&T’s. However, one thing you cannot take away from AT&T is that the stock is remarkably cheap here.

AT&T’s Attractive Valuation

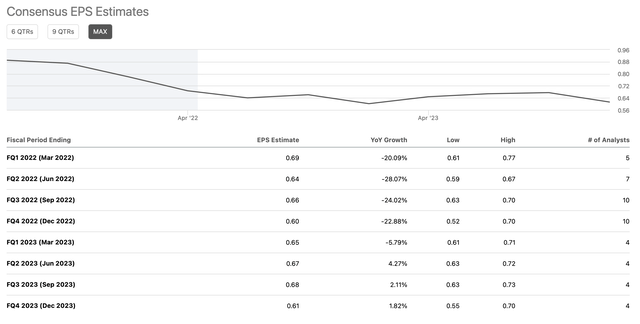

AT&T remains one of the best value propositions in the market today. The company has a forward P/E of around 7.9 and retains a substantial dividend of roughly 6%. Moreover, as the company recovers here, it should increase its dividend again. Next year, consensus estimates are for $2.61 in EPS. Therefore, the company is trading at just 7.5 forward earnings estimates now.

EPS (SeekingAlpha.com)

Additionally, we could see higher earnings results as AT&T becomes leaner and more efficient following the WarnerMedia spinoff. Higher-end EPS estimates are for about $2.80 next year, and if the company’s P/E multiple expands to about ten, we may see AT&T trading at about $28 a year from now. This price target gives us about a 44% potential upside in AT&T shares.

Why I Own Both Stocks

I own WBD for its growth, and I own AT&T for its value. However, at only around 10 times forward earnings WBD is a strong value play. I’ve held AT&T since the November declines last year. While I received some shares in WBD from the spinoff, it’s not enough. I’m adding to my WBD position in anticipation of higher growth and more demand for this stock. I expect WBD’s market cap to roughly double to $100 billion over the next 12-24 months, leading to an approximate 100% gain for the stock. In my view, AT&T should also do well, appreciating by roughly 40-50% over the next year.

- My WBD 1-year price target range is $35-50

- My AT&T 1-year price target range is $25-30

Be the first to comment