wdstock/iStock Editorial via Getty Images

AT&T (NYSE:T) reported a solid quarter, but the results were messy due to the inclusion of WarnerMedia results in the numbers prior to the official spinoff on April 8. The communications focused company still faces a difficult segment with higher competitive and limited growth. My investment thesis remains mixed on the wireless giant as the company is more focused, but the results aren’t impressive.

Messy Quarter

The wireless and former media giant reported a big EPS beat for Q1’22, but the revenues missed analyst estimates by a wide $190 million. The problem is that these numbers are messy with the divestiture of the video business (DirecTV) not included in the comparable Q1’22 results and WarnerMedia included in the results when the stock ownership position no longer includes the business.

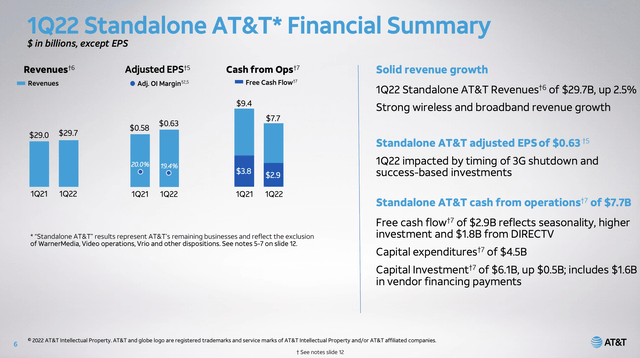

For this reason, investors have to look only at the standalone AT&T financial summary provided by the company. The wireless giant reported revenues growing 2.5% to reach $29.7 billion.

Source: AT&T Q1’22 presentation

The company actually reported some decent growth for once, but the standalone EPS dipped down to only $0.63 in the quarter. The company lost $0.14 worth of EPS in the process of spinning of the WarnerMedia business to Warner Bros. Discovery (WBD).

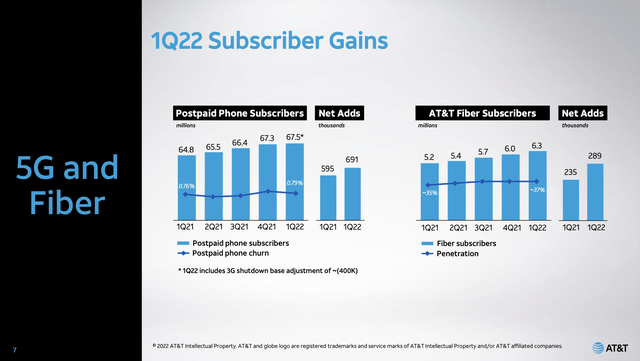

The quarterly subscriber gains were impressive with nearly 700K postpaid phone net adds, though the actual postpaid phone subs are listed at just growing by 200K in Q1’22 due to a base adjusted from shutting down 3G. Fiber sub growth was even more impressive with 289K net adds, pushing the sub base up ~900K, or 17% YoY.

Source: AT&T Q1’22 presentation

Despite these solid subscriber growth metrics, the standalone AT&T only grew revenues 2.5%. The wireline business is causing the total revenue growth to be less impressive with the business wireline segment revenues down $0.4 billion YoY to $5.6 billion in the quarter.

The business is definitely easier to understand going forward with a prime focus on these subscriber numbers combined with ARPU. Broadband ARPU grew 5.9% in the quarter with current ARPU of ~$60 headed to the $65 to $70 range.

Tough Business

The stock traded down below $20 due to these lower EPS targets and the dividend cut to $1.11 with a current yield of 5.7%. Investors have to adjust their view of the stock based on these updated targets and not consider the stock a bargain at $20 just because it traded most of the prior year above $25.

At the recent Analyst Day, AT&T provided these updated 2023 targets for the standalone communications business:

- Continued low single-digit revenue growth, driven by low single-digit growth in wireless service revenues and a ramp in broadband revenue growth to the mid to high single-digit range.

- Adjusted EBITDA of $43.5 billion to $44.5 billion, with approximately $1.5 billion in additional cost transformation savings.

- Adjusted EPS of $2.50 to $2.60.

- Capital investment in the $24 billion range with consistent investment in 5G spectrum deployment in the $5 billion range.

- Free cash flow in the $20 billion range.

These numbers really aren’t very impressive considering the revenue weakness in the business wireline segment and the current EPS run rate is $2.52. Analysts are predicting 2023 EPS of just $2.61 for what amounts to only a minimal 1.7% growth on top of the $2.57 estimate for the year.

This number apparently factors in the original $0.69 target for Q1’22 inclusive of the WarnerMedia business. The standalone EPS forecast was possibly $2.50 per share providing limited upside to this target from AT&T at the recent March Analyst Day.

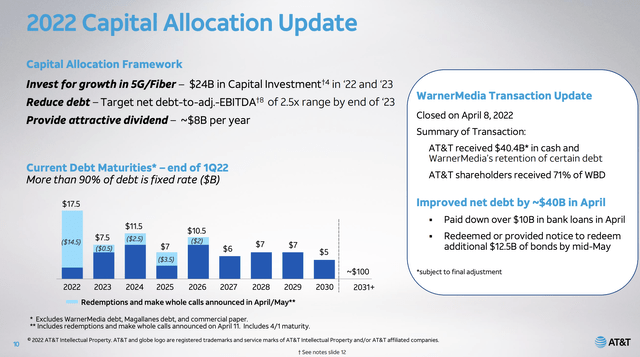

The wireless giant ended March with net debt of $169 billion, suggesting the net debt balance is closer to $129 billion now following the $40 billion received with the WarnerMedia transaction. The company is still targeting a leverage ratio of 2.5x the above 2023 EBITDA target of ~$44 billion, placing the net debt target next year around a still very high $110 billion.

Source: AT&T Q1’22 presentation

In the past, AT&T has regularly spent massive amounts of money on spectrum and deals, limiting the actual debt reduction. An actual reduction in net debt by this amount over the next 2 years would be impressive as $20 billion in free cash flow next year with only $8 billion in dividend payouts would lead to substantial debt reduction.

This is a new focused era for the wireless giant, but the segment is even more competitive now with T-Mobile (TMUS), a legitimate threat, and DISH Network (DISH) working on another competitive 5G network.

Takeaway

The key investor takeaway is that while the company is easier to understand with the communications focus, the business growth is just not impressive. AT&T isn’t overly exciting trading at ~8x 2023 EPS estimates with very limited growth. Where the story gets interesting is if the management team can turn the focused business into a growth story.

Be the first to comment