Justin Sullivan/Getty Images News

AT&T (NYSE:T) is a company with a more than $170 billion market capitalization, making it both one of the largest telecom companies and one of the largest companies. The company has struggled from both increased consolidation and then needing to roll back that consolidation. The splitting of Time Warner is the end of that plan. And it’s an end we expect will unlock significant shareholder rewards.

AT&T Time Warner Split Off

AT&T’s largest upcoming noteworthy news event is the split off of Time Warner.

The company has finally released the details of this although the details have effectively been common knowledge for months. AT&T shareholders will control 71% of the combined company, with $10s of billions of freed debt from the parent company. This will result in roughly 0.24 shares per current AT&T shareholder.

Based on Discovery’s current share price, that’s roughly $6.13 / share in asset value per AT&T share. That’s roughly 26% of AT&T’s share price currently. Now there is one caveat here. For two reasons, we believe that the new Warner Bros. Discovery company will see its share price outperform over its ties to the legacy AT&T business.

(1) Acquisition Interest

(2) Multiple Expansion / Growth

For acquisition interest, we expect that the new pure-play media company will be incredibly appealing to large tech companies looking to be involved in the space. Apple (NASDAQ: AAPL) reportedly considered the idea 5 years ago before it was investing in Apple TV+. With increased synergies and a much larger Apple, plus Discovery, it could be more interesting now.

Second is multiple expansion. Disney (DIS), Netflix (NFLX), competitors all have higher multiples than Time Warner. With HBO Max outperforming, there’s a chance for a higher multiple for the company. The current value per share is substantially lower than where we feel the company could be especially given its rapid debt paydown and growth potential here.

AT&T Fiber

AT&T has an impressive fiber business that has substantial growth potential to support shareholder rewards.

AT&T is planning to significantly expand its AT&T fiber business. The infrastructure bring-up is significant and expensive. The company is aiming for ~3.5-4 million in annual customer location growth with a target for a massive 30 million customer locations by 2025. The company has a more than 40% market share in its existing locations that’s growth.

As a result, we expect the company’s growth here, to add billions in additional annual revenue. That consistent fiber growth will enable increased shareholder rewards.

AT&T Financials

AT&T’s financial position is strong and it’s expected to continue its growth.

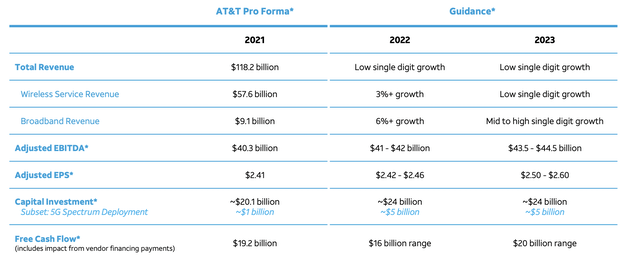

AT&T expects pro forma total revenue of $118.2 billion increasing at low single digits to $130 billion by 2023. The company should see slightly faster growth in adjusted EBITDA to $44 billion. EPS which is expected to grow to $2.55 is strong for a company that’s currently valued at roughly $18 / share after subtracting out Warner Bros. / Discovery.

The company is planning to invest heavily within its business and growth. Capital is expected to grow significantly to $24 billion in 2022 and 2023, with the company continuing its fiber buildout and growth. Despite that heavy investment in its business, the company expects roughly $20 billion in 2023 FCF implying a double-digit FCF yield.

We expect continued cost savings and organic growth to support continued FCF growth past 2023.

AT&T Shareholder Returns

AT&T has a unique ability to continue providing substantial shareholder rewards. The company’s readjusted dividend costs it roughly $8 billion annually. The company expects to have $16 billion in 2022 FCF as it ramps up cash flow for the transition, but expects that to improve significantly going into 2023.

The company expects net debt to be roughly $100 billion by 2023, with the transaction. It has the ability to continue reducing debt by more than $10 billion each year, saving substantially on interest expenditures. Alternatively the company can buy back shares. However, it chooses to utilize that capital, we expect the ability to generate substantial shareholder returns.

We expect those returns to be comfortably in the double-digits.

AT&T Risk

AT&T’s risk is the company is in a competitive environment and has narrowed its focus to fiber plus the cellular division. The company has incredibly strong legacy assets here and it’s also focused on growth, however, competitors like Comcast (CMCSA) are also investing in building out their assets. There’s no guarantee that the company outperforms its peers.

Conclusion

AT&T is finally simplifying its business and focusing on what matters. The Warner Bros. Discovery spin-off will, in our opinion, unlock substantial shareholder value. Additionally, the company is finding increased capital for substantial fiber growth and growth in its legacy business, with a plan to increase spending to $24 billion annualized starting next year.

The company will have roughly $100 billion in debt and a $120 billion market capitalization generating roughly $20 billion in annual FCF. The company can comfortably pay down debt to save on interest, and pay its reasonable roughly 4.5% dividend. We expect overall shareholder returns to be in the double-digits making the company a valuable investment.

Be the first to comment