jetcityimage

Thesis

We cautioned investors in our June article that it was too early to add AT&T Inc. (NYSE:T) stock even though it appeared cheap. We gleaned that it could still underperform at its valuation then, and its price action was also not constructive.

Accordingly, T has fallen nearly 20% since our article (including dividends), as it underperformed the broad market significantly. Investors need to consider that T is still deeply entrenched in a medium-term downtrend. As a result, it’s essential to be cautious about adding into significant tops and assign a generous margin of safety.

Our analysis indicates that the market remains tentative about re-rating T, even though its valuation remains “cheap.” However, when we compared it to its 10Y mean, it seems reasonably well-balanced but not undervalued.

The company is also confident of its execution despite near-term headwinds caused by record inflation and the Fed’s increasing hawkishness. However, the company believes that its less price-sensitive consumer base could help mitigate some inflation challenges that could impact the lower-income demographic harder.

We discussed previously that investors should give T another look if it pulls back toward the $17 support zone. Therefore, given the rapid collapse, we are leaning increasingly bullish as it’s re-testing its current support zone.

We are ready to re-rate T and revise our rating from Hold to Cautious Buy. We believe it’s appropriate for investors who have been biding their time patiently to add exposure, supported by its robust dividend payouts.

T’s Valuation Has Pulled Back to Its 10Y Mean

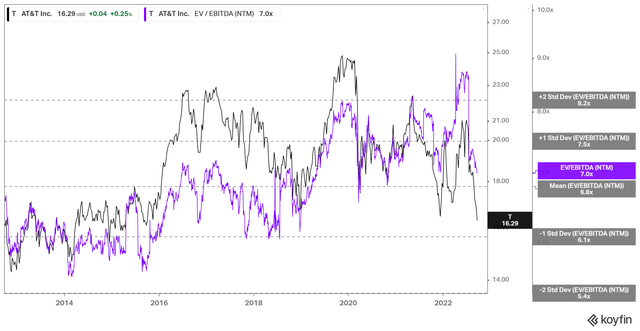

T NTM EBITDA multiples valuation trend (koyfin)

As seen above, T last traded at an NTM EBITDA of 7x, in line with its 10Y mean of 6.8x. Therefore, we believe it’s arguable that T’s valuation may appear cheap but has been so for the last ten years. Moreover, given its tepid revenue growth profile and relative weak operating leverage moving ahead, it’s challenging to envisage that the market will be keen to re-rate T much higher.

As such, we assess that T’s valuation seems pretty well-balanced.

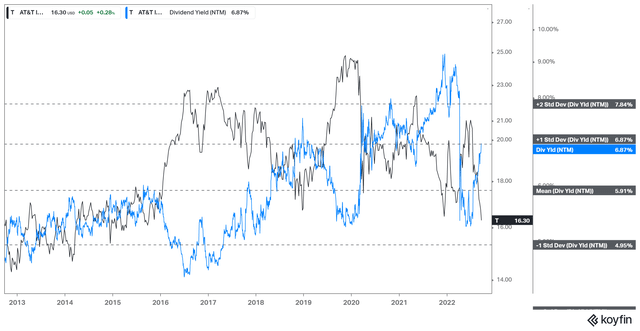

T NTM Dividend yields % valuation trend (koyfin)

However, T’s NTM dividend yield of 6.9% seems relatively attractive, as it’s at the one standard deviation zone above its 10Y mean of 5.9%. Coupled with a relatively low payout ratio of 43% (based on adjusted EPS), we are confident its dividend strategy is secure. Hence, it should proffer T some valuation support at the current levels, helping to stem further downside volatility.

AT&T’s Low-Growth Suggests Challenging Competitive Dynamics

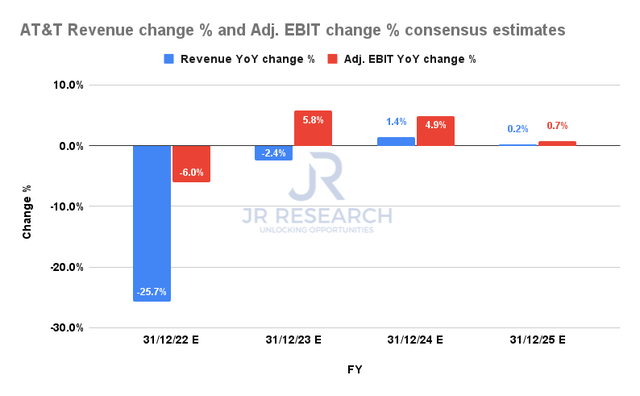

AT&T Revenue change % and Adjusted EBIT change % consensus estimates (S&P Cap IQ)

However, the Street’s consensus remains unconvinced with its business transformation, as revenue growth is still expected to be tepid. Moreover, while AT&T could benefit from fixed costs leverage, it’s unlikely to move the needle on T’s medium-term re-rating. Therefore, we posit that T will likely remain a “cheap” stock.

Wall Street also remains concerned about how the pricing dynamics would play out once those promotional bundles dwindle. However, the company highlighted that it has strong traction in certain segments that don’t rely on aggressive promotions. CEO John Stankey accentuated:

I know folks want to continue to go back and say, well, it’s a high level of promotion that’s doing it, and that’s factually not correct. We’ve had great share shifts that have occurred in certain segments of the market. Public sector is a good example. That’s not based on promotion. That’s based on sustained investment and building the best public safety network that this country has seen. (Goldman Sachs Communacopia + Technology Conference)

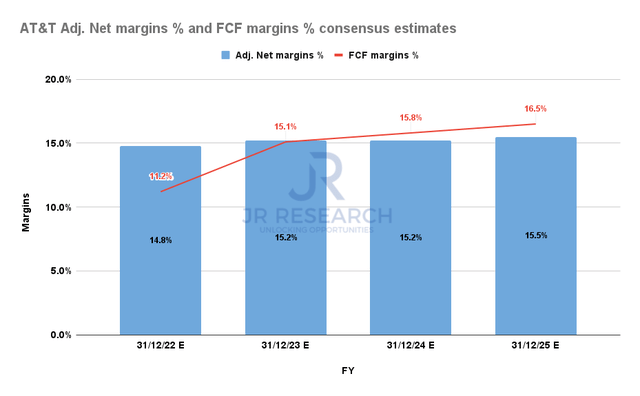

AT&T Adjusted Net margins % & FCF margins % consensus estimates (S&P Cap IQ)

Notwithstanding, the company’s margins profile is still expected to remain stable, and there is a potential upside in its free cash flow (FCF) profitability.

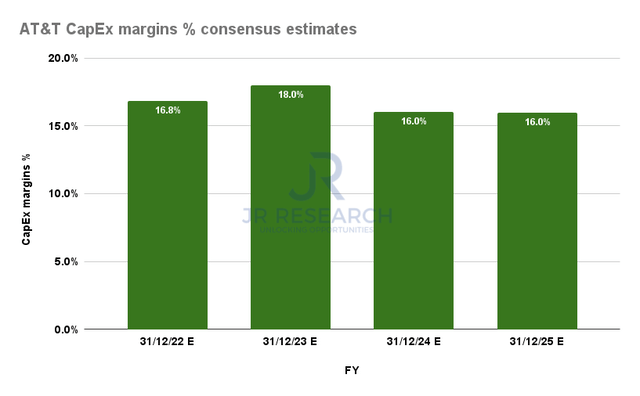

AT&T CapEx margins % consensus estimates (S&P Cap IQ)

The company highlighted that it’s in the 18th month of its three-year capital investments phase. Therefore, exiting its heavy investments cadence should lift its FCF margins markedly through 2025, which should undergird its valuation at the current levels.

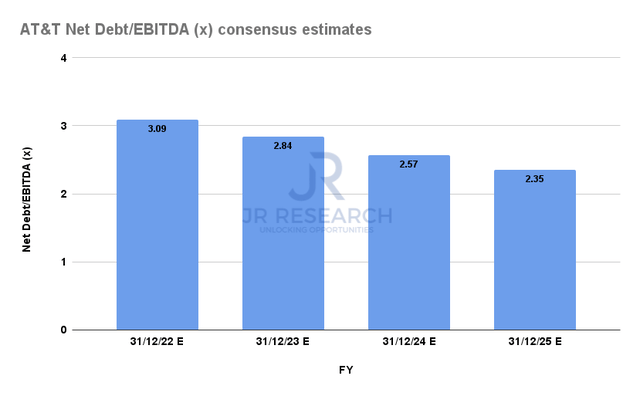

AT&T Net debt/EBITDA consensus estimates (S&P Cap IQ)

Therefore, it should lift the company’s ability to achieve its target of reaching 2.5x in Net debt/EBITDA by the end of FY25, deleveraging its balance sheet further. The consensus estimates suggest that the Street is confident in the company’s roadmap, which is also accretive to driving shareholder value further.

Therefore, we believe several critical drivers could underpin T’s well-battered valuation at the current levels, even though we don’t expect a significant medium-term re-rating.

Is T Stock A Buy, Sell, Or Hold?

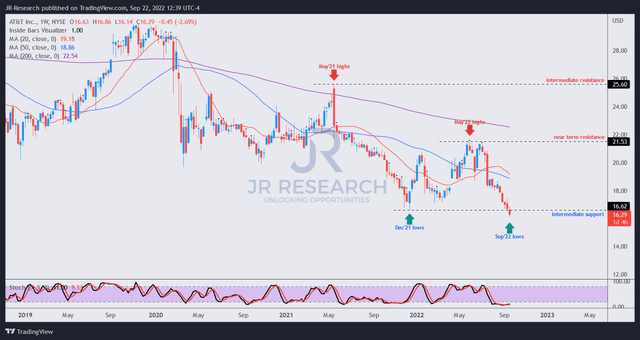

T price chart (weekly) (TradingView)

We gleaned that T remains entrenched in a medium-term downtrend, which is also in line with its bearish bias in its long-term chart. Therefore, investors need to consider that they are investing against a dominant bearish bias.

Hence, we believe it’s critical to cut exposure if T doesn’t reverse its bearish bias decisively at its current levels, as we explained that T is probably not undervalued. Hence, there could still be significant downside volatility if the market intends to take T down further.

Notwithstanding, we posit that T’s well-oversold momentum should at least see a short-term reprieve at the current levels.

We revise our rating on T from Hold to Cautious Buy.

Be the first to comment