Ultima_Gaina

Thesis

The market broadly expected the Fed to deliver a 75 basis point rate hike at the September FOMC meeting. But the Federal Open Market Committee (“FOMC”) managed to surprise even the most hawkish estimates. The median interest rate for 2023 stands now at 4.5-4.75%, which sends once again a strong signal to the markets that the Fed is not thinking to pivot anytime soon.

Most notably, in the press conference following the interest rate decision, chair Powell aggressively confirmed that bringing down inflation is the committee’s most urgent ambition – even if this would cause a recession. Consequently, it is no surprise that equity markets sold off sharply following the announcement: the S&P 500 lost about 1.7% and the more growth-sensitive Nasdaq 100 fell 1.9% respectively. Powell commented, that:

We have got to get inflation behind us. I wish there were a painless way to do that … (But) there isn’t.

Following the FOMC meeting, I am confident to reiterate my bearish thesis that a material re-rating for the S&P 500 (SPX) is imminent. I argue the S&P 500 could trade down to levels as low as 3,000. And investors should hedge this scenario by buying 95/85 percent moneyness put spreads.

The September FOMC Meeting

The Federal Open Market Committee meeting was held on September 20 to 21, and following a hotter-than-expected CPI print for August, the markets expected a hawkish tone. And rightly so. As the Fed is “strongly committed to returning inflation to its 2 percent objective,” the FOMC raised the federal funds rate for the third consecutive time by 75 basis points, to a target range of 3 to 3.25 percent.

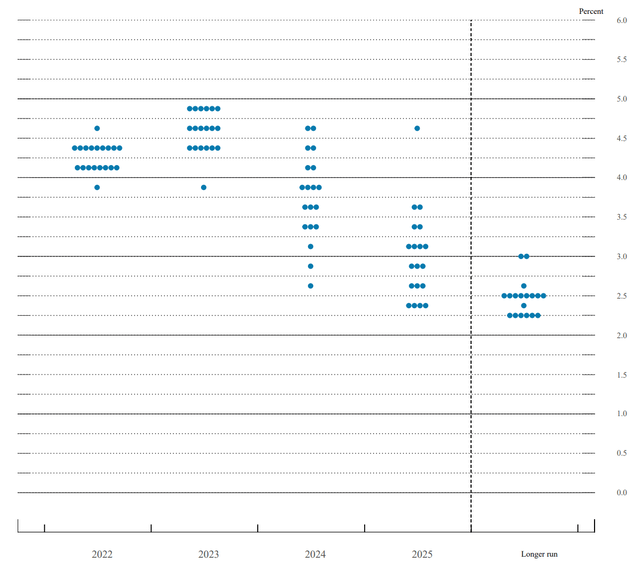

Also, the FED’s dot plot changed significantly. The FOMC committee now projects that rates will end the year 2022 at about 4.4%, and rise even higher in 2023, to 4.6%. Traders immediately reacted, and the yield on the two-year treasury note jumped to a 15-year-high, above 4.1%.

FOMC Summary of Economic Projections

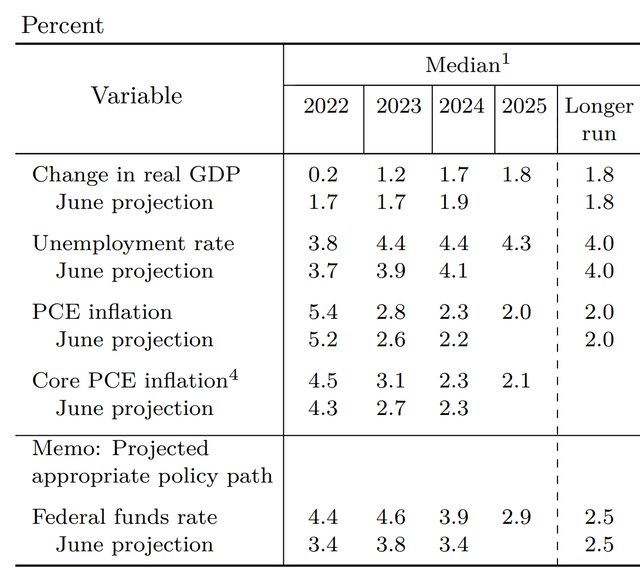

But the funds rate is not the only variable the saw a material revision. Notably, all major economic variables saw a major unfavorable rate of change. According to the Fed, 2022 GDP growth is now expected to be only 0.2%, down from 1.7% three months earlier. GDP for 2023 was cut to 1.2%. At the same time, unemployment expectations increased – 2023 projection increased from 3.9% to 4.4%.

The projections, including the dot plot, represent “each participant’s assessment of the value to which each variable would be expected to converge.”

FOMC Summary of Economic Projections

Investor Implication

Fed chair Powell hinted on what the market has already known and feared: there is little chance to tame inflation without tipping the economy in a recession. This means that lower employment levels, depressed corporate earnings, reduced consumption – and consequently falling asset valuations – is a price that the Fed is willing to pay. Powell commented:

Higher interest rates, slower growth and a softening labor market are all painful for the public that we serve, but they’re not as painful as failing to restore price stability and having to come back and do it down the road again.

Powell’s September remarks stand in sharp contrast to the soft landing scenario that was communicated in June. And I argue that equities markets must still price the changing situation.

The thesis is simple: If you can get a greater than 4.1% yield on the “risk free” treasury yields, how attractive is the S&P 500 at a 5.3% yield (1/PE ration, 1/19), that is exposed to EPS contraction? Not very much, I argue. And I believe traders and investors will re-price the index until an approximate 3% risk premium is restored. This would imply a P/E for the S&P 500 of about x13 and an index valuation of 3,000 (anchored on consensus earnings estimate of $231). Given chair Powell’s rhetoric, I argue there is little hope that the Fed will support the market above this index level with a liquidity put.

Conclusion

My personal takeaway from the September FOMC statements, economic projections and press conference is that in order to have lower inflation, you have to accept a much slower economy, and as an indirect consequence of lower asset prices. Accordingly, so it looks to me, the Fed is actively trying to bring the stock market lower. And as a relative valuation trade to risk-free 2-year treasury notes that now yield north of 4%, a re-pricing of the SP&P 500 to levels as low as 3,000 would not be unreasonable.

Trade Recommendation

Personally, I argue there is currently no better trade than buying 95/85 %-Moneyness PUT spreads on the SPX. Consider that valuation is still elevated versus both yields and historical levels, and multi-dimensional risk is pending over markets – waiting to take the market to new intra-year lows. That said, I advise and target 60 DTE, which would give a payout of approximately 5:1, if the SPX closes at 85% moneyness at expiration (ref, ca. 3200 strike).

Be the first to comment