MicroStockHub/iStock via Getty Images

Perma-Fix Environmental Services (NASDAQ:PESI) is a nuclear services company with capabilities in nuclear waste management that only very few providers can offer. These services include management and treatment of radioactive and mixed waste for hospitals, research labs and institutions, federal agencies, and perhaps most significantly the Departments of Energy and Defense but also the commercial nuclear industry. The company’s four nuclear waste treatment facilities are unique selling points for a deep moat.

For comprehensive overview of the company and the various lines of business I strongly recommend the two articles of Aaron Warwick. My aim for this article is to highlight the developments since Aaron published his last piece and make the case why right now is fantastic opportunity to establish a position in PESI. To me, the company is a fairly low risk investment at these prices since the work PESI is doing is highly specialized with only few competitors and a very deep moat. Crucially, the core business is clearly accelerating now justifying higher fundamental value and thus share prices. On top there is the additional upside from the Hanford clean-up, which could make PESI a multi-bagger.

Disappointing H1

The first half of 2022 was rather disappointingly slow with revenues of $35M, less than the $39M in the prior year period, and net loss of $2.8M and EBITDA of negative $1.8M. Compared to the $155M in revenue and $20.4M EBITDA that Aaron has projected for 2022 this seems like a big miss so far. That being said, this is mostly an effect of a dreadful Q1 and Q2 did show growth of 20.5% revenue and even more importantly 198.6% increase in gross profit.

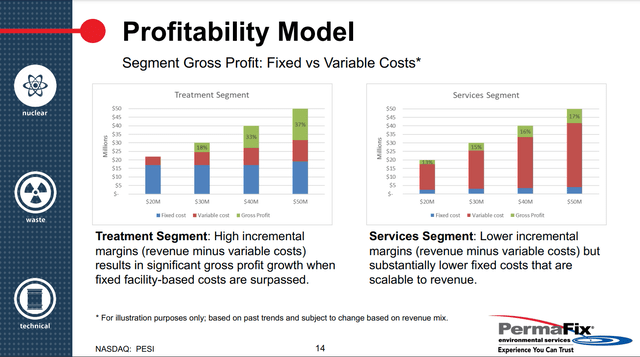

The company has a largely fixed cost base and with only a slight loss in Q2 we are now right at the inflection point. Recall that there are two segments: Treatment and Services, with the former in particular showing very high operating leverage as illustrated in the company presentation.

PESI Profitability Model (Company slide deck)

What makes me say we reached the inflection point? The recent call is very rich in information and the CEO had this to say about the two segments:

Turning first to our services segment, we were able to reach full operational status on several projects that have been delayed due to the impact of the pandemic in March of 22. We began to see increases in activity as the pandemic impacts began to subside, which continued into the second quarter.

Turning to our treatment segment revenue increased by roughly 9% for the second quarter of ’22 as compared to the same period last year, primarily due to higher volume waste. Sequentially, our treatment segment revenue increased 12% over the first quarter of ’22. In addition, we’re seeing improvements in our waste receipts, which increased 54%. So we had a 54% increase in our waste receipts through the quarter. Given how we recognize revenue on a percentage of completion basis, this is a good leading indicator for the second half of the year. In addition, treatment backlog increased to $7.2 million compared to just $6.1 million at the end of the first quarter of ’22.

So we have both segments showing acceleration from small growth in Q2. I would highlight especially the treatment segment where we have a clear quantitative leading indicator pointing towards up to 50% increase after 9%. This will boost margins substantially and all signs point towards this being a sustainable development.

It’s certainly, as we said, at $9.5 million in sales receipts last quarter, we’re starting to see, as I mentioned, the last several quarters, our RFPs that we’re getting for waste treatment continue to keep the same trajectory and they’re going up every quarter and that we had a really good June overall in our fees and receipts. With a little bit of slowdown in the first week of July and getting back on track here now for the latter part of July, we’d hope that we’d be at that same level this quarter and the next, which are typically our 2 best quarters.

The company is making an effort to diversify more towards international and commercial customers away from the DOE, which should aid in sustainably getting to $10M in treatment revenue within quarters.

My aim is not to project financials on a quarterly basis and I would defer you again to Aaron’s pieces for a valuation model. However, my point is that it is fair to assume similar sequential growth in Q3 and perhaps even Q4, which should bring us to around $25M revenue in Q3 and up to $60M in H2. Even with modest blended gross margins of 15% this should make Q3 solidly profitable. In my experience some of the best stock returns occur when a company transitions from losing money to being profitable, especially when coupled with improved business outlook and acceleration in growth.

And — that’s by far at $500 some million more than we’ve ever had on our hot list to come out. And again, that’s about 2 quarter’s projection, so $500 million over the next 2 — maybe 2 to 3 quarters that we expect to come out.

Does $500M in services opportunities sound like an acceleration? It sure does to me.

From breakeven in H2, it is in my opinion quite likely we see $130-150M in revenue in 2023. Assuming even very modest improvements in gross margins towards blended 20% and constant expense, operating income should be $12-16M. At multiple of 10x that alone leaves us with 100-150% upside. Towards the upside we could work with 25% gross margins leaving us with $18-23M operating income for an upside of 200-280% at identical multiple. Even in a no growth scenario in 2023 $6-10M in operating income justify the current market cap of around $60M easily.

Hanford Test Bed Initiative

While this has been dragging on for a very long time and the DOE seems very slow to move, recently there has been even more support for PESI’s grouting approach. The U.S. Government Accountability Office certainly seems in favour of utilizing PESI’s services and saving up to $18 billion!

Certainly the frustration is big that things are moving slowly but the Q2 call has some important information in that regard as well.

ITDC is a $45 billion contract for management of the tank farms at Hanford as well as the start-up of DFLAW a few years down the road. That procurement — while it’s in procurement space, and we’re waiting to hear on it, there’s obviously a lot of sensitivities to it in regards to our team, which I can’t disclose until after the announcement. But I can tell you this is the department has been staying with their current schedule, and they update it frequently that they’ll be making announcement in late September, early October. There were 2 bidders, were 1 or 2 bidders. We’re — we basically support our core competencies on the contract. And I would like to think we least have a 50-50 chance based on the fact there’s only 2 bidders that we know of. […]

If DOE wants to move forward with grouting, they can. And they have a strategy of pushing and working hard on a Dow facility and getting it running without distraction. And they’ve been vocal about that. But to answer your question specifically, DOE has the ability to ship — start shipping us for grouting, the waste that’s generated from the TSCR system, which right now sits at approximately 300,000 gallons.[…]

We can receive that waste starting tomorrow at 30,000 gallons a month and DOE’s position, which has just recently been published in one of the industry newsletters that their choice is to accumulate that TSCR waste on a continual basis until they have enough for operation of the DFLAW facility, which is about 1 million gallons. So that’s the decision on that. They can start shipping to us as soon as they want to. And obviously, the 2,000 gallons will come first as a next level phase.

So, not only is PESI immediately ready to receive tremendous amounts of waste, it is also directly up to the DOE to act at once. Could it be that the announcement expected within weeks will bring more clarity? My bet is yes. Considering also that CEO Duff is rather conservative, him putting the odds of winning at 50/50 makes me rather comfortable going into this announcement. Of course, while the overall opportunity is gigantic, the start with 2,000 gallons will be modest but give PESI the chance to prove itself and remove any doubts. Reducing this uncertainty will likely be very positive for the share price.

But one would think that the opportunity to start treating waste off-site and disposing of it and actually closing tanks would be something that DOE would view as a big accomplishment, in addition to getting the DFO plant operational. And we’ve always said that we’ve always viewed TBI as a supplement to DFLAW because we know the investment that the government has put into that plant, but they can certainly start moving some waste off-site tomorrow if they wanted to.

And the cost savings that we’ve talked about a lot, which is about 10x less the reduced carbon footprint from emissions and the schedule reduction and the risk of the environment, all considerations that we’re hopeful the DOE will recognize the value in shipping some of that TSCR waste was in the near term.

Finishing the year with a big accomplishment seems like something every bureaucrat would want especially while reducing the carbon footprint on top. The funding is already there:

the recent enacted FY ’22 federal spending bill included $7 million in additional funds specifically allocated for the test bed initiative, also referred to as the TBI. Also in that funding bill is referred to as the low-level waste off-site disposal program, which is called LLWOD. This funding line item underscores the continued visibility and recognition within the U.S. Congress for commercial grouting to supplement the current direct feed low-activity waste program or what we refer to as DF law

I want to highlight the fact that PESI’s Northwest facility is fully permitted and able to receive and treat waste from Hanford across a very short distance. Furthermore, the DFLAW facility would only address about 60% at full capacity. So we have a problem with an obvious solution and that is that PESI will get at least some of the treatment work at Hanford. The risk is less of it not happening and more of it being delayed. These kind of “when not if” questions are often the best opportunities for investors.

Shares Under Pressure

The slow recovery in H1 certainly contributed to the lackluster performance of PESI shares. Additionally, rising interest rates, worsening economic outlook and overall markets under pressure provided more headwinds for the stock. Yet shares had been holding up very well all year and never violated the $5 level until recently when they broke the 50DMA to the downside and quickly dropped even below $4.50 with volume drying up.

PESI chart (Stockcharts)

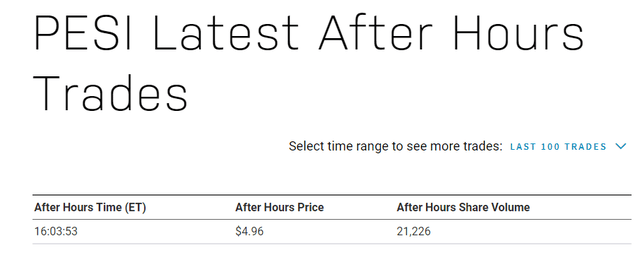

Rumour has it that an institutional seller was in the market, which would fit to the volume more or less disappearing. Usually when a persistent seller is visible, buyers will step away, waiting for cheaper prices to enter. I strongly believe this seller is cleaned up now as evidenced by the high volume reversal on Friday September 16 and the sizable after hours trade of roughly twice the daily volume, which normally happens only when prearranged.

PESI AH trade (Nasdaq)

While not exactly a capitulation event, if I am correct that the seller is cleared, buyers should now begin to step in again and provide a tailwind for the stock.

Risks

Even though I do believe that revenues will accelerate from here, it could be that there are further delays, cost overruns or other problems leading to disappointing earnings in H2. Based on the strong commentary on the Q2 call I view this as unlikely.

The meager $163k cash position was brought up on the call as well, which would normally point to the risk of an imminent offering or worse. However, this was well refuted by management:

But our working capital remains positive. There is a point in time and our availability on our revolver remains healthy. It’s in over $4.5 million almost $5 million and our debt is low. […] A big chunk of that was paying down vendors, and that is a timing issue. We’ve got certain receivables outstanding

So the financial position of the company is very solid.

Any progress in regards to Hanford could well be further delayed and it is hard to gain insight into the motives of the DOE. But as already mentioned, this is more a question of “when not if” and considering improvement in the core business hardly a big risk to the downside.

Summary

Altogether, PESI is operationally and financially right at an inflection point and there is potentially significant news imminent in relation to the Hanford clean-up. On top of that, shares have been depressed by a risk-off market and a larger seller, that seems to be cleared now. All those factors make PESI a fantastic risk/reward at current prices and it would seem to me the time to act on this opportunity is now.

I am seeing up to 280% upside based on 2023 numbers. Can the shares go lower from here after the seller is cleared? Absolutely, but the chance is slim in my opinion. Fundamentally the risks are also limited by the deep moat the company commands, the concentrated industry, improving business outlook and solid financial position.

Be the first to comment