Justin Sullivan/Getty Images News

Dear Readers/Followers,

Over the course of the past few years, I’ve consistently pushed money to work in AT&T (T). Step by step, even as the course dropped. It’s because I take a very long-term view of certain investments – and AT&T is certainly one of them.

The advantages of AT&T are very simple. Its legacy telco operations are essentially nothing less than a nation-obligatory infrastructure that for investors amounts to a cash-printing machine.

The fact – yes, fact – that this cash-printing machine has been poorly managed and mishandled for the past years does nothing to change its fundamental appeal of it. And recent trends suggest with no small amounts of theoretical clarity, that the periods of ambiguity in AT&T might be nearing an eventual end.

To that end, I offer this to you;

AT&T is a math exercise.

Let me show you why.

AT&T (AT&T Corporate)

AT&T – Appealing regardless of what happens

I’m not going to spend time going through the fundamentals – these are well-known at this particular point. The company is one of the largest telco’s on earth, and one of the largest in the US. Problems following the WarnerMedia M&A, but strong legacy operations – if you follow AT&T, you’ve read all of this before.

I’ll get straight to the point here – and that point is that, with the backdrop of its fundamentals and underlying infrastructure and its performance, no matter what happens, AT&T is an attractive “BUY” here, as I see it.

Why?

1. 2021 Performance was stellar – Management commentary wasn’t

In 2021, AT&T once again showed its shareholders that it can perform well. The company delivered just south of $170 billion in revenues and almost $20B in net income.

Income numbers, margins, and fundamental strength have long been overshadowed by the now-infamous WarnerMedia segment, as well as the company’s large debt load – but even including these, results were beyond just “good” in this year.

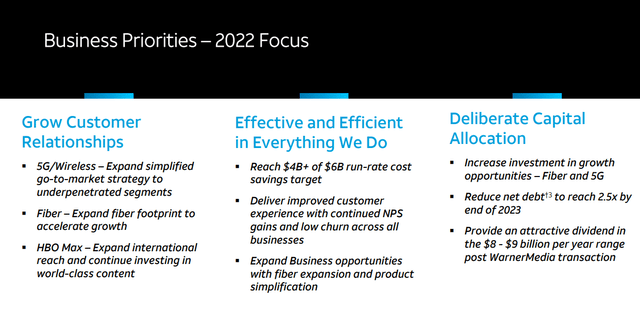

The company delivered adds above expectations in terms of mobile as well as Fiber, and its WarnerMedia/HBO subscriber base increased to almost 75 million subs. Savings were achieved, the customer experience was good, churn was down, superb FCF, $50B in asset monetization, and the company has worked extensively on its capital structure to prepare for the future.

The future involves this.

AT&T 2022 Priorities (AT&T 4Q21)

Again, it’s not easy to find things to complain about in the results. EPS was up on an adjusted basis – virtually everything was up. WarnerMedia, as controversial as the segment is, is doing extremely well. With subs up and the growth offsetting some of the advertising drops, the segment ends the year at 15.4% revenue growth. At any other time and in any other company, this would be cause for popping the champagne.

The company is guiding for 2022 to continue to see growth and expects revenue growth ex-video in the low single digits – typical for a telco – and an FCF of around $23B. Even legacy AT&T, without FCF, will generate a staggering amount of $20B in free cash flow.

This annual free cash flow, even without WarnerMedia, makes the company’s much-talked-about debt essentially a non-issue for the long term. The company can, even with CapEx accounted for, slash that debt to ribbons with time.

The fact is that from a fundamentals standpoint, there shouldn’t be any discontent from shareholders, because AT&T is doing extremely well. The company is delivering almost 28% in operating margin, which is excellent seen to peers.

Yes, I know why shareholders and investors are still not happy – and I’m not entirely happy with how management has handled the WarnerMedia deal. It’s like the CEO, Mr. Stankey, took a look at all of the possible ways he could answer a question about how to handle the WarnerMedia deal and decided to “Well, let’s throw them a curveball.” Out of all the options available, he literally chose the worst in terms of shareholder confidence. You want to give clarity, not ambiguity.

Mr. Stankey chose the latter. It was, in my view, quite literally the worst thing he could have said.

Personally, give me a spin-off. I won’t cry my eyes out if AT&T decides to go for split-off in order to reduce share count, but the bottom line is that AT&T doesn’t need that. With tens of billions in free cash flow, the company has ample room for buybacks if that’s what they want to do.

But the bottom line is, there was nothing fundamental to complain about in terms of actual company performance. And if you intend to mention “the debt” as the issue here, I direct you to my latter point in the article. Seriously. Read that first.

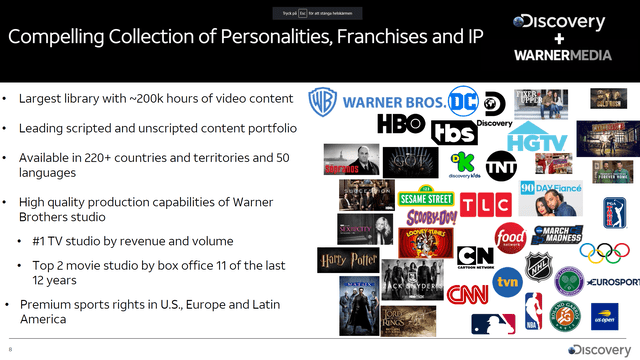

2. By every relevant metric, WarnerMedia is an attractive asset

While T overpaid for the asset, no doubt here, there’s equally little doubt that what the company has turned the segment into is in itself a very attractive sort of asset/segment/business. Revenue growth, subscribers, and content are incredibly appealing. ARPU was excellent, HBO is growing, and with superb content coming out on HBO such as the latest GoT spin-off, it’s going to be interesting to see what will happen here.

Financial times values the new media company at $150 billion – and I believe their methodology, in today’s space and considering Netflix (NFLX) is sound based on EV/EBITDA. a 71% stake of this would amount to $106 billion, make it $100 billion for ease of comparison. Even comparing Netflix directly to only WarnerMedia doesn’t justify the valuation difference between these two businesses (now meaning T), where Netflix has a higher market cap and significantly higher valuation, despite reporting negative free cash flow and compared to 15-16% FCF margin and excellent overall margin for T, including WarnerMedia. Of course, Netflix doesn’t even have a yield.

I don’t invest in pure content creators.

I don’t like them. I like their products. But I don’t like investing in the business, because I find that the ebb and flow of their incomes, margins, costs, and how their assets (productions, etc) are valued and depreciated (as opposed to how much cash they can actually bring for what was invested in them) holds too much ambiguity or uncertainity for me.

It’s been an obvious trend for some years, that Netflix is increasing content spending faster and faster, currently expecting over $15B for the coming year. While many of their assets are indeed blockbuster hits that I enjoy, many of them (too many) are lackluster and dull. To be very clear, my fear is that over 90% of the content that is currently being produced will end up not being worth much, either as its own thing on the platform or as a licensing deal. I believe we’re in a too saturated market in terms of content, and eventually, this will start reflecting in dropping subs and market consolidation.

I’ve no doubt that Netflix will be one of the winners, but my doubt is what valuation the company will command. As a comparison, Netflix is still a great investment on a 5-year basis, but on a 1-year basis, it’s over 20% in the negative – and I still view it as being significantly overvalued.

I believe WarnerMedia, combined with Discovery+, will create a solid competitor to Netflix that at the very least will compete, and in some geographies, given its assets, will easily outpace Netflix. It has offerings Netflix does not, and at least from a European perspective, offers significantly better value than Netflix does in terms of offerings.

AT&T WarnerMedia Merger Presentation (AT&T IR)

The expected revenue for the new business is above that of Netflix (nearly 2X), and EBITDA margins, as well as EBITDA, are far better, and the content library, as well as the channels/variety of content it boasts, is also better. While these are subjective views, I don’t see that many viewers can argue that much of the content is as good as Netflix. To me, that means one of two simple things.

- Either the hypothetical entity needs to be valued similarly to Netflix over time (which I don’t agree with)

- Or Netflix’s valuation over time will come down (which I believe).

To me, it doesn’t matter.

Why doesn’t it matter? Because if AT&T does choose to spin-off and I receive shares of the new company, I likely will only wait a short time before selling them and reinvesting. As I said, I have no desire to own stakes in a content company, and due to my large portfolio position in AT&T, my portfolio stake in the ContentCo would be significant. Telia (OTCPK:TLSNF) is my least favorite Scandinavian telco. Why? Because of their damn content arm which gives it so much uncertainity.

This reflects my very conservative investment approach, which might seem insane to some younger/tech-focused investors. I realize it won’t be a popular one – but I stand by it, and I encourage similarly-minded investors not to allow themselves to be convinced or talked into investing based on the hope for valuation increases or capital appreciation from already outlandish levels.

I’d rather own an asphalt or a gravel company than I would own Netflix or this ContentCo. A company doesn’t just “get” my investment or my trust based on saying “We hope that we can grow our subscribers to X and that our valuation can increase”.

No.

I want dividends/interest and safety for my money.

Telling me that my value is going to go up is not enough. If you “borrow” my money, you’re going to pay me interest. And I don’t borrow to just about anyone. I want safety in operations. I want safety in credit rating. I want safety in prospects and the future.

There are too many unknowns for me here, in much of this content, that isn’t present in other investments on the market. I would rather lend my capital to an oil/energy company that gives me a check in the mail every quarter representing a nice chunk of change for what they get.

3. The numbers

Now we get to the heart of the matter.

The company has repeatedly stated that its legacy dividend payout will be between $8B-$9B once the deal is completed.

I see plenty of people acting as though this isn’t black-on-white information. It is.

Legacy AT&T will generate around $19B-$20B worth of dividends. Let’s use $19B conservatively. It will pay $8B-$9B in dividends. Let’s use $8B to be conservative. AT&T has ~7.14B Shares outstanding.

That means a per-share dividend of $1.22. That’s a current yield of 4.7% on a share price of $25.5/share.

No, that’s obviously not 8% – but nor is it the worst in the peer group – its average. Around the Verizon (VZ) level. If we consider $9B as likely, this goes up to $1.26/share, or close to 5%.

That, dear readers, is point number one. The dividend will be, at today’s share price, between 4.7-5%. Even considering the highest dividend payout of $9B and the lowest FCF at $19B, this is no more than a 47% FCF payout ratio, which is conservative.

That leaves AT&T with around $11-12B annually in FCF, not to mention the $42-43B T will get in a combination of debt securities and cash for the deal. Some of the options for this are very obvious. AT&T has almost $25B in debt maturing his year – so step 1 is eliminating these current liabilities, as well as the corresponding interest.

Following this down payment, this would leave over $17B from the WarnerMedia deal, as well as $11B (or $12B) in annual 2022 FCF. The company could then use these $17B to pay down additional long-term debt to get down to $140B or below, which would still leave them with over $4B worth of post-WarnerMedia Cash.

Extraordinary dividends? Buybacks?

AT&T stock will fall once WarnerMedia is spun off or whatever occurs. For simplicity’s sake, assuming a flat $20/share price, the company could buy back 220 million shares, bringing share count down to below 7B and the dividend up to $1.3/share, or 5.2% yield on the current share price, or 6.5% at the $20 mark. The company could also simply put the billions on the books as cash – though I fail to see the use for doing this to a large degree.

And this is only from the WarnerMedia proceeds. AT&T could retire more debt for those $11B, buy back more shares, etc. AT&T could end the 2022 year with less than $130B in debt – easily – if it wanted to. The company could decide to buy back nearly 10% of the current SO over the next few years, using its capital, if it wanted to.

These aren’t complicated numbers. It’s basic math. No matter which way this goes down, the possibilities for AT&T and how to handle its legacy cash printing machine are endless.

If WarnerMedia is spun off, you will receive shares for your stake in T. With 71% ownership in the new business and assuming a similar share count to AT&T today, and assuming a value of $5/share, you would have a $19-$20 AT&T legacy share, and 0.71 fractional ContentCo shares for every 1 AT&T share. At a hypothetical position of $10,000 today you would end up with 400 AT&T shares and 284 ContentCo shares, valued at $1420/share. You could sell them, and buy back legacy T shares for $19-$20 at a higher yield, adding back to that lost dividend income, or keep them. Or, if we use some other numbers (Source: Barrons) assuming 1.7B distributed shares, you would receive a 0.25X share per AT&T share, worth around $7/share based on recent Discovery stock valuations. Appealing, regardless of how it goes.

If WarnerMedia is split off, you will be made to choose between T or WarnerMedia/ContentCo – you won’t be able to keep both (share-for-share basis). The net effect here is that the share count in AT&T would go lower, which much a similar effect as a buyback. The per-share dividend would increase, as would the yield. The benefit is that AT&T in one fell swoop could theoretically retire more than 1.7 billion of its own SO, bringing it down to less than 5.44B. The previously-mentioned dividends would now be $1.65 on a per-share basis, indicating a $20/share yield of 8.2% on a $20/share basis, or 6.4% on today’s price.

I believe that the avenue that the company eventually chooses will be 100% based on the relative share prices/valuation of the two companies – and this will not be clear until we get closer to the deal date. Any speculation beyond what I’ve said here, is, in my view, useless.

The main point is though, that AT&T, regardless of which way this goes, is a currently undervalued telecom stock with a current S&P global price target of $30/share, even considering the WarnerMedia deal. This gives the company an upside of at least 20% here, and even at $30/share, it’s still not valued in accordance with some of its peers.

Investors and the market have a firm dislike of AT&T based on management falling over more times than Mr. Magoo in an escalator. I accept this – and I understand this.

But the market, and investors, are discounting the possibility, the very real possibility, that there will be a turnaround at some point, even if it’s a slow one. I believe AT&T has long-term massive upward potential, and once this is realized, I believe one of the largest telcos in the US will present a superb target.

Because of this, I view it as a “BUY”. I give it a $30/share long-term target.

AT&T is a math exercise. It’s not an especially complex one, because the result in every way the equation is calculated in every conservative, conceivable way equals “1”, where 1 equals profit. If you believe in fundamental valuation, then I invite you to take a look at this stock.

It’s a “BUY” for me – what about you?

Be the first to comment