cokada

I think I speak for the overwhelming majority of investors when I state the primary motive, or in many cases the sole reason for investing in AT&T (NYSE:T), is to receive a steady stream of dividend income.

Undoubtedly, some investors feel betrayed by management’s decision to cut the dividend. However, that alone cannot account for the poor performance of the stock. Over the last year, the shares are down by nearly 25% versus a fall in the S&P 500 of less than 18% in that time frame.

As I conducted research for this article, time and again, I read comments by readers focused on the company’s debt and/or questioning AT&T’s ability to maintain the dividend at the current level. In part, that is due to the firm’s mixed results in the last quarter.

Is the company caught in a quagmire of debt? Will management once again resort to cutting the dividend in an effort to right the ship? Has the divestiture of the media business resulted in a “leaner, meaner” AT&T, or are current trends just a continuation of what some characterize as inept leadership leading the stock to new lows?

With a P/E below 6X and a yield approaching 7.5%, is the market ignoring a smoking hot buy, or is management creating a melting ice cube?

Differing Takes By Bears And Bulls

One can posit that a major point of contention regarding the recent results lies in management cutting the FY22 FCF forecast by $2 billion. That, along with the fact that the company could not cover the dividend payment with the quarter’s free cash flow (FCF), is viewed by bears as evidence T is in a downward spiral and that the dividend may be unsustainable.

AT&T’s FCF fell from $5.2 billion in the comparable quarter to a relatively paltry $1.4 billion last quarter. Since the company devoted $2 billion to dividend payments in Q2, that meant there was a shortfall of around $600 million.

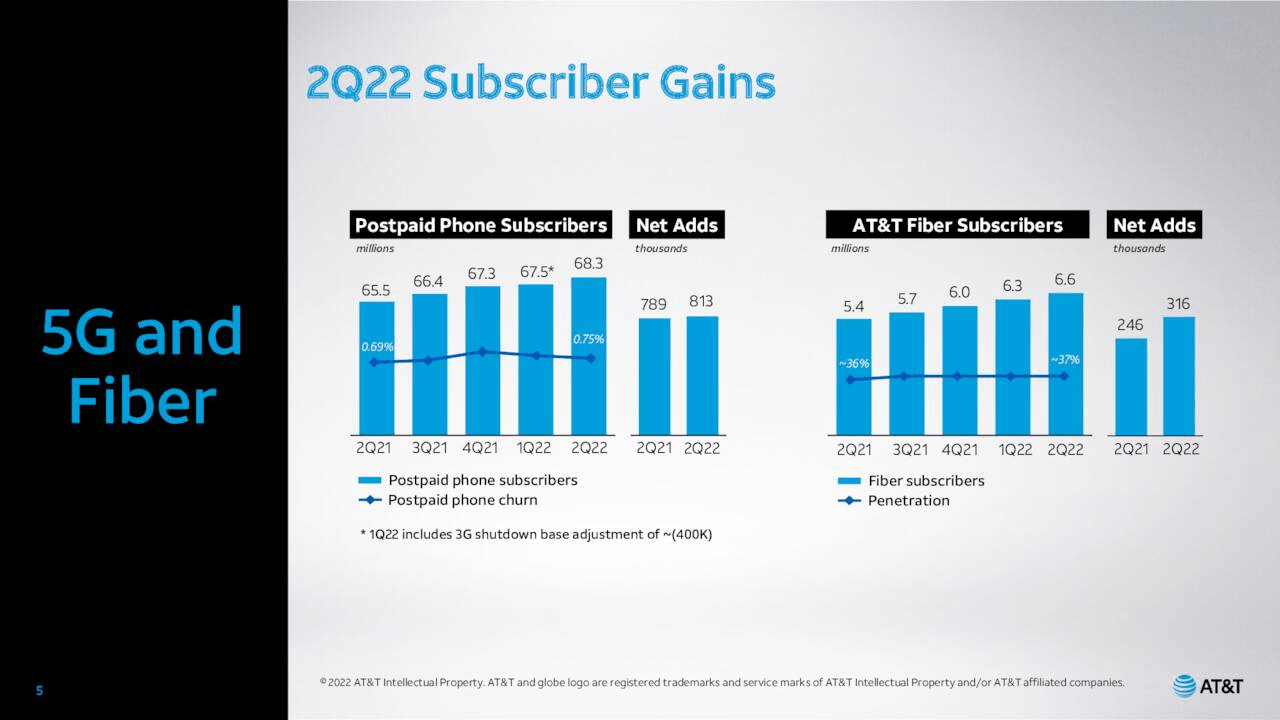

The firm’s operating and adjusted EBITDA (earnings before interest, taxes, depreciation, and amortization) margins also declined, year-over-year. Post-paid phone churn increased from 0.69% last year to 0.75% in the second quarter.

Management noted inflationary pressures adding $1 billion to the company’s costs as one factor that weighs on FCF. Another part of the equation lies in consumers delaying payments for wireless service.

Bulls focused on management’s claim that this was the norm for consumer behavior in this environment, and that the long-term effect would be minimal. Add to that, management attributing much of the shortfall in FCF to front loading capex this fiscal year.

Capex in the latter half of the year is projected to be lower by $2 billion. Furthermore, lower interest expenses should buttress FCF, since AT&T used cash proceeds from the Time Warner spinoff to pay off a big chunk of debt.

Even so, bears latched onto management’s ambiguous response to analysts’ questions regarding upcoming dividend payments as a possible portent of a dividend cut.

Can you comment a little bit on your dividend policy going forward? Is it a priority to grow the dividend by various amounts?

Frank, look, we’ve been pretty clear on the dividend policy as to what we’re doing.…As I said, the Board will evaluate dividends, along with other choices in front of us to return to shareholders. As we’ve indicated, our priority right now is to get the balance sheet where we want it, which is a full rush and push to getting to 2.5x, and then we can evaluate what other options are at that point in time. And those other options will range from whether or not we want to do something on dividend policy or something we want to invest more back into the business or whether we want to push on some buybacks.

John Stankey, CEO

The shibboleth, “Fool me once, shame on you. Fool me twice, shame on me,” comes to mind.

However, a big positive in the results was the addition of 1.6 million net postpaid phone additions through the first six months of 2022. That outpaced T-Mobile’s (TMUS) 1.3 million net postpaid phone additions, and Verizon’s net loss of 24,000 over the same period.

Q2 saw AT&T add 813,000 net new mobile phone subscriptions. This follows FY21 when the company garnered more phone subscribers than the previous 10 years combined.

Company presentation/ Seeking Alpha

Also note that even though AT&T’s churn recorded a modest increase, it still was the lowest of all three companies. These gains contributed to AT&T notching $19.9 billion in second-quarter mobile revenue, a 5.2% increase over the prior year.

When one adjusts for the divested assets, Q1 2022 revenue increased by $2.4 billion over Q2 2020, and Q1 2022 revenue is up $2.1 billion over Q1 of 2020.

A Quick Comparison With The Competition

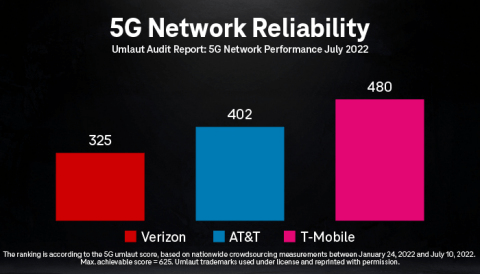

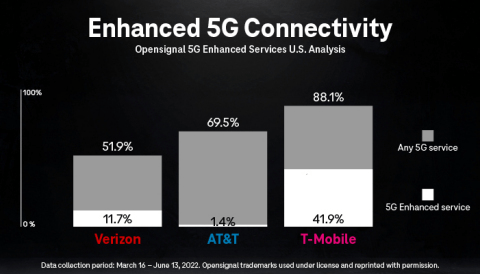

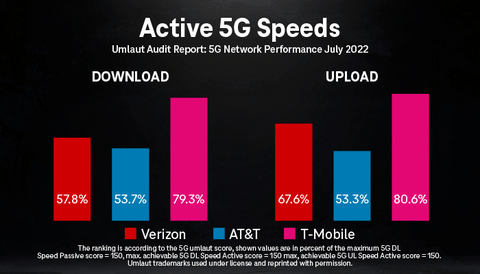

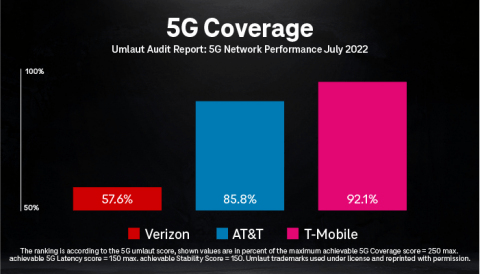

I’ve provided evidence that T is making headway in the competition for wireless subscribers. However, 5G is recognized as the arena in which the future of the wireless companies will be decided. If it is true that a picture is worth a thousand words, then I’ve saved the reader a great deal of time and trouble with the following four charts. These graphs provide a snapshot of where the three telecoms stand in relation to each other in the 5G competition.

businesswire businesswire businesswire businesswire

As you can see, T-Mobile is in the lead, and Verizon is taking up the rear.

Much Ado About Much Ado

I see pundits and proselytizers of the bear faith focusing on AT&T’s debt load. While it is true that the company has a debt load greater than the market cap of most members of the S&P 500, that sum must be placed in context.

T’s weighted average interest rate is 4.0%, not a particularly troublesome metric. When adjusted for taxes, the company’s total interest on debt costs approximately $4 billion annually, and a small fraction of the debt is short-term.

The following metrics compare AT&T with TMUS and VZ.

(Long term debt (LTD)). All stats as of last report unless otherwise noted.

TMUS T VZ

Revenue (TTM) $79.1B $156.6B $134.3B

LTD $68.05B $129.8B $138B

Interest on LTD $452M $162M $1.875B

Cash $3.151B $4.018B $1.857B

Current liabilities $20.622B $31.069B $20.956B

Moody’s rates T-Mobile Baa3/stable, the lowest rung of investment grade. S&P rates T-Mobile at BB+, just below investment grade.

Moody’s rates Verizon’s credit ratings Baa1/stable. S&P rates Verizon at BBB+/stable.

Moody’s rates AT&T as Baa2/stable. S&P rates AT&T as BBB/stable. Fitch rates AT&T at BBB+/stable.

So two of the three credit agencies rate T one slot lower than VZ, while one considers AT&T’s credit to be on par with Verizon’s.

Meanwhile, I cannot recall seeing concern regarding the financial profile of TMUS, yet that company’s debt is rated below investment grade by S&P, and the stock trades for a P/E multiple of roughly 68x, or more than eleven times T’s P/E.

I also note that TMUS has more than half as much long term debt as AT&T and current liabilities that are roughly two-thirds the size of AT&T’s. At the same time, TMUS has one-fifth of the operating income of AT&T.

My point is that AT&T’s debt is being overemphasized. The fact is that telecoms operate in a capex intensive environment. This is particularly true as 5G is being rolled out across the nation. If AT&T is at risk due to the company’s debt load, then the same holds true of its rivals.

AT&T Stock Valuation

AT&T currently trades for $14.84 per share. The average one-year price target of the 17 analysts covering the stock is $23.00. The six analysts that rated the stock following the last quarterly report have a price target of $19.83.

The stock has a forward P/E of 6.39x. That compares to T’s 5-year average P/E ratio of 12.32x.

Is AT&T Stock a Buy, Sell, Or Hold?

In regard to the firm’s debt load, I will not claim that bears are making a mountain out of a molehill. However, continuing in that vein, I’ll characterize the focus on T’s debt as viewing an Appalachian peak as akin to Mount Everest.

Yes, AT&T’s debt is a hindrance, but management is focused on lowering debt, and the company’s FCF is sufficient to achieve that goal.

One can posit that AT&T’s business is stronger than it has been in years. When adjusted for the divested businesses, revenue has grown significantly over the last two years, while debt has been reduced markedly.

The 2022 addition of 1.5 million post-paid phone net adds through the first two quarters outpaced last year’s 1.4 million. If AT&T continues at this pace in the latter two quarters, it will surpass last year’s record-setting 3.2 million post-paid phone net adds, a figure that exceeded the previous 10 years combined.

Management is still guiding for $14 billion in free cash flow. With an annual dividend payout of $8 billion, that results in a payout ratio below 60%. The company is also guiding for FCF of at least $20 billion next year.

Most investors look to AT&T for a source of high-yield, passive income. Under normal circumstances, one should not look to AT&T for capital appreciation. However, I maintain that we will eventually see the shares return to the historical average P/E. With a 7.5% yield, one only needs an increase in valuation of 2.5% a year to meet the market’s annual average return.

Weighing the pros and cons, I conclude that AT&T is far from being a melting ice cube.

I rate AT&T as a BUY.

I would be surprised if AT&T increased the dividend over the short term, as management is focused on lowering the debt load. However, I am reasonably confident that the dividend will not be cut.

I own a small position in AT&T, and I am adding in “nibbles.”

Be the first to comment