John Lamparski/Getty Images Entertainment

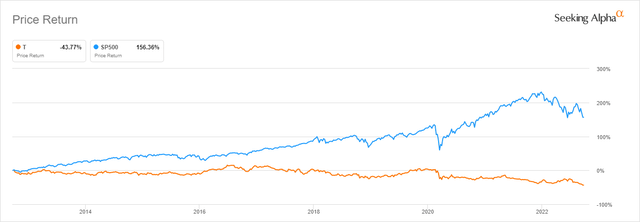

The story of AT&T (NYSE:T) has been one of the most tragic stories of shareholder value destruction that we have had a chance to witness during the course of the past couple of decades. The company’s attempt to venture beyond the legacy telecommunications side of the business and build up a conglomerate has ended in an utter disaster. A decade of unsuccessful acquisitions has passed as management has failed to integrate the acquired companies into the legacy business and reach any meaningful synergies in the process. This chapter of AT&T’s story came to an end as the telecom giant decided to spin off its Warner Media assets earlier this year, cutting the dividend in the process, which led to the company ultimately losing its dividend aristocrat status.

On the other end, the markets have been thrown into turmoil as multiple negative macroeconomic factors jointly produced a unique storm of negativity that put an end to the greatest bull market in history and led to a 23% decline for the S&P 500 (SPY) since the beginning of the year. CNBC’s “Fear and Greed Index” score of 24/100 tells us we are finding ourselves in the extreme fear territory and at the rock bottom of investor sentiment. The combined two factors created the “ultimate bear sentiment” surrounding the company, resulting in tremendous selling pressure being applied to the US-based telecom giant’s stock, which is currently trading at a very attractive looking $16.03 per share. This is exactly why we believe that at this all-time low investor sentiment, AT&T represents a great value proposition for the potential investor.

AT&T and S&P500 10Y Returns (Seeking Alpha)

Stankey’s chains of debt

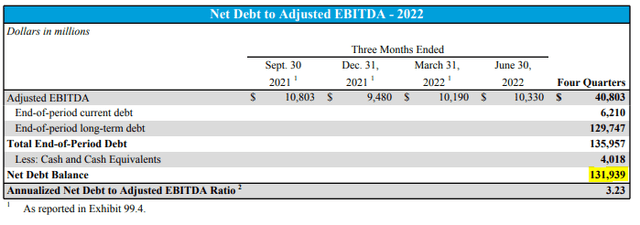

Much emphasis has been placed on discussing AT&T as a company with a monstrosity of a problem in terms of debt. It remains difficult to discuss AT&T without touching on the subject of the elephant in the room, but we would argue that the strong deleveraging efforts during the last two years left the company in a much more favorable position. The debt situation has become significantly more manageable and quite less headline-worthy.

The company ended 2021 with approximately $6.88 billion in interest payments, a mid-to-large cap company in its own name, just in terms of the amount the company had to pay in order to maintain its debt. In 2020, the telecom paid $7.92 billion to service its debt, while the year prior to that was even worse with $8.42 billion in interest expenses. In contrast, AT&T expected to pay out “only” $5.92 billion to service its debt this year.

AT&T’s Debt Level (Q2 2022 Financial Highlights)

The undoubtedly most important role in the deleveraging process played in the decision to spin off the Warner Media assets into Warner Bros. Discovery (WBD), allowing for a long-overdue reduction in debt. Reducing the highly inflated balance sheet could not have come at a better time, given the changes in the macroeconomic environment. Alongside the Warner Media assets, around $40 billion in debt left AT&T’s balance sheet and has now become David Zaslav’s headache.

As per the latest quarterly report, AT&T currently carries $131.93 billion in net debt. Even after the latest downgrade in guidance, the telecom is still expected to generate somewhere between 41-42.00 billion in EBITDA for 2022. This lands Net Debt/EBITDA at approximately 3.21x. The company will likely utilize the synergies that will play themselves out to further reduce its debt and bring the net debt to EBITDA ratio to the 2.5x range by the end of 2023, which would also reduce interest expenses to under $5.5 billion for the year.

Dividend sustainability

John Stankey’s re-envisioned AT&T is fairly straightforward and somewhat simplistic, with the new company aiming to reposition itself as a “boring” telecom, much more in line with what Verizon (VZ) has been doing. After a couple of difficult transition years, the company could find itself in great financial shape and be able to greatly reward shareholders.

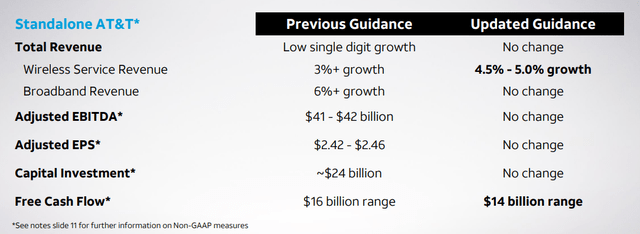

Much of those returns are planned to come from dividend distributions. However, the lackluster second-quarter performance raised even more questions, some going as far as suggesting another dividend cut. AT&T is currently expecting to pay out $1.11/share in dividends, which would cost the company close to $8 billion per year, down from the $15 billion per year prior to the cut. Initial FCF projections from earlier in the year saw the company generating $16 billion in FCF for 2022 and $4 billion more the year after that.

FY22 Guidance Update (Q2 ’22 Earnings Release)

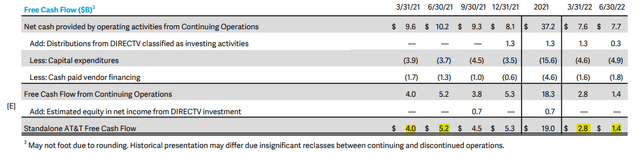

The problem that arises is that if we annualize AT&T’s second-quarter free cash flow, we would fall somewhat short of covering the dividend. The last six months saw only $4.2 billion in FCF, barely in line with the dividends. When compared to the same period in 2021, even after eliminating the effects of the WBD distribution, generated free cash flow is still down roughly 55%.

AT&T Standalone FCF (AT&T Q2 2022 Earnings Release)

Most of the blame for this has been placed on increasing spending on building the 5G infrastructure and also on customers struggling to pay their bills in time. Both factors, in theory, should only represent a temporary pressure on generated free cash flow, henceforth shouldn’t jeopardize the dividend.

Given the combination of elevated success-based investment, the potential for further extension of payments by our customers, inflation and the more challenging environment facing our Business Wireline unit, we consider it prudent to take a more conservative outlook to free cash flow for the year. Given these factors, we anticipate pressure of about $2 billion to our free cash flow guidance from our prior $16 billion range for the year. Now before the questions on how we get to the implied $10 billion of free cash flow in the second half of the year when we generated $4 billion in the first half of the year, let me provide you with some specific items to consider.

John Stankey, CEO – Q2 ’22 Earnings Call

There has been no updated guidance on the 2023 free cash flow. As a matter of fact, Stankey stated that they expect improved EBITDA cash conversion, mostly from better mobility cash flows and higher MVNO volumes. This again, in theory, should suggest even better results in ’23, but given the state of the economy maintaining the initial projection of $20 billion in FCF would be considered a great success. That would place the dividend payout ratio at 40% of generated free cash flow, leaving much room to deploy capital elsewhere.

This pushes us on to a different point that we would like to make. Most of that leftover FCF would ideally be used to pay down more debt, and if necessary reinvest in its communications business or add additional spectrum to further add to the capacity of its network. After a couple of years, the company would find itself in a position to gradually begin raising dividends again. Still, prior to any talks about a potential dividend bump, it would be a tragedy if at least a portion of the FCF would not be redirected to buy-backs. Back of the paper math tells us that with the current average weighted cost of debt in mind, eliminating $1 billion of debt on AT&T’s books would save the company roughly $45 million per year in interest expenses. At these levels, each billion dedicated to buy-backs could buy back roughly 0.87% of outstanding shares and arguably be more accretive to long-term shareholder value creation. When prompted about this, Stankey left an open door for buybacks once leverage is brought to 2.5x.

And the Board ultimately makes this call and this decision. And as I’ve said before, we set this at what we think is an incredibly attractive return in the market right now. And I think we are still standing there relative to the yields on the stock. As I said, the Board will evaluate dividends, along with other choices in front of us to return to shareholders. As we’ve indicated, our priority right now is to get the balance sheet where we want it, which is a full rush and push to getting to 2.5x, and then we can evaluate what other options are at that point in time. And those other options will range from whether or not we want to do something on dividend policy or something we want to invest more back into the business or whether we want to push on some buybacks. And those decisions will be weighted at the time when we have those options in front of us and evaluate the market as to where it stands.

John Stankey, CEO – Q2 ’22 Earnings Call

AT&T’s valuation

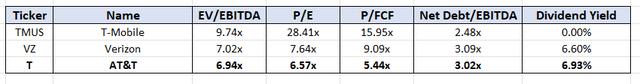

With T-Mobile’s (TMUS) acquisition of Sprint, the US telecommunications market has largely solidified itself and become a three-way oligopoly ruled by AT&T, Verizon, and T-Mobile. Taken at face value, after the spin-off, T’s legacy business seems to present a far better value opportunity as compared to the old company. Based on today’s price of $16.01 per share, the company is selling at an NTM EV/EBITDA of 6.94x, NTM P/E of 6.57x, and a very attractive NTM P/FCF of 5.44x. Even after it was cut, thanks to the decline in price, the $1.11 per share dividend resulted in a 6.93% dividend yield, much higher than the U.S. stock average.

Relative Valuation (Author Spreadsheet Cap IQ Data)

Closing arguments

For a reasonable analysis of Stankey’s “new AT&T”, it would be of paramount importance to sever the perception of the decades of shareholder value destruction that has transpired and place as much emphasis as possible on the future of the company and what T could bring to its investors throughout the course of the next decade. Even if everything that has occurred results in one doubting the efficiency of the management team, it is still fair to say that AT&T today is not the same investment it was only a year ago. We believe that a combination of the recently refocused strategy centered on its core competencies as a “stable and boring” telecom, a high dividend yield surpassing the U.S. average, and a substantial margin of safety thanks to a decade low investor sentiment creates great value for potential investors.

Be the first to comment