jetcityimage/iStock Editorial via Getty Images

Shares of AT&T (NYSE:T) surged after the telecommunications company completed the spin-off of its content business a little more than a week ago. The initial reaction to the media segment spin-off indicates that the market believes AT&T made the right decision to separate its businesses. With the spin-off completed and AT&T receiving more than $40B in cash, investors can expect a significant reduction in the firm’s debt in the short term. Longer term, I expect AT&T to return a large percentage of its free cash flow to shareholders.

AT&T and Warner Bros. Discovery post-separation performance

AT&T completed its spin-off and the business combination of WarnerMedia with Discovery on April 8, 2022. Shares of Warner Bros. Discovery (WBD) started to trade on the Nasdaq on April 11, 2022. Warner Bros. Discovery now includes all of AT&T’s former streaming, film and television assets and the company is set to compete with fast-growing streaming businesses like Netflix (NFLX) for market share and revenue growth.

The initial performance of AT&T after the spin-off has been impressive… with shares surging more than 7%. The reaction to the spin-off could be a sign that investors are bullish on AT&T’s financial prospects, post-separation, despite a significant amount of debt hanging over the telecom.

Expect a massive deleveraging to take place in the short term

AT&T received more than $40B in cash from the transaction, funds that will be used to repay the firm’s massive debt which resulted from past (unsuccessful) acquisitions. Multiple acquisitions in AT&T’s history didn’t go exactly according to plan and especially the acquisition of DirecTV in 2015 was a disaster for AT&T due to massive subscriber losses.

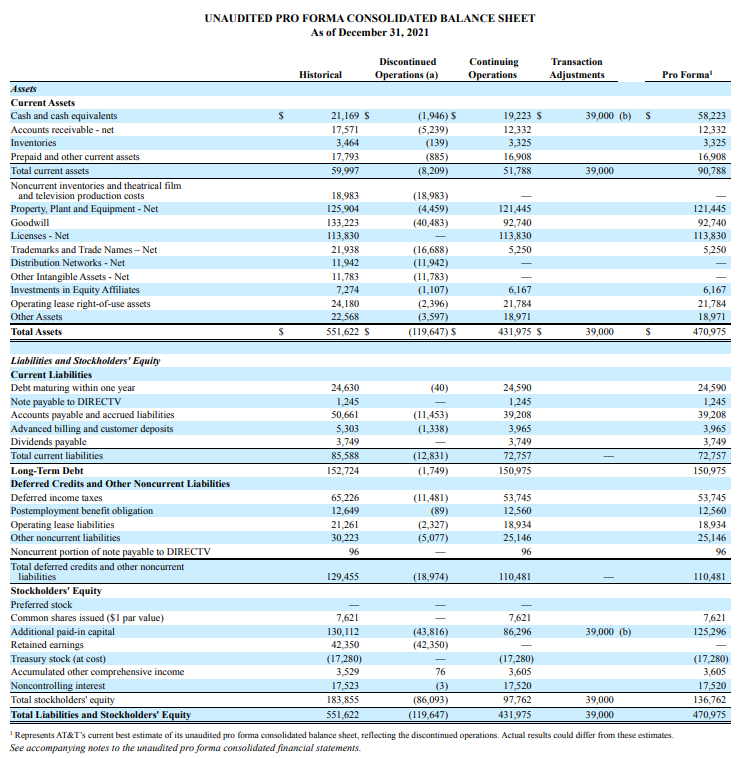

Based off of new unaudited pro forma statements (Source: 8K statement) provided by AT&T lately, the new AT&T has pro forma long term debt of $151.0B. Debt maturing with one year — AT&T’s short term debt — was $24.6B. A large part of the cash proceeds resulting from the business separation will be used to repay these financial obligations.

AT&T

Is a share buyback a possibility?

Longer term, Yes. In the short term, probably not. Although AT&T received a massive amount of cash lately, the firm is set to apply those funds to the repayment of its considerable debt, not to the buyback of shares so shortly after the business separation. Longer term, I expect AT&T to return a material percentage (10-20%) of its free cash flow to finance share buybacks.

This is because AT&T can either use its free cash flow to pay back debt or return cash to shareholders. The new dividend will cost AT&T about $8B annually which is about 40% of AT&T’s FY 2023 expected free cash flow. If AT&T makes progress in reducing its debt, more free cash flow will be available in the future to fund share buybacks or a higher dividend. As a company with slow top line growth and high free cash flow, I expect AT&T to allocate additional funds to share buybacks in the future.

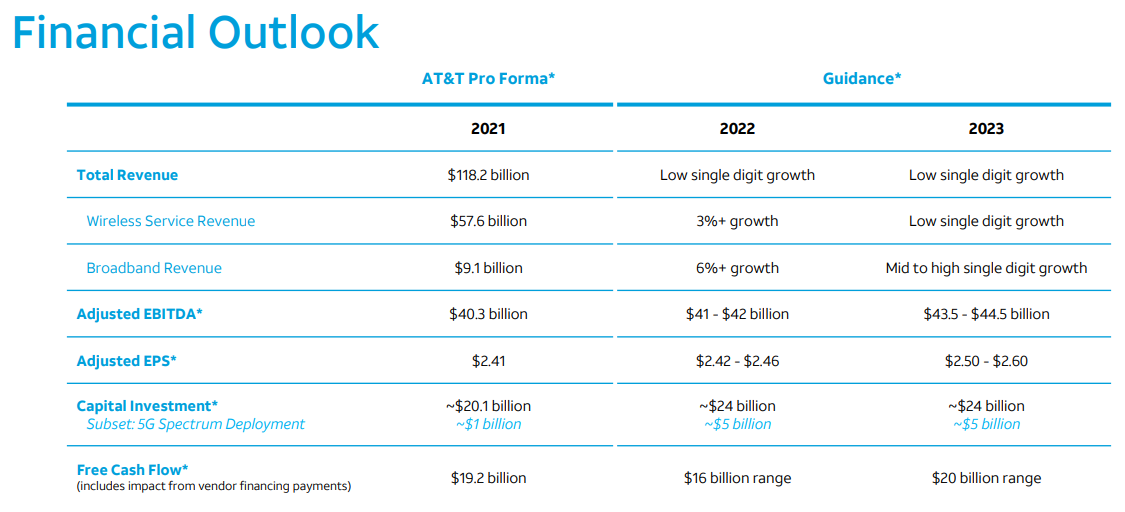

Updated FCF valuation

AT&T projected in March that the firm could achieve $16B in free cash flow in FY 2022 and $20B in free cash flow in FY 2023, a figure that could increase if AT&T repays debt faster than expected. The free cash flow calculation includes the projection of $5.0B in annual 5G spectrum development investments and total capital expenditures of $24.0B. If you have not seen the financial outlook for the new AT&T yet, you can see this table for FY 2022 and FY 2023 expectations below (Source).

AT&T

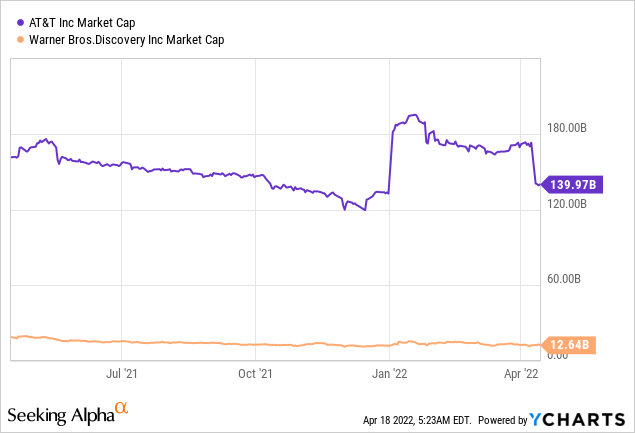

The leaner AT&T, post-separation, has a market cap of $140.0B while Warner Bros. Discovery has a market cap of $12.6B. AT&T has a P-FCF ratio of 7 X, based off of FY 2023 free cash flow predictions. The P-FCF ratio is likely this low because of AT&T’s large amount of debt that weighs on the firm’s financial performance and valuation. If AT&T reduces this debt and creates a healthier (less leveraged) balance sheet for itself, the market may be willing to reward AT&T with a higher P-FCF ratio.

Dividend and updated yield

AT&T’s board approved a post-transaction annual common dividend of $1.11 per-share which calculates to a quarterly dividend payout of $0.2775 per-share. Considering how much free cash flow AT&T is expected to generate from its fiber optic and wireless network assets, the dividend is likely set to grow in the future. Based off of AT&T’s higher share price after the spin-off ($19.54), shares of the new AT&T have an attractive dividend yield of 5.7%.

Risks with AT&T

The spin-off is a done deal and AT&T’s fiber optic and fixed wireless businesses are going to generate a significant amount of free cash flow for AT&T going forward. The biggest risk for AT&T, as I see it, is the firm’s leverage which is still going to weigh on AT&T’s free cash flow and earnings. What would change my mind about AT&T is if the firm saw a large decline in its free cash flow or decided to cut its dividend.

Final thoughts

Shares of AT&T surged after the completion of the media business spin-off, but AT&T still has a lot of potential to power higher. As the firm starts to repay billions of debt, investors will see a clear path for AT&T to develop a more stable balance sheet with significantly less debt. The combination of strong free cash flow from AT&T’s core telecom assets and an improving balance sheet could drive interest in AT&T’s shares going forward. Additionally, shares of AT&T based off of free cash flow are just too cheap.

Be the first to comment